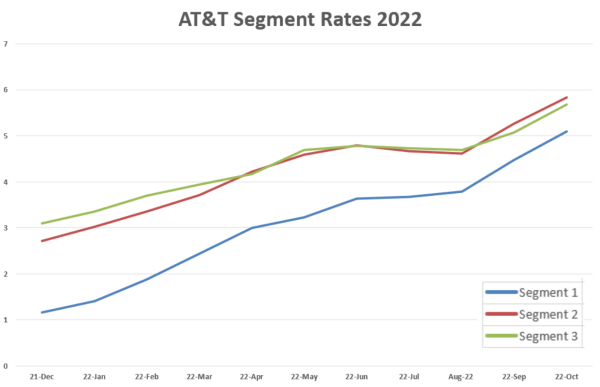

AT&T’s October interest rates were just released and they are even higher than most people anticipated. The rates are 3.11% higher than they were in November of 2021 (in the second segment, which has the largest impact). This means that an AT&T employee could expect to lose about 35% on their lump-sum if they decide to stay with the company in 2023. Legacy AT&T employees, under the ALM plan, would need to leave in November (Not December like many of their coworkers) in order to lock in the 2021 rates and avoid a massive pension loss.

October’s rates are the best indicator AT&T employees will have to make their decision on whether or not they will leave the company in 2022. While AT&T uses the IRS segment rates from November 2022 to calculate an employee’s lump-sum in 2023, those rates will not be made available until mid to late December, when employees will have already made their decision. Based on these rates an AT&T employee with a $1,000,000 lump-sum would stand to lose about $350,000.

AT&T employees will also need to take into consideration the opportunity cost of staying with the company beyond the pension loss. When deciding whether it makes sense to leave, AT&T employees should take into account the additional interest they could have gained on the original $1,000,000 as well as any additional income they could gain by retiring in 2022 and getting a part-time job.

Another factor to consider is the current state of AT&T & the economy. AT&T has already surplused some employees this year, and many companies in the United States have announced layoffs in recent weeks. With the economy potentially headed for a recession, employees that plan to stay with the company for several years should consider the possibility that they could be laid off sooner than anticipated and be forced to accept a 30% loss on their pension. Employees will need to determine whether or not they believe that it is worth the risk.

The Retirement Group is now offering a complimentary cash flow analysis for AT&T employees to help determine their preferred retirement date. The Retirement Group asserts that a cash flow analysis can help AT&T employees potentially avoid making big retirement mistakes. With a cash flow analysis, AT&T employees will see how rising interest rates will impact their retirement.

Video Link: https://www.youtube.com/embed/4sUx-zle7nA

The Retirement Group also offers webinars for AT&T employees which discuss healthcare changes and interest rates. These webinars offer insights into the company’s several benefits packages.

With interest rates rising significantly over the past few months, The Retirement Group suggests that AT&T employees discuss their options with an advisor. These advisors keep employees updated on any changes that may impact their retirement plans.

The Retirement Group has posted on their website that no matter how appealing the pension lump-sum looks, the annuity option may be a better fit depending on an individual’s circumstances. Every situation is unique and a cash flow analysis will allow employees to compare all pension options.

Disclosure: The Retirement Group is an independent financial advisory group that focuses on transition planning and lump sum distribution. Neither The Retirement Group or FSC Securities provide tax or legal advice. Please call the office at 800-900-5867 for additional questions or for help in the retirement planning process. The Retirement Group is not affiliated with, nor endorsed by AT&T.

Securities offered through FSC Securities Corporation (FSC) member FINRA/SIPC. Investment advisory services offered through The Retirement Group, LLC. FSC is separately owned and other entities and/or marketing names, products or services referenced here are independent of FSC. Office of Supervisory Jurisdiction: 5414 Oberlin Dr #220, San Diego CA 92121. AT&T is not affiliated nor endorsed by The Retirement Group or FSC Securities.

Media Contact

Company Name: The Retirement Group

Contact Person: Tiffany Hill

Email: Send Email

City: San Diego

State: CA

Country: United States

Website: https://www.theretirementgroup.com/