- Online prices increased 3.1% year-over-year

- December marked 19th consecutive month of online inflation

- Consumers spent record $855 billion online in 2021, demonstrating strong growth in digital economy

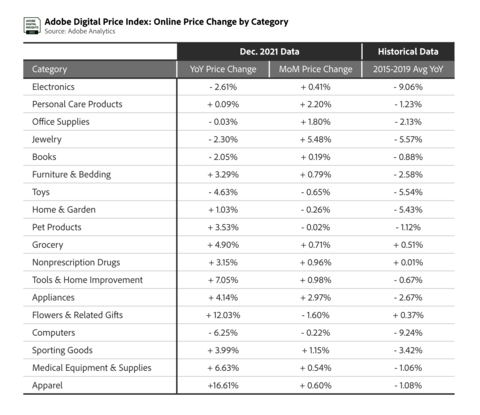

Adobe (Nasdaq:ADBE) today announced the latest online inflation data from the Adobe Digital Price Index (DPI). In December 2021, online prices increased 3.1% year-over-year (YoY) and 0.8% month-over-month (MoM). Meanwhile, consumer spending online for all of 2021 reached a record $855 billion, an increase of 9% YoY, attesting to the strength of the digital economy overall. December’s price increases marked the 19th consecutive month of YoY online inflation and followed the record high of November 2021, when online prices increased 3.5% YoY. In December, groceries and apparel were standout categories, with grocery prices seeing their highest annual increase in more than a year (4.9% YoY, 0.7% MoM). Apparel increased 16.6% YoY (0.6% MoM).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220112005352/en/

(Graphic: Business Wire)

The DPI provides the most comprehensive view into how much consumers pay for goods online. Powered by Adobe Analytics, it analyzes one trillion visits to retail sites and over 100 million SKUs across 18 product categories: electronics, apparel, appliances, books, toys, computers, groceries, furniture/bedding, tools/home improvement, home/garden, pet products, jewelry, medical equipment/supplies, sporting goods, personal care products, flowers/related gifts, nonprescription drugs and office supplies.

“Inflation online is showing no signs of easing, as durable consumer demand is being met with the same, persistent supply challenges that produced over six billion out-of-stock messages online this holiday season,” said Patrick Brown, vice president of growth marketing and insights, Adobe. “As consumers contend with higher offline prices for everything from gas to rent, they are finding that e-commerce is still a less expensive option when it comes to goods like toys, electronics and even jewelry.”

In December 2021, 12 of the 18 categories tracked by the DPI saw YoY price increases, with apparel rising faster than any other category. Price drops were observed in six categories: electronics, office supplies, jewelry, books, toys and computers.

On a MoM basis, 13 of the 18 categories saw December price increases, with price drops observed in five categories, including toys, pet products, home/garden, computers and flowers/related gifts.

Notable Categories in the Adobe Digital Price Index (December 2021)

- Groceries: Prices were up 4.9% YoY (up 0.7% MoM), the highest increase on an annual basis since October 2020, when prices jumped 5.2% YoY. It is the only category that has moved in lockstep with the Consumer Price Index, which captures prices consumers are paying in physical stores.

- Apparel: Prices were up 16.6% YoY (up 0.6% MoM). This is the ninth consecutive month where online prices have risen on an annual basis in a category that typically sees consistent periods of deflation when seasonal discounts kick in.

- Appliances: Prices were up 4.1% YoY (up 3.0% MoM). This marks the 20th consecutive month of inflation for the category, at a time when consumers are keen to invest in their homes. Over the holiday season (November 1 to December 31), online sales for appliances doubled compared to pre-season (September 2021) levels. Furniture and bedding followed a similar trend, after 20 consecutive months of inflation, where December 2021 prices were up 3.3% YoY and up 0.8% MoM.

- Tools & Home Improvement: Prices were up 7.1% YoY (a record high for the category) and up 1.0% MoM, marking the 13th consecutive month of online inflation as consumers continue to spend more in this category. Over the holiday season (November 1 to December 31), online sales in the category grew by 1.7 times pre-season (September 2021) levels.

- Electronics: Prices were down 2.6% YoY (up 0.4% MoM). This is a greater price drop compared to November 2021, when prices for products in the category were only down 0.4% YoY and nearly moved into inflationary territory for the first time since Adobe began tracking price trends in 2014.

Adobe Holiday Season Recap Report: For additional insights on the 2021 holiday shopping season (November 1 to December 31) including consumer spend online, out-of-stock levels and more, find Adobe’s recap report here.

Methodology

The DPI is modeled after the Consumer Price Index, published by the U.S. Bureau of Labor Statistics, and uses the Fisher Price Index to track online prices. The Fisher Price Index uses quantities of matched products purchased in the current period (month) and a previous period (previous month) to calculate the price changes by category. Adobe’s analysis is weighted by the real quantities of the products purchased in the two adjacent months.

Adobe uses a combination of Adobe Sensei, Adobe’s AI and machine learning framework, and manual effort to segment the products into the categories defined by the CPI manual. The methodology was first developed alongside renowned economists Austan Goolsbee and Pete Klenow.

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

© 2022 Adobe. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in the United States and/or other countries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220112005352/en/

Contacts

Kevin Fu

Adobe

kfu@adobe.com

Bassil Elkadi

Adobe

belkadi@adobe.com