- Strong discounts—as high as 30% off listed price—will drive shoppers to “trade up” in categories such as electronics, appliances and sporting goods, contributing over $2 billion in incremental spend this season

- The 2024 holiday season is expected to be the most mobile of all time, with a record $128.1 billion spent through mobile devices at 53.2% share over desktop, while also propelling usage of Buy Now, Pay Later services

- Consumers will discover and research products in new ways this season, with influencers driving people to shop 10 times more compared to social media overall and generative AI-powered chat bots seeing a 100% increase in traffic to retail sites

Today, Adobe (Nasdaq:ADBE) released its online shopping forecast for the 2024 holiday season, covering the period from Nov. 1 through Dec. 31, 2024. Based on Adobe Analytics data, the analysis provides the most comprehensive view into U.S. e-commerce by analyzing commerce transactions online, covering over 1 trillion visits to U.S. retail sites, 100 million SKUs and 18 product categories. Adobe Analytics is part of Adobe Experience Cloud, relied upon by the majority of the top 100 internet retailers in the U.S.* to deliver, measure and personalize shopping experiences online.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240925007732/en/

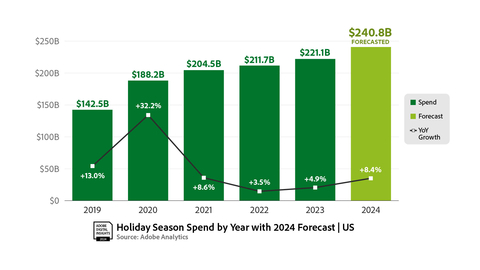

Spend by Year (Graphic: Business Wire)

Record E-commerce Spend in the U.S.

Adobe expects U.S. online sales to hit $240.8 billion this holiday shopping season (Nov. 1 to Dec. 31), representing 8.4% growth year-over-year (YoY). In the 2023 season, shoppers spent $221.8 billion online at 4.9% growth YoY. Shopping on mobile devices is expected to hit a new milestone, contributing a record $128.1 billion and growing 12.8% YoY. This would represent a 53.2% share of online spend this season (versus desktop shopping).

Cyber Week (the 5-day period including Thanksgiving, Black Friday and Cyber Monday) is expected to drive $40.6 billion in online spend, up 7.0% YoY and representing 16.9% of the overall holiday season. Adobe expects Cyber Monday will remain the season’s and year’s biggest shopping day, driving a record $13.2 billion in spend, up 6.1% YoY. Black Friday ($10.8 billion, up 9.9% YoY) and Thanksgiving Day ($6.1 billion, up 8.7% YoY) are both expected to outpace Cyber Monday in growth YoY, as consumers embrace earlier deals promoted by U.S. retailers. In a survey of 5,000 U.S. consumers**, 71% say they plan to shop online on Black Friday, with 70% saying they proactively check for deals during Cyber Week.

“The holiday shopping season has been reshaped in recent years, where consumers are making purchases earlier, driven by a stream of discounts that has allowed shoppers to manage their budgets in different ways,” says Vivek Pandya, lead analyst, Adobe Digital Insights. “These discounting patterns are driving material changes in shopping behavior, with certain consumers now trading up to goods that were previously higher-priced and propelling growth for U.S. retailers.”

Price Sensitive Shoppers Enticed by Strong Discounts

Adobe anticipates major discounts this season—up to 30% off listed prices—as retailers compete for consumer dollars. These levels are on par with the 2023 season. Of the 18 categories tracked by Adobe, discounts for electronics are expected to peak at 30% off listed price (vs. 31% in 2023) while discounts for toys are set to hit 27% (vs. 28%). Record high discounts are expected for TVs at 24% (vs. 23%) and sporting goods at 20% (vs. 18%). Other categories with notable discounts include apparel at 23% (vs. 24%), computers at 23% (vs. 24%), furniture at 19% (vs. 21%) and appliances at 18% (vs. 18%).

Each season, discounting has been a reliable driver of consumer demand and e-commerce growth for retailers. The effect has been more pronounced in 2024 as consumers remain price sensitive, taking advantage of big promotional events after a period of persistent inflation. This year, Adobe’s data showed that for every 1% decrease in price during promotional events (Prime Day, President’s Day, Memorial Day and Labor Day), demand increased by 1.025% compared to the year prior. This drove an incremental $305 million in online spend. For the upcoming holiday season, Adobe expects the strong consumer response to discounts will contribute an incremental $2 billion to $3 billion in online spend—a figure factored into the record $240.8 billion spend forecasted for e-commerce.

Shoppers “Trading Up” for the Holiday Season

Prior to the holiday season, months of persistent inflation had led shoppers to embrace cheaper goods across major e-commerce categories. To conduct this analysis for each category tracked by Adobe, prices were separated into four quartiles from the highest to lowest prices. Shares of units sold in the most expensive and least expensive quartiles were then tracked from April 2019 to August 2024. Adobe found the share of the cheapest goods increased significantly, up 46% across categories. Conversely, share of the most expensive goods decreased by 47% in the same period.

The trend is expected to reverse for the upcoming holiday season, where share of the most expensive goods is set to increase by 19% compared to pre-season trends—driven in large part by competitive discounts. This effect is particularly strong in categories including sporting goods, where share of the most expensive goods is expected to rise by a staggering 76%. Other categories with the same trend include electronics (up 58%) and appliances (up 40%). Adobe sees a more modest rise in apparel (up 3%) and toys (up 3%). Categories with a drop include furniture/bedding (down 12%) and groceries (down 3%), as consumers embrace lower-priced products.

Consumer Guide: Best Time to Shop

The deepest discounts are expected to hit during Cyber Week, the best time to shop for bargain hunters. And across several categories, the best deals are set to happen before the big Cyber Monday event. Thanksgiving Day (Nov. 28) will be the best day to shop for toys, appliances, furniture and sporting goods. On Black Friday (Nov. 29), shoppers will see the deepest discounts for TVs. The Saturday after (Nov. 30) will have the best deals for computers. And Cyber Monday (Dec. 2) will be the best day to shop for electronics and apparel—the two biggest categories in e-commerce by revenue share.

Notably, consumers will see deals beginning in mid-October with the Prime Day event expected to drive discounting across major U.S. retailers, up to 16% off listed price. Discounts are set to ramp up again beginning Nov. 1 and through Nov. 21, up to 18% off listed price. This provides consumers some flexibility in managing their budgets. Even after Cyber Week, discounts are expected to linger through the month of December, up to 15% off listed price.

Social Influencers Driving Consumers to Shop

Across major marketing channels, paid search has remained the top driver of retail sales (28% share of online revenue from Jan. 1 to Sept. 3, 2024) and is expected to grow by 1% to 3% during the holiday season. The fastest growth is set to come from affiliates and partners (17.2% share)—which includes social media influencers—at 7% to 10%. This channel is also expected to outpace retailer traffic from social media overall (nearly 5% share), where growth is at 4% to 7%. In 2024, Adobe’s data showed that influencers are converting shoppers (individuals making a purchase after seeing influencer content) 10 times more than social media overall. This is expected to hold strong during the holiday season. In Adobe’s survey, 37% of GenZ respondents have purchased something based on an influencer’s recommendation.

Additional Adobe Analytics Insights

- Top sellers expected this holiday season: Top toys include Bluey Ultimate Lights and Sounds Playhouse, Slime kits, Fisher-Price Little People, MGA's Miniverse, Descendants: The Rise of Red toys and LEGO sets. Top gaming consoles include Sony PlayStation 5, Xbox Series X and Nintendo Switch OLED. Top games include Madden NFL 25, NBA 2k25, Diablo 4, Call of Duty: Black Ops 6, Super Mario Party Jamboree, Valorant and World of Warcraft: The War Within. Other top sellers this season are expected to include iPhone 16, Google Pixel 9, Samsung Galaxy S24 Ultra, Bluetooth headphones, film/digital cameras, Oura Ring, Kindle/E-readers and Ninja Creami.

- E-commerce categories driving growth: Over half of online spend this holiday season is expected to be driven by electronics ($55.1 billion, up 8.5% YoY), apparel ($43.9 billion, up 5.8% YoY) and furniture/bedding ($28.4 billion, up 4.2% YoY). Groceries remains a high-growth category, expected to drive $20.8 billion and up a notable 8.8% YoY, as well as cosmetics ($10.3 billion, up 7.3% YoY). Other notable growth categories this season include toys ($8.1 billion, up 5.8% YoY) and sporting goods ($7.2 billion, up 5.5% YoY).

- Buy Now, Pay Later (BNPL): The payment method is expected to set new records this season, driving $18.5 billion in online spend, up 11.4% YoY. Adobe expects BNPL to hit $9.5 billion during the month of Nov. 2024, making it the largest month on record; Cyber Monday is set to be BNPL’s largest day on record at $993 million. BNPL is also predominantly driven by mobile shopping, with its share of spend expected to hit a staggering 74% to 79% (vs. desktop)—74.1% so far this year (Jan. 1 – Aug. 11, 2024). In Adobe’s survey, 39% of millennials plan to use BNPL services this season, followed by 38% of Gen Z. Most common reasons cited for using BNPL include freeing up cash (per 22% of respondents) and the ability to purchase something they couldn’t afford otherwise (19%).

- Impact of Generative AI: In 2024 (Jan. 1 to Aug. 31, 2024), traffic to retail sites from generative AI-powered chat bots has doubled. Direct referrals (consumers clicking on a link to retail site) have also increased dramatically—8 times higher than in 2023. Use of generative AI tools for shopping is expected to rise this holiday season. Adobe’s survey shows that 7 in 10 consumers who have used generative AI for shopping believe it enhances their experience, and 2 in 5 plan to use it for the holidays. Additionally, 20% of respondents turn to generative AI to find the best deals, followed by quickly finding specific items online (19%) and getting brand recommendations (15%).

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

*Per the Digital Commerce 360 Top 500 report (2024)

**Survey fielded from Sept. 2 to 9, 2024

© 2024 Adobe. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in the United States and/or other countries. All other trademarks are the property of their respective owners.

Disclaimer: The information and analysis in this release have been prepared by Adobe Inc. for informational purposes only and may contain statements about future events that could differ from actual results. Adobe Inc. does not warrant that the material contained herein is accurate or free of errors and has no responsibility to update or revise information presented herein. Adobe Inc. shall not be liable for any reliance upon the information provided herein.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240925007732/en/

Contacts

Public relations contact

Kevin Fu

Adobe

kfu@adobe.com