- Zilch expands its consumer credit offering with launch of longer-duration zero-interest payment option, adding to existing ‘Pay over 6 weeks’ product

- Designed for bigger-ticket purchases of £75+, ‘Pay over 3 months’ stands out as a regulated credit option within the UK market, offering an extended repayment period

- Customers use their Zilch card on average 100 times a year

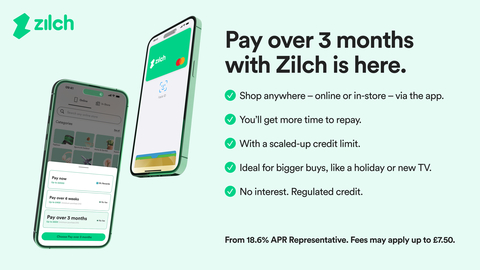

Zilch, the ad-subsidised payments network (ASPN), today announces the launch of a new credit payment product, allowing its customers to spread interest-free repayments for larger purchases over three months. The new ‘Pay over 3 months’ product will provide more flexibility to customers and drive up Zilch’s market-leading wallet share.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240222797743/en/

Zilch Launches Pay over 3 months interest-free regulated product (Graphic: Business Wire)

The new ‘Pay over 3 months’ product has already been made available to around 100,000 Zilch customers in a trial. Eligible customers from Zilch’s more than 3.6 million registered users will be offered the new product from April 2024 onwards. The launch will provide Zilch customers with even greater choice when paying, enabling them to go in app and seamlessly choose between ‘Pay over 3 months’, the shorter-tenor ‘Pay over 6 Weeks’ or, for day-to-day purchases, Zilch’s reward-earning ‘Pay Now’ debit product where they earn up to 5%.

When opting to ‘Pay over 3 months’, Zilch customers will pay 25% up-front and spread the remaining purchase price over three instalments, just like they currently do when making interest-free credit repayments over six weeks. They will benefit from the same industry-leading consumer safeguards given that Zilch will offer this as a regulated product under its FCA consumer credit licence. This product will allow customers to build their credit scores each month, through Zilch’s reporting agreements with the UK’s leading Credit Reference Agencies.

With a higher minimum spend threshold of £75 during beta testing, ‘Pay over 3 months’ empowers consumers to spread the cost of larger purchases over a longer timeframe and better manage the impact of bigger and less regular expenses on their cash flow. It represents one of the longest-duration loans provided by any major UK fintech offering zero-interest regulated credit payments. Customers’ three-month borrowing will be capped at personalised and dynamic affordability limits.

Philip Belamant, CEO and co-founder of Zilch, said: “In the past three years Zilch has successfully delivered more than 50 million customer transactions and £2 billion in customer spending, yielding us extensive behavioural datasets. This is because customers today use Zilch on average more than 100 times annually to manage their day-to-day spending across debit and credit. Today’s product launch moves Zilch closer to our end game of capturing total share of wallet. This new payment option is tailored for significant purchases or emergency moments, such as buying electronics, car tyres or home repairs like when the boiler breaks. As Zilch is FCA-regulated, customers can spend with the confidence that every payment over £100 is covered under section 75 of the Consumer Credit Act. It’s simply the best way for any adult to pay - especially in today’s economic climate.”

Based on the evidence of how the new product drove commerce and helped customers to finance larger purchases during beta testing, Zilch has partnered with a diverse range of leading UK merchants where customers can Pay over 3 months, in-store or on the app, with no fees.

Will Prosser, Director of Digital Marketing and CRM at TUI UK & IE, said: “The launch of ‘Pay over 3 months’ is fantastic news for Zilch customers and consumers everywhere, giving them the option to spread the cost of larger purchases over a longer period. It’s a great tool for supporting people in managing their finances when buying bigger-ticket items like a holiday and it’s important to us that we provide our customers with choice. Partnering with Zilch, who offer zero interest or fees, is one way we’re adding value and peace of mind for our customers.”

Other merchants choosing to fully subsidise customers’ cost of credit through their advertising spend include Lego, Nike and Morrisons. Alternatively customers can Pay over 3 months, for a small and clearly stated up-front fee starting as low as £2, at any of the 38 million merchants who accept Mastercard worldwide.

About Zilch

Zilch’s vision is to eliminate the cost of consumer credit. For good.

Zilch ad-subsidised payments network. Leveraging its unique vertically integrated, first party data business model to set itself apart from the incumbent fintech industry with a profitable global revenue source, bringing unrivalled value to customers and marketers alike. Today, Zilch is revolutionising the $50 trillion advertising and payments industries by merging the very best of debit, credit, and savings.

Zilch provides millions of customers the freedom to go anywhere in the world (online or offline) and when they pay, earn up to 5% cashback & rewards on debit payments (‘Pay Now’) or spread interest-free credit repayments over six weeks (‘Pay in 4 over 6 weeks’) and in the process help build their credit profiles with the major credit agencies. Three years from launch, Zilch had amassed more than 3.6 million registered customers.

With the launch of its proprietary Ad-Subsidised-Payments Network (ASPN), Zilch allows retailers worldwide instant connection with millions of Zilch’s first-party data, closed loop network of high intent customers. Offering customers personalised savings, deals and discounts codified to their habitual spend.

In January 2023, Zilch struck a ground-breaking reporting agreement with the UK’s prime credit reference agencies, transforming the UK lending ecosystem by enabling 35m working adults to build their credit records using interest-free credit rather than high-cost revolving credit products.

Since April 2020, Zilch has been regulated by the Financial Conduct Authority (FCA), obtaining a consumer credit licence through the Regulatory Sandbox Programme.

For more information, visit: www.zilch.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20240222797743/en/

Contacts

Zilch - Ryan Mendy, Chief Communications Officer: press@zilch.com

Media enquiries:

zilch@hawthornadvisors.com