Britain recently announced it is building its first lithium refinery in an effort to strengthen the UK’s supply chain for electric vehicles. In Teesport, the fifth-largest port in the UK, Green Lithium, a company funded by commodities trading behemoth Trafigura, will construct a £600 million refinery for the battery material.

The project’s supporters want to generate 1,000 jobs during construction and enough lithium hydroxide annually for 1 million electric vehicles once the plant is up and running. In order to prepare for the 2030 ban on the sale of new gasoline and diesel vehicles, the government wants to improve the electric vehicle supply chain.

The move comes as confidence in plans to develop the north-east of England into a powerhouse for green jobs and the electric vehicle industry has been rocked by the issues of Britishvolt.

The battery company, which planned to build a £3.8bn “gigafactory,” received five weeks of emergency cash from Glencore last week after planning to hire administrators.

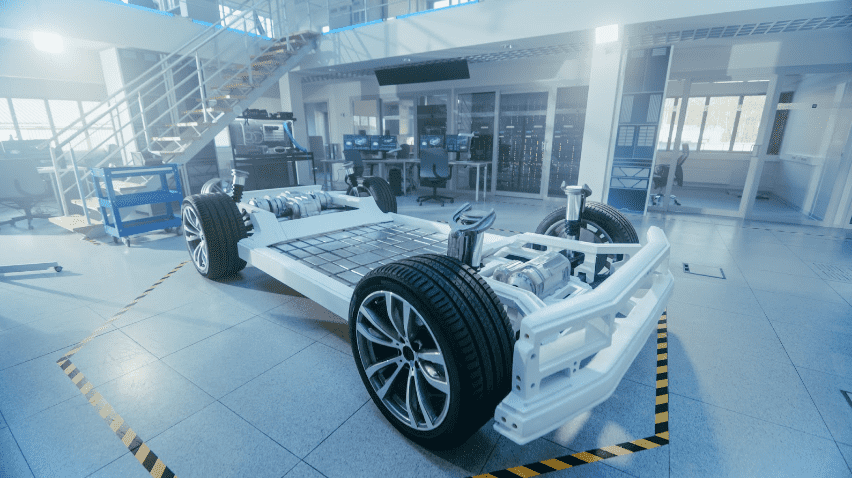

The government intends to strengthen the supply chain for electric vehicles before banning new gasoline and diesel cars in 2030.

Lithium is an essential component for batteries and a “critical mineral” used in technologies ranging from mobile phones to wind turbines.

Ministers are concerned about the fragility of supply chains for important minerals, especially those from China, because of deteriorating relations between China and the US and UK.

In an effort to bridge the supply gap, nations across the globe are scrambling to find new sources of lithium in places like Australia, South America, and even Africa. However, according to Canaccord, Canada is positioned to become a key lithium player in the medium-term thanks to an increasing number of active development and exploration projects.

E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) has an impressive land position in business-friendly Alberta, Canada, but also the proprietary technology to become a dominant lithium producer for the next +20 years.

E3 Lithium (TSXV:ETL) (OTXQC:EEMMF) Announces Sample Results From First Well

On November 10, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) announced the sample results from the first well in the Clearwater Project Area within the Bashaw District. Based on brine samples from five zones, the P50 lithium concentration from at the company’s first well is 76.5 mg/L.

E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) well is the first of three designed to understand the aquifer’s production properties and lithium concentrations in an area not previously tested. This well was completed near the centre of the Clearwater Project Area and is a candidate location for E3’s first commercial operation. E3 retrieved samples of brine from five separate intervals to provide a vertical perspective of lithium concentrations across the 200 metres of producible aquifer in this area.

“This historic well, which was the first of its kind in Alberta drilled for the purposes of evaluating lithium, proves consistent lithium concentrations continue into this part of the aquifer,” said Chris Doornbos, President and CEO of E3 Lithium. “This data validates our model, supports our resource upgrade from Inferred to Measured and Indicated, and increases our confidence in the global significance of the Bashaw District as an emerging lithium jurisdiction in western Canada.”

The brine samples were analyzed by a third-party certified laboratory, following independently verified sample acquisition procedures that maintained a strict chain of custody, in accordance with The Canadian Institute of Mining, Metallurgy and Petroleum (CIM) guidelines.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) is currently analyzing samples from its second well and will report results once complete.

The results come just two weeks after the company completed the production test on the first well. The test was designed to confirm the viability of the lithium-rich brine from E3 Lithium‘s resource in the Leduc Reservoir. The five-day production test provided the company with critical data to support the commercial viability of producing lithium from the Leduc Reservoir.

The test also included reinjecting brine back into the reservoir to confirm injectivity capacity, which is an important component of E3 Lithium‘s environmentally sustainable process. The test included re-injecting the produced brine at a rate of 1,200m3/d in less than two days.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) acquired the Clearwater Project Gross Overriding Royalty that was negotiated back in 2016 during the original amalgamation of the company’s permits in the Clearwater Project Area. As part of the original agreement, the company had the option to buy the royalty by September 30. The royalty would have provided 2.25% of gross revenue from any metallic and industrial mineral production to the original owner.

Based on E3 Lithium’s Preliminary Economic Assessment (PEA) released in 2020, the value of the royalty would have been roughly C$8.5 million per year. Using recent lithium prices, the royalty would be significantly higher, outlining the clear economics behind the decision to acquire it for C$800,000.

For more information about E3 Lithium Ltd (TSXV:ETL) (OTCQX:EEMMF), please visit this link or their website at e3lithium.ca.

SOURCE E3 Lithium Ltd. (TSXV:ETL)(OTCQX:EEMMF).

Featured Image DepositPhotos

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube