Kirby currently trades at $126.36 per share and has shown little upside over the past six months, posting a middling return of 4.1%. The stock also fell short of the S&P 500’s 13% gain during that period.

Is now the time to buy Kirby, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We're swiping left on Kirby for now. Here are three reasons why KEX doesn't excite us and a stock we'd rather own.

Why Is Kirby Not Exciting?

Transporting goods along all U.S. coasts, Kirby (NYSE:KEX) provides inland and coastal marine transportation services.

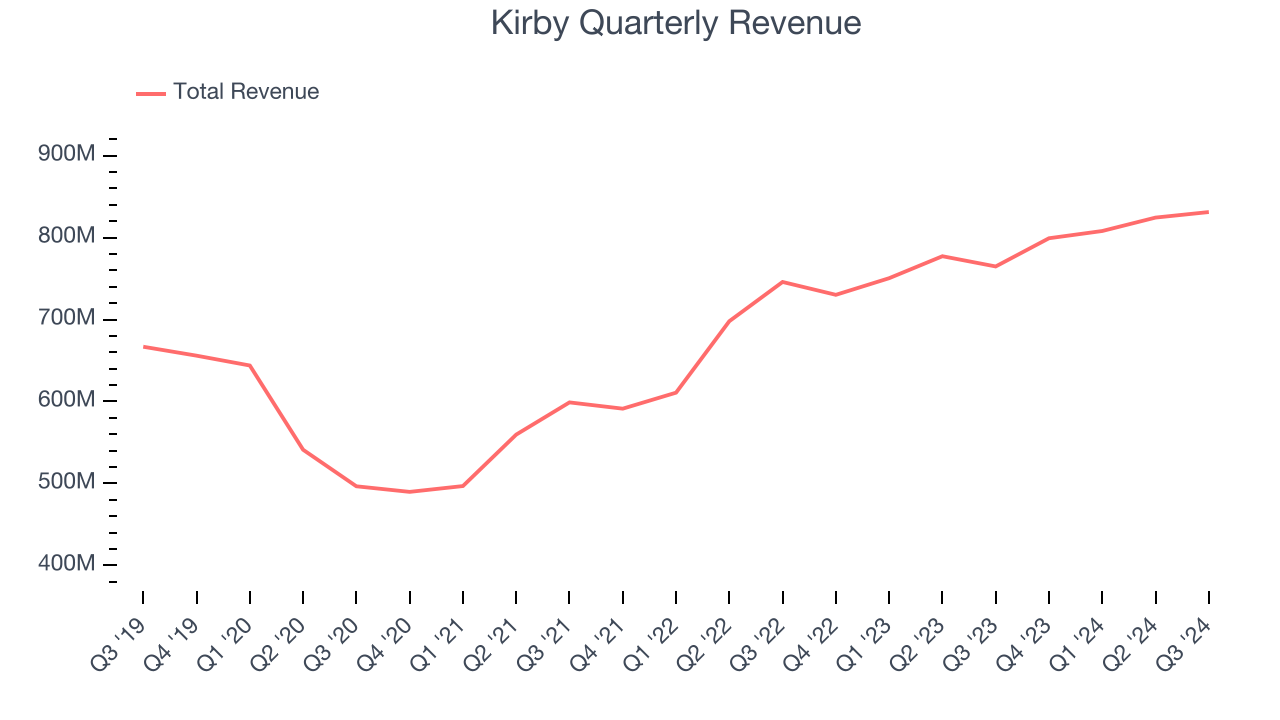

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Kirby’s 2.4% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks.

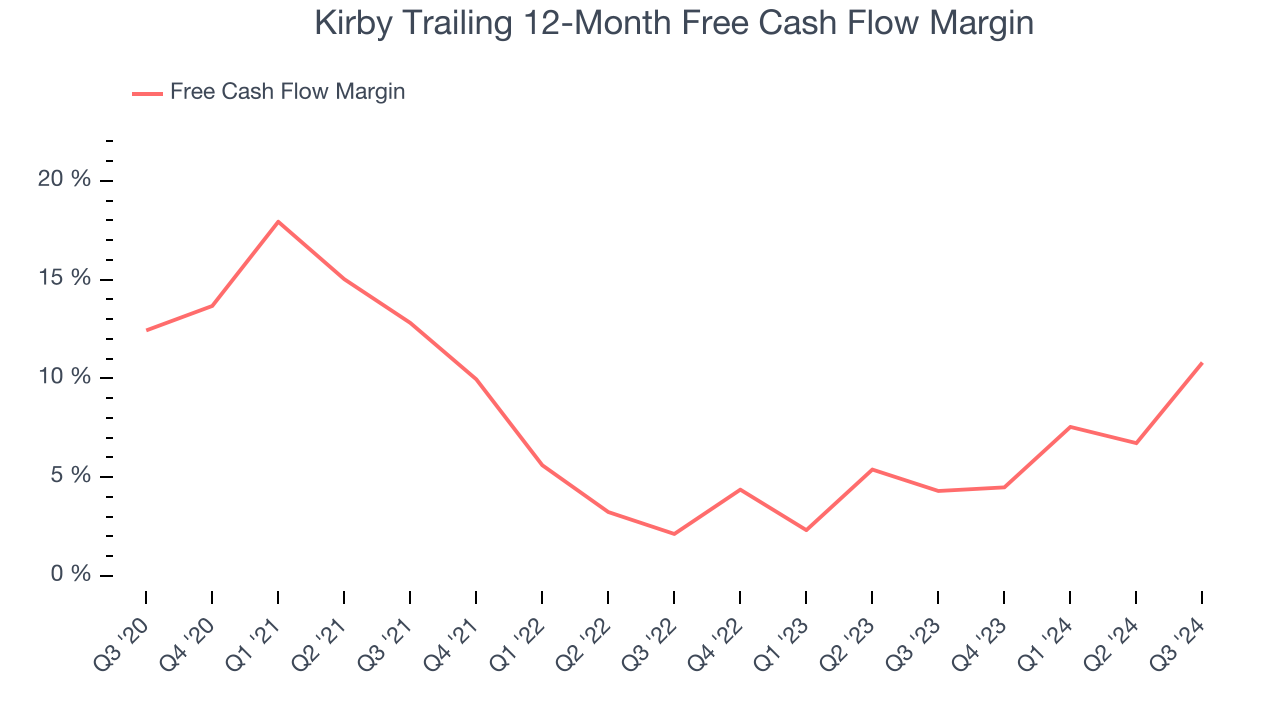

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Kirby’s margin dropped by 1.6 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal higher capital intensity. Kirby’s free cash flow margin for the trailing 12 months was 10.8%.

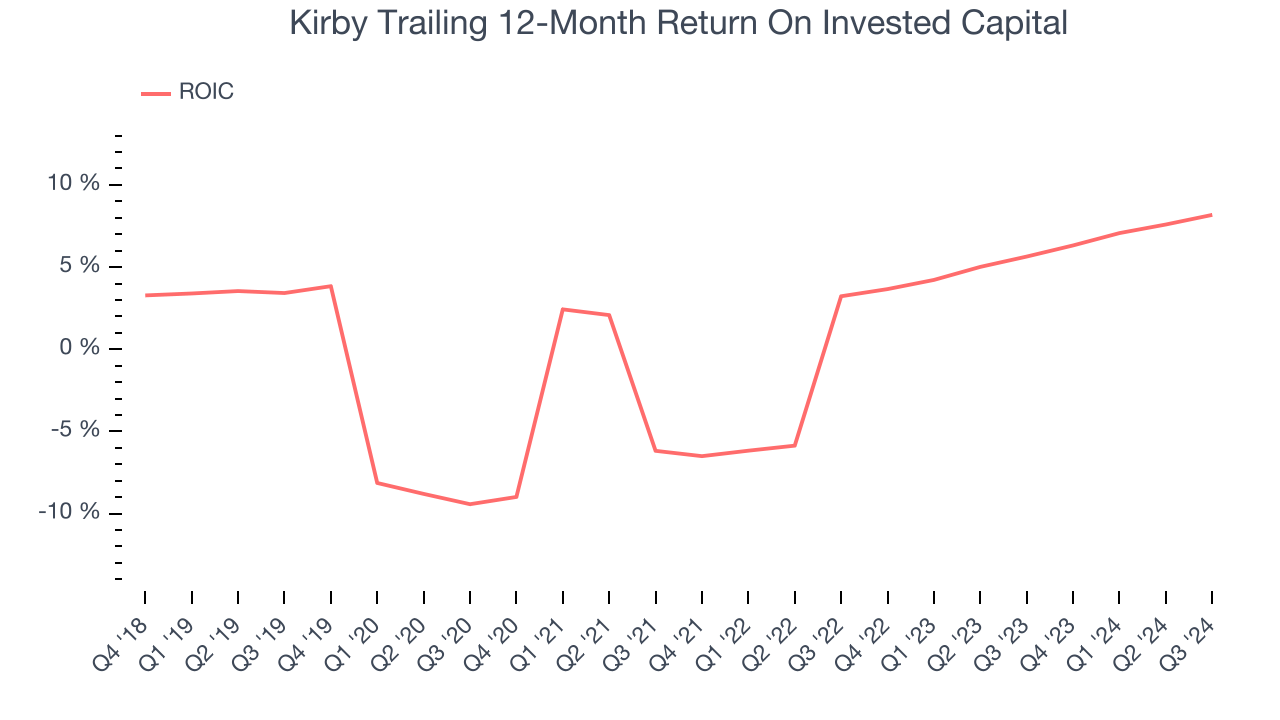

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Kirby historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.3%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

Kirby isn’t a terrible business, but it doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 19.5x forward price-to-earnings (or $126.36 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at Microsoft, the most dominant software business in the world.

Stocks We Would Buy Instead of Kirby

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.