- Nearly nine-in-ten investors say their financial advisor has helped them remain confident in this period of rising inflation and market volatility

- Millennials are significantly more comfortable with the highs and lows of the financial markets than Generation X (Gen X) and Boomers

- Generation X is least likely to work with an advisor

State Street Global Advisors, the asset management business of State Street Corporation (NYSE: STT), today announced the findings of its Inflation Impact Survey: Advisor Edition. The survey found among those currently working with a financial advisor, the vast majority say their advisors’ insight and guidance is valued even more today and has helped them remain confident during this period of rising inflation and market volatility.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220909005402/en/

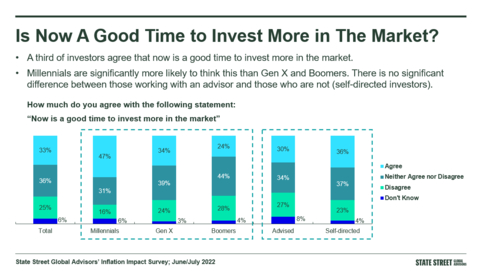

A third of investors agree that now is a good time to invest more in the market. (State Street Global Advisors' Inflation Impact Survey; June/July 2022)

The release of this advisor-related data follows the initial findings of State Street Global Advisors’ Inflation Impact Survey which found inflation-induced stress and anxiety is influencing investor behavior when it comes to short-term budgeting and committing to long-term financial goals. It also analyzed the value provided by financial advisors during a period of heightened volatility and uncertainty.

“The top two questions advisors are hearing from their clients today are, ‘Is now a good time to invest?’ and ‘How can I protect my portfolio against inflation,’” said Allison Bonds, head of Private Wealth Management at State Street Global Advisors.

The survey revealed that among those working with a financial advisor, about three-quarters have discussed inflation with their advisor, including how inflation will impact their investment goals in both the short and long-term. Furthermore, nine-in-ten say they value their financial advisors’ knowledge and guidance even more in these uncertain times, and 86% believe their advisor has helped them remain confident in this period of rising inflation and market volatility.

Is It Better to Work with a Financial Advisor? Sandwich Generation Unsure

Overall, approximately half of investors (49%) agree that it’s better to work with a financial advisor when there is volatility in the market.

When examining the generational differences in attitudes about working with an advisor, Gen X respondents were the least likely to work with an advisor in today’s volatile markets. Only 42% agreed it is better to have the guidance of an advisor compared to 63% of Millennials.

State Street Global Advisors Benchmark Survey1 provides additional insight as to why Gen X balks at the idea of using a financial advisor. It revealed the top two reasons are 1) they prefer to have full control over their investment decisions (46%), and 2) they don’t trust that financial advisors have their best interest in mind (41%).

Gen X’ers are the most concerned with rising inflation, with 88% reporting that inflation is a top concern. Given the majority are also concerned about their ability to afford retirement and staying the course with their current investment strategy, now could be an opportune time for this generation to be more proactive about seeking help from a financial professional.

“Advisors have an opportunity to cultivate trusting, collaborative relationships with Gen X clients who want to remain involved in making their own investment decisions to a greater extent than other generations,” said Bonds. “Gen X’ers are in their peak earning years and in the accumulation phase of their financial planning, yet they are also juggling multiple financial priorities. This generation is currently sandwiched between taking care of their children and aging parents. Gen X is more likely to have children under 18 in the household, so discretionary spending can become stretched if they are also supporting aging parents.”

Investor Tolerance for Market Volatility

A comparison of prior years’ comfort levels with market volatility shows that the market’s ups and downs are making investors more queasy. When asked how much they agree with the statement, ‘I am comfortable with the highs and lows of the financial markets,’ just 31% are in agreement, which is significantly lower than a year ago (51%), and about the same as the height of the pandemic (33%) in 2020.

Millennials are the standout, with 49% saying they are comfortable with the volatility, compared to 22% of Gen X’ers and 24% of Boomers.

“Millennials possess a glass half-full mentality when it comes to their financial futures. They know they have a longer time horizon to ride out the downturns and inflationary pressures. Sixty-three percent are optimistic they will reach their financial goals despite record inflation, whereas most investors in other generations believe inflation is an obstacle to meeting their objectives,” said Bonds.

Is Now a Good Time to Invest More in The Market?

There also seems to be some ambivalence about whether now is a good time to put more money to work in the market, with one-third (33%) of investors agreeing that now is a good time to invest more in the market; 36% neither agreeing or disagreeing and 25% disagreeing.

Not surprisingly, Millennials (47%) are significantly more likely to think it’s a good time to invest than Gen X (34%) and Boomers (24%).

“The old adage about investment success being about time in the market, not timing the market rings true today,” added Bonds. “Advisors who use a goals-based approach can help clients who are vulnerable to overreacting when markets take a downturn. This approach can help clients remain confident about their financial plan even in volatile markets.”

State Street Global Advisors’ Educational Content

For more on State Street Global Advisors’ point of view on how advisors can help clients remain confident during uncertain times, read Market Volatility: A Relationship-Building Opportunity for Financial Advisors.

Appreciating the True Value of Advice offers insights for individual investors on how to find the right financial advisor.

State Street Global Advisors’ list of 4 Things Investors Can Do in Volatile Markets provides insight for investors seeking ways to hedge their portfolio in today’s uncertain economic environment.

Market Volatility’s Back: Get In and Out With Liquid ETFs discusses the importance of liquidity in volatile markets.

For more on SPDR’s point of view on the market, economy and inflation read our 2022 Mid-Year Outlook and 5 Burning Questions Give Investors Insight: Durable Rebound or More Pain to Come?

SPDR’s Uncommon Sense provides contrarian perspectives from Michael Arone, Chief Investment Strategist for the US SPDR® business, that encourage investors to think beyond consensus opinion to identify and capitalize on new opportunities.

For more on SPDR’s take on inflation and the Federal Reserve, read The Federal Reserve Will Declare a Premature Victory Over Inflation.

For more educational tools and resources on ETFs, click here.

To learn about how investors are using low-cost ETFs to achieve a variety of investment objectives, read Build a Low-Cost Core Portfolio with SPDR ETFs.

About State Street Global Advisors’ Inflation Impact Survey

State Street Global Advisors, in partnership with A2Bplanning and our field partner, Prodege, conducted an online survey among a nationally representative sample of adults. Data was collected from June 28 – July 5, 2022. For our Custom “Inflation Impact Survey,” we analyzed 243 adults with Investable Assets (IA) of $250K or more. Nearly half of those are currently working with a financial advisor.

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of international and domestic asset classes. The funds provide investors with the flexibility to select investments that are aligned to their investment strategy. For more information, visit www.ssga.com.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the world’s governments, institutions and financial advisors. With a rigorous, risk-aware approach built on research, analysis and market-tested experience, we build from a breadth of index and active strategies to create cost-effective solutions. As stewards, we help portfolio companies see that what is fair for people and sustainable for the planet can deliver long-term performance. And, as pioneers in index, ETF, and ESG investing, we are always inventing new ways to invest. As a result, we have become the world’s fourth-largest asset manager* with US $3.48 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/21.

†This figure is presented as June 30, 2022 and includes approximately $66.43 billion of assets with respect to SPDR products for which State Street Global Advisors Funds Distributors, LLC (SSGA FD) acts solely as the marketing agent. SSGA FD and State Street Global Advisors are affiliated.

1 State Street Global Advisors Individual Investors 2019 Study. A global survey on consumer sentiment, purpose and behavior in wealth management.

Important Risk Disclosures

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor. The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing involves risk, including the risk of loss of principal.

This communication is not intended to be an investment recommendation or investment advice and should not be relied upon as such.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

There can be no assurance that a liquid market will be maintained for ETF shares.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third-party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured · No Bank Guarantee · May Lose Value

State Street Global Advisors, 1 Iron Street, Boston, MA 02210-1641.

© 2022 State Street Corporation.

All Rights Reserved.

4864608.1.1.AM.RTL Exp. Date: 01/31/2023

View source version on businesswire.com: https://www.businesswire.com/news/home/20220909005402/en/

Contacts

Deborah Heindel

+1 617 662 9927

DHEINDEL@StateStreet.com