Alternative dairy is growing fast. To grow with it, manufacturers need to overcome four key challenges.

SOURCE: CRB

SUMMARY:

This article originally appeared in our Horizons: Alternative Proteins report, which includes insights from industry leaders and CRB’s experts. Get your copy of the report here.

DESCRIPTION:

The alternative dairy industry is so hot that even Jay-Z thinks it’s cool. In 2020, the rapper was the latest celebrity to invest big money in this booming industry, which is expected to reach more than US$12 billion by 2024.

To drive all of this activity, alternative dairy brands have staked a lot on what they are not: not derived from animals, not a source of lactose, not (as) destructive to the environment. For long-term business success, though, they need to focus on what they are. And for many of today’s alternative dairy manufacturers, this comes down to a single urgent question: are we scalable?

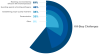

For more than half of our survey respondents, commercialization is still a long way off (Figure 1). Even if you’re among the 47% who are manufacturing alternative dairy products at commercial scale, chances are good that this represents only about half of your overall output (Figure 2), and that you’ve come this far by subsidizing your alternative dairy operation with revenue from elsewhere in your product portfolio.

With so much investment pouring in and such novel food science emerging from plant-based test kitchens, what’s standing in the way of exponential growth for these alternative dairy manufacturers? After all, shouldn’t the Danones and Chobanis of the world, with their resources and a legacy of manufacturing experience to lubricate their progress, make quick work of expanding their portfolio with plant-based dairy production?

We recently helped a client see just how complex that expansion can be. This client was trying to convert an aging dairy plant into a modern production center for plant-based dairy products, and the complications emerged right away. The plant’s storage facilities, designed for large batches of animal-based milk, weren’t optimized for small quantities of frozen and fresh ingredients, each requiring different holding temperatures to maintain stability. Then there were the facility’s water lines, which couldn’t support the volume needed for their water-intensive plant-based milk formulation. And there was the overall facility layout and interconnecting process piping, which was optimized for transferring small batches between processes and into packaging. The list goes on.

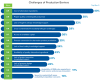

That’s the thing: converting from mammalian to alternative dairy production is not a pivot or a simple expansion. It’s a transformation. And transformations are challenging, especially in an industry so new that many of its players are operating without a roadmap — or the roadmap they have, from traditional dairy operations, doesn’t get them where they need to be. When we asked our survey respondents in the alternative dairy space about the barriers they face as they scale their operations, their answers illustrated the scope of these challenges (Figure 3).

It takes robust design and construction strategies based on current and forthcoming food science to address these challenges and equip companies entering the alternative dairy market with the new and retrofitted facilities they need to succeed. To get that far, it helps to first understand each of those challenges, which is exactly what we’ll do here by discussing the four top-ranked barriers identified in our survey.

Alternative dairy processing challenge #1: Cost of alternative ingredients

Manufacturers used to the commodified prices of animal-based raw ingredients face an abrupt awakening when they transition to plant-based materials. Though there may be little room to negotiate those hard costs, alternative dairy manufacturers do have one advantage: diversity. From soy to pea protein to coconut, the range of potential base ingredients is vast and growing (Figure 4). From this range manufacturers can strategically develop a product portfolio that will help to offset their material costs.

Getting this strategy right comes down to understanding what motivates your target consumer. Are they driven primarily by environmental concerns? Certain replacements for mammalian milk, like almonds, are increasingly scrutinized for their impact on the environment, which could deter a small segment of consumers. This possibility hasn’t slowed the booming almond industry, though, nor has it dissuaded half of our survey respondents from using almonds as their primary source of alternative protein.

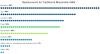

Consumers motivated by health concerns appear to be a more influential demographic for manufacturers at this time. Oat products, for example, are most commonly manufactured through a process that converts starch to sugar. The FDA may soon require an “added sugar” label on those products, similar to products that contain high-fructose corn syrups. This development has prompted more than half of the oat-based manufacturers who responded to our survey to rethink their process or consider replacing oats as their core ingredient (Figure 5). Manufacturers of products that rely on pea protein are at a similar inflection point over allergen concerns; many are looking at replacement ingredients (Figure 6).

Concerns for the planet, for allergen exposure, for overall health — different motivators will steer consumers towards different products.

These are the dice that manufacturers hold in their hand, and the secret to success is part good process design, part good market analysis, and part good luck. Increasingly, it may also come down to good science: lab-grown dairy proteins, still a nascent concept, could one day address most or all of these motivators at once, further galvanizing the industry.

Until then, manufacturers must carefully balance the high cost of plant-based ingredients with consumers’ reasons for choosing alternative dairy products.

Alternative dairy processing challenge #2: Proper quality control/quality assurance

In the animal-based dairy industry, manufacturers can rely on decades of research, giving them detailed insights about everything from seasonal variations in milk quality to product stability at various temperatures. This research is the foundation for the robust QC/QA systems that govern traditional dairy production, helping manufacturers ensure the consistency, repeatability, and quality of every batch. It’s also a diagnostic tool: if a product’s texture or taste profile changes unexpectedly, for example, manufacturers of traditional animal-based products understand the variables involved and can isolate and solve the issue relatively quickly in most cases.

Alternative dairy manufacturers, by contrast, are flying blind, or so it can seem. They have few established quality measures to rely on and little inherited knowledge. Can seasonal changes affect the behavior of harvested ingredients? How will scaling from a 20-gallon mixing tank in the test kitchen to a 2,000-gallon commercial tank affect the way ingredients are incorporated? Why is this batch cooking consistently under a certain temperature, but that one isn’t? As the industry matures and manufacturers aggregate more data, they’ll encounter fewer of these mysteries; for now, though, each one requires extensive detective work.

Alternative dairy processing challenge #3: Lack of hygienic design support

Legacy dairy producers know how to integrate best practices with high-performing equipment to ensure that finished products are free from harmful milk-borne pathogens. Central to this constellation of risk mitigation strategies is the pasteurization process, or kill step. After this kill step, the product is cooled, further processed as needed, packaged and prepared for distribution. Strategic process and facility design protect the pasteurized product from recontamination throughout these steps.

How does pasteurization apply to plant-based dairy products?

Manufacturers who are new to alternative dairy processing might assume that what works for animal-based dairy products would work for plant-based products as well, killing all bacteria and resulting in a safe and hygienic product. But there are flaws in this plan. For example, a typical pasteurizer uses plate and frame technology designed for smooth, fluid substances. The problem is that many plant-based materials include particulates: seeds and grains, coconut flakes, the strings from crushed plantain — it’s a long list. These particulates could clog within the pasteurizer’s plates and increase fouling, reducing the product’s flow through the system. This could potentially harm the equipment and/or impact product quality. The bottom line: equipment designed for animal-based substances isn’t always suitable for all alternative products.

Equipment aside, there’s also the problem of understanding the appropriate conditions for successful pasteurization, which is a concern for our survey respondents (Figure 7). The same temperatures and kill times that are appropriate for mammalian milk may not be as effective on plant-based products, which could carry pathogens that aren’t affected by high temperatures — or, worse, that are activated by a pasteurizing process calibrated for mammalian milk.

Alternative dairy processing challenge #3: Cross-contamination, traceability and allergens

Many legacy dairy facilities are optimized for producing a single fluid or cultured mammalian milk product in a dedicated, 24/7 facility. This comes with significant advantages: high production rates, low risk of contamination, few concerns for allergen crossover. In some cases, residual product left behind in a dedicated line may be incorporated into the next batch without necessarily affecting quality, which extends run times by reducing the need for multiple full sanitations. Manufacturers could also dispose of this residual product without necessarily hurting the bottom line, since small amounts of product loss are amortized across a large throughput.

Many alternative dairy manufacturers don’t have that volume of throughput. Instead of a single, bulk product type that moves reliably and in high quantities through the consumer supply chain, they must make up for their limited real estate in the grocery store by offering a portfolio of niche products.

This need for diversification within a single manufacturing facility elevates the consequences of lost yield.

When you’re making high-cost, small-batch products, the risk of cross-contamination is very real, and so is the risk of lost yield. To put it simply, every drop matters, including the drops left behind in your production line. Alternative dairy manufacturers need to design their facilities and their cleaning protocols with these considerations in mind. If allergens are present, this risk rises further, putting both the manufacturer’s reputation and the health of consumers at considerable risk. In fact, undeclared allergens cause more food recalls in the U.S. than any other factor.

It takes a considered and experienced design approach to address these cross-contamination and allergen risks reliably. That approach might involve segregation strategies, airflow dynamics, specialized cleaning and sanitation protocols, and continuous personnel training to ensure safe and sustainable throughput.

Got plant-based milk? Get good advice.

As consumers continue to explore plant-based alternatives, the opportunities for fast-moving startups and big brands seeking to diversify their portfolios are growing quickly.

To make sure that you’re part of that growth, don’t let the complexities of scaling an alternative dairy operation take you by surprise. Turn to a trusted design and construction partner with experience in traditional and plant-based dairy manufacturing. They may not promise a call from Jay-Z, but the right partner will help you meet and exceed your production targets, safely, sustainably and cost-effectively, now and far into the future.

This article originally appeared in our Horizons: Alternative Proteins report, which includes insights from industry leaders and CRB’s experts. Get your copy of the report here.

KEYWORDS: CVE:CRB, CRB, alternative dairy processing, plant-based milk

![]()

![]()

![]()

![]()