- All generations moved CCL, RCL and NCLH into their top holdings

- Apex Next Investor Outlook report reveals generational investing trends

With summer travel booming, all four generations - Gen Z, Millennials, Gen X and Boomers - invested heavily in popular cruise lines in Q2, according to the Q2 2023 Apex Next Investor Outlook (ANIO). The study utilizes data from Apex Fintech Solutions (“Apex”), the fintech for fintechs powering innovation and the future of digital wealth management. The data also reinforced the continued powerful interest in AI, with major rallies and investments in Nvidia, C3 AI, and Palantir.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230810085354/en/

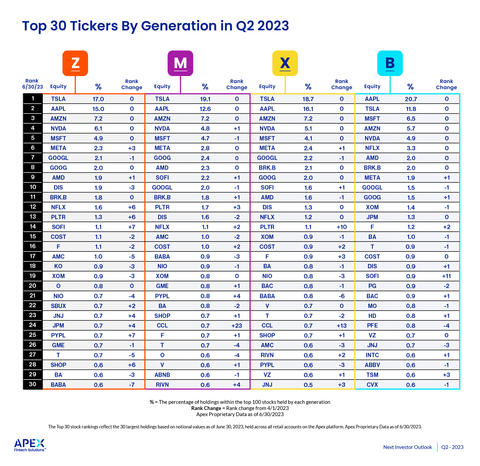

The Top 30 stock rankings reflect the 30 largest holdings based on notional values as of June 30, 2023, held across all retail accounts on the Apex platform. Top 30 Tickers by Generation in Q2 2023*, Apex Proprietary Data as of 6/30/2023, Rank Change = Rank change from 4/1/2023 (Graphic: Business Wire)

The ANIO report analyzes investor data who trade through introducing brokers on the Apex Clearing Platform - across more than 1.3m Gen Z accounts and 5.6m accounts held by Millennials, Gen Z and Boomers, calculated from April 1 - June 30, 2023.

The following data refers to the rankings of the most commonly held securities at Apex by generation in Q2 2023. The data shows a given ticker’s movement within this ranking system among a particular generation. These observations are for informational purposes about generational trends and are not investment advice. Key report findings include:

-

Everyone loves cruises

- With cruise lines announcing record bookings, Q2 saw a significant shift in investment focus towards cruise lines, with Norwegian Cruise Lines (NCLH), Carnival Corp. (CCL) and Royal Caribbean Group (RCL) receiving heavy investments across all generational cohorts.

-

Gen Z is less enthusiastic about AI

- Millennials and Gen X are enthusiastic about AI, with C3 AI (AI) moved up the lists 18 and 27 points, respectively. Boomers doubled down on Palantir (PLTR), moving it up 24 spots. Only Gen Z held back from jumping on the AI bandwagon.

-

COVID’s over - at least from an investing standpoint

- All four generations jettisoned biotech stock Moderna (MRNA), falling down the ranks across ages.

-

Technology stocks are a preferred choice across all generations

- Across all generational cohorts, technology stocks maintain a strong lead in equity investments among these Top 10 Stocks: TSLA, AAPL, AMZN, NVDA, MSFT, META, GOOGL/GOOG, AMD, BRK.B, and SOFI.

-

Gen Z took a cautious approach in Q2

- Gen Z appeared to scale back in bullish trading patterns compared to Q1. Possible reasons for this cautious approach may include the First Republic Bank crash, negative press surrounding AI from Google, and the departure of a prominent figure in the AI industry.

-

Gen Z still likes crypto and digital

- Gen Z’s three hottest, climbing-the-ranks stocks in Q1 include a crypto-economy company (COIN); a Bitcoin ecosystem provider (MARA), and a cybersecurity business (CRWD).

“What’s remarkable about our Q2 ANIO report is how many investing stereotypes were broken,” comments Connor Coughlin, Chief Commercial Officer, Fintech at Apex Fintech Solutions. “The multi-generational investing interest in cruise stocks is a great example. But also, despite perceptions around the ‘meme stock’ generation, it was actually Gen Z that appeared to be more conservative in Q2, even holding back on investing in AI stocks. As such, better understanding the changing needs and behaviors of retail investors is going to continue to be critical for advisors and fintechs.”

To download the full ANIO report, click here: https://go.apexfintechsolutions.com/apex-next-investor-outlook-q2-2023

About Apex Fintech Solutions

Apex Fintech Solutions is a fintech powerhouse enabling seamless access and frictionless investing. Apex’s omni-suite of scalable solutions fuel innovation and evolution for hundreds of today’s market leaders, challengers, change makers, and visionaries. The Company’s digital ecosystem creates an environment where clients with the biggest ideas are empowered to change the world. Apex works to ensure their partners succeed on the frontlines of the industry via bespoke custody & clearing, advisory, institutional, digital assets, and SaaS solutions through its Apex Clearing™, Apex Advisor Solutions™, Apex Silver™, and Apex CODA Markets™ brands.

Disclaimer

The views noted in this report are solely intended for educational and informational purposes only and should not be construed as research, analysis, or a recommendation to buy or sell a particular security or product. Readers of this report should consider whether this information is suitable for their particular investment circumstances and if appropriate, seek professional advice, including tax advice.

For more information, visit the Apex Fintech Solutions website: https://www.apexfintechsolutions.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230810085354/en/

Contacts

Vested

apex@fullyvested.com