Online used car dealer Carvana (NYSE: CVNA) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 31.8% year on year to $3.66 billion.

Is now the time to buy Carvana? Find out by accessing our full research report, it’s free.

Carvana (CVNA) Q3 CY2024 Highlights:

- Revenue: $3.66 billion vs analyst estimates of $3.47 billion (5.3% beat)

- EBITDA: $429 million vs analyst estimates of $330.7 million (29.7% beat)

- Operating Margin: 9.2%, up from 1.8% in the same quarter last year

- EBITDA Margin: 11.7%, up from 5.3% in the same quarter last year

- Market Capitalization: $25.85 billion

Company Overview

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

Sales Growth

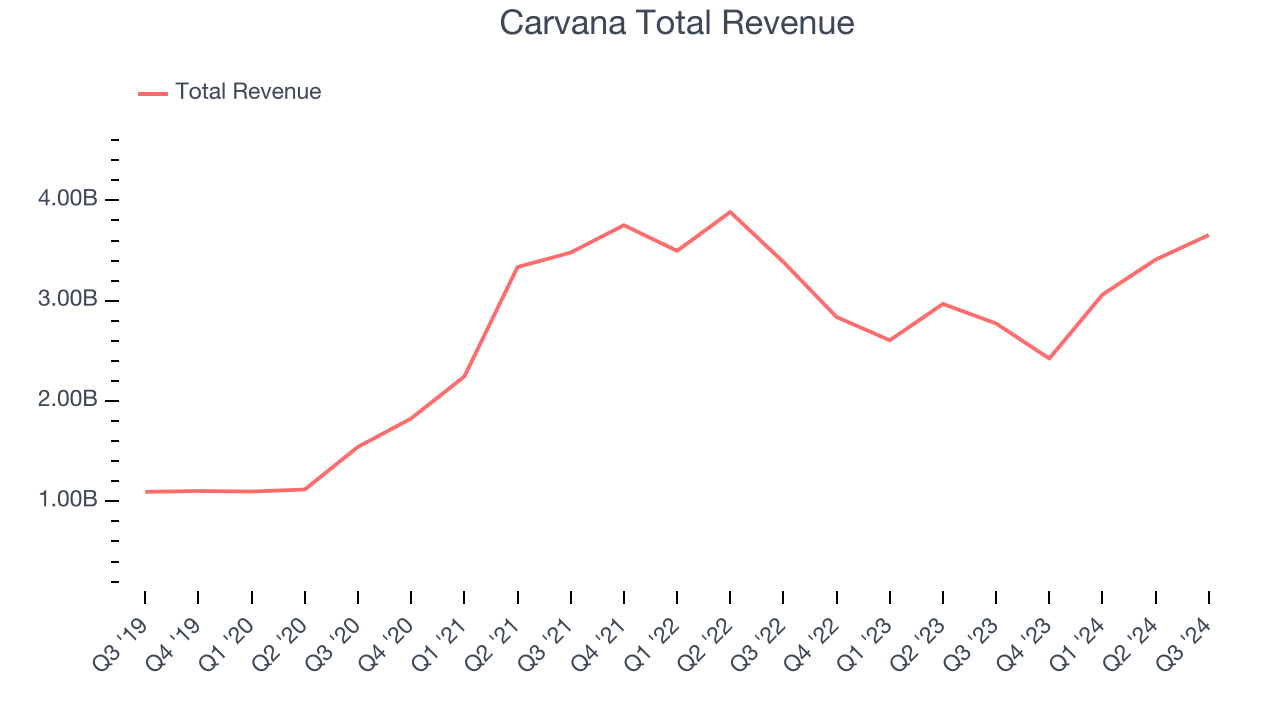

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Regrettably, Carvana’s sales grew at a sluggish 4.9% compounded annual growth rate over the last three years. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Carvana reported wonderful year-on-year revenue growth of 31.8%, and its $3.66 billion of revenue exceeded Wall Street’s estimates by 5.3%.

Looking ahead, sell-side analysts expect revenue to grow 16.5% over the next 12 months, an acceleration versus the last three years. This projection is noteworthy and illustrates the market thinks its newer products and services will spur faster growth.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

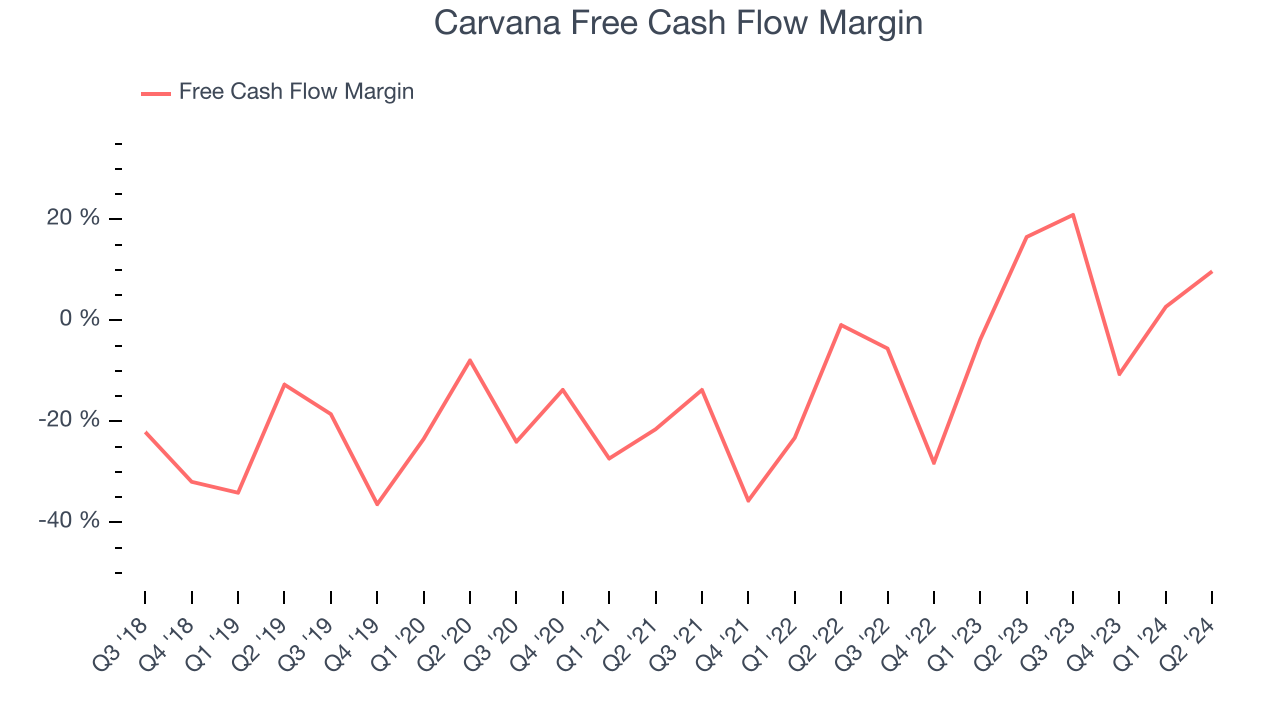

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Carvana has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.6%, subpar for a consumer internet business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Carvana to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Taking a step back, an encouraging sign is that Carvana’s margin expanded by 23.2 percentage points over the last three years. The company’s improvement shows it’s heading in the right direction, and because its free cash flow profitability rose more than its operating profitability, continued increases could signal it’s becoming a less capital-intensive business.

Key Takeaways from Carvana’s Q3 Results

We were impressed by how significantly Carvana blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a very good quarter. The stock traded up 19.9% to $248.70 immediately following the results.

Indeed, Carvana had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.