Voyager Therapeutics Inc. (NASDAQ: VYGR) is a biotech in the medical sector that specializes in gene therapy for neurological diseases. Its shares took a 30% spike on news of its partnership with Novartis AG (NYSE: NVS). The deal is a collaboration and capsid licensing agreement worth up to $1.3 billion. It also validates Voyagers TRACER capsid discovery platform.

While shares spiked to a high of $11.72 on Jan. 5, 2024, they quickly fell on Jan. 5, 2024, with the announcement of a secondary offering of common stock prices at $9.00 per share. The train has returned to the station for investors looking to board.

Voyager Therapeutics

While not a widely known biotech, Voyager focuses on gene therapy development, which seeks to replace or fix faulty genes in neurological disease patients. Its pipeline includes programs for amyotrophic lateral sclerosis (ALS), Parkinson's disease, Alzheimer's disease, and Huntington's disease. Their lead candidate is VY-TAU01, an anti-tau antibody program for Alzheimer’s disease.

TRACER capsid discovery platform

Voyager developed its proprietary tropism redirection of AAV cell-type-specific expression RNA) TRACER capsid discovery platform. It’s an RNA-based screening platform that can quickly locate adeno-associated-virus (AAV) capsids in the brain. TRACER focuses on improving the delivery of genetic material to specific locations.

TRACER-generated AAV capsids are like tiny delivery trucks that can carry genetic material into the brain and central nervous system (CNS) to reach incredibly difficult areas. These deliveries are very targeted and accurate, so they don't end up in places like the liver or dorsal root ganglia. Voyager has licensed its next-generation TRACER capsids to aid its collaboration partners' gene therapy programs to treat a number of diseases.

Novartis is not just GLP-1 drugs.

Novartis has been making headlines for its blockbuster GLP-1 weight-loss drugs Ozempic and Wegovy, which are taking the world by storm. However, Novartis is active in the gene therapy segment and also collaborates with Intellia Therapeutics Inc. (NASDAQ: NTLA) to develop advanced CRISPR/Cas 9 gene-editing therapies utilizing CAR-T cells. Check out the sector heatmap on MarketBeat.

Novartis $1.3 billion collaboration deal

The partnership with Novartis and Voyager involves developing gene therapies for Huntington's disease (HD), a hereditary condition where nerve cells break down over time, and spinal muscular atrophy (SMA), a genetic condition for nerve cells in the spinal cord that controls voluntary muscle movements affecting a child's ability to walk, crawl and control head movements. Novartis gains access to Voyager's TRACER capsids to develop gene therapies.

Voyager will lead preclinical development for HD, and Novartis will handle clinical development and commercialization and secure global rights to Voyager's AAV gene therapy for HD.

Financial details of the Novartis partnership

Novartis will pay Voyager $100 million upfront, which includes a $20 million purchase of newly issued Voyager stock and up to $1.2 billion in payments for achieving preclinical, development, regulatory, and sales milestones. On Jan. 5, 2023, Voyager priced a $100 million offering of common stock, which included 7.779 million shares priced at $9.00 per share and 3.33 million warrants. Get AI-powered insights on MarketBeat.

CEO comments

Voyager Therapeutics CEO Dr. Alfred Sandrock Jr. commented, “Combining the proven capabilities of Novartis in gene therapy development and commercialization with Voyager’s next-generation TRACER capsids and payloads could enable the advancement of important new therapies for patients. In addition, the consideration Voyager will receive from this collaboration will strengthen our balance sheet and extend our runway into mid-2026.”

Novartis, President of Biomedical Research, commented, “We believe Voyager’s TRACER capsids hold promise for enabling next-generation gene therapies for diseases of the central nervous system, aligning well with our deep neuroscience expertise and gene therapy leadership at Novartis.”

Opera analyst ratings and price targets are at MarketBeat. Opera peers and competitor stocks can be found with the MarketBeat stock screener.

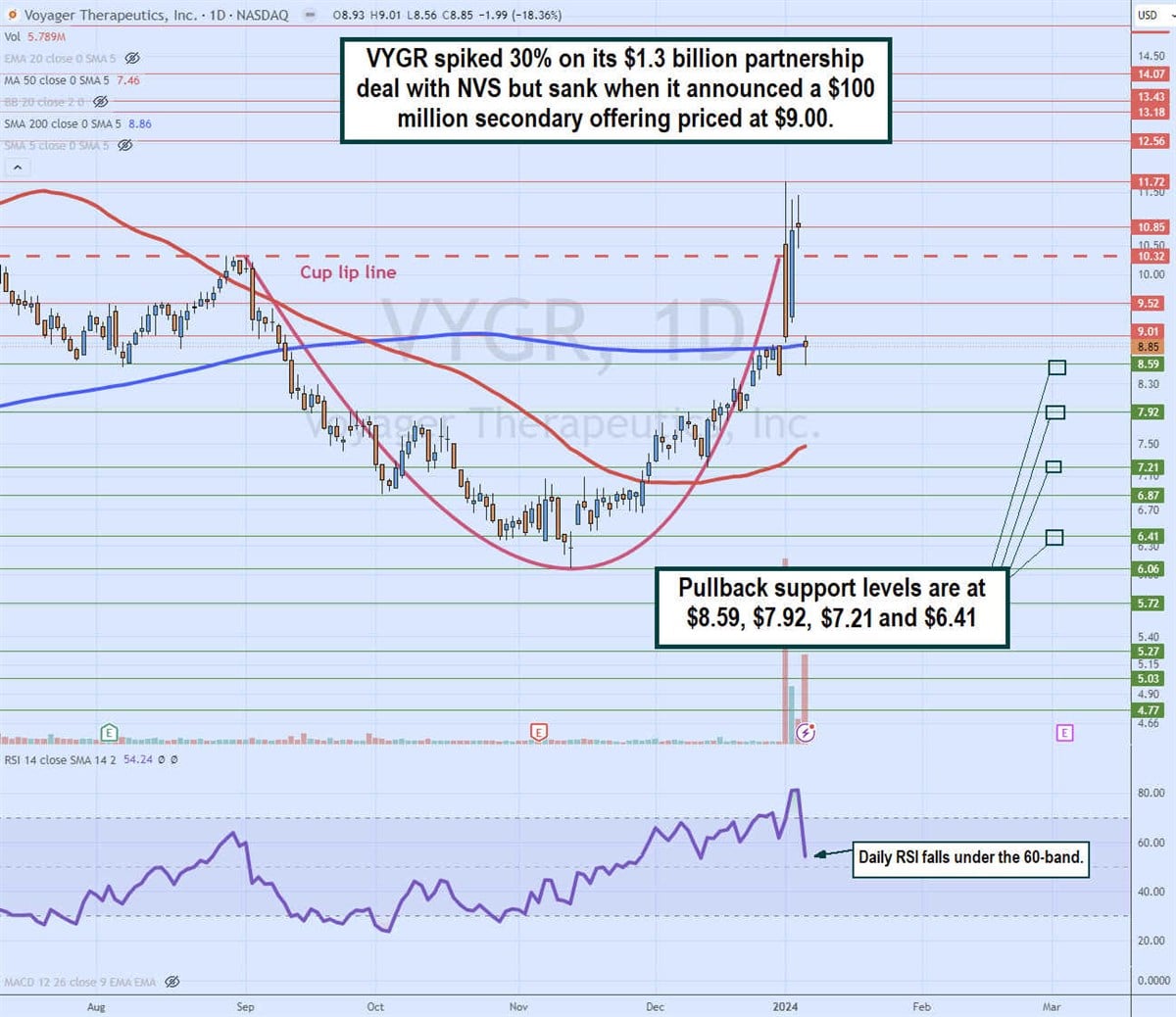

Daily cup pattern

The daily candlestick chart for VYGR illustrates a cup pattern. The cup lip line formed at $10.32 on Sept.1, 2023. Shares sold off to a low of $6.06 on Nov. 13, 2023. VYGR staged a rally back up through its 50-period moving average, stalling at its daily 200-period moving average (MA) until the release of the Novartis deal.

Shares spiked to $11.72 before collapsing back down towards the $9.00 price level, which was the $100 million secondary offering's price level. The daily relative strength index (RSI) fell sharply from the 80-band through the 60-base towards the 70-band. Pullback support levels are at $8.59, $7.92, $7.21 and $6.41.