VANCOUVER, BC / ACCESSWIRE / May 11, 2022 / Blackwolf Copper and Gold ("Blackwolf", or the "Company") (TSXV:BWCG),(OTC PINK:BWCGF) is pleased to provide an update on its 100% owned Niblack and Hyder Projects in southeastern Alaska. The Company is currently planning a multi-phased exploration campaign that will include diamond drilling, focused on both resource definition and exploration at its polymetallic Niblack Project, a maiden diamond drilling program targeting wide, outcropping veins and breccias at the Cantoo gold-silver property in the Golden Triangle near Hyder, Alaska as well as continued reconnaissance exploration of the Texas Creek and Casey properties.

"Blackwolf is looking forward to a year with numerous catalysts including discovery-focused exploration at our flagship, Niblack copper-gold-silver-zinc VMS deposit, and an upcoming, updated mineral resource estimate ("MRE") incorporating recent drilling and our comprehensive new geological interpretations. Additionally, we are looking forward to drilling the initial holes into the outcropping gold-silver veins, which are up to 30 meters wide at our new Cantoo Property, located just west of the Premier Mine currently in construction by Ascot Resources," said Rob McLeod, President and CEO of Blackwolf Copper and Gold. "We appreciate our shareholders' patience during our various permitting processes and Niblack site upgrades. It is our commitment to operate safe, clean and low-impact projects in southeast Alaska. We are now set up to rapidly advance one of the largest, undeveloped underground copper-gold deposits in the Pacific northwest."

Niblack Project

The 100% owned Niblack project, located on Prince of Wales Island in southeast Alaska, hosts high-grade Cu-Au-Ag-Zn VMS style mineralization within a series of felsic volcanic flows and breccias, typically as stringer, semi-massive to massive chalcopyrite and sphalerite-rich replacement-style mineralization, commonly with additional pyrite. Multiple deposits with both exhalative and replacement-style mineralization have been identified.

In 2021, the Company made a significant geological breakthrough on the Property, confirming that the folded volcanic stratigraphy was overturned. This new interpretation has opened up significant areas of prospective stratigraphy for exploration and resource expansion.

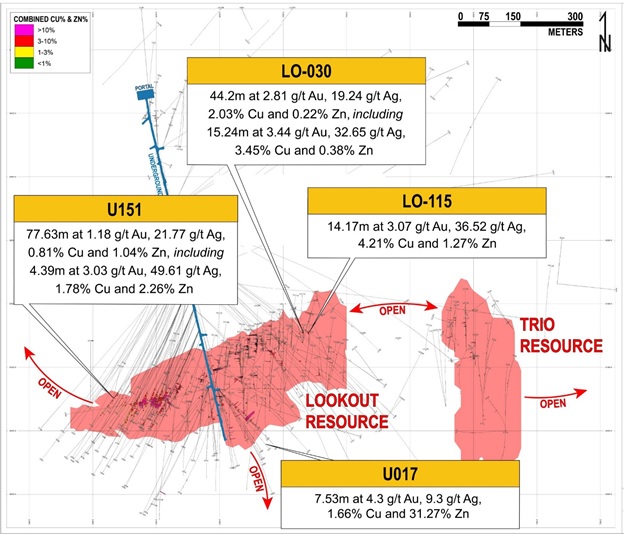

Blackwolf's geological interpretation has shown that the Lookout deposit, the largest identified to-date on the Property, is wide-open for expansion in most-directions. The potentially most accretive targets are located on the west side of the folded deposit in multiple areas and depths. The Company has concluded that priority targets are best drilled, initially, from helicopter-supported surface drilling, versus inclined holes from the underground workings. Step-out drilling from high-grade intercepts completed by Blackwolf at the historic Niblack Mine, such as 7.6 meters of 5.18% Cu, 2.66 g/t Au, 145.1 g/t Ag and 6.53% Zn, could be completed from the current road network. Additionally, exploration will include both step-out and in-fill diamond drilling on the high-grade Lookout and Trio deposits focused on resource definition, and expansion and exploration drilling targeting other known areas of mineralization as warranted including the Mammoth, Niblack, Dama, and Lindsy zones.

The drilling will ideally occur in multiple phases, split approximately 50/50 between resource definition/expansion and exploration. In addition, surficial exploration including geological mapping, high resolution drone imagery, prospecting, and geophysical surveys will be conducted to assess for additional targets on un/underexplored portions of the Property.

Currently, the Lookout and Trio deposits host 5.6 million tonnes of Indicated Resources averaging 0.95% Cu, 1.75 g/t Au, 29.52 g/t Ag and 1.73% Zn, with additional Inferred Resources of 3.4 million tonnes of 0.81% Cu, 1.32 g/t Ag, 20.10 g/t Ag and 1.29% Zn. A higher-grade core of Indicated Resources hosts 1.2 million tonnes averaging 1.7% Cu, 3.2 g/t Au, 62.6 g/t Ag and 3.8% Zn on the Lookout Zone. Refer to disclosure below for further details on the Company's current NI 43-101 Mineral Resources Estimate. Subsequent to this estimate, there have been multiple rounds of expansion and exploration drilling, including at the high-grade old mine area drilled by Blackwolf. These rounds of drilling as well as comprehensive geological remodeling using the new, overturned stratigraphic interpretation, will be included in an updated MRE. The Company has engaged Independent Qualified Persons Gilles Arsenault, P.Geo and Andrew Hamilton, P.Geo., to complete the new MRE and technical report, expected to be completed by early Q3 2022.

Figure 1. Lookout deposit and select intercepts where mineralization is open along strike or dip.

Blackwolf is expecting imminent receipt of surface exploration permits for the Company's US Federal Claims at the Niblack Property. Additionally, the Company has patented mineral claims covering the key portions of the Property. While waiting for drilling permits, the Company has completed significant site maintenance and upgrades at Niblack. Permits have been received for a new land-based tent camp to support exploration and development efforts as well as cleanup of historic sites such as old structures, a barge camp, dilapidated core storage and old fuel tanks have been completed. Additionally, corroded pilings on the barge landing were replaced and needed repairs to the dock were completed.

Hyder Properties

Acquired through staking in 2021, Blackwolf has 100% interest in its Hyder Properties which are comprised of three claim groups (Texas Creek, Cantoo, and Casey), totaling 3,874 hectares across 474 Federal Mining claims. These properties are located on the Alaskan side of the Golden Triangle, northwest of the village of Hyder and tidewater. The properties are located south of the past-producing Granduc Copper and Scottie gold mines and due west of the past-producing Premier, Big Missouri and Silver Coin gold-silver mines. Several small, historic producers and exploration prospects are located on Blackwolf's claims. The claims are underlain by regionally prospective Lower Hazelton volcanics and coeval Texas Creek polyphase, dioritic intrusions. Very limited modern exploration has been performed in the area, with virtually none in the last 25 years.

Planned exploration on the Hyder properties will include geologic mapping/prospecting, and a regional scale LiDAR survey followed by diamond drilling.

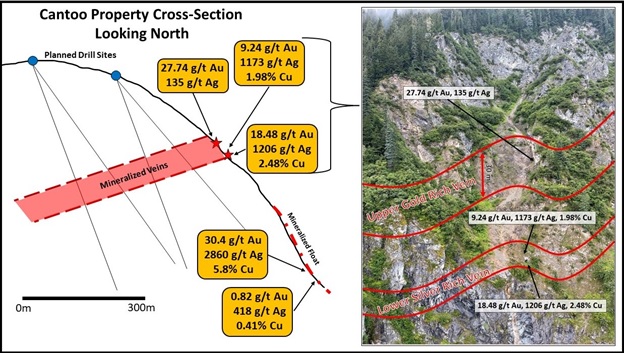

Figure 2. E-W Cross-section of Cantoo showing planned relative to historic workings and high-grade Au, Ag, & Cu samples.

Cantoo Property

The Cantoo Property is located due east of the Premier, Silver Coin and Premier deposits currently in development by Ascot Resources and likely part of the same metallogenic system. Historic, direct shipping mining and exploration work focused on at least two wide, shallow southeast dipping vein structures up to 30 meters in true thickness. Previously announced sampling by Blackwolf included samples up to 30.4 g/t Au, 2,860 g/t Ag, 5.8% Cu, and 8.81% Zn(1).

Exploration on the Cantoo Property in 2022 will include geologic mapping, prospecting, soil sampling and a maiden 2,000-meter drill program targeting the high-grade vein occurrences. Subject to receipt of drill permits expected soon, diamond drills would be set up above cliffs where the veins/breccias are observed to outcrop on a steep slope; these veins were historically accessed using aerial tramlines from the bottom.

Texas Creek Property

The Texas Creek claim block is located approximately nine kilometers east of Cantoo and covers a series of historic prospects and showings. Exploration of Texas Creek in 2022 will focus on follow up geologic mapping and detailed sampling on the high-grade occurrences with a purpose to define drill targets for late 2022/2023.

The source of very-high grade historic electrum veins will continue to be a focus for Blackwolf. In the 1930s, prospectors and miners tunneled through glacial ice to explore for a local source, eventually identifying mineralization that is similar in style of veins that have been historically and currently mined at the Brucejack and Premier deposits. The glacial ice sheet, located near the summit of a mountain, has significantly melted since the 1930s. Work by the Company during 2021 identified high-grade veins, including a grab sample that returned 10.05 g/t Au and 7,910 g/t Ag. A cool spring and summer in the Golden Triangle resulted in the previous winters snowpack not fully melting over the priority target area of veins that were identified by the glacier miners.

Casey Property

The Casey Property is located approximately one kilometer south of Texas Creek and is unexplored. Initial prospecting and mapping will be performed on the project in 2022 with a focus on historic high-grade occurrences including the Casey (individual samples of 5 g/t Au, 62.4 g/t Ag, 0.1% Cu, & 29.5% Zn) and Engineer (samples up to 26.3 g/t Au and 366.9 g/t Ag)(2).

- Refer to the Company's News Release dated February 23, 2022. Available on Blackwolf's Website

- Refer to the Company's News Release dated July 6, 2021. Available on Blackwolf's Website

Exploration Permitting

As discussed, Permit applications for planned work on both the Niblack and Hyder projects have been submitted to the US Forest Service. Both applications have completed the environmental review and public scoping process and the Company anticipates the receipt of a Decision Memo regarding the projects shortly.

Qualified Persons

The Qualified Person(s) under NI 43-101 for the Company are Jodie Gibson, P. Geo, Vice-President of Exploration and Robert McLeod, P. Geo, President, and CEO. Both Mr. Gibson and Mr. McLeod have reviewed and approved the technical content of this release.

About Blackwolf Copper and Gold

Blackwolf's founding vision is to be an industry leader in transparency, inclusion and innovation. Guided by our Vision and through collaboration with local and Indigenous communities and stakeholders, Blackwolf builds shareholder value through our technical expertise in mineral exploration, engineering and permitting. The Company holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater in southeast Alaska as well as the Cantoo, Casey, and Texas Creek gold-silver and VMS properties in southeast Alaska. For more information on Blackwolf, please visit the Company's website at www.blackwolfcopperandgold.com.

ON BEHALF OF THE BOARD OF DIRECTORS

"Robert McLeod"

Robert McLeod, P.Geo

President, CEO and Director

For more information, contact:

ROB MCLEOD

604-617-0616 (Mobile)

604-343-2997 (Office)

rm@bwcg.ca

LIAM MORRISON

604-897-9952 (Mobile)

604-343-2997 (Office)

lm@bwcg.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements relating to the historic Niblack mine's potential to be a new resource area and the Company's future objectives and plans. Forward‐looking statements involve numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company's securities; fluctuations in commodity prices and changes in the Company's business plans. In making the forward looking statements in this news release, the Company has applied several material assumptions that the Company believes are reasonable, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. The Company seeks safe harbor.

The Company's "Mineral Resource Estimate" refers to a November 2011 NI 43-101 Report authored by SRK Consulting Independent of the Company and Deon Van Der Heever, Pr. Sci. Nat., Hunter Dickinson Inc., a Qualified Person who was not independent of the Company. Net Smelter Return (NSR) cutoff uses long-term metal forecasts: gold US$1,150/oz, silver US$20.00/oz, copper US$2.50/lb, and zinc US$1.00/lb; Recoveries (used for all NSR calculations) to Cu concentrate of 95% Cu, 56% Au and 53% Ag with payable metal factors of 96.5% for Cu, 90.7% for Au, and 89.5% for Ag; to Zn concentrate of 93% Zn, 16% Au, and 24% Ag with payable metal factors of 85% for Zn, 80% for Au and 20% for Ag. Detailed engineering studies will determine the best cutoff.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com.

SOURCE: Blackwolf Copper and Gold Ltd

View source version on accesswire.com:

https://www.accesswire.com/700867/Blackwolf-Copper-and-Golds-Niblack-and-Hyder-Projects-Exploration-and-Permitting-Update