Bedding manufacturer and retailer Sleep Number (NASDAQ:SNBR) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 9.7% year on year to $426.6 million. Its GAAP loss of $0.14 per share was 34.9% above analysts’ consensus estimates.

Is now the time to buy Sleep Number? Find out by accessing our full research report, it’s free.

Sleep Number (SNBR) Q3 CY2024 Highlights:

- Revenue: $426.6 million vs analyst estimates of $446 million (4.3% miss)

- EPS: -$0.14 vs analyst estimates of -$0.22 (34.9% beat)

- EBITDA: $27.69 million vs analyst estimates of $27.2 million (1.8% beat)

- EBITDA guidance for the full year is $120 million at the midpoint, below analyst estimates of $128.9 million

- Gross Margin (GAAP): 60.8%, up from 57.4% in the same quarter last year

- Operating Margin: 2%, in line with the same quarter last year

- EBITDA Margin: 6.5%, up from 5.3% in the same quarter last year

- Locations: 643 at quarter end, down from 678 in the same quarter last year

- Same-Store Sales fell 10% year on year (1% in the same quarter last year)

- Market Capitalization: $298.4 million

“Our actions throughout the business over the past year are driving sustainable operating model improvements and contributing to our increased financial flexibility and durability. Our initiatives drove broad cost efficiencies and a gross margin rate improvement to 60.8%, resulting in third quarter adjusted EBITDA of $28 million, which was in-line with expectations even with persistent consumer demand weakness,” said Shelly Ibach, Chair, President and CEO.

Company Overview

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

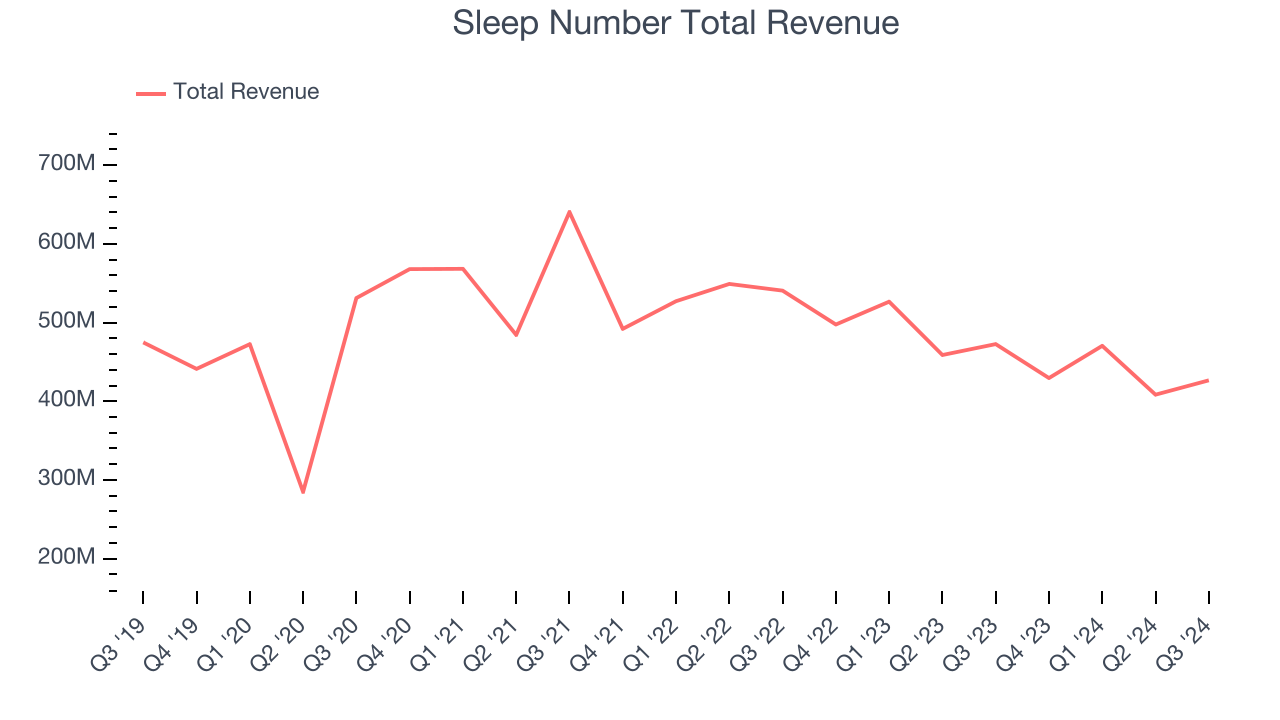

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Sleep Number is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

As you can see below, Sleep Number’s sales were flat over the last five years (we compare to 2019 to normalize for COVID-19 impacts) because it didn’t open many new stores.

This quarter, Sleep Number missed Wall Street’s estimates and reported a rather uninspiring 9.7% year-on-year revenue decline, generating $426.6 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, an acceleration versus the last five years. This projection is commendable and illustrates the market believes its newer products will spur faster growth.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Store Performance

Number of Stores

Sleep Number listed 643 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Sleep Number’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and we’d be skeptical if Sleep Number starts opening new stores to artifically boost revenue growth.

In the latest quarter, Sleep Number’s same-store sales fell by 10% annually. This decline was a reversal from the 1% year-on-year increase it posted 12 months ago. We’ll keep a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Sleep Number’s Q3 Results

We were impressed by how significantly Sleep Number blew past analysts’ EPS expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. On the other hand, its EBITDA forecast for the full year missed and its revenue missed Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 7.9% to $12.20 immediately after reporting.

Should you buy the stock or not?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.