The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Booking (NASDAQ:BKNG) and the rest of the consumer internet stocks fared in Q3.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 49 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.2% on average since the latest earnings results.

Booking (NASDAQ:BKNG)

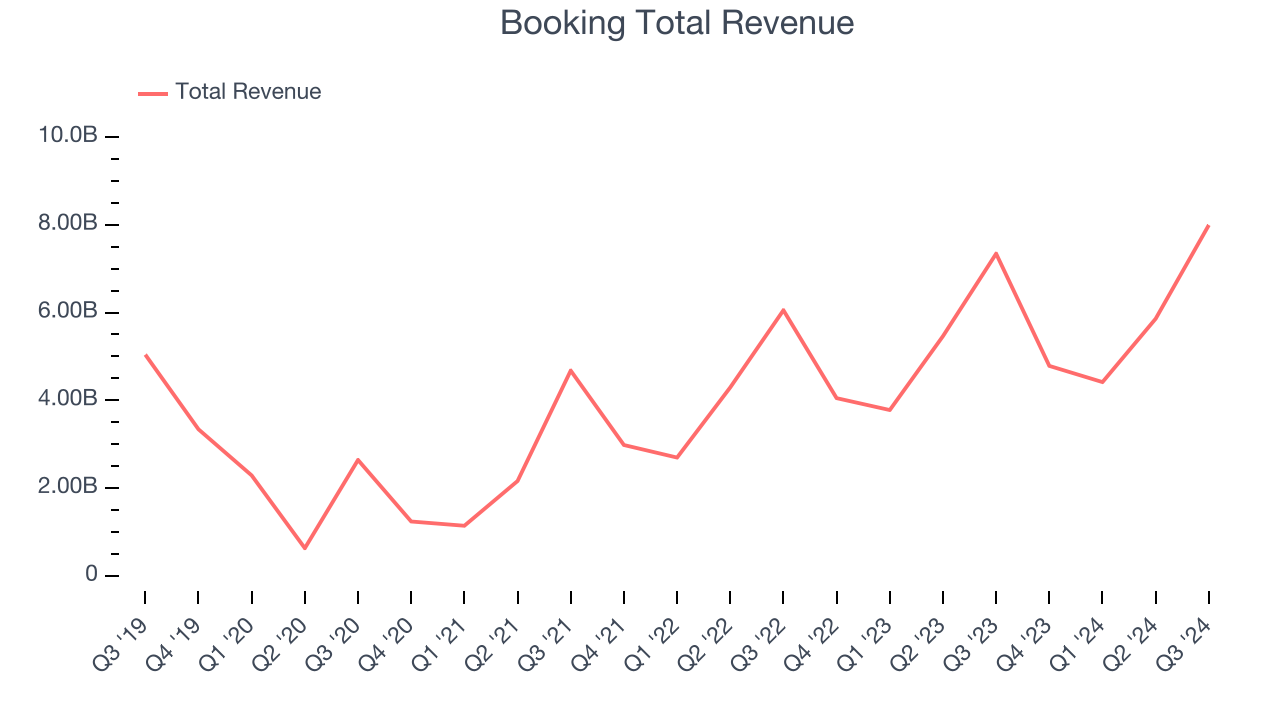

Formerly known as The Priceline Group, Booking Holdings (NASDAQ:BKNG) is the world’s largest online travel agency.

Booking reported revenues of $7.99 billion, up 8.9% year on year. This print exceeded analysts’ expectations by 4.8%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates.

Interestingly, the stock is up 11.2% since reporting and currently trades at $4,975.

We think Booking is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q3: EverQuote (NASDAQ:EVER)

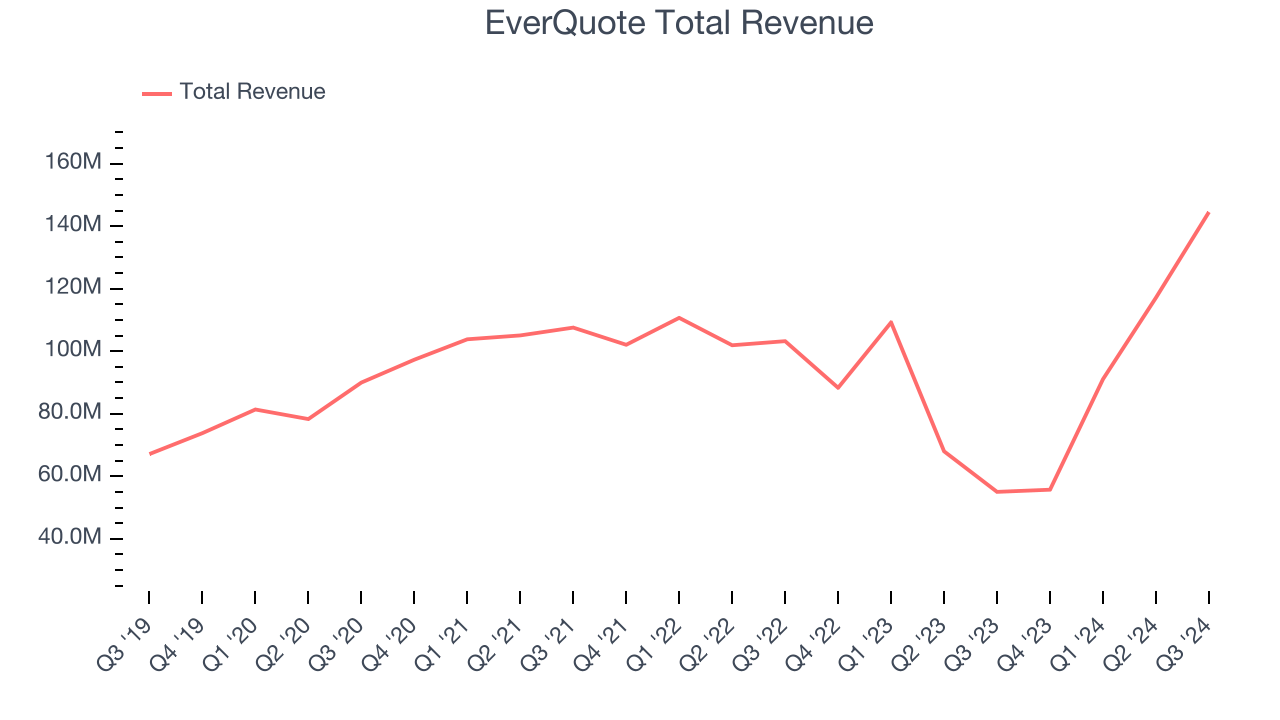

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $144.5 million, up 163% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

EverQuote delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 8.5% since reporting. It currently trades at $18.81.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $24.56 million, down 32.6% year on year, falling short of analysts’ expectations by 7.9%. It was a disappointing quarter as it posted a decline in its users.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 28% year on year. As expected, the stock is down 7.1% since the results and currently trades at $5.24.

Read our full analysis of Skillz’s results here.

The RealReal (NASDAQ:REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $147.8 million, up 11% year on year. This number beat analysts’ expectations by 3.2%. Overall, it was a strong quarter with full-year EBITDA guidance exceeding analysts’ expectations.

The company reported 389,000 users, up 6.9% year on year. The stock is up 30.6% since reporting and currently trades at $3.99.

Read our full, actionable report on The RealReal here, it’s free.

Yelp (NYSE:YELP)

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE:YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Yelp reported revenues of $360.3 million, up 4.4% year on year. This result was in line with analysts’ expectations. Overall, it was an exceptional quarter as it also put up a solid beat of analysts’ EBITDA estimates.

The stock is down 1.1% since reporting and currently trades at $35.95.

Read our full, actionable report on Yelp here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.