Wrapping up Q3 earnings, we look at the numbers and key takeaways for the defense contractors stocks, including BWX (NYSE:BWXT) and its peers.

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

The 14 defense contractors stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 2.7% below.

Thankfully, share prices of the companies have been resilient as they are up 7.3% on average since the latest earnings results.

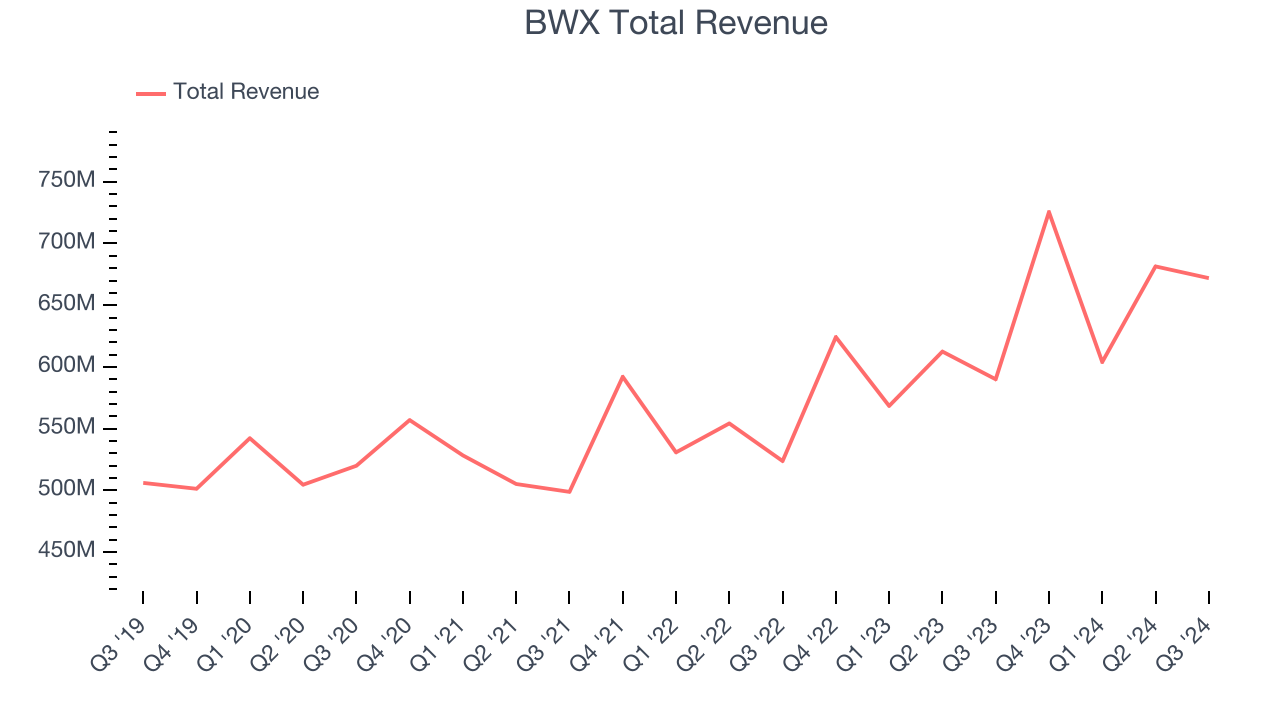

BWX (NYSE:BWXT)

Contributing components and materials to the famous Manhattan Project in the 1940s, BWX (NYSE:BWXT) is a manufacturer and service provider of nuclear components and fuel for government and commercial industries.

BWX reported revenues of $672 million, up 13.9% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was a strong quarter for the company with full-year revenue guidance exceeding analysts’ expectations and a decent beat of analysts’ EBITDA estimates.

“Our strong third quarter performance underscores the momentum BWXT has built throughout 2024,” said Rex D. Geveden, president and chief executive officer.

Interestingly, the stock is up 5.7% since reporting and currently trades at $126.51.

Is now the time to buy BWX? Access our full analysis of the earnings results here, it’s free.

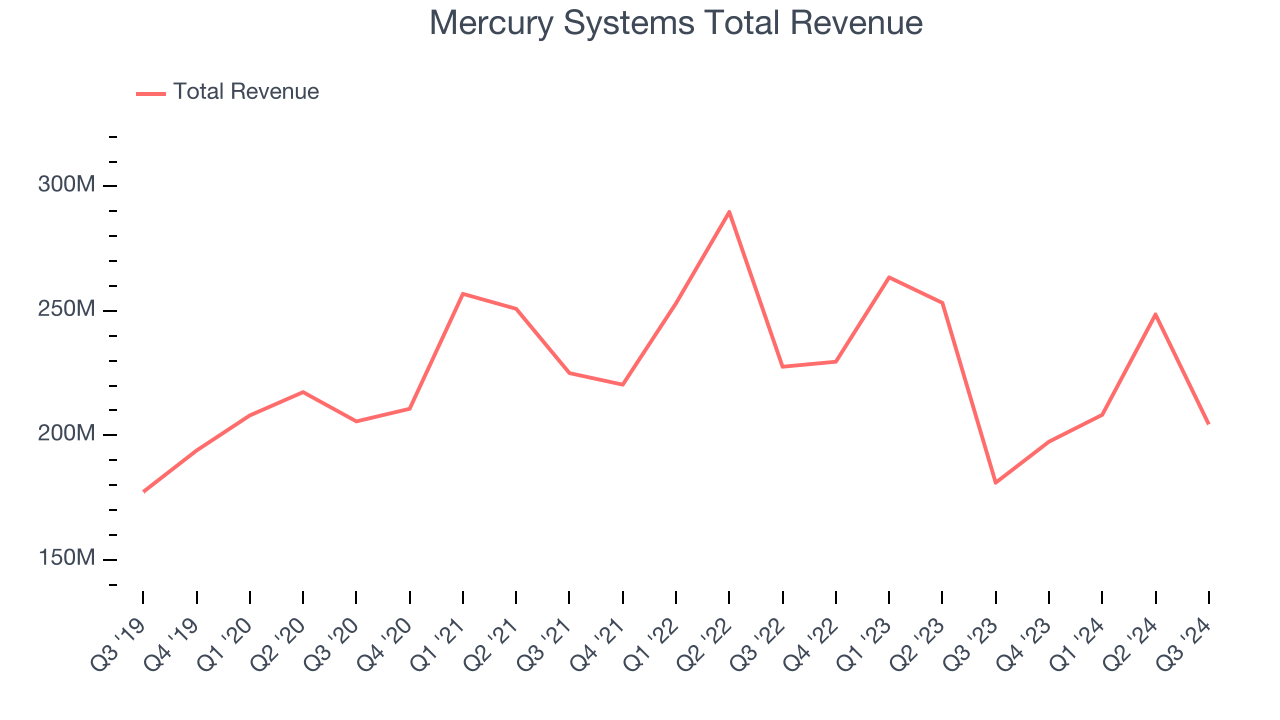

Best Q3: Mercury Systems (NASDAQ:MRCY)

Founded in 1981, Mercury Systems (NASDAQ:MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $204.4 million, up 13% year on year, outperforming analysts’ expectations by 12.5%. The business had an incredible quarter with an impressive beat of analysts’ organic revenue and earnings estimates.

Mercury Systems achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 29% since reporting. It currently trades at $44.18.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Huntington Ingalls (NYSE:HII)

Building Nimitz-class aircraft carriers used in active service, Huntington Ingalls (NYSE:HII) develops marine vessels and their mission systems and maintenance services.

Huntington Ingalls reported revenues of $2.75 billion, down 2.4% year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted a miss of analysts’ operating margin estimates.

Huntington Ingalls delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 17.6% since the results and currently trades at $206.70.

Read our full analysis of Huntington Ingalls’s results here.

CACI (NYSE:CACI)

Founded to commercialize SIMSCRIPT, CACI International (NYSE:CACI) offers defense, intelligence, and IT solutions to support national security and government transformation efforts.

CACI reported revenues of $2.06 billion, up 11.2% year on year. This result beat analysts’ expectations by 7%. Overall, it was an exceptional quarter as it also recorded an impressive beat of analysts’ backlog sales and EBITDA estimates.

The stock is up 8% since reporting and currently trades at $566.28.

Read our full, actionable report on CACI here, it’s free.

Leonardo DRS (NASDAQ:DRS)

Developing submarine detection systems for the U.S. Navy, Leonardo DRS (NASDAQ:DRS) is a provider of defense systems, electronics, and military support services.

Leonardo DRS reported revenues of $812 million, up 15.5% year on year. This number topped analysts’ expectations by 4.7%. It was an exceptional quarter as it also recorded an impressive beat of analysts’ earnings and EBITDA estimates.

The stock is up 32% since reporting and currently trades at $37.50.

Read our full, actionable report on Leonardo DRS here, it’s free.

Market Update

As expected, the Federal Reserve cut its policy rate by 25bps (a quarter of a percent) in November 2024 after Donald Trump triumphed in the US Presidential election. This marks the central bank's second easing of monetary policy after a large 50bps rate cut two months earlier. Going forward, the markets will debate whether these rate cuts (and more potential ones in 2025) are perfect timing to support the economy or a bit too late for a macro that has already cooled too much. Adding to the degree of difficulty is a new Republican administration that could make large changes to corporate taxes and prior efforts such as the Inflation Reduction Act.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.