The clean energy revolution continues accelerating as the world embraces the global decarbonization movement. There are many forms of clean energy, each doing its part to limit greenhouse gases and improve sustainability.

Ethanol is a triple threat as a clean, green and sustainable energy source that can reduce greenhouse gas emissions on many levels. We'll review five publicly traded ethanol stocks that may fit your investment criteria in this piece.

What is Ethanol?

You may have heard of ethanol and even seen it as an ingredient in gasoline when filling up your car. Ethanol is a form of alcohol. It also goes by the name of ethyl alcohol. It's a colorless, flammable, volatile liquid with the chemical formula of C2H50H or C2H60 and has many uses.

Beer, wine and most liquors contain a mix of ethanol and water. Medical practitioners use ethanol as an antiseptic and disinfectant to clean wounds and swab an area before a needle injection. Ethanol is also commonly used as a biofuel and fuel additive.

Ethanol comes from fermenting a range of starch-based crops, also called biomass, which includes corn, wheat, grain, barley or potatoes, to sugar cane and sweet sorghum. Due to its abundance and relatively cheap costs, corn makes up most of the ethanol produced in the U.S. Ethanol can also come from landfill gasses and agricultural, animal and food wastes. Most gasoline in the U.S. contains up to 15% ethanol.

Ethanol is a renewable fuel produced from biomass. It burns more entirely and is cleaner than gasoline. It cuts greenhouse gas emissions (GHG) by 44% to 52% compared to gasoline, aiming to reduce reduction to 70%. Many claim it's carbon neutral due to the smaller amount of carbon dioxide (CO2) released in vehicles, offset by the CO2 absorbed by the plants grown to make ethanol.

E85 is the code composition for anhydrous ethanol or flex fuel containing 85% ethanol and 15% gas. In reality, it usually contains 51% to 83%. These fuels are often used in cars designated as flex-fuel vehicles. Oil companies were required to add ethanol to gasoline in the Energy Act of 2005. Its use as an additive continues to grow, reaching more than 10% blend in U.S. gasoline in 2022.

The U.S. ethanol industry has over 200 fuel-grade ethanol production facilities that can produce 17 billion gallons annually. The global ethanol fuel market will grow at a 6.3% compound annual growth rate (CAGR) to $96.63 billion in 2023.

5 Best Ethanol Stocks to Buy Now

Here is a list of ethanol company stocks to consider when looking for ethanol stocks to buy. The ethanol producing stocks list is in no particular order or ranking. You can look up stock ratings on MarketBeat. The companies are involved in various aspects of the ethanol industry, including producing, refining, improving, marketing and distribution. They range from agriculture to energy companies and publicly traded ethanol companies.

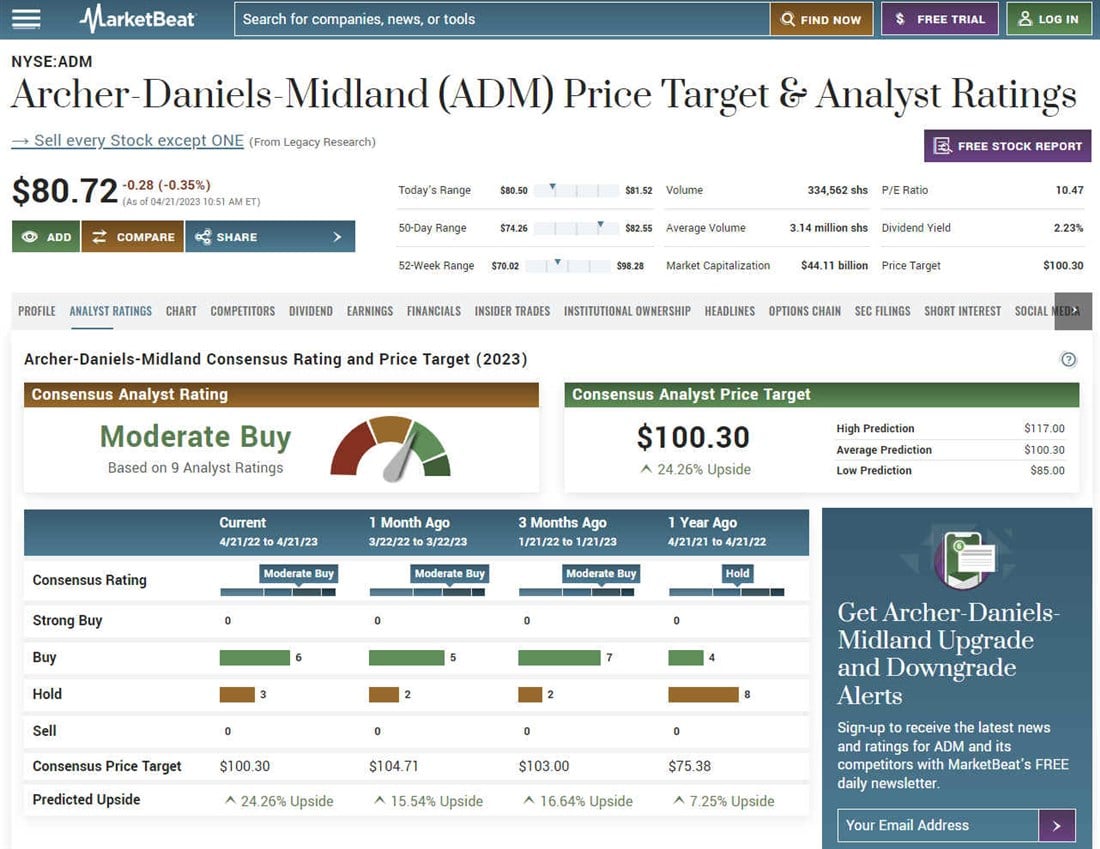

Archer-Daniels-Midland Co.

Archer-Daniels-Midland Co. (NYSE: ADM) is the world's largest processor of grains and seed oils, generating over $100 billion in annual revenues. It's an agricultural giant with a significant role in the cultivation and harvesting of the crops commonly used to produce ethanol. It is one of the world's largest ethanol producers, with an annual production capacity of 1.6 billion gallons.

Ethanol production occurs through its vantage corn processors subsidiary, which saw two of its dry mills back online after being temporarily closed during the pandemic.

It supplies industrial ethanol to large oil and energy companies. It expects the demand for ethanol fuel to continue rising. Demand for the E15 ethanol blend will increase when the U.S. Environmental and Protection Agency (EPA) allows year-round sales for biofuel in 2024. You can find more agriculture stocks on MarketBeat. You can find Archer-Daniels-Midland analyst ratings on MarketBeat. The five-year performance for ADM stock is up 78% and pays a 2.22% annual dividend yield.

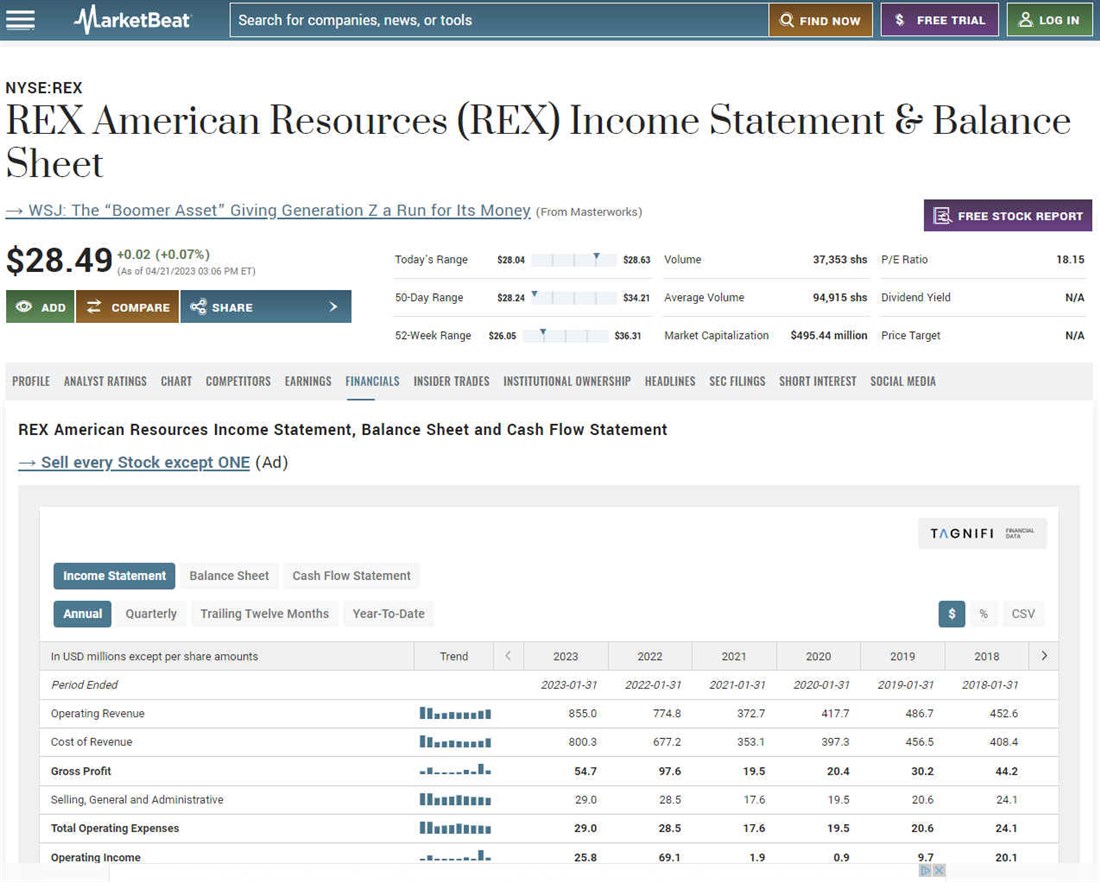

Rex American Resources

REX American Resources Corp. (NYSE: REX) is a holding company with varying ownership levels in six ethanol production facilities in corn-belt areas in the Midwest with access to major railroads. The company produces over 600 million gallons of ethanol annually and grew revenues north of $800 million in 2022.

Its facilities produce ethanol through refining and distilling corn. They also offer non-food grade corn oil, distiller grains for animal feed and natural gas. The Russian-Ukraine war has elevated oil and corn prices, benefiting the company as its margin expands. The company carries no debt and doesn't pay an annual dividend. You can find Rex American Resources financials on MarketBeat. The five-year performance for REX stock is 16%.

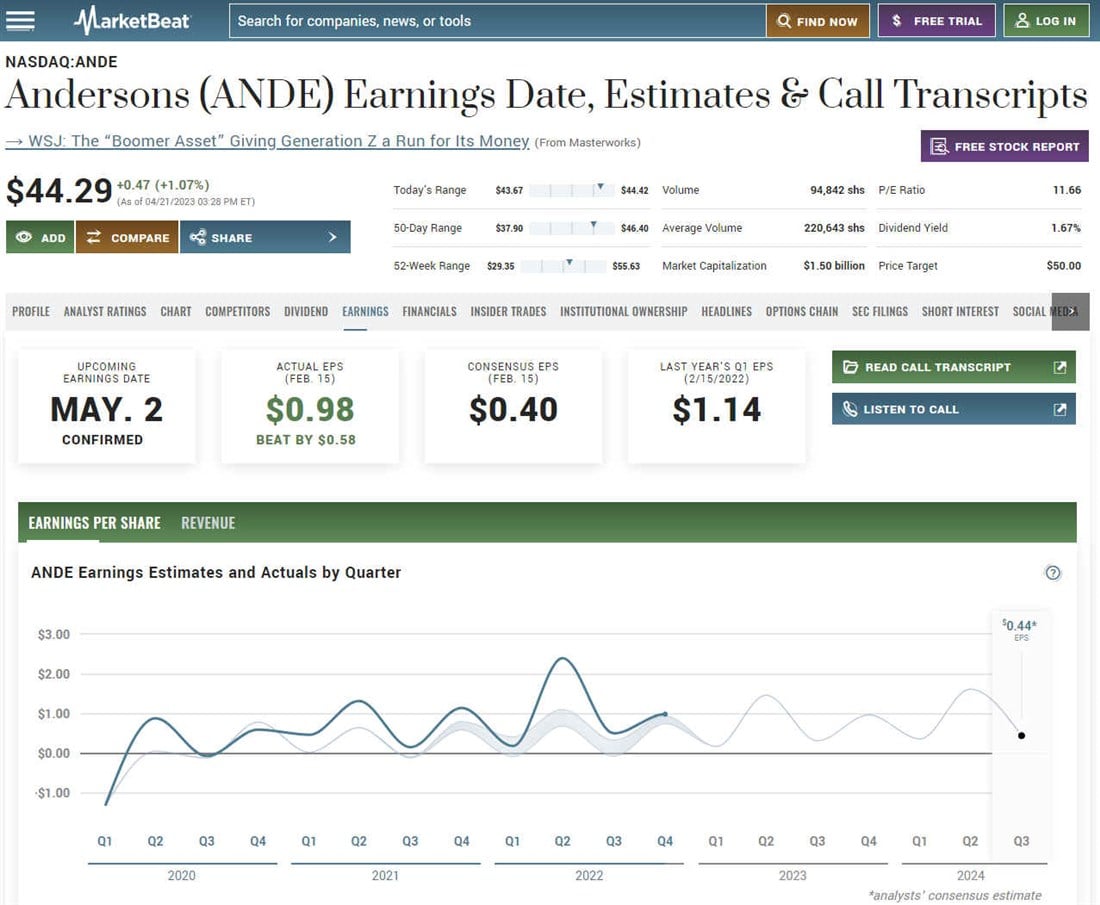

The Andersons Inc.

The Andersons Inc. (NASDAQ: ANDE) is a diversified agriculturally rooted company operating in three segments: trade, renewables and plant nutrients. Its renewables segment engages in the production of ethanol co-products and biofuels, including biodiesel. It co-owns five ethanol plants throughout the Midwest located close to corn production areas with an annual production capacity of 545 million gallons. The company partners with the country's largest ethanol blender, Marathon Petroleum.

The Andersons are a significant supply chain player in the U.S. Its trade segment manages the logistics of shipping whole grains, feed ingredients, fuel products and physical commodities across the U.S. and Canada. The Andersons generate north of $13 billion in annual revenues. The company is all about sustainability, as its ethanol plants are powered through cogeneration facilities, considerably reducing power grid usage.

Find The Andersons earnings estimates and conference call transcripts on MarketBeat. The five-year performance for ANDE stock is up 36% and pays a 1.69% annual dividend yield.

Valero Energy Co.

Valero Energy Co. (NYSE: VLO) is one of the largest oil refineries in the country. Combustion engine cars can't run on straight crude oil. The crude oil has to be refined into gasoline or diesel fuel.

While oil pipeline problems can cause minor disruptions in the oil supply, refinery shutdowns cause significant problems. It takes at least two weeks to convert crude oil into gasoline, but delays or problems can prolong the process for months.

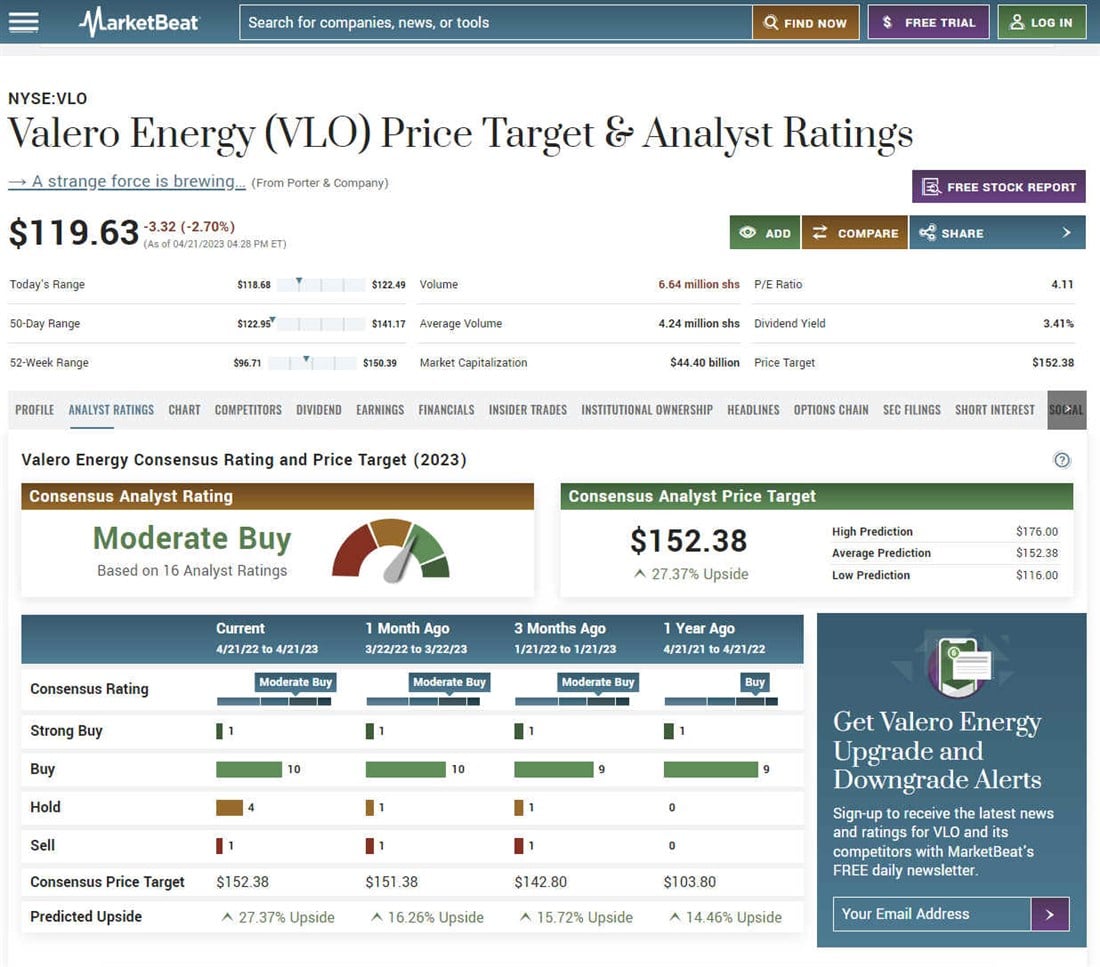

Valero is a vertically integrated operation controlling its supply chain from crude oil production to refining and selling to energy companies and retail customers through its gas stations. The company has 15 oil refineries and over 7,000 retail and wholesale outlets. Valero operates 12 ethanol plants to produce renewable fuel from corn plants. It has as much annual ethanol production capacity as Archer-Daniels-Midland at 1.6 billion gallons. Valero generated over $176 billion in 2022. Most of its revenues come from refining transportation fuels, as the company generated over $4 billion in ethanol revenues in 2022. Look at Valero Energy analyst ratings and price targets on MarketBeat. The five-year performance for VLO stock is up 10.4% and pays a 2.78% annual dividend yield.

Green Plains Inc.

Green Plains Inc. (NASDAQ: GPRE) is another vertically integrated organization that produces, markets, sells and distributes ethanol. It has 11 ethanol plants in six states producing up to one billion gallons of biofuels annually, making it the third largest ethanol producer in the country. It takes 56 pounds of corn to produce around three pounds of ethanol.

The escalated price of corn has made input costs expensive, since Great Plains must buy the corn before processing it into ethanol. The company acquired Fluid Quip in 2021, enabling it to integrate MSC protein technology to yield higher corn oil and protein quality for wider margins. The new premium products sell for $200 over conventional distillers' low-protein products.

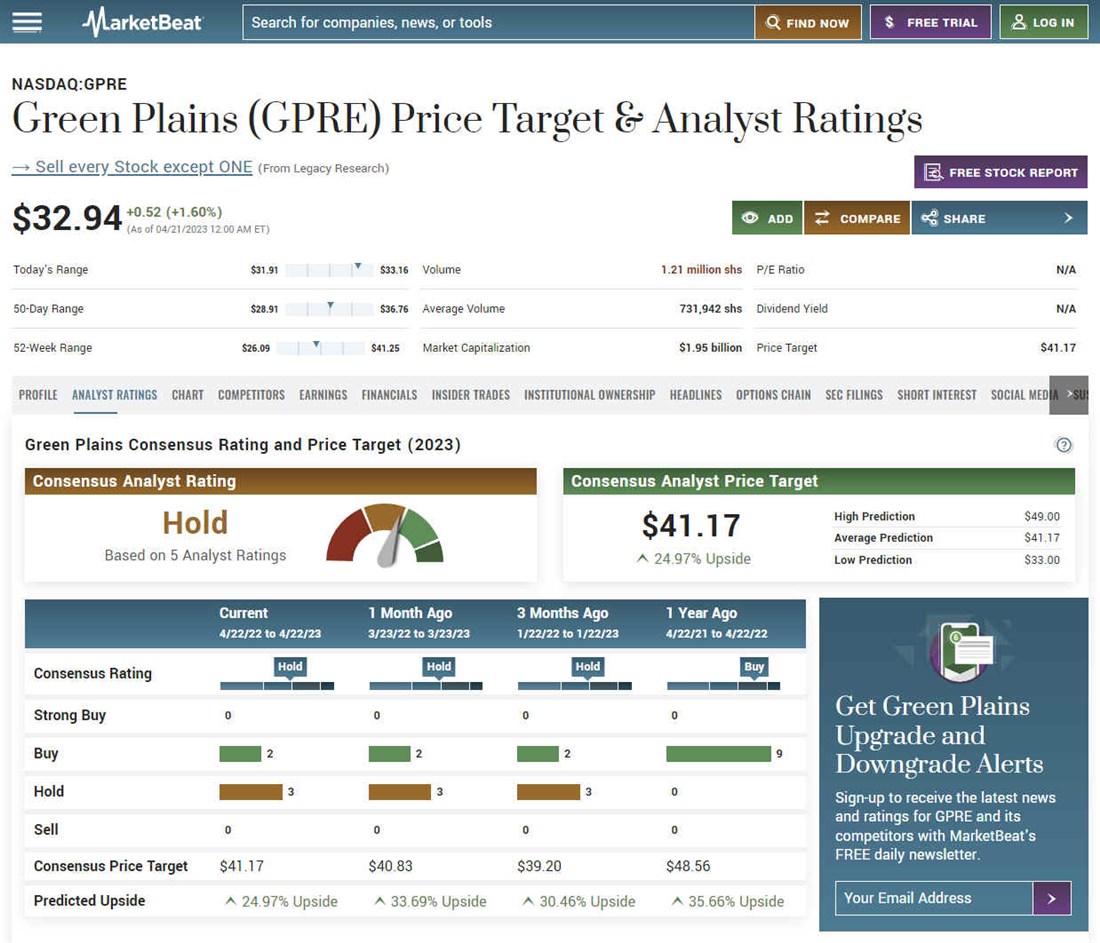

The company has a total of five MSC technology locations. The company announced a sustainable jet fuel partnership with United Airlines, PNNL and Tallgrass. The company had $3.4 billion in revenues for 2022. The five-year performance for VLO stock is up 10.4% and pays a 2.78% annual dividend yield. Learn more about Green Plains analyst ratings and price targets on MarketBeat.

Pros and Cons of Investing in Ethanol Stocks

Here are some pros and cons that come with investing in ethanol stocks.

Pros

Here are some of the benefits:

- Clean energy demand: The global decarbonization movement should accelerate and gain more momentum. This demand for clean, green and renewable energy will continue to grow. This demand should continue to benefit ethanol companies.

- Diversification: Ethanol stocks can provide diversification for your portfolio. Since they are more anchored to commodity prices, falling inflation lowers corn prices, thereby improving margin as input costs fall. Ethanol stocks tend to move with the oil and energy sector.

- Favorable government incentives: The U.S. Energy Act of 2005 required all gasoline in the U.S. to contain at least a 10% blend of ethanol to gasoline. More regulation aimed toward clean and renewable energy can further bolster the demand and application of ethanol. The U.S. government provides incentives for the production and use of ethanol. Qualified ethanol producers get a $1 income tax credit per gallon of corn or cellulose-based ethanol.

Cons

Here are some cons that come with investing in ethanol stocks:

- Commodity market volatility: Rising commodity prices result in higher input costs for ethanol producers who need to buy corn or grain first. Rising inflation can impact net margins for ethanol producers, who may charge more for the product causing demand to taper.

- Technology risks: Advancements in technology can also impact ethanol users negatively. For example, migrating to electric vehicles (EV) should reduce the demand and usage of fossil fuels. EVs don't use ethanol; more EVs theoretically mean less need for ethanol.

- Regulatory risks: Government regulation can cut both ways. Mandating its inclusion into U.S. gasoline is an obvious benefit. However, depending on the day's politics, the government could reduce its support for ethanol. The U.S. and other nations are moving towards electrification and ultimately cutting down the use of fossil fuels.

Vertical Integration

Many ethanol producers are vertically integrated organizations, meaning they grow the crop, process it, and then distribute it to customers. Vertically integrated ethanol companies are less reliant on the supply chain since they own it. They are their complete ecosystems. These companies may be less risky but command a higher premium and are worth investing in if you seek less risk. These companies also have a track record of consistent dividends. They are worth considering when buying the best dividend stocks.

FAQs

Here are some answers to some of the most frequently asked questions.

Who is the largest producer of ethanol?

Archer-Daniels-Midland and Valero can each produce 1.6 billion gallons of ethanol annually. Archer-Daniels-Midland is one of the world's most prominent grain and oilseed processors. Valero is one of the country's largest oil refineries, which exposes you to the oil industry if you invest in the company.

Which is the best ethanol stock?

The best ethanol stock depends on your investment criteria. If looking for growth, consider some pure ethanol stock plays. If looking for income, consider companies participating in other industries like agriculture, food production or oil and gas that also pay dividends. Use the MarketBeat dividend calculator to gauge if the APR fits your investment income goals. You can also look at stock ratings on MarketBeat to compare ethanol stocks.

Can you invest in ethanol?

You can invest in the stocks of companies involved in the ethanol industry. Review the five companies in this article if you're considering investing in ethanol stocks.