Company committed to helping millions of U.S. renters instantly improve their FICO® Score with Experian Boost®

In a move to help millions of U.S. renters improve their credit scores, Experian® today launched a beta release of Experian Boost®1 that allows consumers to contribute qualifying, “positive” residential rent payments directly to their Experian credit file. This capability makes Experian Boost the only feature that can instantly improve a consumer’s FICO® Score 82 through positive rent payments at no cost.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220907005460/en/

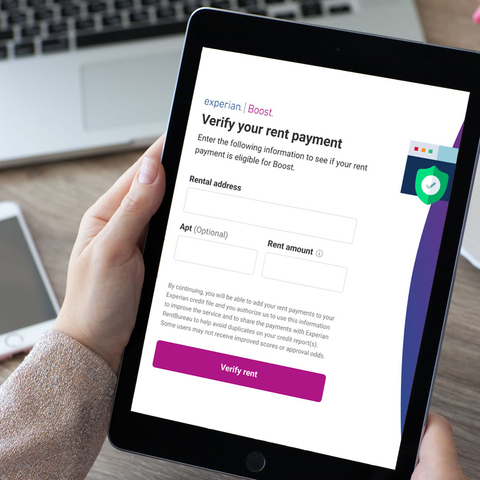

Experian Helps Consumers Use Positive Rent Payments to Build Credit (Photo: Business Wire)

“Experian Boost is a gamechanger and we’re excited to launch the first phase of this new enhancement that will allow consumers to instantly add rental payments to their Experian credit file,” said Jeff Softley, president Direct to Consumer, Experian Consumer Services. “We are committed to continually improving Experian Boost to bring financial power to all.”

Based on preliminary analysis3 highlighting the potential impact of positive residential rent payment reporting through Experian Boost, Experian estimates:

- 66% of consumers will see an instant increase to their FICO® Score 8

- A FICO® Score 8 improvement of nearly 10 points on average for those who receive a boost and are new to using Experian Boost

- Consumers who receive a boost with thin credit files or low FICO® Scores see an improvement of approximately 14 points

- An average improvement of nearly 19 points for new users who see a FICO® Score 8 improvement when positive rent payments are combined with other eligible payments for Experian Boost, such as telecom, utilities and video streaming services

Reporting positive rent payments through Experian Boost: how it works

With the beta release, consumers who rent from over 1,500 of some of the largest U.S.-based property management companies, and who pay their rent directly to their property management company or through platforms like AppFolio Property Management, Buildium®, Yardi® Breeze and Zillow® Rental Manager, can add qualifying positive rent payments to their Experian credit file through Experian Boost.

Once a consumer creates an Experian account and enrolls in a free or paid Experian membership, the consumer can opt-in and allow access to the checking, savings or credit card accounts used to pay rent so that Experian can identify residential rent payments within the qualifying amount range. Once three qualifying rent payments in the last six months are verified by the consumer, with at least one in the last three months, they can be added to the consumer’s Experian credit file, assuming they don’t already have rent on their credit file through Experian® RentBureau® or an active mortgage tradeline. The whole process takes less than five minutes. Once connected, future qualifying rent payments can be automatically added to a consumer’s Experian credit file.

New property management companies and payment methods will continue to be evaluated and added during the beta release. Experian also plans to add individual landlords and smaller property management companies over time.

Experian Boost: three years of meaningful impact

Since launching in the spring of 2019, 8.6 million4 consumers have instantly improved their FICO® Score 8 with an average increase of 13 points by having their positive telecom, utility and video streaming service payments added to their Experian credit file through Experian Boost. While not all users receive an increased FICO Score, the free feature has added a total of 88 million points to FICO Scores nationwide. Those with limited credit histories and FICO Scores below 620 have seen the most benefit with an average FICO Score 8 improvement of nearly 17 points for subprime consumers and nearly 20 points for those with thin credit files (among users who see improvement).

Experian analysis shows members’ FICO® Score 8 continues to improve over the course of an Experian membership, even after boosting. In fact, members who initially received a boost saw their FICO Score 8 continue to improve by an additional 9 points on average over the next 12 months.

Experian was the first major credit reporting agency to include rent payments in consumer credit reports and has a longstanding history supporting the use of positive rent payments. In 2010, the company acquired RentBureau, which provides consumers another avenue to report positive rent payments to Experian through their landlord, property management company or a third-party rent reporting service.

About Experian

Experian is the world’s leading global information services company. During life’s big moments – from buying a home or a car, to sending a child to college, to growing a business by connecting with new customers – we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organisations to prevent identity fraud and crime.

We have 20,600 people operating across 43 countries and every day we’re investing in new technologies, talented people, and innovation to help all our clients maximize every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners.

FICO is a registered trademark of Fair Isaac Corporation.

| ____________________ | ||

1 |

Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. Learn more. |

|

2 |

Credit score calculated based on FICO Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. |

|

3 |

Analysis completed using FICO Score 8 with Experian data. |

|

4 |

8.6 million consumers is reflective of those who have instantly improved their FICO® Score 8 |

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20220907005460/en/

Contacts

Sandra Bernardo

Experian Public Relations

sandra.bernardo@experian.com