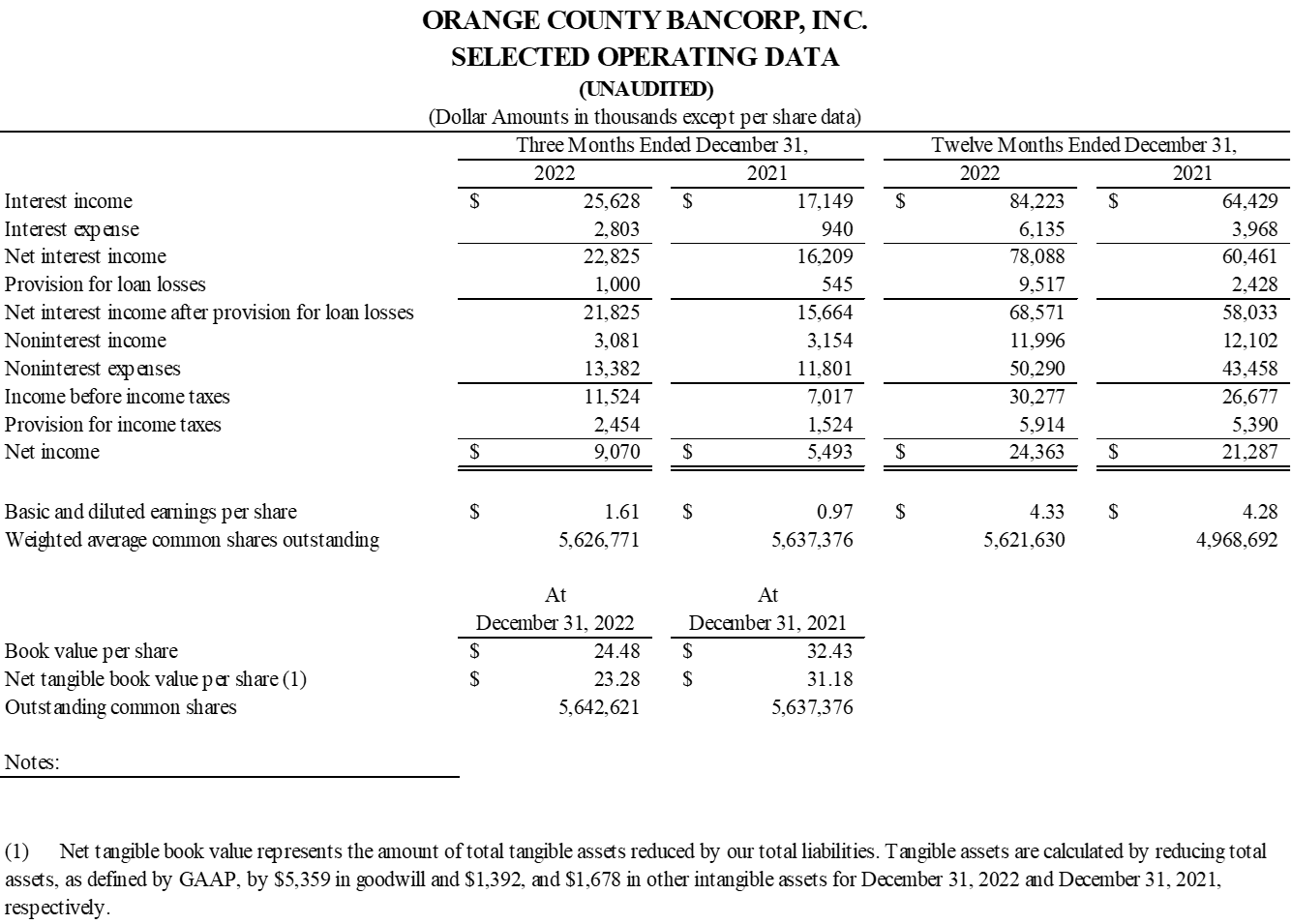

- Net income for Q4 2022 reached a quarterly record $9.1 million, a $3.6 million, or 65.0% increase, over net income of $5.5 million in Q4 2021, due primarily to increased interest income

- Net income for fiscal year 2022 reached a record $24.4 million, a $3.1 million, or 14.4% increase, over net income of $21.3 million in fiscal year 2021, also due primarily to increased interest income

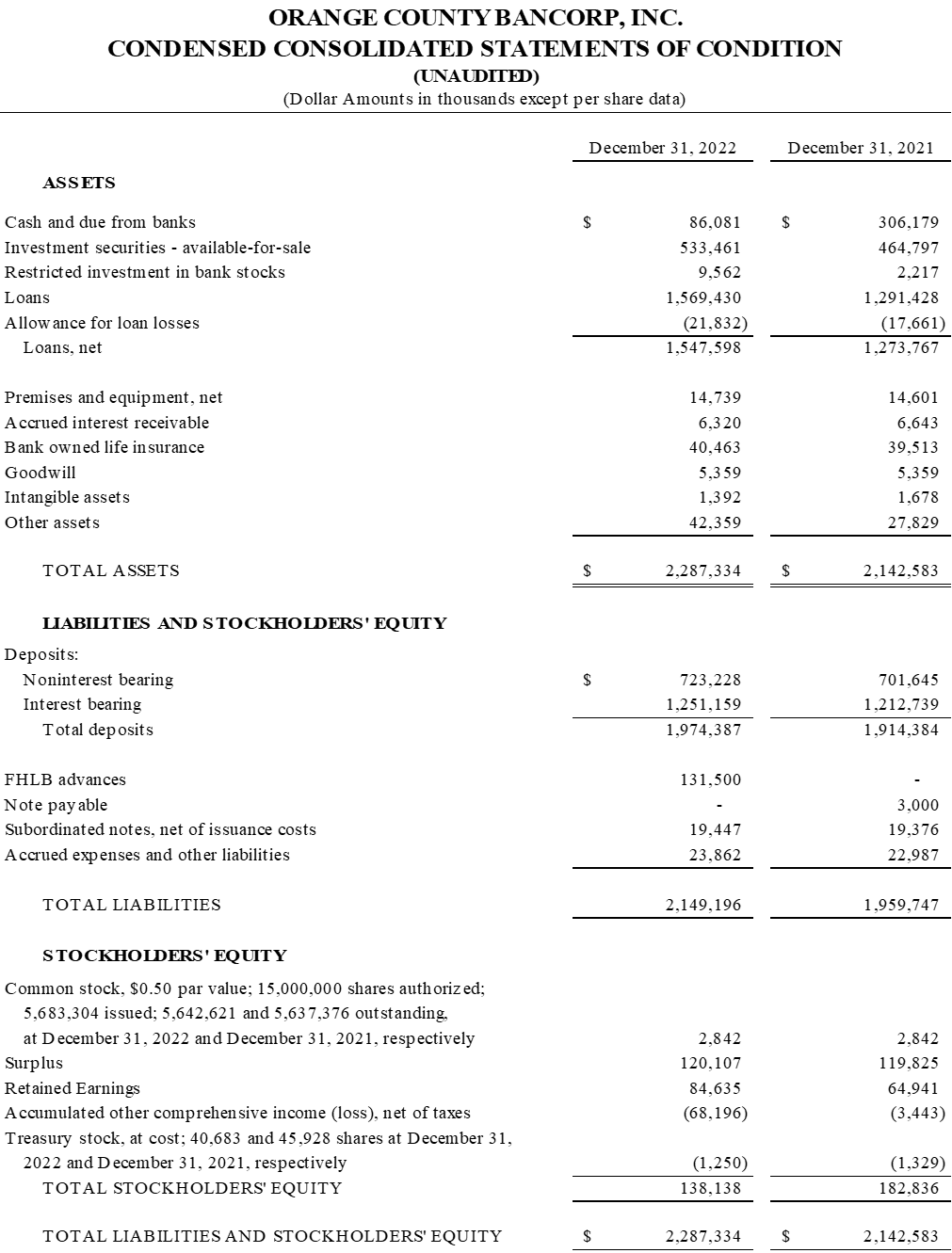

- Total assets increased $144.8 million, or 6.8%, to $2.3 billion at December 31, 2022 from $2.1 billion at December 31, 2021

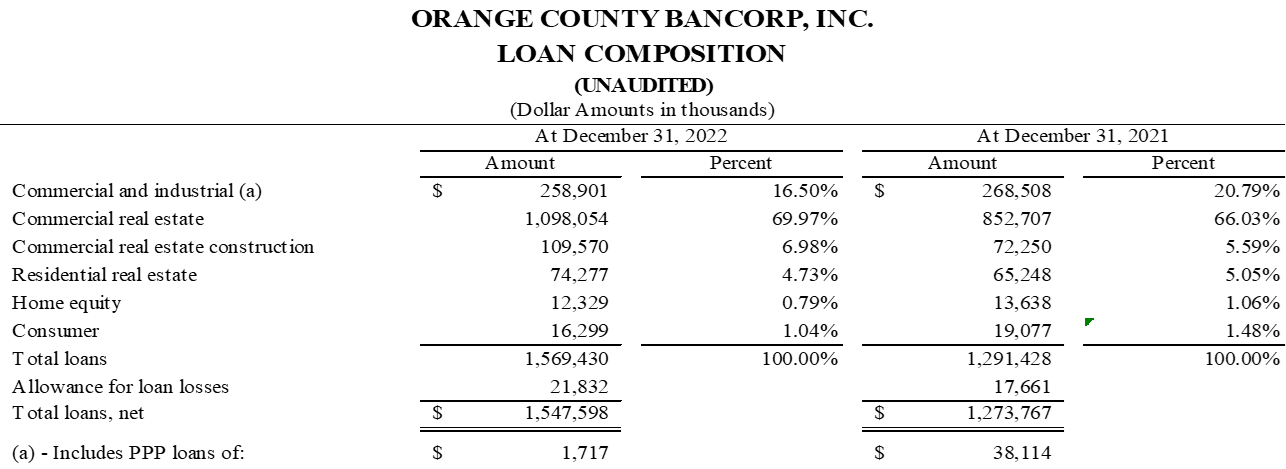

- Total loans grew $278.0 million, or 21.5%, to $1.6 billion at December 31, 2022 from $1.3 billion at December 31, 2021

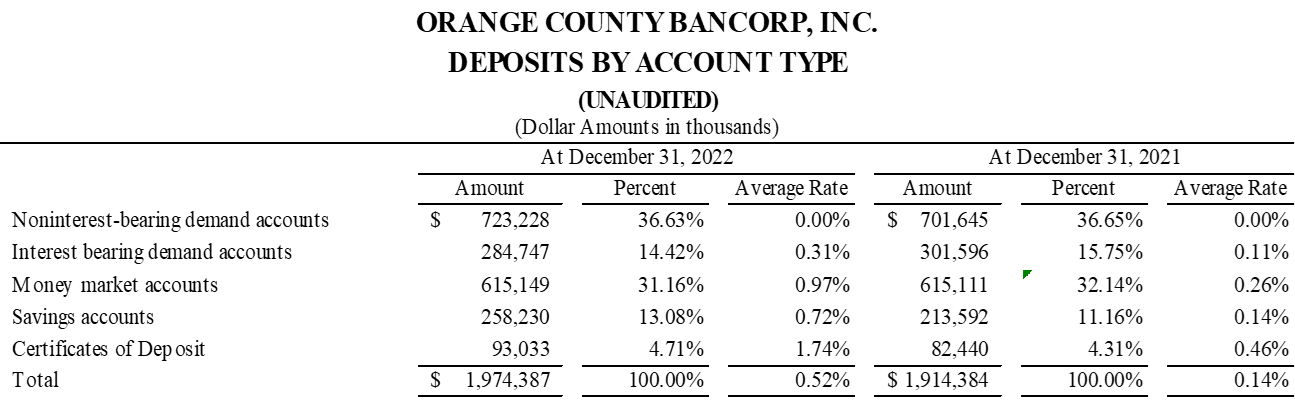

- Total deposits were $2.0 billion at December 31, 2022, as compared to $1.9 billion at December 31, 2021, an increase of $60.0 million, or 3.1%

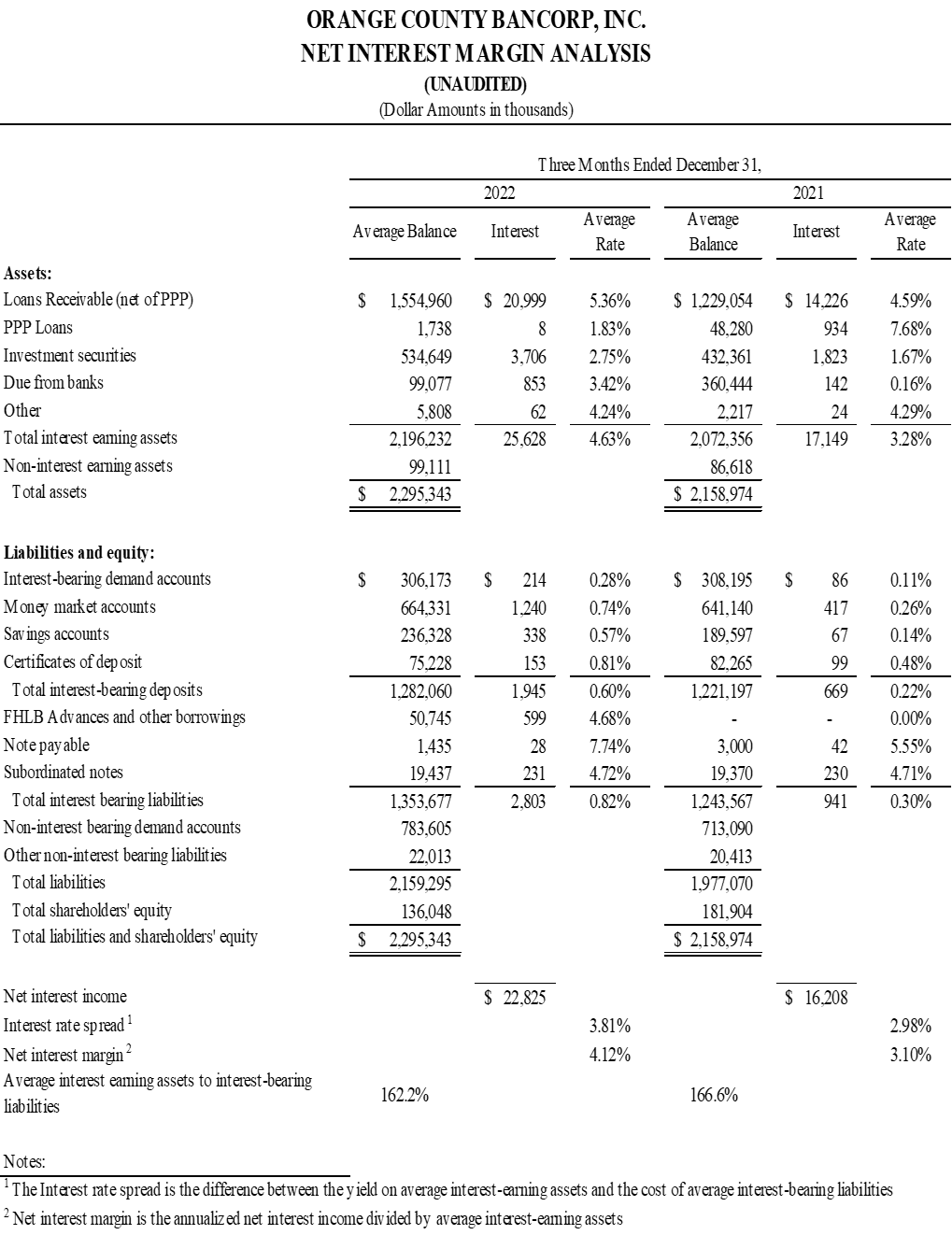

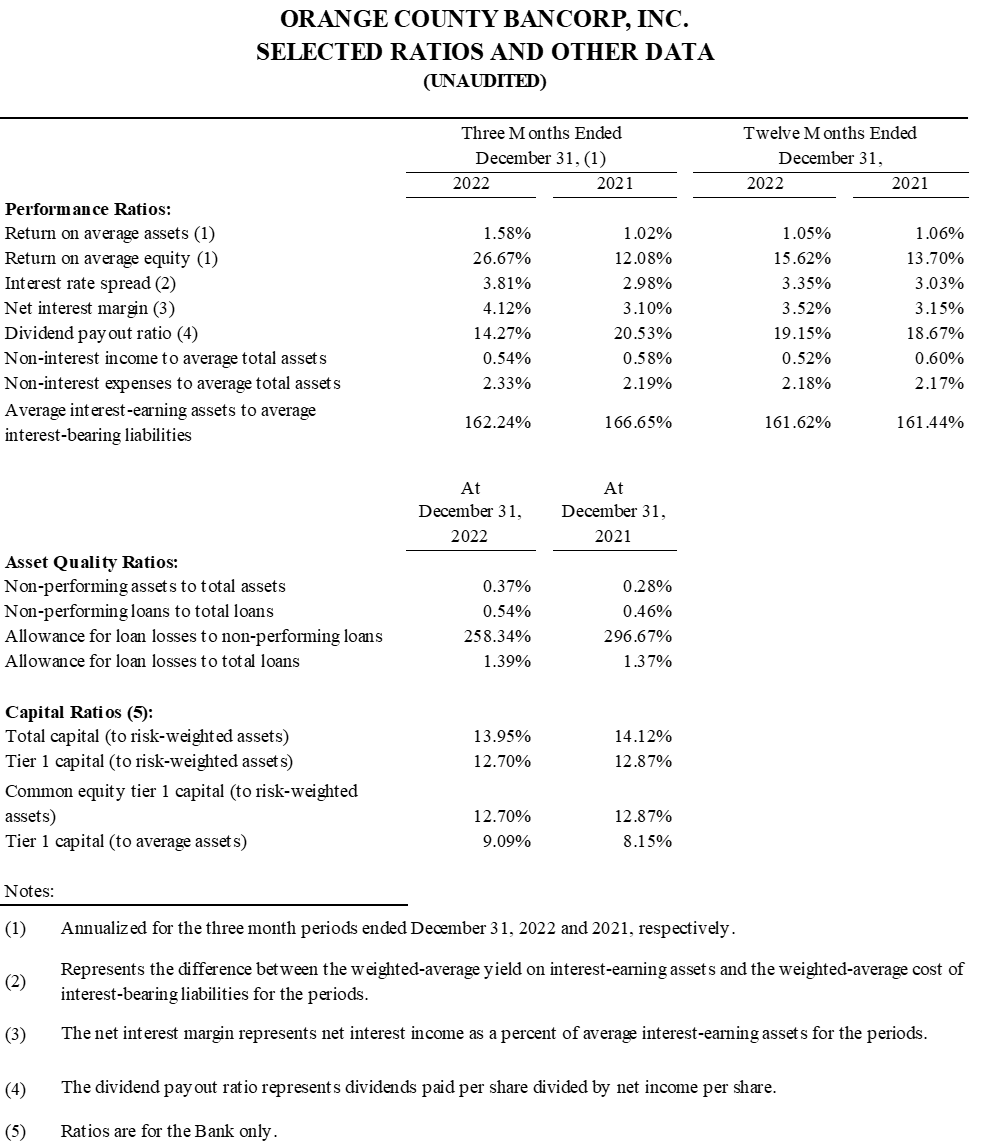

- Net interest margin for Q4 2022 rose 102 basis points, or 32.9%, to 4.12% from 3.10% for Q4 2021

- Annualized return on average assets of 1.58% for the three months ended December 31, 2022 increased 56 basis points, or 54.9%, versus the same period in 2021

- Annualized return on average equity of 19.41% for the three months ended December 31, 2022 increased 733 basis points, or 60.7%, versus the same period in 2021

MIDDLETOWN, NY / ACCESSWIRE / January 25, 2023 / Orange County Bancorp, Inc. (the "Company" - Nasdaq:OBT), parent company of Orange Bank & Trust Company, (the "Bank") and Hudson Valley Investment Advisors, Inc. ("HVIA"), today announced net income of $9.1 million, or $1.61 per basic and diluted share, for the three months ended December 31, 2022. This compares with net income of $5.5 million, or $0.97 per basic and diluted share, for the three months ended December 31, 2021. The increase in net income was primarily driven by a $6.6 million increase in net interest income during the quarter resulting from further increases in interest rates and strong loan growth.

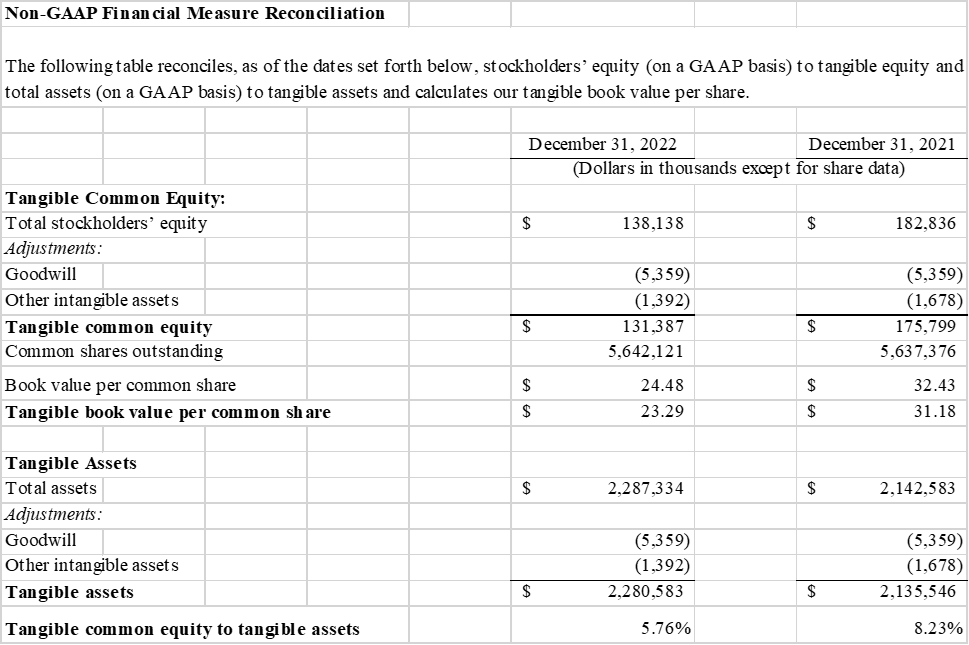

Book value per share declined $7.95, or 24.5%, from $32.43 at December 31, 2021 to $24.48 at December 31, 2022. Tangible book value per share decreased $7.89, or 25.3%, from $31.18 to $23.29 at December 31, 2021 and 2022, respectively (see "Non-GAAP Financial Measure Reconciliation" below for additional detail). These decreases reflect the impact of changes in market value in the available-for-sale investment portfolio, which continue to be affected by rising interest rates. The Bank maintains its entire investment portfolio within the available-for-sale category.

"I am pleased to announce Orange Bank ended the year with the strongest quarter in our history," commented Company President and CEO Michael Gilfeather. "We earned $9.1 million, or $1.61 per share, for the quarter, compared to $5.5 million, or $.97 per share, during the same period last year, a 65% increase. These earnings were the result of rising interest rates impacting our entire industry, as well as strong organic loan and deposit growth throughout the year. Our loan portfolio finished the year at $1.6 billion, up 21% over year end 2021, while total deposits rose 3.1% to close out the year at $2 billion.

Though enthusiastic about loan growth trends we see from quality borrowers, we recognize local economies aren't immune to the widespread impact of current interest rate policy at the Federal Reserve. It's also worth noting that the Fed's efforts to slow economic growth also involve the reduction of liquidity in the financial system, negatively impacting the industry's deposit base. While deposits at the Bank rose on a year-over-year basis, there was some contraction in the fourth quarter deposit base. This was attributable largely to seasonal withdrawals associated with municipalities which we expect will be replaced early in 2023. Though the Fed's efforts to further reduce liquidity will remain a challenge for the entire industry, the Bank remains focused on its deposit gathering and meeting our goals to expand market share and support our funding plans. Based on our strategic loan objectives, the Bank is well positioned to continue originating high quality loans further into the year and gather a larger share of our business clients' funds on deposit. While higher interest rates may slow the economy and impact loan and deposit growth, they have also provided an opportunity for the bank to increase its margins during 2022 and create a strong foundation for the coming year. The Bank's net interest margins for Q4 2022 grew 102 basis points, or 32.9%, to 4.12% versus 3.10% the prior year.

Wealth management revenues for the quarter, including our Trust and Advisory businesses, were $2.35 million, down slightly from $2.51 million the same quarter last year. Assets under management ("AUM") are the principal driver of fee income for this division and subject to fluctuations in market valuation. With major bond market indices down more than 10% and the S&P 500 equity index down nearly 20% in 2022, the fluctuation realized - from $1.3 billion at year end 2021 to $1.2 billion at year end 2022 - reflects impact of these market adjustments and the capable oversight of our Wealth Management team.

This quarter represents further validation of our strategic positioning as the region's premier business bank. I couldn't be more pleased by our team's performance navigating the past year's challenges, particularly the Federal Reserve's aggressive efforts to control inflation through interest rate policy and liquidity tightening measures. While these actions are having their intended effect, regional economic activity remains relatively strong and Orange is well positioned to manage current headwinds. We are a high-performing business bank in a large market with significant upside opportunity focused on execution of our strategic initiatives. I want to once again thank our dedicated employees for their commitment to our clients. The record results we experienced this quarter, and this year, reflect the combined efforts of our entire team at Orange Bank."

Fourth Quarter and Full Year 2022 Financial Review

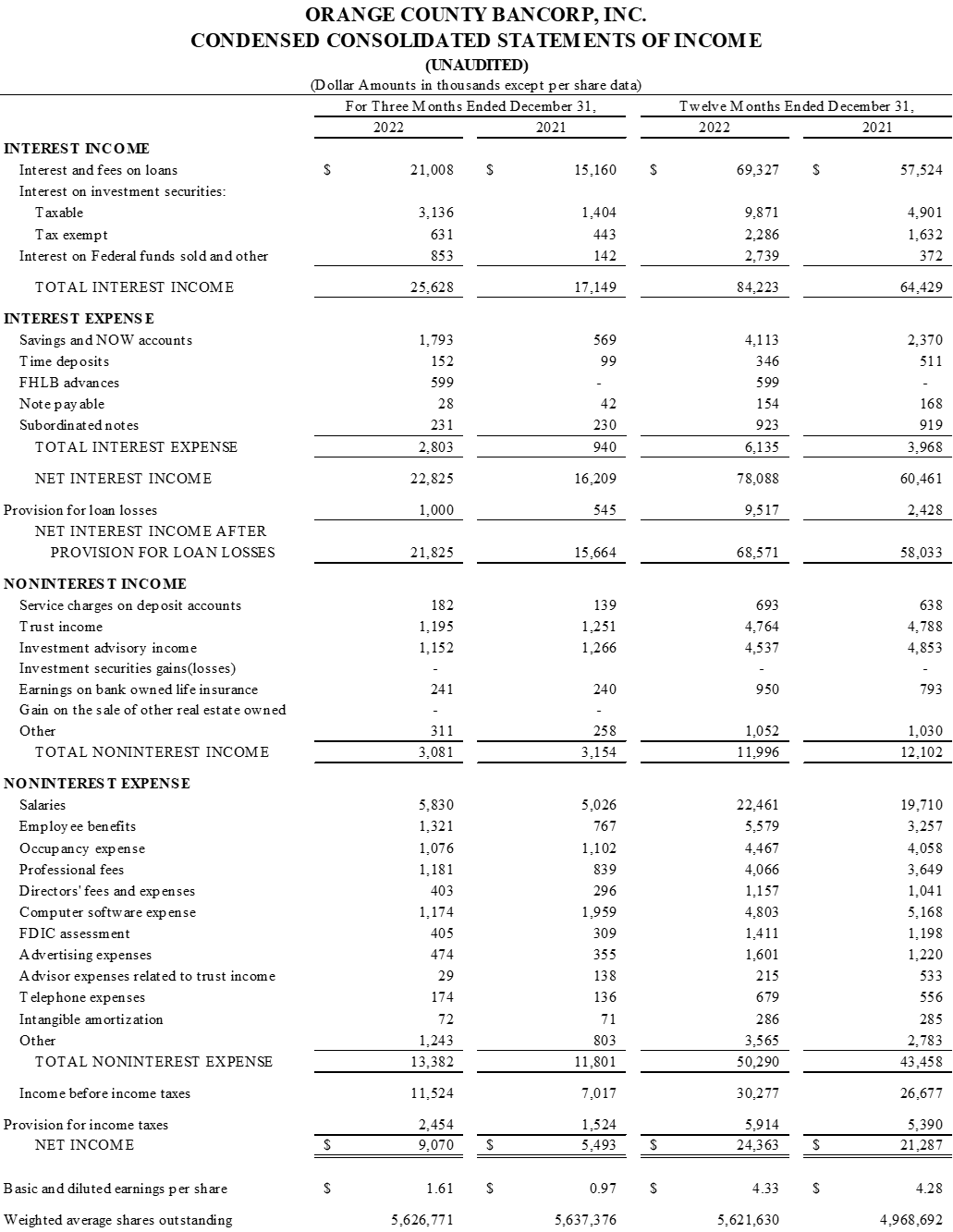

Net Income

Net income for the fourth quarter of 2022 was a record $9.1 million, an increase of approximately $3.6 million, or 65.0%, versus net income of $5.5 million for the fourth quarter of 2021. Net income for the twelve months ended December 31, 2022 was a record $24.4 million, as compared to $21.3 million for the same period in 2021. The increase in both periods was driven primarily by increased net interest income driven by interest rate increases and strong loan growth, which outpaced deposit growth during the year.

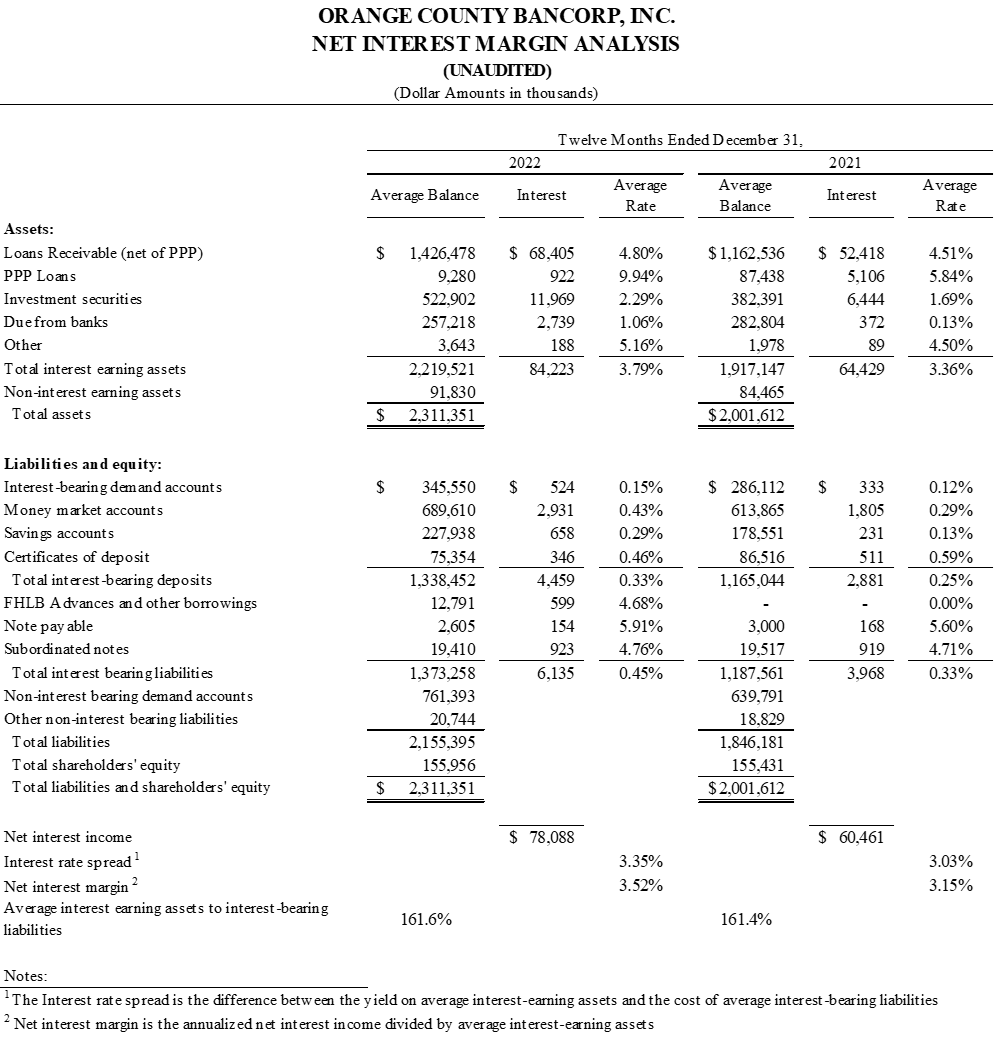

Net Interest Income

For the three months ended December 31, 2022, net interest income increased $6.6 million, or 40.8%, to $22.8 million, versus $16.2 million during the same period in 2021. For the twelve months ended December 31, 2022, net interest income increased $17.6 million, or 29.2%, over the twelve months ended December 31, 2021. These increases include the rising cost of deposits resulting from the rising interest rate environment.

Total interest income rose $8.5 million, or 49.4%, to $25.6 million for the three months ended December 31, 2022, compared to $17.2 million for the three months ended December 31, 2021. The growth in interest income continues to be associated with increased interest and fees driven by loan growth, as well as an approximately 104.0% increase in interest income associated with higher levels of investment securities. The securities-related increase reflects the deployment of excess liquidity in 2022 to capture incremental interest income in the rising rate environment. For the year ended December 31, 2022, total interest income rose $19.8 million, or 30.7%, to $84.2 million, as compared to $64.4 million for the year ended December 31, 2021.

Total interest expense increased $1.9 million in the fourth quarter of 2022, to $2.8 million, as compared to $940 thousand in the fourth quarter of 2021. The increase reflects the ongoing impact of rising interest rates on deposit products during the quarter as well as costs associated with FHLB borrowings during the quarter. The control of interest expense has been a focus area for management in 2022, as we anticipate further increases in short-term rates based on Federal Reserve guidance. During the twelve months ended December 31, 2022, total interest expense rose $2.2 million, or 54.6%, to $6.1 million, as compared to $3.9 million for the twelve months ended December 31, 2021.

Provision for Loan Losses

The Company recognized a provision for loan losses of $1.0 million for the three months ended December 31, 2022, compared to $545 thousand for the three months ended December 31, 2021. The increased provision primarily reflects reserve increases required by continued growth of the loan portfolio. The allowance for loan losses to total loans was 1.39% as of December 31, 2022, an increase of 2 basis points, or 1.5%, versus 1.37% as of December 31, 2021. For the year ended December 31, 2022, the provision for loan losses totaled $9.5 million, as compared to $2.4 million for the year ended December 31, 2021 due to the continued growth of the loan portfolio as well as additional reserves associated with charge-offs of certain syndicated loans during 2022. Syndicated loans represented less than 3.5% of total loans at December 31, 2022.

Non-Interest Income

Non-interest income remained relatively stable at $3.1 million for the fourth quarter of 2022 as compared to $3.2 million for the fourth quarter of 2021. With assets-under-management of approximately $1.2 billion at December 31, 2022, non-interest income continues to be supported by the success of the Bank's trust operations and HVIA asset management activities. For the twelve months ended December 31, 2022, non-interest income remained level with the twelve months ended December 31, 2021, generating approximately $12.0 million and $12.1 million, respectively.

Non-Interest Expense

Non-interest expense was $13.4 million for the fourth quarter of 2022, reflecting an increase of approximately $1.6 million, or 13.6%, as compared to $11.8 million for the same period in 2021. The increase in non-interest expense for the current three-month period was due to continued investment in Company growth, including increases in compensation and benefit costs, occupancy costs, information technology, and deposit insurance. Our efficiency ratio was 51.7% for the three months ended December 31, 2022, down from 61.0% for the same period in 2021. For the year ended December 31, 2022, our efficiency ratio was 55.8% as compared to 59.9% for 2021.

Income Tax Expense

Our provision for income taxes for the three months ended December 31, 2022 was $2.5 million, compared to $1.5 million for the same period in 2021. The increase for the current period was due to the increase in income before income taxes during the quarter. Our effective tax rate for the three-month period ended December 31, 2022 was 21.3%, as compared to 21.7% for the same period in 2021. For the twelve months ended December 31, 2022, our provision for income taxes was $5.9 million, as compared to $5.4 million for the twelve months ended December 31, 2021. Our effective tax rate for the twelve month period ended December 31, 2022 was 19.5%, as compared to 20.2% for the same period in 2021. The reduction in effective tax rates for the 2022 three and twelve month periods, respectively, is due mainly to the increase in proportion of non-taxable revenue (tax-exempt interest income and earnings on bank-owned life insurance) compared with total pre-tax income.

Financial Condition

Total consolidated assets increased $144.8 million, or 6.8%, from $2.1 billion at December 31, 2021 to $2.3 billion at December 31, 2022. The increase during the year was driven primarily by growth in loans, deposits, and investment securities.

Total cash and due from banks decreased from $306.2 million at December 31, 2021, to $86.1 million at December 31, 2022, a decrease of approximately $220.1 million, or 71.9%. The decline is due to increased loan growth, as well as management's deployment of excess cash into investments during the year.

Total investment securities rose $76.0 million, or 16.3%, from $467.0 million at December 31, 2021 to $543.0 million at December 31, 2022. The increase represents the effect of purchases of investment securities, offset by an increase in unrealized losses on investment securities since December 31, 2021, as well as paydowns and maturities during the period.

Total loans increased $278.0 million, or 21.5%, from $1.3 billion at December 31, 2021 to approximately $1.6 billion at December 31, 2022. The increase was driven by $245.3 million of commercial real estate loan growth and $37.3 million of commercial real estate construction loan growth. PPP loans declined $36.4 million, to $1.7 million at December 31, 2022, from $38.1 million at December 31, 2021. Most of the remaining PPP loan balance is subject to SBA loan forgiveness.

Total deposits grew $60.0 million, to $2.0 billion at December 31, 2022, from $1.9 billion at December 31, 2021. This increase was driven by success during 2022 in business account development, attorney trust deposit growth and increased deposit levels for local municipal accounts. At December 31, 2022, 51.1% of total deposits were demand deposit accounts (including NOW accounts). FHLB advances supplemented customer deposits to fund a portion of the loan growth and totaled $131.5 million at December 31, 2022. There were no borrowings outstanding at December 31, 2021.

Stockholders' equity experienced a decrease of approximately $44.7 million, to $138.1 million at December 31, 2022, from $182.8 million at December 31, 2021. The decrease was primarily due to $68.2 million of unrealized losses on the market value of investment securities recognized within the Company's equity as accumulated other comprehensive income (loss) ("AOCI"), net of taxes, as a result of the increase in market interest rates. Offsetting the AOCI fluctuation, the Bank recognized an approximately $19.7 million increase in retained earnings during the twelve months ended December 31, 2022, net of dividends paid.

At December 31, 2022, the Bank maintained capital ratios in excess of regulatory standards for well capitalized institutions. The Bank's Tier 1 capital to average assets ratio was 9.09%, both common equity and Tier 1 capital to risk weighted assets were 12.70%, and total capital to risk weighted assets was 13.95% at December 31, 2022.

Asset Quality

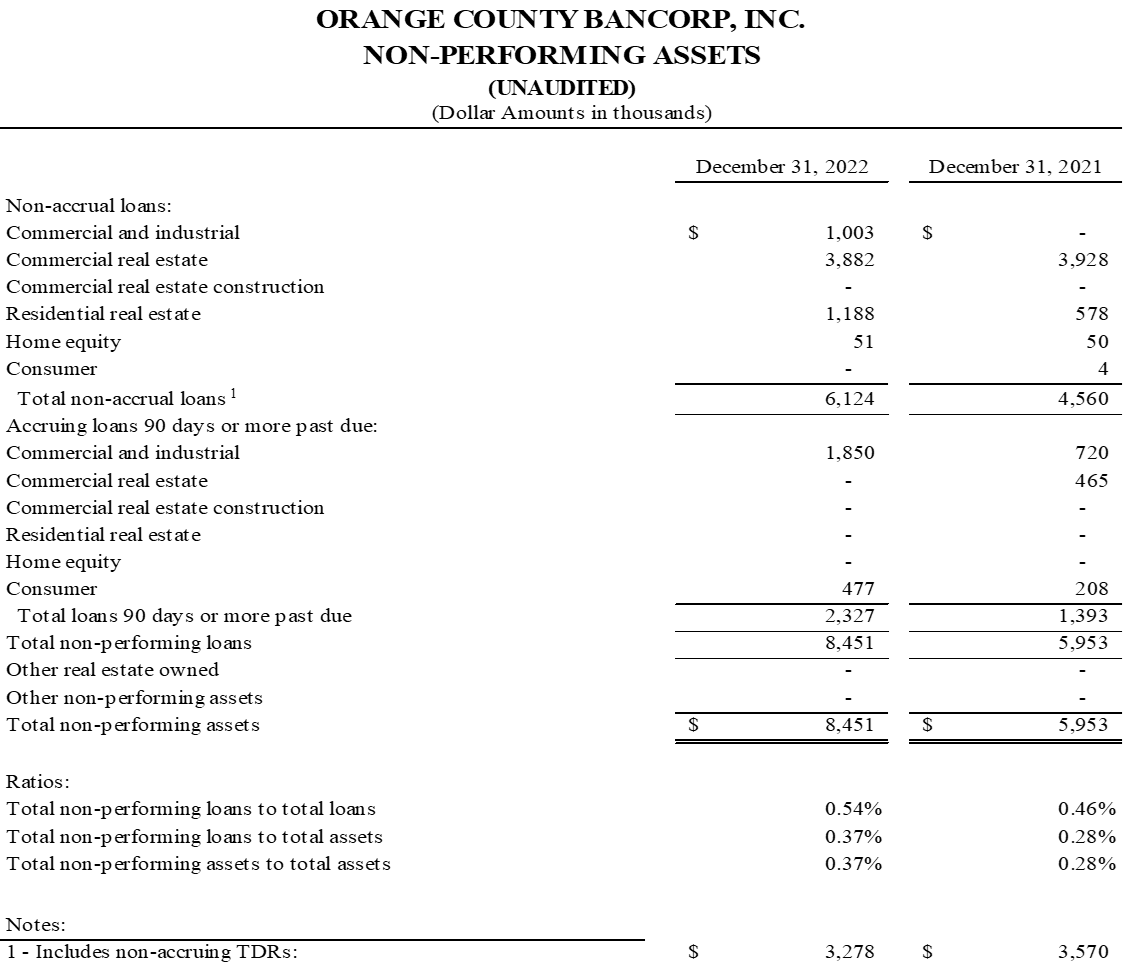

At December 31, 2022, the Bank had total non-performing loans of $8.5 million, or 0.54% of total loans, which included $3.3 million of Troubled Debt Restructured Loans ("TDRs"). Total TDRs at December 31, 2022, was $3.3 million, or 0.21% of total loans, and experienced a decrease of approximately $300 thousand compared with $3.6 million at December 31, 2021. Accruing loans delinquent greater than 90 days experienced an increase during 2022 and totaled $2.3 million as of December 31, 2022, as compared to $1.4 million at December 31, 2021.

About Orange County Bancorp, Inc.

Orange County Bancorp, Inc. is the parent company of Orange Bank & Trust Company and Hudson Valley Investment Advisors, Inc. Orange Bank & Trust Company is an independent bank that began with the vision of 14 founders over 125 years ago. It has grown through innovation and an unwavering commitment to its community and business clientele to approximately $2.3 billion in total assets at December 31, 2022. Hudson Valley Investment Advisors, Inc. is a Registered Investment Advisor in Goshen, NY. It was founded in 1996 and acquired by the Company in 2012.

Forward Looking Statements

Certain statements contained herein are "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward looking statements may be identified by reference to a future period or periods, or by the use of forward looking terminology, such as "may," "will," "believe," "expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms, or the negative of those terms. Forward looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the real estate and economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, inflation, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. Further, given its ongoing and dynamic nature, it is difficult to predict what the continuing effects of the COVID-19 pandemic will have on our business and results of operations. The pandemic and related local and national economic disruption may, among other effects, continue to result in a material adverse change for the demand for our products and services; increased levels of loan delinquencies, problem assets and foreclosures; branch disruptions, unavailability of personnel and increased cybersecurity risks as employees work remotely.

The Company wishes to caution readers not to place undue reliance on any such forward looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

For further information:

Robert L. Peacock

SEVP Chief Financial Officer

rpeacock@orangebanktrust.com

Phone: (845) 341-5005

SOURCE: Orange County Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/736757/Orange-County-Bancorp-Inc-Announces-Record-Quarterly-and-Annual-Earnings