Penny stocks can be a treasure trove of investment opportunities, and the list of Most Active Penny Stocks is a good place to start looking. The downside is that many penny stocks are active for no good fundamental reason and have only volatility to offer investors.

Today's list looks at five of the most active penny stocks with fundamentally bullish outlooks and visible catalysts to drive them higher. The filters for this list include volume, "most active" is meaningless without some frame of reference, and in this case, the minimum is five million shares daily, with a dollar value greater than $25 million.

Grab Holdings: Hold On Tight, Profitability in Sight

Grab Holdings (NASDAQ: GRAB) is a penny stock trading near $3.35 per share with a daily average volume of nearly 30 million shares. It is a "super app" based in Singapore, providing exposure to emerging markets in Asia, ex-China and Japan. It offers a full-service platform for consumers, businesses, and advertisers across the delivery, mobility, fintech, and travel industries. Its offerings include ride-sharing/delivery services, payment processing, travel booking, gift cards, and rewards programs.

The company's performance is expected to slow to 50% revenue growth in the next quarterly report, but this is down from a hyper-growth level sustained for the previous four quarters. The last report included sequential and YOY growth, YOY growth of 76%, outperformance relative to the analysts, and improved guidance. Seven analysts rate GRAB stock a Moderate Buy and see it moving up 40% at the consensus midpoint.

ChargePoint: Struggles to Hurdle a High Bar

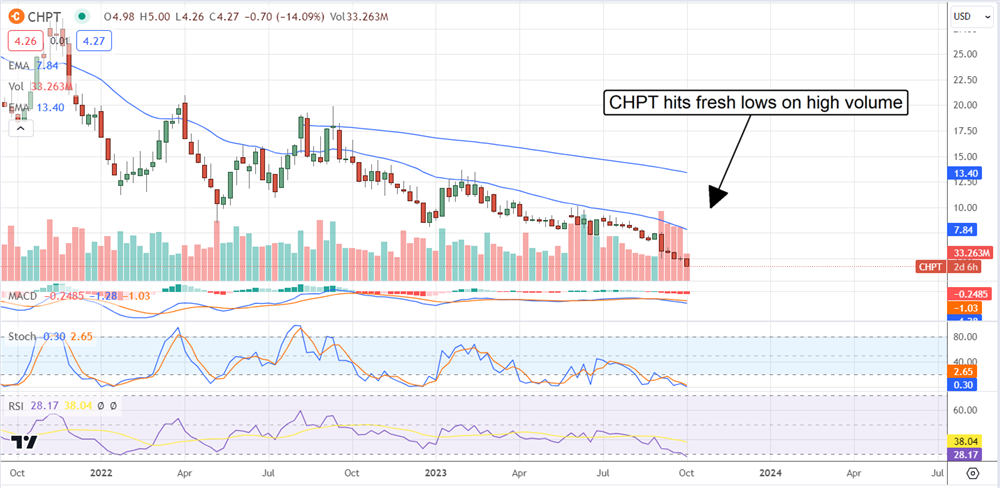

ChargePoint (NYSE: CHPT) struggles to meet the analysts' consensus targets, overshadowing its sustained high-double-digit growth. However, the company continues to grow and is expected to post a near-40% increase this year. More importantly, the analysts and outlook indicate another 40% increase in revenue next year and a significant loss reduction. This has the company on track for profitability in a rapidly growing industry, setting it up as a potential takeover target.

ChargePoint has seen a steady string of price target reductions over the past year, enough to land on the Most Downgraded Stocks list. But take this with a grain of salt. Trading near historic lows, CHPT stock is still rated a Moderate Buy with a price target that assumes 60% of upside at the range's low end. The consensus implies 185% of upside is possible.

Nikola Market Is Electrified

The average daily volume for Nikola (NASDAQ: NKLA) has ramped significantly over the past four months, putting it near 39 million shares. This is due to the company's production of the Tre FCEV long-haul truck, which appears to be gaining momentum with freight haulers. The fuel-cell model is desirable due to its longer range and quicker charging time comparable to hydrocarbon engines. Production began earlier this year and is ramping now; orders continue to roll in. Analysts expect Nikola's revenue to more than triple in 2024. Analysts rate NKLA stock a Hold and see it more than doubling at the consensus midpoint.

Femasys Inc. Gets FDA Approval

Femasys Inc. (NASDAQ: FEMY) is a small biomedical company focused on women's health. The company has several products on the market, including one that the FDA recently approved. The FemaSeed in vitro fertilization device is less invasive and costly than current methods and could take significant market share. The in vitro insemination market is already valued at nearly $700 million annually and is expected to double by 2030. Shares of this stock spiked on a significant uptick in volume. Three analysts rate FEMY stock a Buy and see it advancing nearly 200% at the low end of its range.

Sabre Corporation Banks on the Hospitality Industry

Sabre Corporation (NASDAQ: SABR) operates a platform/marketplace for B2B sales in the hospitality industry. Properties and service providers can list their inventory and make it available to resellers, agencies, and other websites. Sabre Corporation also provides SaaS services to the industry and is sustaining double-digit growth in 2023 following eight consecutive quarters of the same. The company is expected to post profits next year; the analysts rate SABR stock at Hold with a price target about 20% above the current levels.