Home improvement retail giant Home Depot (NYSE:HD) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 6.6% year on year to $40.22 billion. Its non-GAAP profit of $3.78 per share was also 3.4% above analysts’ consensus estimates.

Is now the time to buy Home Depot? Find out by accessing our full research report, it’s free.

Home Depot (HD) Q3 CY2024 Highlights:

- Revenue: $40.22 billion vs analyst estimates of $39.21 billion (2.6% beat)

- Adjusted EPS: $3.78 vs analyst estimates of $3.66 (3.4% beat)

- EBITDA: $6.21 billion vs analyst estimates of $6.25 billion (small miss)

- Gross Margin (GAAP): 33.4%, in line with the same quarter last year

- Operating Margin: 13.5%, in line with the same quarter last year

- EBITDA Margin: 15.4%, in line with the same quarter last year

- Free Cash Flow Margin: 8.5%, similar to the same quarter last year

- Locations: 2,345 at quarter end, up from 2,333 in the same quarter last year

- Same-Store Sales fell 1.3% year on year (-3.1% in the same quarter last year)

- Market Capitalization: $405.6 billion

"While macroeconomic uncertainty remains, our third quarter performance exceeded our expectations," said Ted Decker, Chair, President and CEO.

Company Overview

Founded and headquartered in Atlanta, Georgia, Home Depot (NYSE:HD) is a home improvement retailer that sells everything from tools to building materials to appliances.

Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Sales Growth

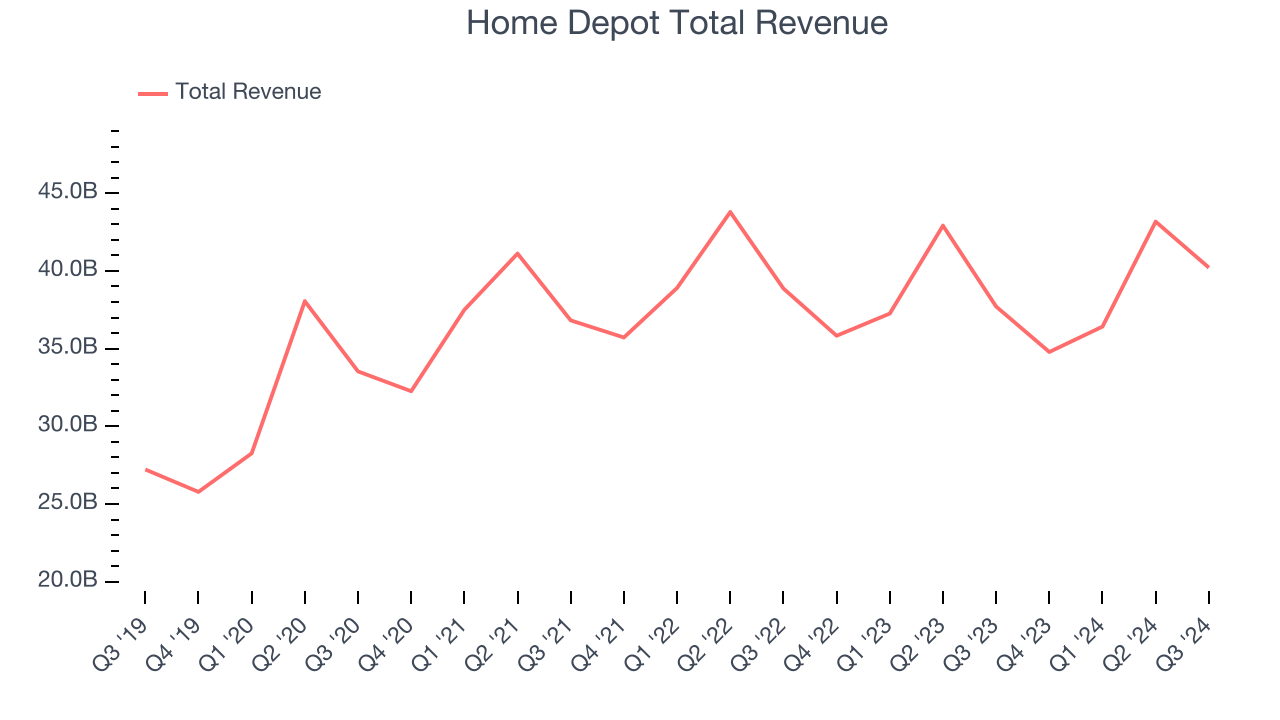

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years.

Home Depot is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution and the flexibility to offer lower prices. However, its scale is a double-edged sword because there is only so much real estate to build new stores, placing a ceiling on its growth.

As you can see below, Home Depot grew its sales at a tepid 6.9% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new stores.

This quarter, Home Depot reported year-on-year revenue growth of 6.6%, and its $40.22 billion of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, a slight deceleration versus the last five years. Some tapering is natural given the magnitude of its revenue base, and we still think its growth trajectory is attractive.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

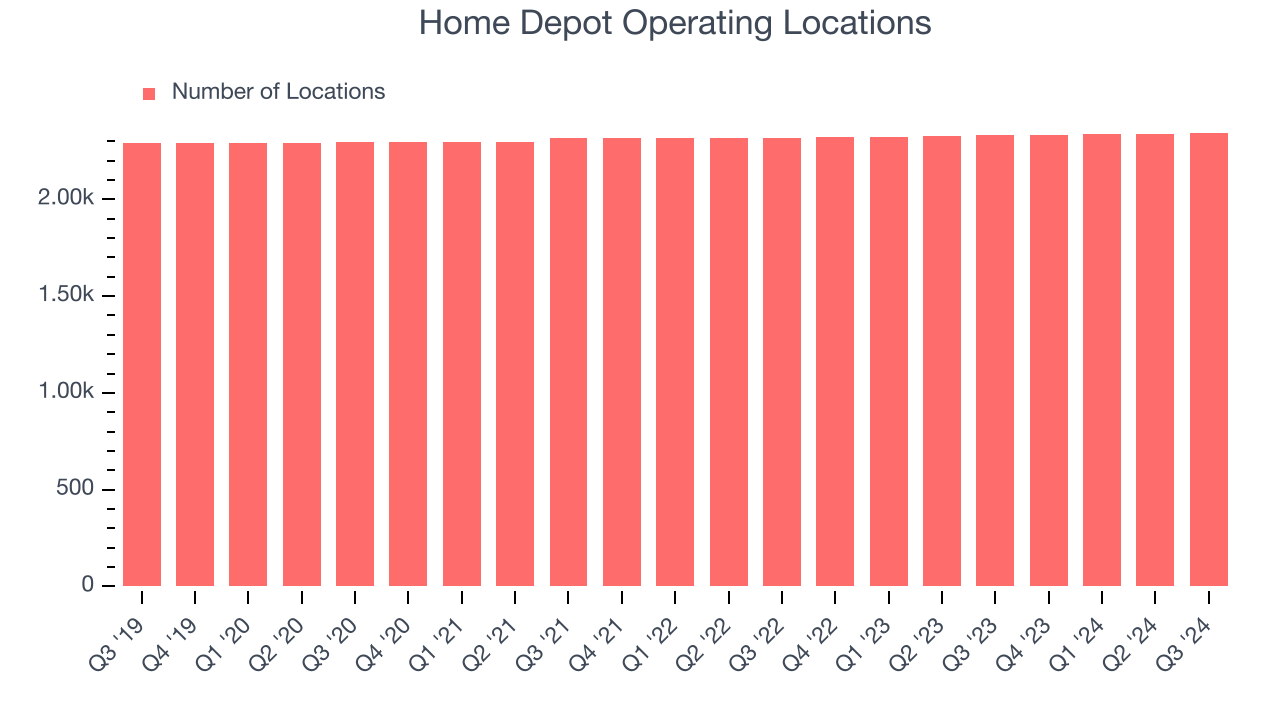

Home Depot listed 2,345 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

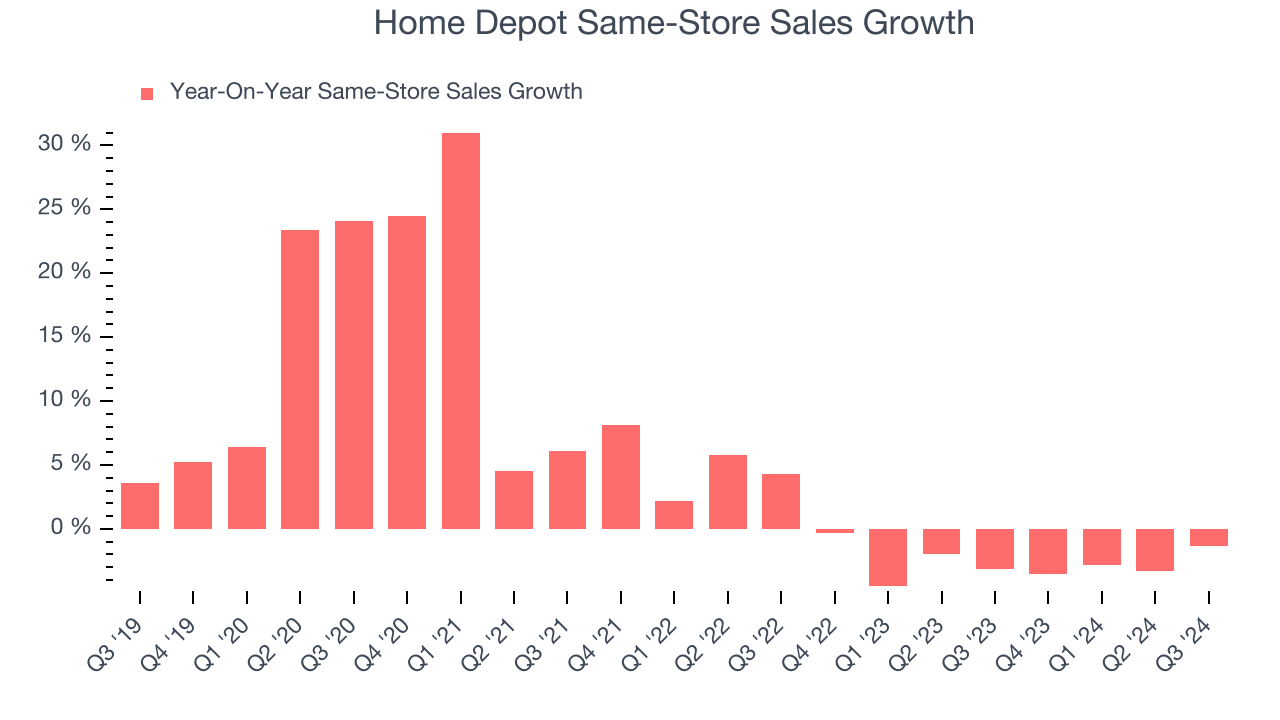

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth for shops open for at least a year.

Home Depot’s demand has been shrinking over the last two years as its same-store sales have averaged 2.6% annual declines. This performance isn’t ideal, and we’d be concerned if Home Depot starts opening new stores to artifically boost revenue growth.

In the latest quarter, Home Depot’s same-store sales fell by 1.3% annually. This decrease was an improvement from the 3.1% year-on-year decline it posted 12 months ago. It’s always great to see a business improve its prospects.

Key Takeaways from Home Depot’s Q3 Results

We enjoyed seeing Home Depot exceed analysts’ revenue expectations this quarter. We were also happy its EPS narrowly outperformed Wall Street’s estimates. On the other hand, its gross margin and EBITDA fell short. Overall, this quarter was mixed but still had some key positives. The stock traded up 1.8% to $416 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.