- REVENUE STRONG AT $30.8 million

- Cash of $30.5 Million at June 30, 2021

- IMPLEMENTED PROFIT SHARING WITH OUR EMPLOYEES

- FILTRATION PLANT AND DRY STACK EXPECTED TO BE ON BUDGET AND DELIVERED IN Q3 2021

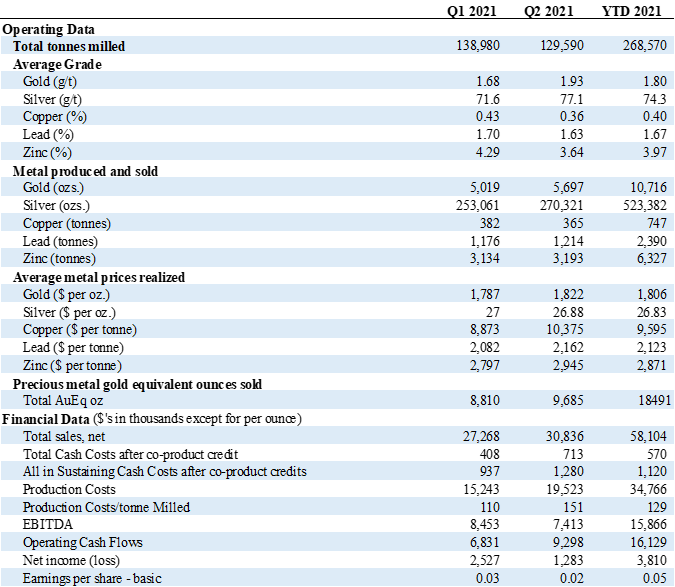

DENVER, CO / ACCESSWIRE / July 27, 2021 / Gold Resource Corporation (NYSE American:GORO) (the " Company ", " We ", " Our " or " GRC ") earned net income of $1.3 million or earnings of $0.02 per share reflecting the adoption of the new Mexican labor reform, effective June 2021, pursuant to which we onboarded all employees from the outsourced third-party provider to our wholly owned subsidiary, Don David Gold Mexico, resulting in a $1.9 million impact on net income. Revenues were strong at $30.8 million and were greater than both the same period in 2020, which had an interruption in production due to COVID-19 and the same period in 2019, which was a more normal year of mining. Cash flow from operating activities was $9.3 million in the second quarter of 2021 bringing our cash at June 30, 2021 to $30.5 million, an increase of $5.1 million for the first six months. The Company produced and sold 9,685 gold equivalent ounces, comprising 5,697 gold ounces and 270,321 silver ounces at an average price per ounce of $1,822 and $26.88, respectively resulting in a total cash cost of $713 per ounce of gold equivalent and an all-in sustaining cost of $1,280 per ounce of gold equivalent.

Allen Palmiere, President and CEO said "Our operations team continues to demonstrate their ability to be nimble and adaptive operators all while focusing on excellent environmental, social and governance practices. Notwithstanding an excellent work culture, there were two lost time incidents at the Don David Gold Mine during Q2 2021, which were investigated, and measures were taken to reinforce adherence to safety protocols. While there were no serious injuries, accidents like these are unacceptable and the Company recognized the need to modify and reinforce the safety program. Accordingly, a series of programs are underway to improve the overall safety culture. Gold production in the second quarter was as expected while silver and base metal production were modestly behind forecast as the team continues to address challenging ground conditions. Accordingly, our all-in sustaining cost per ounce were higher than our guidance at $1280 per ounce of gold equivalent. Notwithstanding this we reinvested $11.2 million into exploration and infrastructure improvements at the Don David Gold Mine and ended the quarter with a cash balance of $30.5 million effective June 30, 2021." Mr. Palmiere went on to say, "Our strong free cash flow per share and dividend yield puts us among the top of our peer group which is not reflected in our share price."

SECOND QUARTER 2021 HIGHLIGHTS

Additional highlights for the three months ended June 30, 2021, are summarized below:

Strategic

- The Company continues to strengthen our senior leadership team with the addition of Alberto Reyes as the new Chief Operating Officer. Mr. Reyes has more than 20 years of international mining experience. This addition adds to the expertise necessary to focus on unlocking the value of our assets while implementing best in class governance.

- $1.0 million distributed in shareholder dividends this quarter, totaling $117.8 million since 2010.

Operational

- Construction of the water filtration plant and dry stack tailings facilities progressed with an expected completion in the third quarter. The dry stack facilities will conserve water, accelerate reclamation of certain areas of the open pit mine as well as extend the life of tailings storage facilities.

- The exploration program progressed with the development of 156 meters of development drifts and 3,421 meters of diamond drilling with 12 drill holes underground at our Arista and Switchback vein systems and 2,069 meters drilled with two surface drill holes at the Aguila project. Additionally, there is a renewed emphasis on satellite areas, including Cerro Colorado and the area surrounding the Aguila project with drilling planned for the second half of 2021.

- With a focus on unlocking the value of the Don David Gold Mine, a total review of first principles commenced to review the geology, metallurgy, block models, mining methods and other key details of the mineral reserve and mineral resource models.

Financial

- Working capital was $32.6 million at June 30, 2021.

- Total cash cost for the quarter was $713 per gold ounce equivalent (after co-product credits). [1]

- Total all-in sustaining cost for the quarter was $1,280 per gold ounce equivalent (after co-product credits). [1]

2021 Capital and Exploration Investment Summary

| For the six months ended June 30, | 2021 full year guidance | |||||||

| (in thousands) | ||||||||

Capital Investments: | ||||||||

Gold Regrind | $ | 45 | $ | 1,900 | ||||

Dry Stack Completion | 3,509 | 6,200 | ||||||

Underground Development | 2,505 | 9,800 | ||||||

Other Sustaining Capital | 1,707 | 4,100 | ||||||

Exploration Investment: | ||||||||

Surface Exploration Expense | 1,837 | 3,000 | ||||||

Underground Drilling | 740 | 2,600 | ||||||

Exploration Development | 817 | 1,600 | ||||||

Total | $ | 11,160 | $ | 29,200 | ||||

The Company's investment in Mexico continued in Q2 2021 with year to date investments totaling $11.2 million. One of the current initiatives taking place at DDGM is a full review and analysis of all remaining capital for 2021 to ensure the budgeted projects continue to align with the key priorities of the organization. Based on the analysis performed to date, it is unlikely that the full amount of guided underground development ($9.8 million) will be spent in 2021 as a result of the mine sequence changes made during the first half of the year.

Gold Regrind Project: Metallurgical testing, full scale design, and engineering of a tailings regrind circuit were completed, including procuring certain components and equipment for this project. The new circuit is expected to increase gold recovery by 6% to 10% by regrinding sulfide mill tailings followed by a leaching circuit to produce doré bars. Completion and commissioning are expected by the first quarter of 2022 due to the manufacturing lead time for specialized equipment, flotation cells and the regrind mill. As of June 30, 2021, $45,000 has been invested in this project with another $1.8 million expected prior to completion.

Dry Stack Project: Significant construction progress was made on the filtration plant and dry stack tailings project which is on track for completion in the third quarter of 2021. The dry stacked tailings will accelerate reclamation of certain areas of the open pit mine, extend the life of current tailings storage facility, and reduce water consumption as approximately 80% of the process water will be available for reuse. As of June 30, 2021, $9.0 million has been invested in this project, $3.5 million in 2021, with another $2.7 million expected prior to completion.

In addition, the open pit is undergoing final preparation work to receive dry stack tailings material, including completion of a new access road.

Dry stack tailings filtration plant

New access road at the open pit

Underground and Exploration Development: Mine development during the quarter included ramps and accesses to different areas of the deposit and exploration development drifts. A total of 1,787 meters of underground development and exploration development, at a cost of $3.3 million, was completed during the year, including access to new exploration diamond drilling platforms on level 17. We plan to invest a total of $1.6 million in exploration development during 2021 and the total expected amount for underground mine development is currently being evaluated but expected to be less than the originally guided amount of $9.8 million as discussed above.

2021 Key Statistics

2021 Q2 Conference Call

The Company will host a conference call tomorrow, Wednesday, July 28, 2021 at 11:00 a.m. Eastern Time.

The conference call will be recorded and posted to the Company's website later in the day following the conclusion of the call. Following prepared remarks, Allen Palmiere, President and Chief Executive Officer, Kim Perry, Chief Financial Officer and Alberto Reyes, Chief Operating Officer will host a live question and answer (Q&A) session.

There are two ways to join the conference call.

To join the conference via webcast, please click on the following link:

https://www.webcaster4.com/Webcast/Page/2361/42039 .

To join the call via telephone please use one of the following dial-in details:

Participant Toll Free: 877-545-0320

Participant International: 973-528-0016

Entry Code: 758194

Please connect to the conference call at least 10 minutes prior to the start time using one of the connection options listed above.

About GRC:

Gold Resource Corporation is a gold and silver producer, developer, and explorer with operations in Oaxaca, Mexico. Under the direction of a new board and senior leadership, the focus is to unlock the significant upside potential of its existing infrastructure and large land position surrounding the mine. For more information, please visit GRC's website, located at www.goldresourcecorp.com and read the Company's 10-K for an understanding of the risk factors involved.

Cautionary Statements:

This press release contains forward-looking statements that involve risks and uncertainties. The statements contained in this press release that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. When used in this press release, the words "plan", "target", "anticipate," "believe," "estimate," "intend" and "expect" and similar expressions are intended to identify such forward- looking statements. Such forward-looking statements include, without limitation, the statements regarding Gold Resource Corporation's strategy, future plans for production, future expenses and costs, future liquidity and capital resources, and estimates of mineralized material. All forward- looking statements in this press release are based upon information available to Gold Resource Corporation on the date of this press release, and the company assumes no obligation to update any such forward-looking statements. Forward looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. The Company's actual results could differ materially from those discussed in this press release. In particular, the scope, duration, and impact of the COVID-19 pandemic on mining operations, Company employees, and supply chains as well as the scope, duration and impact of government action aimed at mitigating the pandemic may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Also, there can be no assurance that production will continue at any specific rate. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the Company's 10-Q filed with the SEC.

For further information please contact:

Ann Wilkinson

Vice President, Investor Relations and Corporate Affairs

Ann.Wilkinson@GRC-USA.com

www.goldresourcecorp.com

[1] Total cash cost after co-product credits and all-in sustaining cost per gold equivalent ounce sold are non-GAAP financial measures. Please see the Non-GAAP Measures section of the Management's Discussion and Analysis and Results of Operations for a complete reconciliation of the non-GAAP measures.

SOURCE: Gold Resource Corporation

View source version on accesswire.com:

https://www.accesswire.com/657305/Gold-Resource-Corporation-Reports-Strong-Year-to-Date-Operating-Cash-Flow-of-161-Million