E-commerce software platform Shopify (NYSE:SHOP) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 26.1% year on year to $2.16 billion.

Is now the time to buy Shopify? Find out by accessing our full research report, it’s free.

Shopify (SHOP) Q3 CY2024 Highlights:

- Revenue: $2.16 billion vs analyst estimates of $2.11 billion (2.2% beat)

- Revenue Guidance for Q4 CY2024 is ~$2.73 billion at the midpoint, above analyst estimates of $2.63 billion

- Gross Margin (GAAP): 51.7%, in line with the same quarter last year

- Operating Margin: 13.1%, up from 7.1% in the same quarter last year

- Free Cash Flow Margin: 19.5%, up from 16.3% in the previous quarter

- Market Capitalization: $116.2 billion

"Q3 was outstanding, further establishing Shopify as a leader in powering commerce anywhere, anytime. Our unified commerce platform is becoming the go-to choice for merchants of all sizes," said Harley Finkelstein, President of Shopify.

Company Overview

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Luckily, Shopify’s sales grew at a solid 25% compounded annual growth rate over the last three years. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Shopify reported robust year-on-year revenue growth of 26.1%, and its $2.16 billion of revenue topped Wall Street estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 20.8% over the next 12 months, a deceleration versus the last three years. This projection is still healthy and implies the market sees success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

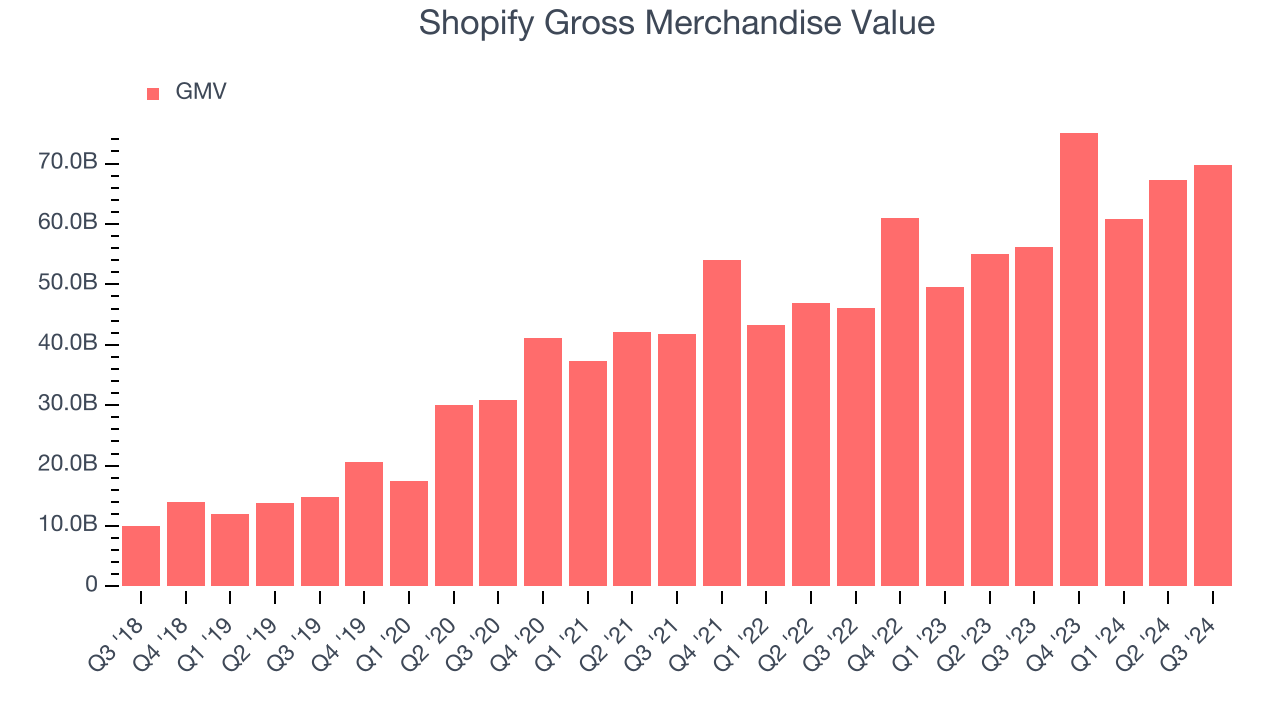

Gross Merchandise Value

In addition to reported revenue, it is useful to analyze GMV or gross merchandise value for Shopify. That’s because GMV accounts for the total dollar value of goods and services sold on Shopify’s platform. This is the number from which the company will ultimately collect fees (usually called a take rate) to generate revenue. Like most software companies, Shopify’s other major revenue stream is subscription revenue.

Over the last year, Shopify’s GMV growth has been impressive, averaging 23.1% year-on-year increases and punching in at $69.72 billion in the latest quarter. This performance was in line with its revenue growth and shows the company is capturing significant demand on its platform. Its growth also indicates that customers are highly active and engaged, driving higher transaction volumes and allowing Shopify to collect more in transaction fees.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Shopify is extremely efficient at acquiring new customers, and its CAC payback period checked in at 6.8 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Shopify’s Q3 Results

We enjoyed seeing Shopify exceed analysts’ GMV (gross merchandise value) expectations this quarter, enabling it to beat Wall Street's revenue estimates and provide Q4 revenue guidance that came in higher than anticipated. On top of that, its revenue growth accelerated and it produced a 19.5% free cash flow margin, showing it can balance growth and profits. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 14.5% to $103.04 immediately following the results.

Shopify may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.