Oil refining stocks posted record-high profits in 2022, thanks to the wide margin between the cost of crude oil and refined products. Despite a decline in crude oil prices since the summer of 2022, refiners are bullish on their 2023 profitability.

Oil refiners convert crude oil into valuable products like gasoline, diesel, and jet fuel, which they then sell to gas stations, airports, and other distributors. Refiners profit from the spread between the cost of crude oil and the market price of refined products, commonly known as the "crack spread," named after the "cracking" process refiners use to break down crude oil.

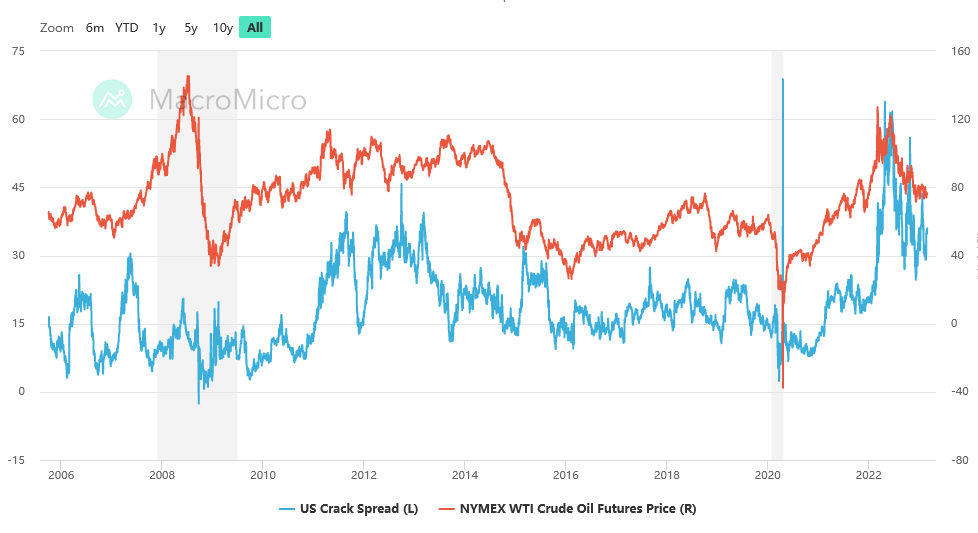

These spreads give investors a rough idea of refining profitability. When spreads are high, refiners make big profits. When spreads are low, refiners struggle to break even, making these spreads a critical component to analyzing the oil refiner sector.

Today, the benchmark crack spread is $35, far above the historical average of $10.50. Based on today's prices, a refiner makes $35 in gross margins per barrel of refined crude oil.

For reference, here’s a historical chart of crack spreads:

While many analysts see crack spreads and refiner profitability normalizing in 2023, several factors point to potentially high spreads for the foreseeable future. This article highlights two firms trading at single-digit earnings multiples that are best positioned to benefit from potentially elevated margins for refiners.

The Supply And Demand Story

The entire energy market post-COVID created several exciting supply and demand trends. One of the most significant is how slow new production will come online. For instance, according to Mike Hennigan, CEO of Marathon Petroleum (NYSE: MPC), refining capacity has declined by nearly 4 million barrels per day over the last few years while demand for refined products remains robust.

And after US refiners spent most of 2022 at near-full utilization, the industry plans to reduce capacity to perform maintenance in 2023, with most US refiners planning to run at mid-80s capacity, compared to low-90s last year.

The upshot is that US refiners won't be able to produce as many refined products in 2023. And this comes when global inventories of refined products like diesel and jet fuel remain very low.

However, there’s little sign that demand will ease, especially with China’s reopening and Europe turning to the US to replace its Russian refined product imports.

PBF Energy

PBF Energy (NYSE: PBF) is the most attractive of the US-based refiners because it's dirt cheap. The company earned $23.47 per share in 2022 while the stock price is $44.76, making for a 1.9x earnings multiple.

PBF is trading like it’s going out of business, even when operations at the company have seldom looked better. The company has made massive strides in reducing its debt load, paying down $2.3 billion in debt in 2022 alone, and interim CFO Karen Davis said the company’s balance sheet is its strongest ever.

While all refiners are trading at low valuations, like Marathon Petroleum's 4.5x PE ratio, PBF seems especially hated by the market with its 1.9x earnings multiple. And that's because they have yet to be as aggressive with returning capital to shareholders, instead opting to pay down debt.

But looking forward, the company has significantly reduced its leverage and is now looking to return cash to shareholders. The company recently raised its dividend and authorized a $500 million share buyback program.

Marathon Petroleum

Marathon Petroleum (NYSE: MPC) is the largest US-based oil refiner by market cap and capacity. Most of the company's profits come from its refining operations, which involve refining crude oil into refined products like gasoline, diesel, and jet fuel and selling them to distributors.

The company delivered a record performance in 2022, buoyed by the highly positive backdrop for refiner margins. Marathon earned $28.17 per share in 2022, representing a 1,287% year-over-year earnings increase.

The company is flush with cash and aggressively aims to return almost all of it to shareholders. Marathon repurchased $18 billion worth of shares since May 2021, which is gargantuan compared to the current market cap of $54 billion. The company recently authorized plans for an additional buyback of $5 billion in shares.

Given the company's impressive shareholder distributions and earnings growth, you'd expect it to trade at a premium to the market's multiple. However, the company trades at just 4.5x 2022 earnings, even as the next few years seem bright.

Bottom Line

Like most energy stocks, refiners are highly cyclical investments. There are stretches of years where they make very little or lose money and then stretches where they seem to make half of their market cap in earnings.

One of the primary challenges for investors is identifying where an industry is within its cycle. That presents the primary question for refiners: can the industry maintain record-high crack spreads throughout 2023 and beyond?