KELOWNA, BC / ACCESSWIRE / January 13, 2023 / Lexaria Bioscience Corp. (Nasdaq:LEXX) (Nasdaq:LEXXW) (the "Company" or "Lexaria"), a global innovator in drug delivery platforms is pleased to provide an annual letter from CEO, Chris Bunka and a thorough strategic update to all stakeholders.

CEO LETTER TO STAKEHOLDERS

As 2022 came to a close, it isn't news that nearly all companies - not to mention most people - are facing challenges not experienced in years. Lexaria continues to navigate well and is focused on those things it can control such as applied R&D designed to entice others to work with us commercially.

Inflation rates running at 40-year highs have prompted interest rates to rise at the fastest rate in decades with radical changes underway in the economy and in the financial markets. Supply chains everywhere have been disrupted by geopolitical trends, by the pandemic, and sadly, by war in Europe. Stock markets around the world are experiencing the longest protracted decline since 2008, with the technology-heavy Nasdaq exchange down as much as 37% from November 2021 to October 2022.

Despite this, Lexaria is forging ahead. Lexaria has not terminated any staff and in fact our in-house team as well as our external consultant head-count has never been higher, in order to conduct and analyse an unprecedented volume of work. We've managed our growth while exercising excellent fiscal controls and have hit our annual budgets, +/- about 2%, for the last two years running.

Our applied R&D is paying off in spades (even if the stock market does not reflect that.., yet) because we are currently in active discussions with several multi-billion dollar companies around the world, for the potential use of Lexaria's DehydraTECH technology in their commercial product pursuits. We have not disclosed the identities of these companies nor the progress of those relationships because of a lack of materiality and to try to remain responsible to our prospective corporate partners, our shareholders, and to avoid rank speculation. These discussions are ongoing and have thus helped us to meet one of our primary objectives of the last year which is to introduce DehydraTECH to world-leading potential collaborators.

Below I will try to recap our progress of 2022 and indicate why I expect 2023 to be our best year ever. (All dates within this letter refer to calendar periods, not fiscal periods.)

CAPITAL MARKETS

The "price" that development-stage companies like Lexaria pays for capital, is ownership - equity - of our company. That's because we have to issue equity to receive money in our treasury that we use to conduct our operations. After raising roughly US$15 million in 2021, we had no plans to raise additional funds in 2022; and we did not. Thankfully, that deflected some of the hardship associated with the worst conditions in the stock markets in years, which would have been doubly painful had we raised any significant amount of capital at near record-low prices.

Our reference earlier in this letter to our strong cost controls is a point of pride: because we are not spending money foolishly, we have been able to hit our budgets even during a year when inflationary pressures are at their highest in roughly 40 years. The Lexaria management team has done a great job of preserving our precious capital the best we can.

In fact, we've done such a good job of preserving capital that we could survive through nearly all of 2023 without needing to raise additional capital, if we cut back a little on our R&D spending. However, as we prefer to keep advancing our applied R&D at as rapid a pace as we can, we are also continuing to pursue capital-strengthening possibilities that do not involve the issuance of any equity.

We are not considering taking on any debt. That would be a risky step for a company that has not reached profitable revenue-based operations. Instead, we have been working all year on developing specific corporate relationships that might obviate the need for equity-linked capital.

In fact, most early-stage biotech and pharmaceutical companies rely most heavily on licensing and R&D deals as a key component of their growth strategies. Technology licensing deals vary greatly in their specifics, but usually include an up-front payment, defined milestone payments as regulatory progress is made, and some sort of ongoing royalty structure once in commercial use. Of most importance to Lexaria shareholders today, both the up-front payment and the defined milestone payments can be significant revenue streams long before (or even whether or not) a product is ever offered for commercial sale.

This is a continuation of a strategy we began over two years ago, as we prepared for our uplist to the Nasdaq exchange and capital raise in 2021. Our applied R&D programs completed since then have yielded almost entirely positive results - a crucial accomplishment as we prepared to use those results to reinforce our outreach strategy to potential corporate partners. As a point of fact, I've always felt that the market never accurately valued our positive R&D results of 2021/22, because negative results could have created significant barriers with our hoped-for future corporate partners. Happily, we have been succeeding with almost entirely positive R&D results.

It is a direct result of our positive R & D programs that, as 2023 begins, we are actively involved in several sets of ongoing discussions and due diligence proceedings with potential corporate partners with a goal of collaboration, DehydraTECH out-licensing, or other corporate relationships. As is true in several sectors of the economy, pharma and biotech companies conduct deep investigatory programs into any technologies they are considering utilizing and it is nearly impossible to provide "too much" information. Accordingly, typical due diligence investigations can take several months to a year or more to complete. This is to be expected as we will be seeking significant investments to use DehydraTECH technology in what are usually multi-billion-dollar markets and these potential corporate partners cannot afford to make mistakes.

As such, I feel I and my team are delivering on a statement made in last year's CEO letter:

"As we look towards 2022 and 2023, Lexaria is also taking steps to ensure we have multiple choices in how we fund the Company. Some details must remain undisclosed for now and will be revealed at the appropriate times, but in other respects we clearly are trying to position the Company for non-dilutive injections of capital through strategic partners and other commercial relationships."

SHAREHOLDER/MARKET ACHIEVEMENTS

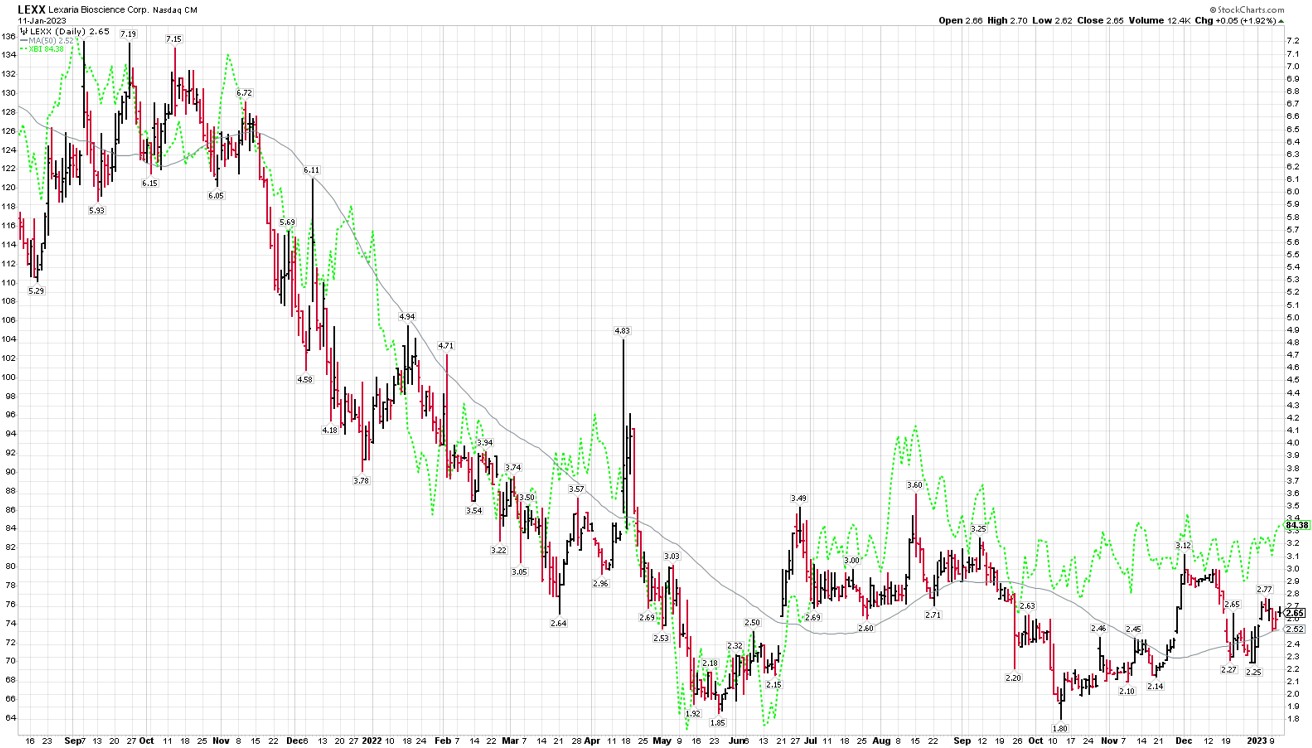

As you can see from this chart, Lexaria's stock has tracking the SP biotech index quite well since the summer of 2021 though we seem to be slightly behind in recent months. (The SP biotech index is shown with the green dotted line.) In general, the biotech sector declined precipitously into about May 2022, and has not made much progress since. We of course are hopeful to begin outperforming the broader biotech sector soon, and I believe we have good reasons to think that might be the case, as you will see below.

I purchased an additional 38,500 shares of our common stock in October, in the open market, to hold a little more than 520,000 shares in total: I remain the largest shareholder of Lexaria and my conviction in the long-term prospects of this company is stronger than ever. My purchases reflect my vote of confidence in the Company.

We've also been pleased to notice an increase in institutional ownership of our shares which I believe is a sign of "smart money" coming into our stock. Lexaria's management presents to biotech analysts and responds to investors conducting serious due diligence on a regular basis.

According to data accessed at Nasdaq in November, our institutional ownership reached 11.6% which was the highest it had been during 2022. As a reminder, we only have 5.95 million shares issued and outstanding, which is a very low number within our peer group of companies.

The table below shows our ten largest institutional shareholders according to their latest regulatory filings. Collectively, all our institutional shareholders own 690,344 shares according to their disclosures.

OWNER NAME |

DATE |

SHARES |

VALUE (IN 1,000S) |

|---|---|---|---|

| INVENOMIC CAPITAL MANAGEMENT LP | 09/30/2022 |

473,103 |

$1,017 |

| GEODE CAPITAL MANAGEMENT, LLC | 09/30/2022 |

49,002 |

$105 |

| SUSQUEHANNA INTERNATIONAL GROUP, LLP | 09/30/2022 |

40,119 |

$86 |

| VANGUARD GROUP INC | 09/30/2022 |

33,164 |

$71 |

| CITADEL ADVISORS LLC | 09/30/2022 |

24,874 |

$53 |

| DIMENSIONAL FUND ADVISORS LP | 09/30/2022 |

15,264 |

$33 |

| CENTIVA CAPITAL, LP | 09/30/2022 |

13,259 |

$29 |

| TWO SIGMA INVESTMENTS, LP | 09/30/2022 |

13,063 |

$28 |

| RENAISSANCE TECHNOLOGIES LLC | 09/30/2022 |

11,900 |

$26 |

| UBS GROUP AG | 09/30/2022 |

6,398 |

$14 |

Despite increases in our insider ownership, and institutional ownership, Lexaria's stock price suffered in 2022. This has been exceptionally frustrating for the entire Lexaria team, especially in light of the significant progress made towards our longer, more sustainable corporate goals as described earlier. We will continue to do everything we can to improve our valuation in the eyes of the market and try to deliver valuation gains to our shareholders.

FOOD AND DRUG ADMINISTRATION REGISTRATION

Last year I told you that we would pursue a pre-IND (Investigational New Drug) meeting with the FDA to introduce DehydraTECH-CBD for the treatment of hypertension. Although it required more time than expected, we did have a successful pre-IND response from the FDA in July that cleared our process to proceed toward formal IND filing. Since then, we have invested significant financial and human resources into this project and, although our steady progress has not warranted the issuance of press releases, we are getting closer and closer to registering the formal IND program.

We hired a regulatory compliance firm over one year ago and their large team of highly skilled professionals are working closely with Lexaria's President, John Docherty, and our research scientists on a constant ongoing basis. Achieving FDA registration for our IND program will be a major accomplishment that we expect to achieve this year.

Below, I will describe our most significant R&D programs, some of which are intimately connected to our FDA registration project. Indeed, I have said repeatedly that Lexaria has, with a lot of forethought, completed five human clinical studies already investigating DehydraTECH-CBD for its hypertension applications as a way of de-risking our future endeavours, as much as we possibly can, for our shareholders and potential corporate partners. These studies have been conducted at a European academic research hospital to rigorous standards even though they were purposefully not registered with the FDA. In fact, two peer-reviewed articles have already been published as a result of our 2018 and 2021 human clinical studies, and several more manuscripts are under development or in process toward additional publications in medical/science journals.

Our human clinical studies have been a vital component of our efforts at building relationships with prospective corporate partners; making it clear that our commercial efforts, our applied R&D studies, and our regulatory pursuits are all intimately connected.

Results from our already-completed human clinical studies have been an asset in our pre-IND meeting with the FDA, and with our regulatory compliance firm, as we prepare for our Phase 1(b) FDA-registered study expected to begin this year for DehydraTECH-CBD. It is a fact that across our five human studies completed to date, involving more than 130 people altogether, we have not yet recorded even a single serious adverse event. This is a major, significant accomplishment as we prepare for our Phase 1(b) study, the primary outcome of which will be rigorous safety and tolerability testing to pave the path toward product commercialization.

As verified with the FDA by way of our pre-IND meeting, Lexaria is envisioning its registered clinical trials ultimately culminating in filing of a 505(b)2 new drug application to obtain commercial authorization. The 505(b)2 pathway is advantageous because this pathway is considered abbreviated, as it is often described, typically enabling a faster route to commercial approval than the traditional 505(b)(1) NDA pathway. In order to pursue the abbreviated 505(b)2 pathway, Lexaria intends to lever as much as possible the wealth of publicly available, precedent safety data for the established pharmaceutical Epidiolex® which has already demonstrated the safety and tolerability of chronic CBD dosing but at much higher doses than Lexaria intends to pursue with its DehydraTECH-CBD hypertension program. Of note, Lexaria believes that its DehydraTECH-CBD offers advanced CBD delivery performance, including significant brain perfusion capabilities, in turn enabling enhanced pharmacological effectiveness at lower doses.

DehydraTECH-CBD for hypertension is not our only long-term plan for FDA registration. Stakeholders can follow our progress in other areas of therapeutic interest through the results we receive in our applied R&D programs - since we are a company that "follows the science", you can generally assume that our commercial and regulatory interests often follow those areas of investigation where we experience the most scientific success.

RESEARCH & DEVELOPMENT

If you've been following Lexaria for any period of time you know that applied R&D is our lifeblood. It helps us establish areas of investigation for commercial pursuits, reduces risks of the unknown for both commercial and regulatory goals, and more. Indeed, I cannot say it much better than I did last year:

"Meaningful national or international implementation of DehydraTECH is unrealistic prior to full knowledge and understanding of its limitations and capabilities. Lexaria has been very brazen and transparent conducting these studies in full public view compared to many pharma companies that keep these sorts of investigations hidden within their walls and undisclosed. Every positive result we generate is one more step towards removing risks associated with regulation and commercialization; eventually, with enough positive data, that formula will tilt in our direction."

Our top priority during 2022 was clearly to develop our DehydraTECH-CBD hypertension program and this has been an unqualified success. Our second priority was to explore whether DehydraTECH-nicotine could be a replacement for damaging and deadly lung-based absorption methods and a human clinical study in that program had a delayed start but is currently underway and expected to complete early in 2023.

Additionally, during 2022 we completed our first-ever animal study into DehydraTECH-CBD as an anti-seizure therapeutic and enjoyed success compared to one of the world's leading existing anti-seizure drugs. We released partial study results in November 2022 that received a lot of investor attention.

Hypertension and Heart Disease.

After the successful completion of several hypertension-focused human clinical trials in 2021, we were pleased to complete dosing in July in our largest-ever human clinical trial; 66 patients in our first extended multi-week study of DehydraTECH-CBD.

HYPER-H21-4 consisted of male and female volunteers between the ages of 40-70 with documented or measured elevated blood pressure (120/80 to 139/80 mmHg), mild (stage 1) hypertension (140/90 to 159/99 mmHg) or moderate (stage 2) hypertension (160/100 to 179/109 mmHg) who received DehydraTECH-CBD every day for a 5-week duration. DehydraTECH-CBD doses escalated between 225 mg/day to 450 mg/day over the study duration adjusted relative to body weight. Some volunteers were already using leading standard of care hypertension drugs such as angiotensin-converting enzyme ("ACE") inhibitors with or without diuretics and/or calcium channel blockers, which helped evaluate the safety and efficacy of DehydraTECH-CBD with and without other hypertension treatments. The extended duration of the study allowed Lexaria to gather critical data monitoring the safety and efficacy of DehydraTECH-CBD over time to allow us to evaluate the potential for longer term health benefits.

At the time of writing this letter, we had released results on blood pressure and on pharmacokinetic performance, both of which were positive; and on the absence of any serious adverse events, which is also positive. Given that these were the primary objectives of the study, it is accurate to say that HYPER-H21-4 was a success. In addition, a series of secondary study objective evaluations as previously announced, are in progress and these findings will be released in due course if any of them are notable.

For 2023, and as noted above, our primary R&D program is expected to be the launching of our FDA-registered IND program to formally investigate DehydraTECH-CBD for hypertension. This single program is a large undertaking and will dominate our second half of 2023 and beyond. Given its size we expect to conduct fewer additional smaller studies than we have in years past.

Nicotine.

Lexaria's oral nicotine program is designed to offer nicotine users less harmful alternatives to using nicotine, than smoking or vaping; and, for potential pharmaceutical applications, to demonstrate a reliable and ethical method of using nicotine for potential therapeutic use. Lexaria does not advocate the use of oral nicotine by anyone not currently using nicotine products, or not otherwise advised to by their doctor.

After a late-2021 animal study wherein we demonstrated superiority in delivering nicotine in an oral pouch format for absorption through the buccal tissues, we turned our attention to conducting a very similar study in humans. We faced repeated delays in doing so, first connected to global supply chain issues and then related to manufacturing challenges and more, but our service provider began dosing the DehydraTECH oral-nicotine pouch to humans in December. Dosing in this study should be complete early in 2023, during the first quarter.

We hope to demonstrate that the Lexaria DehydraTECH-processed nicotine absorbs more quickly and more efficiently into the human bloodstream than the world's leading oral nicotine brand, Zyn™; or America's third leading brand, On!™. If we are successful, we feel this will be a major step towards adoption of our technology into a consumer product, which could result in an important commercial relationship developing in 2023. Of course, we cannot predict how third-party companies will respond to our developments, but in our view there seem to be clear advantages to an oral nicotine product that absorbs more quickly and has fewer side effects such as oral tissue aggravation, than existing brands.

Successful human testing would be the ultimate demonstration of DehydraTECH's technological superiority. Additional R&D into oral nicotine will be related to very specific therapeutic use, or limited to formulation and or manufacturing improvements that we might investigate during the year. If our human nicotine study is successful, we will then focus on commercializing our technology most desirably through partnering with one or more leading global nicotine companies.

Seizure Disorders.

Our 2022 seizure-related R&D was slower to complete than we expected, but also delivered positive results. Just a week prior to the end of 2022 we reported results from our animal seizure study program EPIL-A21-1 in which we demonstrated certain performance enhancements compared to one of the world's leading anti-seizure medications, Epidiolex®.

This was a scientifically challenging study program to execute and our third-party laboratory required more time than we planned to conduct it. In general, DehydraTECH-CBD demonstrated a greater likelihood of inhibiting seizure activity and in a larger proportion of the tested animals, an apparent trend to be more efficacious at lower doses than Epidiolex.

Although Epidiolex enjoys regulatory exclusivity for its noted medical conditions, its exclusivity provisions are nearing expiration. We said last year that our studies might help Lexaria attract commercial relationships and represent opportunities for DehydraTECH to enter commercial markets far more quickly than is generally thought. Lexaria is very encouraged by our 2022 study results which represented our first-ever foray into this field, and we are considering possible opportunities for expanded investigations going forward.

Given the success of the 2022 program, we are internally rating our DehydraTECH-CBD for seizure investigation as one of our highest priorities along with our DehydraTECH-CBD for hypertension and DehydraTECH-nicotine for oral use pursuits. Each of these three areas of investigation has the potential to support important industry relationships that prove meaningful or even transformative for Lexaria. Because of the obvious medical and market needs in each of these three sectors, we will be pursuing commercial relationships in 2023 even as our R&D continues to progress.

Other R&D Programs.

In Q4, 2022 we announced our first ever programs to investigate DehydraTECH-CBD for possible use in the fields of dementia and in diabetes. Dosing in these programs is underway as of the time of this update and each are expected to complete during Q1, 2023.

We chose to investigate the utility of DehydraTECH-CBD in each of these areas for a number of reasons. For instance, it has long been known that hypertensive patients are at greater risk of developing diabetes, and that those people who have diabetes are twice as likely to suffer from hypertension. This interconnected relationship between the two diseases begs for further investigation of DehydraTECH-CBD given our growing knowledge of DehydraTECH-CBD's ability to lower blood pressure.

Likewise, vascular dementia is known to be more common in people who suffer from hypertension. Alzheimer's disease is the most common type of dementia, followed by vascular dementia. In addition to our ongoing animal study investigating whether there is any impact on cognitive performance in animals dosed with DehydraTECH-CBD, we are also intrigued by the knowledge that certain studies conducted by others are currently evaluating nicotine for possible utility related to dementia which is obviously another area where Lexaria has demonstrated possible utility of its technology.

We are awaiting the results from each of these two studies before determining our next steps with each. It is possible we may consider additional investigations in 2023 related to either or both of these areas of interest, and even possibly including some combination of DehydraTECH-CBD with DehydraTECH-nicotine with regards to our dementia investigations. Since each of these programs are at earlier stages than our other, leading program areas, additional R&D will be required before we investigate commerciality.

R&D Summary.

We've been fortunate to have succeeded in most of our R&D pursuits during 2022. Our optimism at the start of 2022 turned out to be well founded, and that optimism is, if anything, even stronger today. We've firmly established Lexaria as one of the world's leaders in the investigation of CBD for the purposes of controlling human blood pressure; and, we've demonstrated in animal studies that DehydraTECH-CBD is competitive with one of the world's leading anti-seizure medications.

2023 will be full of additional R&D developments.

During Q1 we expect:

- additional results from hypertension study HYPER-H21-4

- dosing completion in our animal dementia study

- dosing completion in our animal diabetes study

- dosing completion in human nicotine study NIC-H21-1

- submissions and publishing of additional results in research journals

During the balance of 2023 we expect to both file our IND application and receive FDA approval to commence the actual IND clinical study. That will be a major step in our maturation as a pharmaceutical company and will be our primary research focus once it begins. If it is successful it should contribute to an increase in our corporate value, and an increase in the likelihood of our reaching one or more commercial agreements within the pharmaceutical industry. And, as is now well known, the primary reasons we conducted our earlier human hypertension studies was to demonstrate both efficacy and safety - which we think has reduced the risk of unexpected failure in our IND program.

Finally, in the area of oral nicotine and pending successful results of our ongoing human absorption study, we feel we have come close to completing our scientific investigations and can now market the technology to the global nicotine industry in pursuit of growing revenue streams. This will mark a transition from scientific R&D to a commercial focus, which many of you have long awaited.

Incidentally, if our IND hypertension program is a success then it could potentially pave the way for more commercial pursuits of our DehydraTECH-CBD for therapeutic use: a real milestone for us as a company to be able to interact with the pharmaceutical industry.

COMMERCIAL RESULTS AND COLLABORATION

As noted last year, "Lexaria's business plan has long been one of collaboration following reduction of risk."

Our revenues shrank during both calendar and fiscal 2022 (our fiscal year-end is August 31). But, beginning in the quarter ending August 31, 2022 and continuing into the quarter ending November 30, 2022 we have begun to see some improvements in our revenues. They are admittedly still small and I continue to stress that revenue is not a current metric to build a valuation for Lexaria at this still-early stage of development.

That said, we signed new customers during 2022 that will only begin to have an impact on our revenues during 2023 and beyond. Chief among these was Premier Wellness Science Co., Ltd. of Japan - our first client in Asia. Premier is a subsidiary of a Tokyo Stock Exchange-listed company, Premier Anti-Aging Co., Ltd.

In order to retain ongoing exclusivity, the negotiated minimum quarterly payments to Lexaria began September 1, 2022 and, during the first five years of the Agreement, amount to US$4,527,500. Minimum quarterly payments start at $16,750 in the fiscal quarter ending November 30, 2022 but increase each year to reach $332,500 in the quarter ending November 30, 2025 and beyond. Assuming this client executes its business plan as expected, it will obviously generate significant revenue streams to Lexaria over time.

Lexaria is also in discussions with a number of larger companies in Europe and North America regarding licensed use of our DehydraTECH technology both for consumer sectors as well as - for the first time ever - within the pharmaceutical industry. These discussions are ongoing and would not have been possible were it not for our successful R&D programs that continue to validate our technology. It is impossible to predict the outcomes of business discussions, nor their timing, but we hope to be able to announce one or more significant new transactions in the first half of 2023.

Also, while it remains impossible and likely misleading to try to predict in advance the size of any potential transaction, it is not incorrect to examine the underlying assumptions. As presented last year,

"For example, many national or international corporations do not participate in new business segments unless they can be assured of multi-billion revenue potential. For companies with sales of $10 billion or $30 billion per year, this makes sense. And given that Lexaria's business model is to out-license our technology in exchange for royalties, you can see very quickly how every single percentage point of royalty on each $1 billion in revenue, amounts to $10,000,000 per year in highly profitable revenue to Lexaria. A 3% royalty rate on $4 billion would be $120,000,000 in revenue; or an 8% royalty on $2 billion would be $160,000,000 in revenue.

Furthermore, any out-licensing transactions Lexaria achieves with pharmaceutical companies may also be accompanied by significant, potentially multi-million dollar staged development milestone fees payable to Lexaria: this is customary in pharmaceutical licensing deals. These fees can at times be received years before a product ever reaches the market, or even regardless of whether a product ever reaches the market. Lexaria expects licensing fees to significantly complement its royalty revenue generation and also allow it to realize commercial revenue generation well in advance of when revenues start to flow from royalties upon actual product sales under these licensing transactions."

As 2023 begins, the Lexaria team is delighted to have begun the transition towards a more commercial focus which we hope will build the base of a successful and profitable future. Both our underlying R&D work as well as our commercial discussions will continue and we will report on developments as they occur.

INTELLECTUAL PROPERTY

During 2022, Lexaria was awarded five more new granted patents, bringing our total to 28 granted worldwide. Our latest new patent award was also our first ever granted in Canada. We currently have patents granted in the following countries:

United States

Canada

Mexico

Australia

Japan

India

European Union (many individual countries within)

While we expect additional patents to be awarded in 2023, we have already achieved considerable intellectual property protection through our existing patent portfolio. We also retain a large number of patent applications that continue to progress through various patent offices around the world. We do not receive a granted patent for each application we submit, and have begun to encounter our own "prior art" as a barrier to some new applications. This is, somewhat perversely, possibly "a good thing" in that our existing intellectual property is robust enough to potentially impede competing patent issuances importantly from unknown third parties.

Lexaria's intellectual property rests on a sound foundation of granted patents around much of the world.

SUMMARY

Lexaria achieved most of its goals for 2022 and did so while adhering to tight budgets and fiscal controls in a world where inflation is rampant. We're very careful and stingy with our shareholder's money and we try to build value at every step; even if that sometimes means projects take more time to complete. Our largest study ever, HYPER-H21-4, was completed on schedule, and although primary results have been released and were positive, secondary results have been slow to arrive and will continue to be released in 2023.

We have several studies ongoing with dosing completion expected in the first three months of 2023, and these could help shape subsequent investigatory work. And of course, the biggest item to be accomplished in 2023 will be our IND filing and approval for initiation of the work program thereunder.

One of our biggest achievements of 2022 was our greater emphasis on commercial pursuits. The signing of our first business client in Japan was certainly one indication of that, but so too are ongoing commercial discussions. Our scientific investigations into oral nicotine are nearing an end after several years of study and, assuming positive results from our human study as we experienced from an earlier animal study, we will be looking to commercialize this technology in 2023 with any of several interested parties.

We've continued on the path towards commercialization with our lead program, our DehydraTECH-CBD for hypertension which we expect to enter FDA IND-registered Phase 1(b) studies in 2023. And given the success experienced in our five previous human clinical studies examining DehydraTECH-CBD for pharmacokinetic performance and hypertension relief, we feel we have effectively de-risked that upcoming program.

We continue to enjoy more successes than failures. We're hopeful that our commercial endeavors might obviate any need to raise capital via equity issuance at current market levels, and our tight fiscal controls have greatly assisted in that pursuit. We will be trying to enter one or more commercial arrangements in 2023 that include our receipt of significant cash payments. And, our past and current efforts at building our client base for use of our tech related to consumer products will continue and intensify as we try to build incremental cash flows.

I continue to thank our many supportive shareholders - you have expressed your belief in our goals and share our desire for success. It hasn't always been easy, but the best things in life rarely are. It is my goal for 2023 to make Lexaria Bioscience one of the top drug delivery performers in the biotech/pharmaceutical world as we continue to prove the validity of our technology, and really begin our efforts to deliver financial rewards to you, our owners. Thank you for giving us this opportunity to work our way forward.

Chris Bunka

About Lexaria Bioscience Corp.

Lexaria Bioscience Corp.'s patented drug delivery technology, DehydraTECH™, improves the way active pharmaceutical ingredients (APIs) enter the bloodstream by promoting more effective oral delivery. Since 2016, DehydraTECH has repeatedly demonstrated the ability to increase bio-absorption with cannabinoids, antiviral drugs, PDE5 inhibitors and more. DehydraTECH has also evidenced an ability to deliver some drugs more effectively across the blood brain barrier. Lexaria operates a licensed in-house research laboratory and holds a robust intellectual property portfolio with 28 patents granted and many patents pending worldwide. For more information, please visit www.lexariabioscience.com.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release includes forward-looking statements. Statements as such term is defined under applicable securities laws. These statements may be identified by words such as "anticipate," "if," "believe," "plan," "estimate," "expect," "intend," "may," "could," "should," "will," and other similar expressions. Such forward-looking statements in this press release include, but are not limited to, statements by the company relating the Company's ability to carry out research initiatives, receive regulatory approvals or grants or experience positive effects or results from any research or study. Such forward-looking statements are estimates reflecting the Company's best judgment based upon current information and involve a number of risks and uncertainties, and there can be no assurance that the Company will actually achieve the plans, intentions, or expectations disclosed in these forward-looking statements. As such, you should not place undue reliance on these forward-looking statements. Factors which could cause actual results to differ materially from those estimated by the Company include, but are not limited to, government regulation and regulatory approvals, managing and maintaining growth, the effect of adverse publicity, litigation, competition, scientific discovery, the patent application and approval process, potential adverse effects arising from the testing or use of products utilizing the DehydraTECH technology, the Company's ability to maintain existing collaborations and realize the benefits thereof, delays or cancellations of planned R&D that could occur related to pandemics or for other reasons, and other factors which may be identified from time to time in the Company's public announcements and periodic filings with the US Securities and Exchange Commission on EDGAR. The Company provides links to third-party websites only as a courtesy to readers and disclaims any responsibility for the thoroughness, accuracy or timeliness of information at third-party websites. There is no assurance that any of Lexaria's postulated uses, benefits, or advantages for the patented and patent-pending technology will in fact be realized in any manner or in any part. No statement herein has been evaluated by the Food and Drug Administration (FDA). Lexaria-associated products are not intended to diagnose, treat, cure or prevent any disease. Any forward-looking statements contained in this release speak only as of the date hereof, and the Company expressly disclaims any obligation to update any forward-looking statements or links to third-party websites contained herein, whether as a result of any new information, future events, changed circumstances or otherwise, except as otherwise required by law.

INVESTOR CONTACT:

George Jurcic - Head of Investor Relations

ir@lexariabioscience.com

Phone: 250-765-6424, ext 202

SOURCE: Lexaria Bioscience Corp.

View source version on accesswire.com:

https://www.accesswire.com/735245/Lexaria-Releases-Annual-Letter-from-the-CEO