UniFirst (NYSE: UNF) had a decent first quarter but provided weak guidance, sending shares down nearly 10%. As bad as the move sounds, it’s a knee-jerk reaction in a stock whose future is bright. While guidance was weak, the company continues to expect growth and margin improvement driven by organic gains, penetration and recent acquisitions, all of which will aid cash flow, profits and capital returns. Regarding capital returns, this stock is reminiscent of another high-quality growth stock that happens to be in the same industry: Cintas (NASDAQ: CTAS).

Cintas leveraged its fortress balance sheet to produce triple-digit revenue growth over the last ten years while paying dividends and buying back shares, so this is no idle comparison. In that time, Cintas' share price increased more than 500%, not counting the dividend.

Cintas's dividend isn’t a high-yield but is among the most reliable on Wall Street. The payout is worth about 1% at face value but has grown 460% since 2015 and is on track to grow robustly. Cintas pays only 36% of its earnings as dividends and has ample coverage to continue annual increases without earnings growth, and growth is in the forecast. Analysts expect Cintas to grow its earnings by double-digits this year and next.

UniFirst falls on weak outlook; company continues to grow

UniFirst had a solid quarter in Q1 2024, producing $593.5 million in net revenue for a gain of 9.5% compared to last year. The top-line results outpaced the Marketbeat.com consensus by 100 basis points and are compounded by a widening margin. Strength was seen in both segments, with core operations growing by 9.8%, including acquisitions and 5.2% organically. Specialty Garments, a small portion of revenue, grew by 1.3% but posted the largest improvement in margin.

Margin improvement is significant, with CRM, ERP and branding initiatives aiding growth and leverage. The company reported a 22.% improvement in operating income, a 24.6% increase in net income and a 25% increase in diluted earnings to beat consensus by a nickel.

The bad news is that quarter-ending trends in the core business led management to dampen the outlook for the year. Management reiterated its previous guidance, which is shy of the consensus estimate, and cautioned that results would likely fall in the lower half of the range. Even so, management expects 8% growth this year at the range's low end, and growth will likely persist in F2025.

Labor markets remain resilient despite an expectation for slowing. The takeaway from the labor data is that labor markets are still in excellent health relative to the pre-pandemic period. Because the Fed has signaled a peak to interest rates and expects rate cuts to begin this year, investors may also expect to see business investment and hiring pick up in response. Hiring is good news for UniFirst and Cintas. The caveat to that outlook is that the first interest rate cuts are not seriously expected until mid-year.

UniFirst cheap compared to Cintas, on track for dividend growth

UniFirst is in a different position than Cintas but is on track to follow in its footsteps, which is true for the dividend. The company pays a low 17% of its earnings with earnings growth in the forecast and a fortress balance sheet to back it up, so it can sustain increases similarly.

As it is, UniFirst has only ever increased its payment and has made consecutive annual increases for three years. Assuming that UNF continues to increase at the current pace, near 30%, it should have no trouble getting the yield up to match Cintas and may even spark a price-multiple expansion within the next year or two.

UniFirst is cheap, trading at 24X earnings compared to Cintas 45X, but there are history, size and dividend payments in the balance. Cintas is larger, has a longer history of dividend payments and increases, and pays a larger portion of earnings, so it should command a higher value.

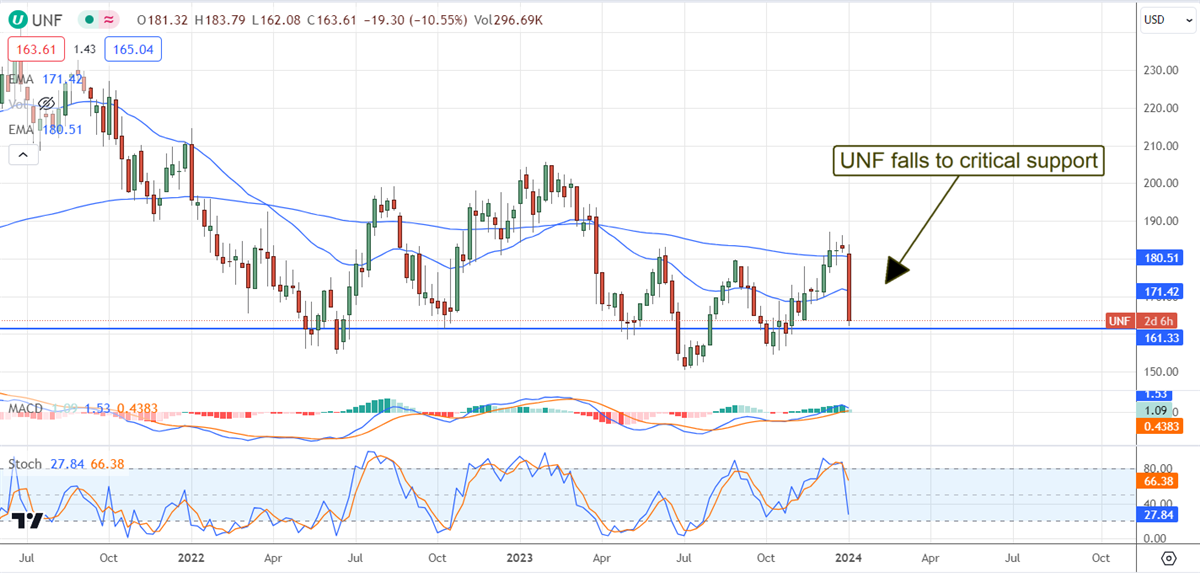

The technical outlook: UniFirst falls to support, buying the dip

The price action in UniFirst fell nearly 10% after the opening and may remain under pressure for the next few months or quarters, but support is evident. Buyers are holding prices above critical support near $161, which has been the floor for the last two years. Assuming the market can hold at this level, shares of UNF should move sideways within their range until later in the year, when economic activity is expected to improve.