Investing in dividend capture stocks can be a strong place to begin if you want to earn money buying and selling stocks. A dividend capture stock is a stock that an investor buys specifically to capture the dividend payment and then sells shortly after, typically within a few days or weeks. Ideally, the investor earns back the capital they used to place the investment plus the cash paid from the dividend.

While investing in dividend capture stocks can be risky, it offers the potential for short-term gains without the entire risk of day trading. However, these strategies come with risks, which you must consider before forming them. Read on to learn more about dividend capture stocks and strategies and some of the best stocks for dividend capture trading today.

What is the Dividend Capture Strategy?

Investors use dividend capture strategies to generate income from stocks by capturing the dividend payout without holding the stock for a long time. Income-oriented investors, such as retirees or those seeking additional income from their investments, usually use these strategies.

The basic idea of a dividend capture strategy is to purchase a stock a few days before the ex-dividend date, which is the date by which a shareholder must be on record to receive the dividend payout. The investor then holds the stock just long enough to receive the dividend and then sells the stock shortly after the ex-dividend date. You can also use this strategy with some of the best dividend ETFs, which follow the same dividend distribution methods as individual stocks you may buy and sell.

While this strategy can generate income from dividends, there are risks involved. For example, if the stock price drops after you purchase the stock, the dividend income may be offset by the capital loss when the stock sells. Additionally, the strategy may not work well in a volatile market, where stock prices may fluctuate significantly.

It's also worth noting that some investors may use more complex dividend capture strategies, such as buying call options on stocks with upcoming dividends or using dividend futures contracts to capture dividend income.

Overall, dividend capture strategies allow income-oriented investors to generate additional income from their stock investments. Still, they are not without risks and you should carefully consider them in the context of your financial goals and risk tolerance.

How to Use the Dividend Capture Strategy

If you plan to implement the dividend capture strategy, it's important to start by researching the best monthly dividend stocks and ETFs and keeping track of which assets' ex-dividend dates are approaching. Use these steps to get started as you look for the best stocks for dividend capture strategy.

- Identify stocks with upcoming dividend payments: Identify which stocks are about to pay dividends. You can find this information by checking the company's website or through online financial resources like stock screeners. MarketBeat's list of the best dividend stocks can be an excellent resource. Look for each stock's most recent "dividend declaration date," a company's official announcement of an upcoming dividend.

- Determine the ex-dividend date: Once you have identified a dividend stock, determine the ex-dividend date. The ex-dividend date is the date when a company looks at its list of shareholders to determine the dividend each investor is entitled to. You must own your stock before the ex-dividend date to be on record to receive a payout.

- Buy the stock: Buy the stock a few days before the ex-dividend date to ensure that you are on the record as a shareholder and will receive the dividend payment.

- Hold the stock until the ex-dividend date: Hold the stock until the ex-dividend date, typically one day before the dividend payment date.

- Sell the stock: Sell the stock shortly after the ex-dividend date. Most investors sell within a few days of the ex-dividend date to capture the dividend payment and potentially profit from the stock price increase.

Remember that a stock is not guaranteed to hold its value past the ex-dividend date. If the value of the stock drops significantly after the dividend distribution, you could see a significant loss, even adding in the value of the dividend payment.

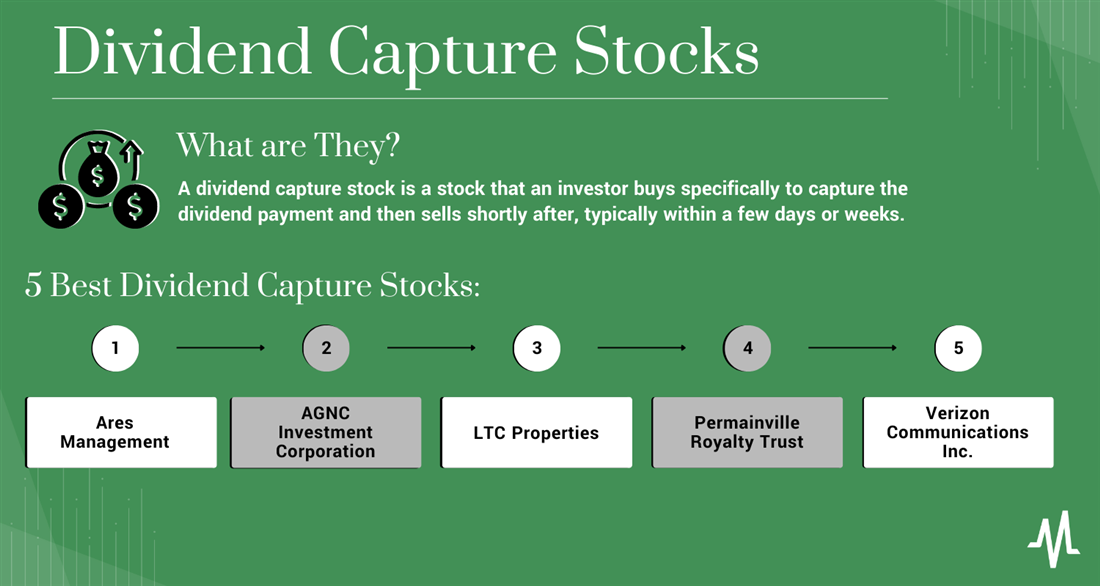

5 Best Dividend Capture Stocks

Before buying the best dividend stocks, exploring multiple investment vehicle options is a good idea.

Ares Management

The Ares Management Corporation (NYSE: ARES) is a global alternative investment management firm offering investment solutions to investors worldwide. The company manages assets across various asset classes, including private equity, real estate, credit and traditional asset management. The company also provides a limited range of credit and lending services. As of March 2023, the company featured a dividend yield rate of 3.20%.

AGNC Investment Corporation

AGNC Investment Corp. (NYSE: AGNC) is a real estate investment trust (REIT) primarily investing in agency mortgage-backed securities. The company uses leverage to enhance returns and hedges its interest rate risk through various financial instruments. As a REIT, AGNC is required by law to distribute at least 90% of its taxable income out to shareholders. It pays out a monthly dividend instead of a quarterly option like other options on our list of the best stocks for the dividend capture strategy. As of March 2023, AGNC showcased a dividend yield of 14.46%.

LTC Properties

LTC Properties (NYSE: LTC) is another REIT that pays monthly dividends. The company invests primarily in long-term care facilities, such as nursing homes, assisted living facilities and rehabilitation centers. LTC properties generate revenue from renting out these facilities to operators who manage and provide care services to residents. As of March 2023, LTC Properties featured an annual dividend yield of 6.67%.

Permianville Royalty Trust

Permianville Royalty Trust (NYSE: PVL) is a publicly traded trust with a net profit interest in oil and gas properties in Texas, Louisiana and New Mexico. The trust receives royalty income from oil and natural gas production from these properties, which is distributed to unit holders monthly. The income generated by the trust depends on the price and volume of oil and gas produced from the underlying properties. This asset may be a feature of one of the best dividend capture strategies when oil prices are trending upwards. In March 2023, PVL paid an annual dividend yield of 10.41%.

Verizon Communications Inc.

Verizon Communications Inc. (NYSE: VZ) is a multinational telecommunications company best known for providing communication and technology services to consumers, businesses, and governments. Verizon's primary product is its wireless phone services, which it offers in all 50 states alongside landline phone and internet services. Verizon is a member of the S&P 500 index and a variety of additional major indexes, leading to increased demand and liquidity compared to most other items on our list. As of March 2023, Verizon showcased a dividend yield percentage of 7.14%.

Pros and Cons of Investing in Dividend Capture Stocks

While the dividend capture strategy does provide the opportunity for short-term profits, it does come with risks. Consider the benefits and drawbacks before buying items from our best dividend capture stocks list.

Pros

The following benefits can help boost dividend capture stocks in your eyes:

- Income generation: The primary advantage of buying stocks that pay out a dividend is that they offer a potential source of income for investors seeking to generate short-term income. When buying shortly before the ex-dividend date and selling shortly afterwards, you won't need to worry about long-term value growth potential while also seeing income through dividends.

- Potential for capital appreciation: While most dividend capture investors sell shortly after buying their preferred stock, no law requires you to sell following dividend distributions. Dividend capture stocks may also offer potential for capital appreciation, especially if the stock price rises after the ex-dividend date.

- Diversification: Dividend capture stocks may benefit a portfolio, especially if the stocks are from different sectors and industries.

Cons

However, the downsides of following the best dividend capture strategy can include:

- Market volatility: Dividend capture stocks can be affected by market volatility, leading to losses if the stock price falls significantly after the ex-dividend date.

- Short-term focus: Dividend capture stocks are a short-term strategy that may not be suitable for all investors, especially those with a long-term investment horizon.

- Active management: To earn the most from dividend capture stocks, you'll need to devote a lot of time to research, comparing stocks with upcoming dividend dates, examining dividend sustainability, making ex-dividend dates and more. If you're an investor looking for a more hands-off approach to wealth building, this strategy may not be for you.

Consider Investing in Dividend-Paying Stocks

While the dividend capture strategy may provide short-term profits, it could be more suitable for investors looking for a long-term route toward primary financial goals. Investing in the best dividend capture stocks using an ETF may provide a less volatile way to invest in dividend payers without the risk of holding individual stocks. If you're looking for a more long-term way to invest in dividend-paying assets, consider a mutual fund or ETF.

FAQs

Consider these important frequently asked questions before you choose this investment method.

Is dividend capture profitable?

The profitability of the dividend capture strategy depends on various factors, such as the transaction costs, market volatility and the stock's price movement after the ex-dividend date. Many investors profit from this strategy, but an equal number of investors may lose funds due to drops in share price following distribution. Overall, the dividend capture strategy is a short-term strategy that may not be suitable for all investors.

What stock pays the highest dividend?

Dividend payments are constantly changing based on the value of the underlying companies. Some companies with the highest dividend yield rates as of March 2023 include Prenetics Global, Aspira Women's Health and iPower.

Can you get rich buying stocks that pay you a dividend?

It is possible to generate wealth by investing in stocks that pay dividends, but it is important to understand that there is no guarantee of future profits or returns after you buy. Most companies can cut dividend payments at any point, meaning dividend yield could drop sharply after investing. Be mindful of the risks and reevaluate your portfolio regularly if you invest heavily in dividend capture ETFs or stocks.