Sends Letter to Stockholders Outlining Urgent Need for Change to Restore and Rebuild Value

Highlights Poor Operational Performance, Egregious Executive Compensation and Reckless Capital Allocation Under Incumbent Board

Urges Stockholders to Vote FOR Rubric’s Nominees Thomas A. Lacey and Deborah S. Conrad on the WHITE Proxy Card

Rubric Capital Management LP (“Rubric”), an investment advisor whose managed funds and accounts collectively own approximately 9.0% of the outstanding shares of common stock of Xperi Inc. (NYSE: XPER) (“Xperi” or the “Company”), today filed its definitive proxy statement with the Securities and Exchange Commission in connection with its nomination of Thomas A. Lacey and Deborah S. Conrad for election to Xperi’s Board of Directors (the “Board”) at the Company’s 2024 Annual Meeting of Stockholders, which is scheduled to be held on May 24, 2024.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240417649522/en/

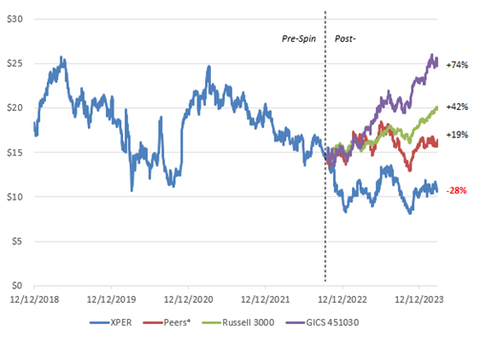

XPER Share Price Performance (Source: Bloomberg)

Rubric also sent a letter to Xperi stockholders outlining the urgent need for change at the Company in order to reverse its history of underperformance and poor decisions under the incumbent Board and drive long-term stockholder value.

The full text of the letter follows:

April 17, 2024

Dear Fellow Stockholder:

At Xperi Inc.’s (“Xperi” or the “Company”) upcoming 2024 Annual Meeting of Stockholders, which is scheduled to be held on May 24, 2024, you will be presented with a choice: maintain the status quo of underperformance by voting for an incumbent Board of Directors (the “Board”) which has overseen years of stockholder value destruction, or elect to the Board two new directors with the perspectives, skills and expertise to help set Xperi on a trajectory of sustained growth and profitability. As a large, long-term Xperi stockholder who, like you, has seen the value of our investment deteriorate, we urge you to choose the latter by voting FOR our director nominees – Thomas A. Lacey and Deborah S. Conrad – on the enclosed WHITE proxy card today.

RUBRIC IS ALIGNED WITH YOU AND HAS A PLAN FOR CHANGE

Rubric Capital Management LP (“Rubric”) manages funds and accounts which collectively own approximately 9.0% of Xperi’s common stock, making us the Company’s third largest stockholder. We have been stockholders of Xperi since its spin-off from its predecessor company on October 1, 2022, and we were stockholders of Xperi’s predecessor company since 2017.

We invested in the Company due to its attractive portfolio of innovative enablement technologies and our firm belief in their significant monetization potential. Unfortunately, from our perspective, this potential has been squandered under the oversight of the current Board, and stockholders have paid the price.

We take no pleasure in publicly criticizing companies or directors and prefer to spend our time working collaboratively with the boards and management teams of our portfolio companies to help drive sustained value. We have taken this same constructive approach to our engagement with Xperi’s Board and management team across the duration of our investment. Unfortunately, in our view, this Board has shown that it is more focused on granting excessive compensation to executives than it is engaging with stockholders to improve the Company’s performance. Simply put, the direction of the Company is untenable, and we believe meaningful change is required in the boardroom to ensure stockholder value is not eroded further.

Rubric has a clear roadmap for change and value creation that benefits all stakeholders. We have identified two highly qualified, independent director candidates – Thomas A. Lacey and Deborah S. Conrad – with the leadership experience, marketing knowledge, and financial and corporate strategy expertise that is urgently needed to stem the tide of losses at Xperi and drive long-term stockholder value. We are confident that Mr. Lacey and Ms. Conrad will act as dedicated advocates for the interests of ALL Xperi stockholders, and will work tirelessly to address the poor operational performance, egregious insider compensation and reckless capital allocation practices that we believe have continued to plague the Company.

Vote for restoring and building value at Xperi. Please vote your enclosed WHITE proxy card TODAY for the election of Thomas A. Lacey and Deborah S. Conrad. Vote by telephone, over the Internet, or by signing, dating and returning your WHITE proxy card in the postage-paid envelope provided.

XPERI AND THE CURRENT BOARD HAVE A HISTORY OF UNDERPERFORMANCE

Underperformance has been idiomatic to Xperi throughout its life as a standalone company – and earlier. Since the completion of Xperi’s spin-off, the Company’s shares have materially underperformed any comparable benchmark, declining by approximately 28%. During this same period, the S&P Software Index (GICS: 451030) had a total return of approximately 74% and the Russell 3000 returned approximately 42%.1

See XPER Share Price Performance chart.

While this underperformance is alarming, the duration of measurement is too short to warrant censure on its own. Xperi’s former parent company, Xperi Holding Corporation (“Xperi Holding”) (n/k/a Adeia Inc. (“Adeia”)), which shared all but one director from the Company’s current Board, similarly underperformed comparable benchmarks on both an absolute and relative basis. Xperi Holding shares were down approximately 27% on a trailing 3-year total return basis coming into the spin-off, underperforming the Russell 3000 by 52% and the S&P Software Index (GICS: 451030) by 81%.2

Contrast this with the performance of Xperi’s predecessor company under Rubric director nominee Thomas A. Lacey, who served as CEO of the business from 2013 to 2017 and oversaw stockholder returns that were double the rate of the Russell 3000 (21% vs 10% CAGR),3 and it becomes clear to us what – or who – is responsible for the destruction of stockholder value.

XPERI’S POOR MARGINS HAVE LED TO UNACCEPTABLE UNDERPERFORMANCE

Xperi’s margin performance has been similarly underwhelming when compared to peers, and points to an excessive expense structure that desperately needs to be addressed in order to unlock stockholder value.

The facts speak for themselves. Despite operating at a similar revenue scale to, and having higher gross margins than, its Institutional Shareholder Services Inc. (“ISS”) peer group,4 Xperi’s LTM Adjusted EBITDA margins are ~1,700 basis points below peers.5

Adjusted |

Adjusted |

|||||

Revenue ($MM) |

Gross Margin |

EBITDA Margin |

||||

| Average ISS Peers | $538 |

76% |

23% |

|||

| Xperi | $521 |

78% |

7% |

|||

| Xperi vs ISS Peer Average | 2% |

-17% |

To put Xperi’s level of operational underperformance in context for stockholders, simply achieving peer margins (which are within the target ranges Xperi provided at its 2022 Analyst Day), and valued using a median 2024 peer group multiple of 11.0x EBITDA, Xperi would be worth approximately $29 per share, representing an increase of approximately 170% over its current price.6

XPERI’S BOARD SEEMINGLY REWARDS INSIDERS TO THE DISADVANTAGE OF STOCKHOLDERS

To make matters worse, Xperi has instituted a compensation program that seemingly rewards insiders to the disadvantage of stockholders. In 2023, the Company issued over 4.2 million RSUs to insiders (approximately 76% of which are not subject to any performance-based vesting), representing approximately 9% of the Company’s diluted share count, and recognized a stock-based compensation expense of approximately $70 million.7 This dilution occurred while Xperi grew revenue by only 4% in 2023, and reduced the midpoint of its EBITDA guidance in the third quarter.

To drive this point home, during 2023, Xperi’s former parent, Adeia, which has over twice as many shares outstanding and twice the market capitalization of Xperi, issued only 2.9 million RSUs, or approximately a 2.7% dilution, less than 33% of that experienced by Xperi stockholders.8 Adeia’s stock-based compensation expense was only roughly $18 million for the full year (nearly $52 million less than Xperi).9

Unsurprisingly, Xperi’s stock-based compensation expense is similarly bloated when compared to its ISS peer group.10

| GAAP SBC Expense | GAAP SBC Expense | |||

| as % of Revenue | as % of Market Cap | |||

| Average ISS Peers | 9.6% |

2.98% |

||

| Xperi | 13.3% |

14.72% |

The fact that this Board deems such an unsustainable and misaligned compensation scheme appropriate, despite Xperi’s staggeringly poor returns, is, in our view, indefensible. It is for this reason that we are seeking to replace two of the three members of the Board’s Compensation Committee – Darcy Antonellis and David C. Habiger – with new independent directors who are committed to prioritizing the best interests of stockholders.

WE BELIEVE XPERI’S RECKLESS CAPITAL ALLOCATION HIGHLIGHTS THE BOARD’S POOR DECISION MAKING AND THREATENS THE PRESERVATION OF STOCKHOLDER VALUE

We have watched and grown increasingly concerned about the capital allocation decisions being made at Xperi. These concerns began when Xperi’s former parent disclosed the existence of its investment in Perceive Corporation (“Perceive”) in 2020. Unbeknownst to stockholders, Xperi’s former parent had been spending upwards of $20 million per year to incubate an AI startup, apparently without regard to cost of capital. At the time (and many times since), we recommended that the Company (and its former parent) sell a partial stake in Perceive in order to provide investors with a metric by which to value Perceive’s potential, while derisking some of the financial drag. Despite those repeatedly stated concerns, it was not until February 28, 2024 that the Company announced that it had hired Centerview Partners LLC to finally conduct a strategic review for Perceive.

Moreover, in December 2023, the Company announced that it agreed to sell its AutoSense division to Tobii AB (“Tobii”) for approximately $42.7 million. Despite what we believe to be a long runway of potential growth driven by regulatory changes requiring additional in-cabin monitoring, Xperi elected to divest this business for zero upfront consideration, instead accepting a $27.7 million promissory note paid in three tranches starting in 2027, and $15 million in future cash payments made over four years starting in 2028.11 In other words, Xperi sold a business it incubated and understands well, and instead became the primary creditor to Tobii, a company that has had negative operating profit in 10 of the last 11 quarters and currently has an enterprise value of approximately $35 million.12

These actions are, in our view, emblematic of the Board’s repeated poor decision making and capital mismanagement, which we fear are a grave threat to the preservation of stockholder value.

RUBRIC’S NOMINEES BRING THE EXPERIENCE AND OVERSIGHT REQUIRED IN XPERI’S BOARDROOM

It is apparent that Xperi’s Board as currently constituted cannot be trusted to effectively lead the Company forward and create value for stockholders. Accordingly, we have nominated two highly qualified, independent directors – Thomas A. Lacey and Deborah S. Conrad – who will help bring the necessary rigor and skillset to improve the Board for the benefit of all stakeholders. Our nominees have proven track records of value creation and possess relevant operating and capital allocation expertise that we believe is needed to help Xperi reach its full potential.

If elected, our nominees are committed to working alongside the incumbent directors to:

- Address the operational underperformance which has directly contributed to the Company’s declining stock price;

- Design a compensation plan that is aligned with stockholders and truly pays for performance; and

- Allocate capital in a more efficient and results-oriented manner.

With the right plan and right people in place, we are confident that Xperi can deliver meaningful long-term value to stockholders. We urge you to protect and enhance the value of your investment by voting for Rubric’s director nominees – Thomas A. Lacey and Deborah S. Conrad – on the enclosed WHITE proxy card today. Together, we can make Xperi extraordinary.

PLEASE VOTE YOUR WHITE PROXY CARD TODAY.

If you have any questions, require assistance in voting your WHITE universal proxy card, or need additional copies of Rubric’s proxy materials, please contact our proxy solicitor Okapi Partners at (855) 305-0856 or via email at info@okapipartners.com.

Sincerely,

David Rosen

Managing Partner

Rubric Capital Management LP

Your Vote Is Important, No Matter How Many or How Few Shares You Own! |

|

Please vote today by telephone, via the Internet or by signing, dating and returning the enclosed WHITE proxy card. Simply follow the easy instructions on the WHITE proxy card. |

|

If you have questions about how to vote your shares, please contact: |

|

Okapi Partners LLC |

1212 Avenue of the Americas, 24th Floor |

New York, New York 10036 |

|

Stockholders may call toll-free: (855) 305-0856 |

Banks and brokers call: (212) 297-0720 |

E-mail: info@okapipartners.com |

____________________

1 Source: Bloomberg. Calculated as of March 7, 2024.

2 Source: Bloomberg. Calculated as of September 30, 2022.

3 Source: Bloomberg.

4 See ISS report published on March 31, 2023 in connection with the Company’s 2023 annual meeting of stockholders. Peer group consists of A10 Networks, Inc.; Appian Corporation; BlackBerry Limited; Everbridge, Inc.; OneSpan Inc.; Rimini Street, Inc.; SolarWinds Corporation; Varonis Systems, Inc.; Yext, Inc.; Adeia Inc.; Blackbaud, Inc.; Commvault Systems, Inc.; InterDigital, Inc.; Progress Software Corporation; SecureWorks Corp.; Upland Software, Inc.; Verint Systems Inc.; and Zuora, Inc.

5 Source: Xperi Form 10-K, filed March 1, 2024; year-end and quarterly reports filed by ISS peer group members; VisibleAlpha. Calculated on LTM basis as of March 7, 2024. Adjusted Gross Margin defined as (total revenue – (cost of goods sold plus stock-based compensation expense)) / total revenue. Adjusted EBITDA Margin defined as (operating income plus depreciation, amortization, stock-based compensation expense, transaction and restructuring expenses) / total revenue.

6 Source: Rubric analysis with inputs from Bloomberg/VisibleAlpha. Calculated as of March 7, 2024.

7 Source: Xperi Form 10-K, filed March 1, 2024.

8 Source: Adeia Form 10-K, filed February 23, 2024.

9 Source: Adeia Form 10-K, filed February 23, 2024.

10 Source: Xperi Form 10-K, filed March 1, 2024; year-end and quarterly reports filed by ISS peer group members; VisibleAlpha. Calculated on LTM basis as of March 7, 2024.

11 Source: Xperi press release, dated December 12, 2023.

12 Source: Tobii year-end and quarterly reports. Enterprise value as of March 7, 2024.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240417649522/en/

Contacts

Media:

Jonathan Gasthalter/Sam Fisher

Gasthalter & Co.

(212) 257-4170

Investors:

Jason W. Alexander/Bruce H. Goldfarb

Okapi Partners LLC

(212) 297-0720