In a world where financial technology (fintech) has reshaped how we handle money, investing in fintech has never been more enticing. From cutting-edge payment solutions to revolutionary blockchain technology, fintech companies pave the way for a new era of financial services.

As the industry continues its rapid growth, savvy investors seek opportunities to ride this wave of innovation. But with so many fintech ETFs, how do you pick the ones that will propel your portfolio to new heights?

Check out our list of top fintech ETFs that could revolutionize your investment strategy and capitalize on the financial technology revolution.

Overview of Fintech ETFs

Fintech exchange-traded funds (ETFs) have emerged as a popular and enticing investment option in the ever-evolving financial technology landscape. These fintech funds, designed to track the performance of a basket of fintech companies, are at the forefront of technological innovation in the financial services industry. Fintech encompasses many innovative solutions, including mobile payments, blockchain technology, digital banking, peer-to-peer lending and more.

Investing in fintech ETFs offers several compelling advantages for investors seeking exposure to this dynamic sector. First and foremost, fintech ETFs provide diversification, spreading investment risk across multiple companies within the industry. Diversification helps mitigate the impact of individual company volatility and enhances the potential for consistent returns.

Furthermore, fintech ETFs offer a hassle-free and cost-effective way to invest in this cutting-edge sector. With a single purchase, investors gain access to a well-balanced portfolio of fintech companies, eliminating the need for extensive research and individual stock selection. The fintech industry's rapid growth and disruptive potential drive investor interest in these ETFs. As technological advancements continue to reshape traditional financial services, fintech companies are well-positioned to capitalize on the changing landscape. Investing in fintech ETFs can help you tap into growth potential and benefit from the continued expansion of the fintech industry.

Additionally, fintech ETFs cater to diverse investment goals and risk appetites. Whether you seek long-term growth, income or exposure to specific fintech subsectors, various ETFs can suit your investment strategies. For those seeking socially responsible investment options, some fintech ETFs focus on companies promoting financial inclusion, sustainable practices and ethical financial services. You can even align fintech investing with the growing interest in investing with environmental, social and governance (ESG) factors in mind.

ETFs allow you to participate in the innovation and disruption in the financial services industry. Conduct thorough research and understand the ETF's underlying holdings, expense ratios and management style to select an ETF that aligns with your investment objectives and risk tolerance. As the fintech sector continues to evolve, fintech ETFs offer a compelling opportunity to be at the forefront of technological advancements and the transformation of the financial services landscape.

Why Invest in Fintech ETFs?

The fintech industry has experienced remarkable growth, driven by technological advancements and changing consumer behaviors. As the demand for innovative financial solutions increases, so does the appeal of investing in fintech ETFs.

One of the key advantages of fintech ETFs is diversification. Investing in a single fintech ETF exposes you to a broad spectrum of fintech companies across various subsectors. This diversification helps to spread risk, reducing the impact of individual company performance on the overall investment. Fintech ETFs offer a more balanced and controlled approach than investing in individual fintech stocks, which can be more volatile and carry higher risk.

Liquidity is a crucial benefit of investing in fintech ETFs. Being traded on major exchanges, these ETFs can be easily bought or sold, allowing investors to access their investments quickly when needed. This liquidity provides flexibility and convenience, particularly during market volatility or when capital requirements change. Fintech ETFs are also known for their cost-effectiveness. With low expense ratios compared to actively managed funds, these ETFs can help you keep more investment returns. The cost-saving feature makes fintech ETFs an attractive option for long-term investors looking to capitalize on the potential growth of the fintech industry.

Despite the promising prospects, it is essential to recognize the associated risks of investing in fintech ETFs. The fintech industry is relatively young and evolving rapidly, introducing uncertainty regarding future developments. Additionally, fintech companies are subject to regulatory risk as governments worldwide increasingly implement regulations to address fintech's impact on financial services. Moreover, fintech ETFs can be subject to price volatility, exposing investors to potential losses. As with any investment, carefully consider individual risk tolerance and conduct thorough research before making decisions.

Investing in fintech ETFs presents an opportunity to participate in the ongoing transformation of the financial services industry. These ETFs offer diversification, liquidity and cost-effectiveness, making them attractive for investors seeking exposure to the booming fintech sector. However, remain aware of the inherent risks and perform due diligence to align your investment strategy with your financial goals and risk appetite.

Seven Best Fintech ETFs to Buy Now

Now that we have reviewed the reasons for investing in fintech ETFs, let's look closely at some of the top players in this exciting space. Each ETF has its unique approach, investment strategy and a diverse portfolio of fintech companies driving innovation in the financial technology sector. These ETFs offer you a convenient and well-managed pathway to gain exposure to the flourishing world of fintech.

|

Name |

Ticker |

Assets under management (AUM) |

Holdings |

|

ARK Fintech Innovation |

NYSEARCA: ARKF |

$996 million |

37 |

|

iShares Exponential Technologies |

NASDAQ: XT |

$3.3 billion |

223 |

|

Global X FinTech Thematic |

NASDAQ: FINX |

$411 million |

67 |

|

Amplify Transformational Data Sharing |

NYSEARCA: BLOK |

$563 million |

51 |

|

Capital Link Global Fintech Leaders |

NYSEARCA: KOIN |

$14.3 million |

50 |

|

BlackRock Future Financial and Technology |

NYSEARCA: BPAY |

$4.3 million |

40 |

|

ETFMG Prime Mobile Payments |

NYSEARCA: IPAY |

$422 million |

57 |

ARK Fintech Innovation ETF

ARK Fintech Innovation ETF (NYSEARCA: ARKF) is a dynamic and actively managed exchange-traded fund focusing on companies leading the financial technology industry. With a strong track record of growth, ARK Fintech Innovation ETF has garnered attention as a popular choice among investors seeking exposure to the burgeoning fintech sector.

ARK Fintech Innovation ETF's investment strategy revolves around selecting companies at the forefront of innovation in the fintech space. By targeting firms that offer transformative technologies and solutions, such as Square, PayPal and Upstart, the fund aims to capitalize on the rapid evolution of financial services.

Managed by the renowned investment manager Cathie Wood, ARK Fintech Innovation ETF benefits from Wood's expertise and forward-looking approach to disruptive innovation. Wood's focus on identifying potential game-changers and her successful stock-picking track record have contributed to ARK Fintech Innovation ETF's appeal among investors. One of the key attractions of ARK Fintech Innovation ETF lies in its low expense ratio, which enables investors to retain a larger share of their investment earnings. This cost-efficient structure aligns with the fund's mission of providing access to promising fintech opportunities while optimizing returns.

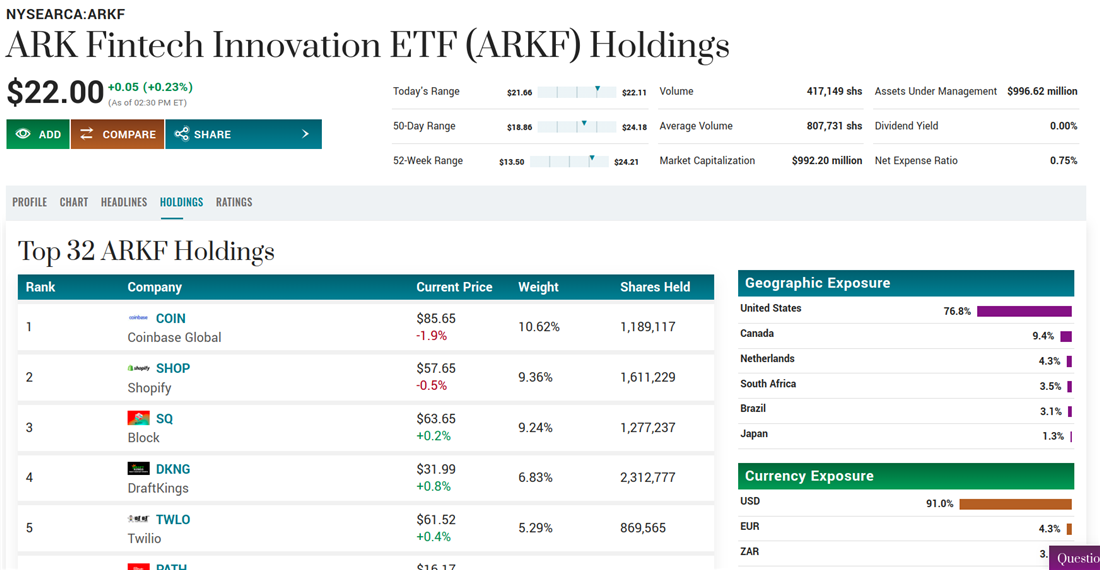

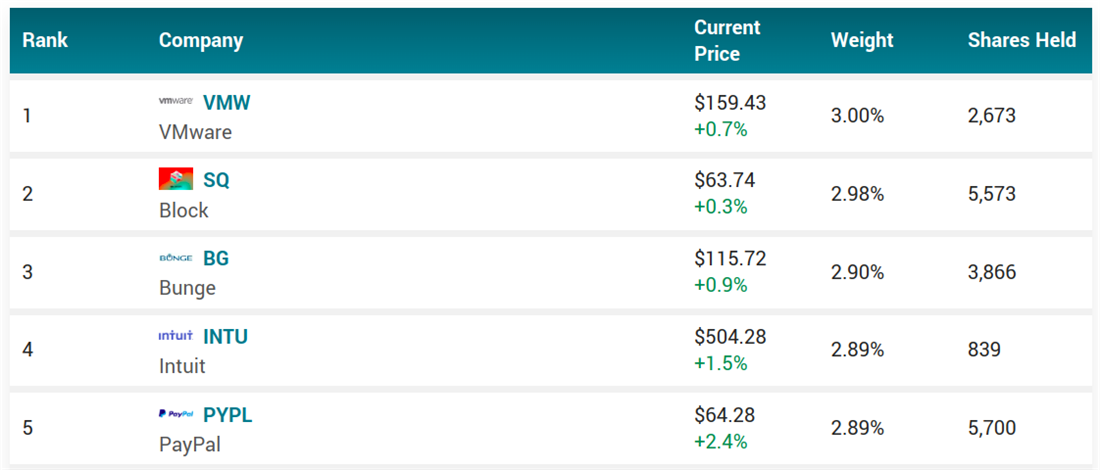

The ARK Fintech Innovation ETF's holdings portfolio consists of 30 companies, with a significant weight in leading companies like Coinbase Global (NASDAQ: COIN), Shopify (NYSE: SHOP), Block (NYSE: SQ) and DraftKings (NASDAQ: DKNG). The fund's holdings reflect a diverse mix of fintech subsectors, offering comprehensive exposure to the fintech landscape.

The ARK Fintech Innovation ETF allows investors to participate in growth and innovation within the fintech industry. While the sector may face challenges, ARK Fintech Innovation ETF's emphasis on transformative technologies and its active management approach may continue to position it as a compelling choice for those looking to capitalize on the fintech industry's disruptive potential.

iShares Exponential Technologies ETF

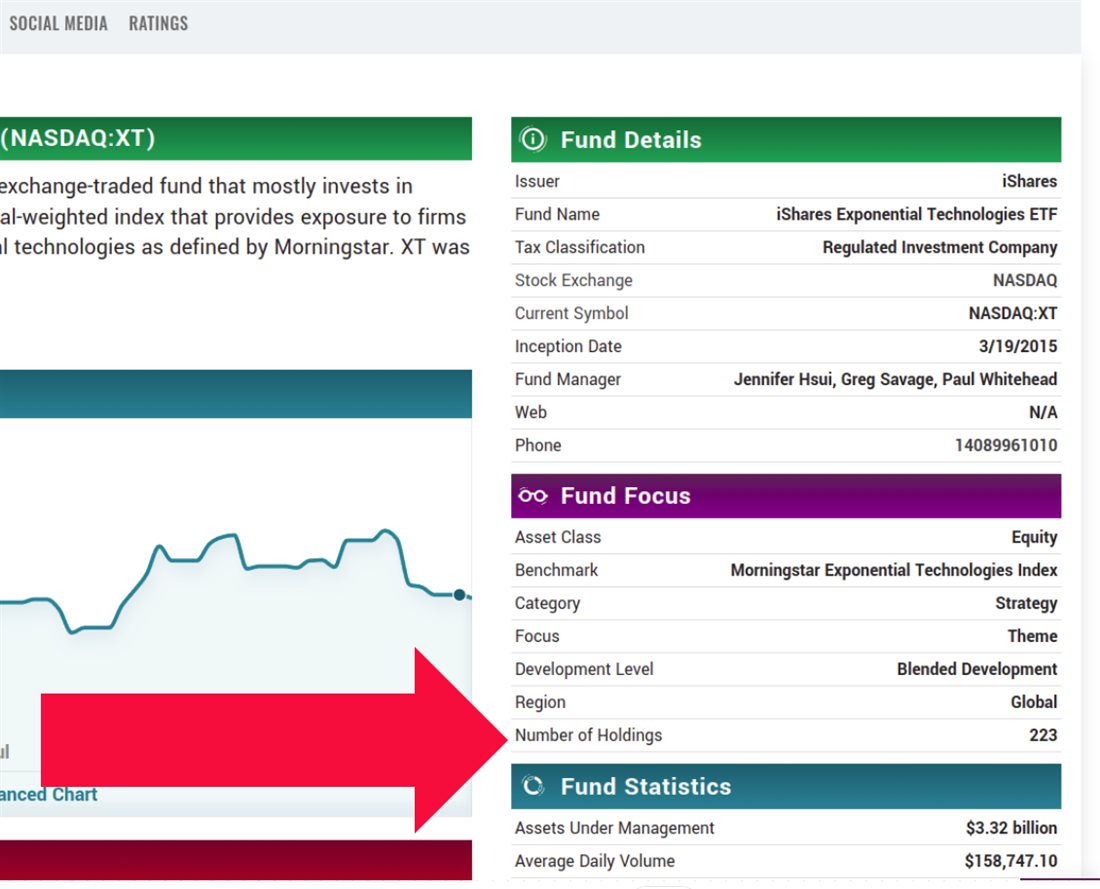

The iShares Exponential Technologies ETF (NASDAQ: XT) presents an enticing opportunity for investors seeking to ride the wave of exponential technologies. This broad-based exchange-traded fund targets companies driving innovation across various transformative sectors. From artificial intelligence to blockchain, gene editing and robotics, iShares Exponential Technologies ETF offers exposure to technologies with the potential to reshape industries and create new markets. What makes iShares Exponential Technologies ETF (NASDAQ: XT) stand out is its comprehensive exposure to multiple exponential technologies. iShares Exponential Technologies ETF holdings contain over 223 assets.

The fund offers broad-based exposure, strategically selecting companies developing and implementing exponential technologies. Exponential technologies improve and evolve rapidly, often accelerating and leading to transformative changes in various sectors. This comprehensive approach allows investors to tap into various potential growth opportunities.

iShares Exponential Technologies ETF boasts a low expense ratio, allowing investors to retain a significant portion of their investment returns. The fund is liquid, ensuring easy trading and accessibility.

Despite its appeal, investing in the technology sector carries inherent risks. The technology sector is known for its volatility, with prices subject to sharp fluctuations in the short term. The future of exponential technologies remains to be determined, making long-term performance predictions challenging. While iShares Exponential Technologies ETF has shown impressive returns, carefully consider these risks and conduct thorough research before making investment decisions.

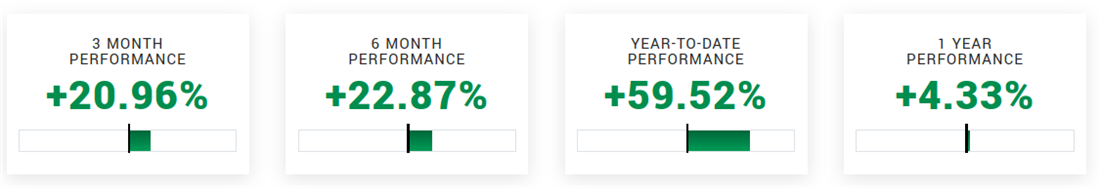

Global X FinTech Thematic ETF

The Global X FinTech Thematic ETF (NASDAQ: FINX) is an exchange-traded fund focusing on investing in companies at the forefront of the emerging financial technology sector. This sector encompasses a range of innovations, transforming established industries like insurance, investing, fundraising and third-party lending through mobile and digital solutions.

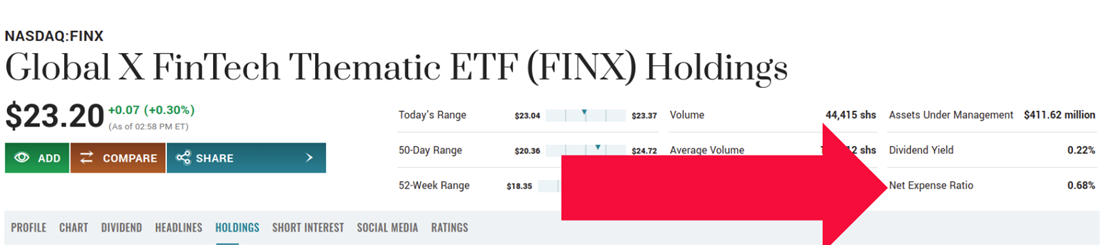

The Global X Fintech ETF seeks to provide investment results that correspond to the price and yield performance of the Indxx Global FinTech Thematic Index. One of the key reasons we chose the Global X FinTech Thematic ETF for our list includes its broad-based exposure to the fintech industry. FINX holdings include various companies engaged in fintech, including payment processors, lending platforms and cryptocurrency exchanges, offering investors access to diverse potential growth opportunities, broad-based exposure, a low expense ratio and funds liquidity.

Amplify Transformational Data Sharing ETF

The Amplify Transformational Data Sharing ETF (NYSEARCA: BLOK) is a distinctive exchange-traded fund (ETF) focusing on companies involved in blockchain technology. Launched in 2018, Amplify Transformational Data Sharing ETF is an actively managed portfolio of global equities centered around blockchain development. Managed by Amplify, this ETF offers investors exposure to various blockchain companies, including cryptocurrency exchanges, infrastructure providers and software developers. Checking Amplify Transformational Data Sharing ETF chart provides insight into whether the active management approach has been paying off.

Blockchain can revolutionize industries like finance, healthcare and supply chain management. Amplify Transformational Data Sharing ETF was chosen for its unique investment approach in this transformative technology. Investing in Amplify Transformational Data Sharing ETF comes with notable advantages. It provides broad exposure to blockchain technology, offering the potential for growth and innovation. With a low expense ratio, investors can maximize their returns. Moreover, Amplify Transformational Data Sharing ETF is a liquid ETF, allowing easy access to funds.

Capital Link Global Fintech Leaders ETF

The Capital Link Global Fintech Leaders ETF (NYSEARCA: KOIN) is an exchange-traded fund focusing on companies leading innovation in the financial technology industry. It is based on the ATFI Global Fintech Leaders index, which tracks an equal-weighted selection of stocks globally as fintech leaders. Managed by Capital Link, the ETF launched in 2018.

Capital Link Global Fintech Leaders ETF offers exposure to a basket of global fintech leaders, making it a strategic choice for those interested in the future of the fintech industry. With a low expense ratio, investors can retain more of their earnings, and its liquidity allows for easy buying and selling.

Capital Link Global Fintech Leaders ETF has distinct advantages that make it a compelling choice. Capital Link Global Fintech Leaders ETF holdings focus on global fintech leaders, providing potential growth and innovation opportunities.

Its equal-weighted index and focus on global leaders offer a unique perspective on fintech growth. While considering the risks associated with the industry, you may find Capital Link Global Fintech Leaders ETF a promising addition to your portfolio.

BlackRock Future Financial and Technology ETF (NYSEARCA: BPAY)

The BlackRock Future Financial and Technology ETF (NYSEARCA: BPAY) is an exchange-traded fund with a specific focus. The BlackRock Future Financial and Technology ETF, launched in 2022, is actively managed and primarily invests in stocks of global companies involved in innovative technologies used and applied in financial services.

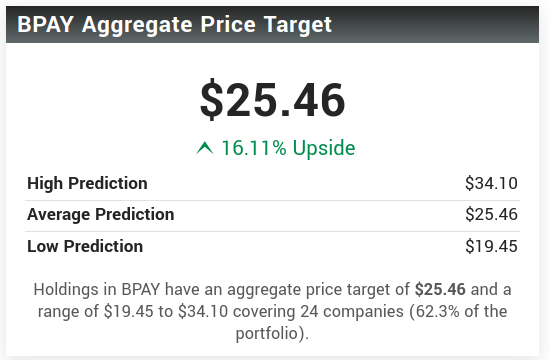

The BlackRock Future Financial and Technology ETF invests in companies at the forefront of innovation in the financial technology and payments industries. As the fintech industry grows rapidly, BlackRock Future Financial and Technology ETF offers investors exposure to this promising growth. The BlackRock Future Financial and Technology ETF's ratings will show a fair amount of upside in the stock, signifying its potential for growth and positive performance in the future. BlackRock Future Financial and Technology ETF provides exposure to the future of finance by investing in companies developing new technologies and services, transforming how we bank, invest and pay for goods and services. The BlackRock Future Financial and Technology ETF boasts a low expense ratio, allowing investors to retain more investment earnings.

ETFMG Prime Mobile Payments ETF

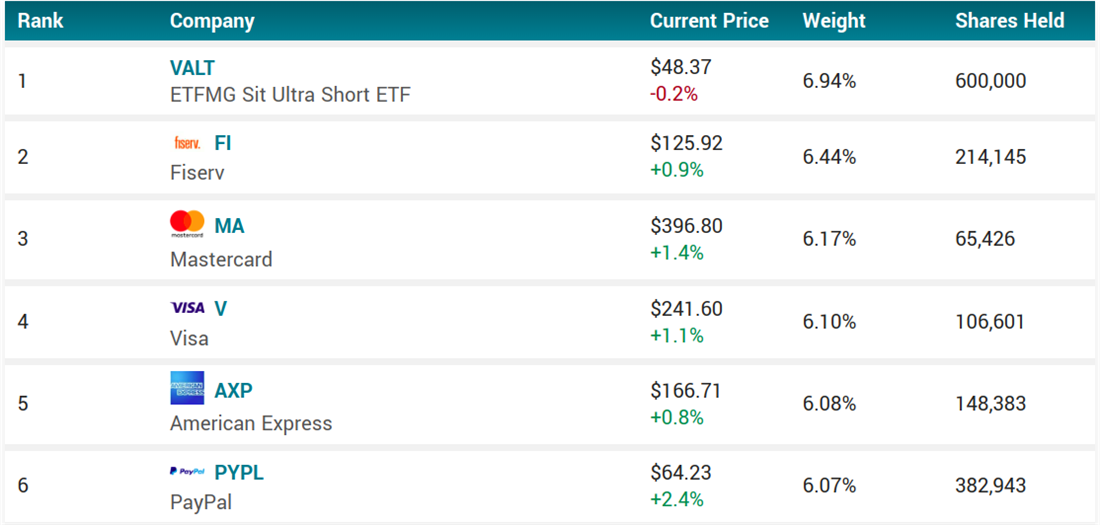

The ETFMG Prime Mobile Payments ETF (NYSEARCA: IPAY) is an ETF that offers exposure to the Prime Mobile Payments Index. Launched in 2015, the ETFMG Prime Mobile Payments ETF tracks an index of global equity in credit card firms and companies providing payment infrastructure, payment services, payment processing and payment solutions. ETF Managers Group manages the ETF.

ETFMG Prime Mobile Payments ETF allows investors to invest in a diverse portfolio of mobile payment companies. It aims to capitalize on the growing trend of mobile payment solutions and the increasing adoption of digital payment methods globally. Mobile payments have become integral to modern financial transactions with the rise of smartphones and digital wallets.

The ETF focuses on equity asset class and is categorized under the theme of mobile payments. ETFMG Prime Mobile Payments ETF holdings are 57 different companies, providing investors broad exposure to the mobile payments industry.

Paving the Way to Financial Innovation

The world of ETFs offers a dynamic gateway to financial innovation. By tapping into themes like blockchain, artificial intelligence, mobile payments and digital finance, these ETFs present unique opportunities to be part of a transformative journey.

These ETFs offer a powerful means of participating in technological advancements. Keeping expense ratios low and liquidity high ensures accessibility and flexibility to capitalize on financial innovation.

FAQs

Let's address some of the most common questions investors often have about ETFs and their relevance to the fast-evolving world of financial innovation. Let's explore the following answers to gain valuable insights into these frequently asked questions and make informed decisions about your investment journey.

Is there a fintech index fund?

Is there a fintech ETF or index fund? Yes, there are several fintech index funds available in the market. Fintech index funds are exchange-traded funds (ETFs) that track the performance of a specific fintech-related index. These funds typically invest in companies involved in innovative technologies and services within the financial sector, such as mobile payments, blockchain, artificial intelligence and digital finance.

Is fintech a good long-term investment?

As with any investment, the performance of fintech stocks and funds can vary, and past performance does not indicate future results. However, many experts consider fintech a promising sector for long-term investment. The rapid advancements in financial technology and the increasing adoption of digital solutions across various financial services have led to significant growth opportunities. Carefully assess your risk tolerance and conduct thorough research before considering fintech as part of your long-term investment strategy.

Are financial ETFs good?

Financial ETFs can be a suitable investment option if you're seeking exposure to the financial sector. These ETFs typically invest in a diversified basket of financial companies, including high-performing bank stocks, finance and insurance sector-based companies, asset management firms and other financial institutions. The performance of financial ETFs influences factors such as interest rates, economic conditions and regulatory changes. Financial ETFs carry risks, so assess your investment goals and risk tolerance before making investment decisions. If investing in a Vanguard fintech ETF fits your portfolio, start with our list of financial ETFs.