VANCOUVER, BC / ACCESSWIRE / July 28, 2021 / Pampa Metals Corp. ("Pampa Metals" or the "Company")(CSE:PM)(FSE:FIRA)(OTCQX:PMMCF) is pleased to announce that further to the news release of April 14, 2021 it has completed the formal documentation with Austral Gold Ltd. ("Austral")(TSXV:AGLD)(ASX:AGD), whereby Austral has been granted an option to acquire in stages up to an 80% joint venture interest in Pampa Metals' Cerro Blanco and Morros Blancos properties (the "Properties") in exchange for certain cash payments, exploration expenditures and the cancellation of 2,963,132 shares of Pampa Metals held by Austral's wholly-owned subsidiary, Revelo Resources Corp. The formal documentation (the "Agreement") consists of the Definitive Option and Joint Venture Agreement, a Shareholders' Agreement in the event the Option is exercised, and an Exploration Deed that enables enforcement of the Agreement in Chile.

Highlights of the Agreement are:

- Cancelation of 2,963,132 of the Company's shares representing the return to treasury of more than 6% of the issued and outstanding share capital;

- Austral incurring Exploration Expenditures of at least $1 million in year 1 and $2 million in year 2;

- Austral being required to complete a bankable feasibility study to earn an 80% interest in either or both properties. If studies indicate that copper is the most valuable commodity instead of gold and silver, Pampa Metals can earn back an 80% interest under the same terms and conditions as those for Austral.

Julian Bavin, CEO of Pampa Metals, commented: "We are extremely pleased to have signed this Agreement with Austral, which brings great experience in gold exploration to our Cerro Blanco and Morros Blancos Properties. Through this transaction we are also returning to our treasury a significant number of shares that will better position the Company when additional capital is required. The transaction also ensures that more projects within Pampa Metals' portfolio will be advanced rapidly and efficiently, allowing the Company to direct its treasury towards other projects within its 100% owned portfolio." And he continued: "In addition, the close proximity of our Cerro Blanco and Morros Blancos projects to Austral's operating mines and processing operations in Chile provide enhanced optionality to Pampa Metals and, subject to exploration and development success, future real value returns to our shareholders."

Stabro Kasaneva, CEO of Austral, commented: "We are excited to have signed this Agreement with Pampa Metals which provides exploration upside and future development optionality for our existing mines in the district."

Austral Gold Ltd. is a growing gold and silver mining producer. Over the last few years, Austral Gold has successfully built a portfolio of assets in the Americas (Chile, Argentina, and United States) and is dual-listed on the Australian Securities Exchange (ASX:AGD) and the Toronto Venture Exchange (TSXV:AGLD). The Group's flagship asset is the Guanaco/Amancaya gold and silver mine complex in Chile. Other mining interests include the Casposo Mine in Argentina (100%), a non-controlling interest in the Rawhide Mine in the USA, and an attractive portfolio of exploration projects in Argentina and Chile.

About the Agreement

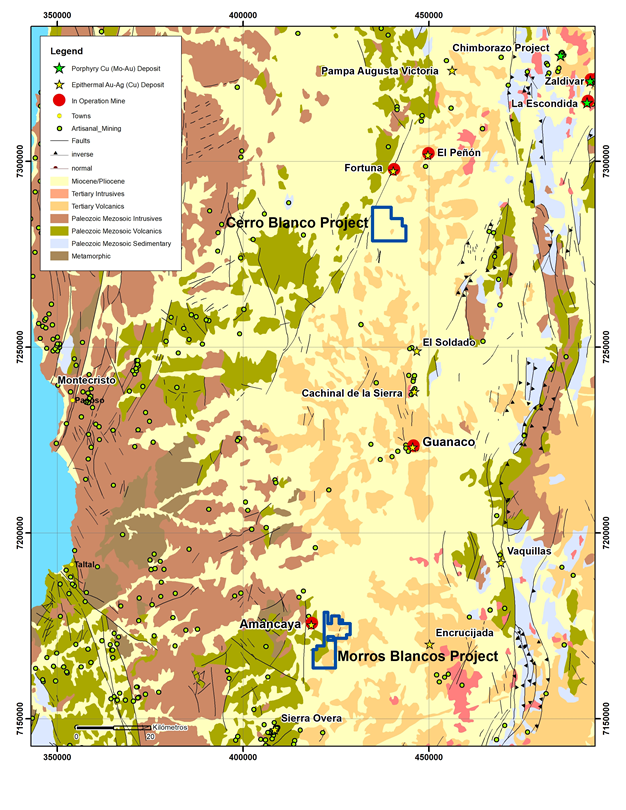

Pampa Metals' Cerro Blanco and Morros Blancos projects are located within 50 Km to 60 Km from Austral's flagship gold-silver mine and processing facilities at Guanaco in northern Chile, and Morros Blancos is additionally located adjacent to Austral's Amancaya gold-silver mine, which provides additional feed to the Guanaco plant.

The 6,500-hectare Cerro Blanco and 7,300-hectare Morros Blancos projects are two of the three "lithocap" projects within the Company's 8 project exploration portfolio. Lithocap targets geologically represent the upper portions of potential porphyry copper systems, and often have significant precious metals potential. Historic results to date at both projects suggest good potential for near surface gold-silver mineralization possibly associated with deeper copper mineralization.

As a result of the Company's primary focus on copper and desire to advance its portfolio as rapidly and efficiently as possible, it is open to third party investment in some key projects, including this transaction with Austral.

Key terms of the Agreement, originally announced on April 14, 2021, which will allow Austral to acquire an initial 60% interest in the Properties for certain considerations and commitments, are as follows:

- Austral incurring Exploration Expenditures on the Properties of at least $1 million in year 1 and $2 million in year 2.

- Austral returning 2,963,132 Pampa Metals' shares held by Revelo Resources Corp. for cancellation on the Effective Date of the grant of the Option. The share cancellation leaves Austral's holding in Pampa Metals at 13.6%, and represents one-third of Austral's share holdings in Pampa Metals. This will reduce the total issued shares of Pampa Metals to 43,432,261 based on the current number of issued shares.

- At the Effective Date Austral has also terminated Revelo Resources Corp.'s right to nominate a representative to the board of directors of Pampa Metals.

- Termination of rights to contingent payments in favour of Austral on the Cerro Blanco and Morros Blancos Properties, unless a Property reverts to Pampa Metals and exploration results determine that copper is the dominant metal rather than gold, silver, and other precious metals, in which case Austral would receive half of the contingent payment if its interest in that Property reduces to less than 20%.

- If less than $ 1million is spent on either of the Properties by the end of year 2, the Property that fails to receive such expenditure will revert to the Company.

If the initial 60% Earn-In is completed, Austral can increase its interest to 65% by producing a Preliminary Economic Assessment ("PEA") on either or both Properties within 5 years based on a minimum of 15,000m of drilling and related engineering studies. Any Property that does not have a PEA completed within 5 years will be returned to the Company.

Austral can further increase its interest to 80% by producing a Bankable Feasibility Study ("BFS") to NI 43-101 standards with an additional 10,000m (minimum) of drilling on any one of the Properties. However, if the results of exploration or the BFS indicate that the value of mineralization is dominated by copper rather than gold, Pampa Metals can earn an 80% interest in any such discovery by diluting Austral to 20% using the same expenditure formula by which Austral has earned its interest.

About Cerro Blanco & Morros Blancos

Both the Cerro Blanco (6,500 Ha) and the Morros Blancos (7,300 Ha) Properties are prospective for high-sulphidation epithermal gold-silver (+/- copper) and porphyry copper (+/- gold +/-moly) deposits and are located in the heart of the Paleocene Mineral Belt in northern Chile. The Paleocene Belt is host to important gold-silver and copper deposits and mines, and the Properties are located along a prolific segment of the prospective belt, along trend from important precious metals mines and projects. Cerro Blanco is located about 20 Km south-southwest of the multi-million ounce El Peñon gold-silver mining district (Yamana Gold) and Morros Blancos is located adjacent and to the east of Austral's Amancaya gold-silver mine. Access to both projects is easy, both being located less than 30 Km from the Pan American Highway, and altitudes are moderate. Both projects lie within potential operational distance of Austral's Guanaco processing plant, which could allow for more efficient and cost-effective development and operation.

Technical information in this news release has been approved by Mario Orrego G., geologist and a registered member of the Chilean Mining Commission and a qualified person as defined by National Instrument 43-101. Mr. Orrego is a consultant to the company.

ABOUT PAMPA METALS

Pampa Metals is a Canadian company listed on the Canadian Stock Exchange (CSE:PM) as well as the Frankfurt (FSE:FIRA) and OTC (OTCQX:PMMCF) exchanges. Pampa Metals owns a highly prospective 59,000-hectare portfolio of eight projects for copper and gold located along proven mineral belts in Chile, one of the world's top mining jurisdictions. The Company has a vision to create value for shareholders and all other stakeholders by making a major copper discovery along the prime mineral belts of Chile, using the best geological and technological methods. For more information, please visit Pampa Metals' website www.pampametals.com .

ON BEHALF OF THE BOARD

Julian Bavin | Chief Executive Officer

INVESTOR CONTACT

Ioannis (Yannis) Tsitos | Director

investors@pampametals.com

www.pampametals.com

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Reference to existing or historic mines and projects, and the overall prospectivity of Chile, is for reference purposes only. The reader is cautioned that there is no evidence to date that comparable mineral resources could be found on Pampa Metals' properties.

FORWARD-LOOKING STATEMENTS

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential", "indicate" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance and actual results may differ materially from those in forward-looking statements.

Location Map - Cerro Blanco & Morros Blancos Properties

SOURCE: Pampa Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/657313/Pampa-Metals-Signs-Definitive-Agreement-with-Austral-Gold-Returns-6-of-Issued-and-Outstanding-Shares-Back-to-Treasury