Water analytics and treatment company Veralto (NYSE:VLTO) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 4.5% year on year to $1.31 billion. Its GAAP profit of $0.88 per share was 6.9% above analysts’ consensus estimates.

Is now the time to buy Veralto? Find out by accessing our full research report, it’s free.

Veralto (VLTO) Q3 CY2024 Highlights:

- Revenue: $1.31 billion vs analyst estimates of $1.31 billion (in line)

- EPS: $0.88 vs analyst estimates of $0.82 (6.9% beat)

- Gross Margin (GAAP): 59.6%, up from 57.7% in the same quarter last year

- Operating Margin: 23.4%, up from 22.2% in the same quarter last year

- Free Cash Flow Margin: 16.4%, down from 18.5% in the same quarter last year

- Market Capitalization: $27.62 billion

Company Overview

Spun off from Danaher in 2023, Veralto (NYSE:VLTO) provides water analytics and treatment solutions.

Air and Water Services

Many air and water services are statutorily mandated or non-discretionary. This means recurring revenues are often earned through contracts, making for more predictable top-line trends. Additionally, there has been an increasing focus on emissions and water conservation over the last decade, driving innovation in the sector and demand for new services. On the other hand, air and water services companies are at the whim of economic cycles. Interest rates, for example, can greatly impact manufacturing or industrial processes that drive incremental demand for these companies’ offerings.

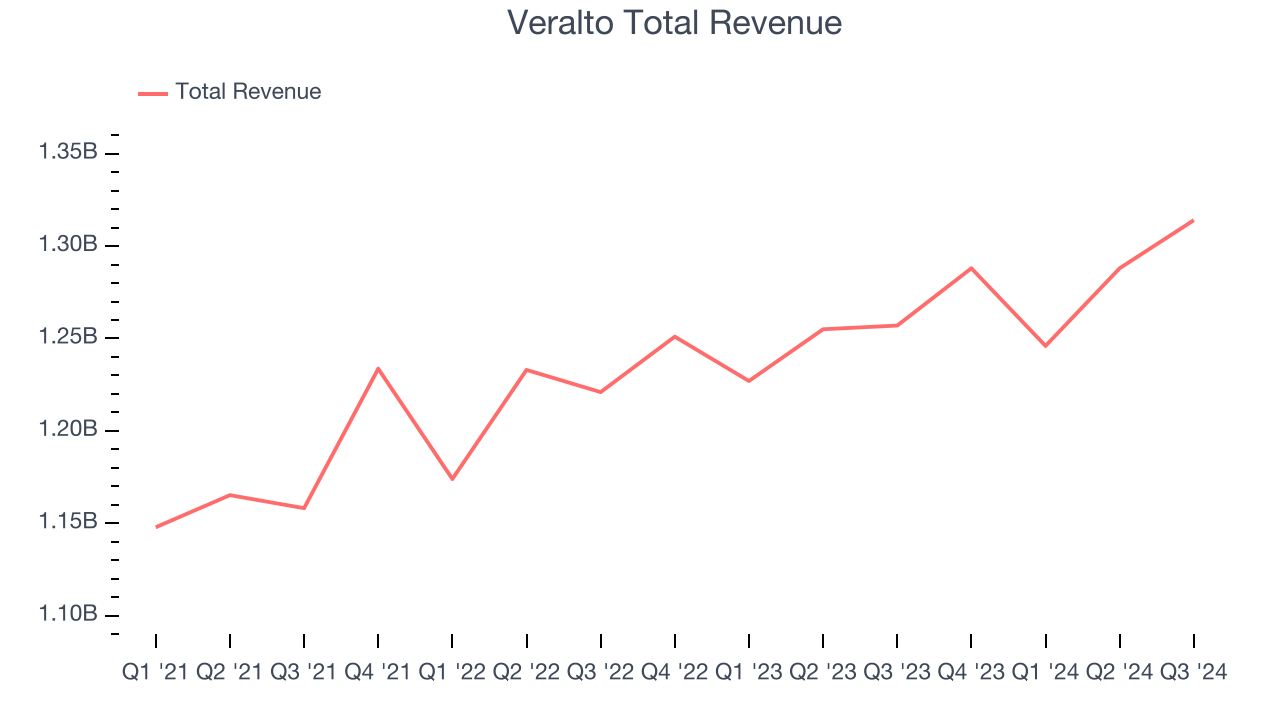

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Unfortunately, Veralto’s 3.5% annualized revenue growth over the last three years was sluggish. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Veralto’s annualized revenue growth of 2.8% over the last two years aligns with its three-year trend, suggesting its demand was consistently weak.

This quarter, Veralto grew its revenue by 4.5% year on year, and its $1.31 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months, an acceleration versus the last two years. While this projection illustrates the market thinks its newer products and services will spur better performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

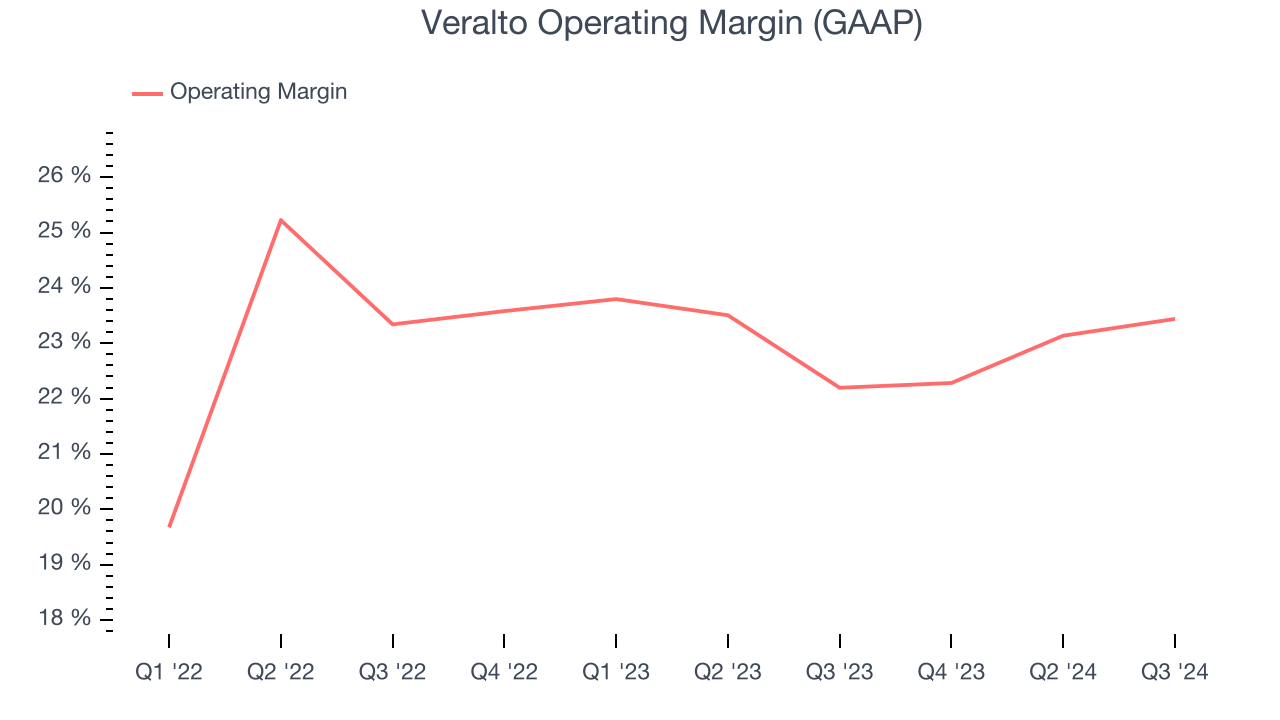

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

In Q3, Veralto generated an operating profit margin of 23.4%, up 1.2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Cash Is King

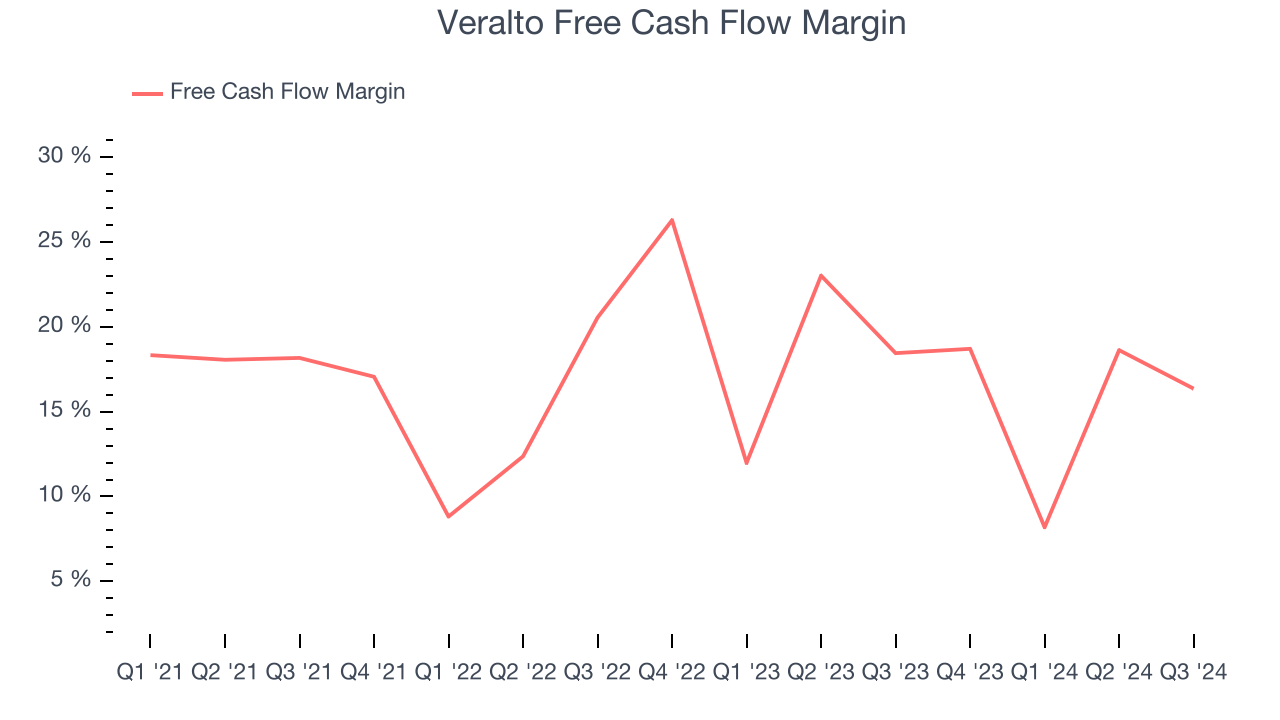

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Veralto has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 17% over the last four years.

Taking a step back, we can see that Veralto’s margin dropped by 3.7 percentage points during that time. Veralto’s four-year free cash flow profile was compelling, but shareholders are surely hoping for its trend to reverse.

Veralto’s free cash flow clocked in at $215 million in Q3, equivalent to a 16.4% margin. The company’s cash profitability regressed as it was 2.1 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from Veralto’s Q3 Results

It was good to see Veralto beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The areas below expectations seem to be driving the stock move, and shares traded down 1% to $109.81 immediately after reporting.

So should you invest in Veralto right now?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.