Footwear retailer Shoe Carnival (NASDAQ:SCVL) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 4.1% year on year to $306.9 million. The company’s full-year revenue guidance of $1.22 billion at the midpoint came in 1.5% below analysts’ estimates. Its non-GAAP profit of $0.71 per share was 6% above analysts’ consensus estimates.

Is now the time to buy Shoe Carnival? Find out by accessing our full research report, it’s free.

Shoe Carnival (SCVL) Q3 CY2024 Highlights:

- Revenue: $306.9 million vs analyst estimates of $316.2 million (4.1% year-on-year decline, 3% miss)

- Adjusted EPS: $0.71 vs analyst estimates of $0.67 (6% beat)

- Adjusted EBITDA: $37.38 million vs analyst estimates of $32.9 million (12.2% margin, 13.6% beat)

- The company dropped its revenue guidance for the full year to $1.22 billion at the midpoint from $1.24 billion, a 2% decrease

- Management reiterated its full-year Adjusted EPS guidance of $2.68 at the midpoint

- Operating Margin: 8%, in line with the same quarter last year

- Free Cash Flow Margin: 2.7%, down from 10.6% in the same quarter last year

- Same-Store Sales fell 4.1% year on year (-7.4% in the same quarter last year)

- Market Capitalization: $909.8 million

“Our Back-to-School results were strong, with comparable store sales growth across our banners and robust margins. Our flexible digital-first marketing campaign and great brand assortment drove demand during this peak shopping period and profitability in line with expectations for the third quarter. I am very proud of our team for delivering the Company’s profit results despite two significant hurricanes disrupting third quarter sales and a very warm October that delayed the start of our winter boot season,” said Mark Worden, President and Chief Executive Officer.

Company Overview

Known for its playful atmosphere that features carnival elements, Shoe Carnival (NASDAQ:SCVL) is a retailer that sells footwear from mainstream brands for the entire family.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Shoe Carnival is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

As you can see below, Shoe Carnival grew its sales at a sluggish 3.4% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Shoe Carnival missed Wall Street’s estimates and reported a rather uninspiring 4.1% year-on-year revenue decline, generating $306.9 million of revenue.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

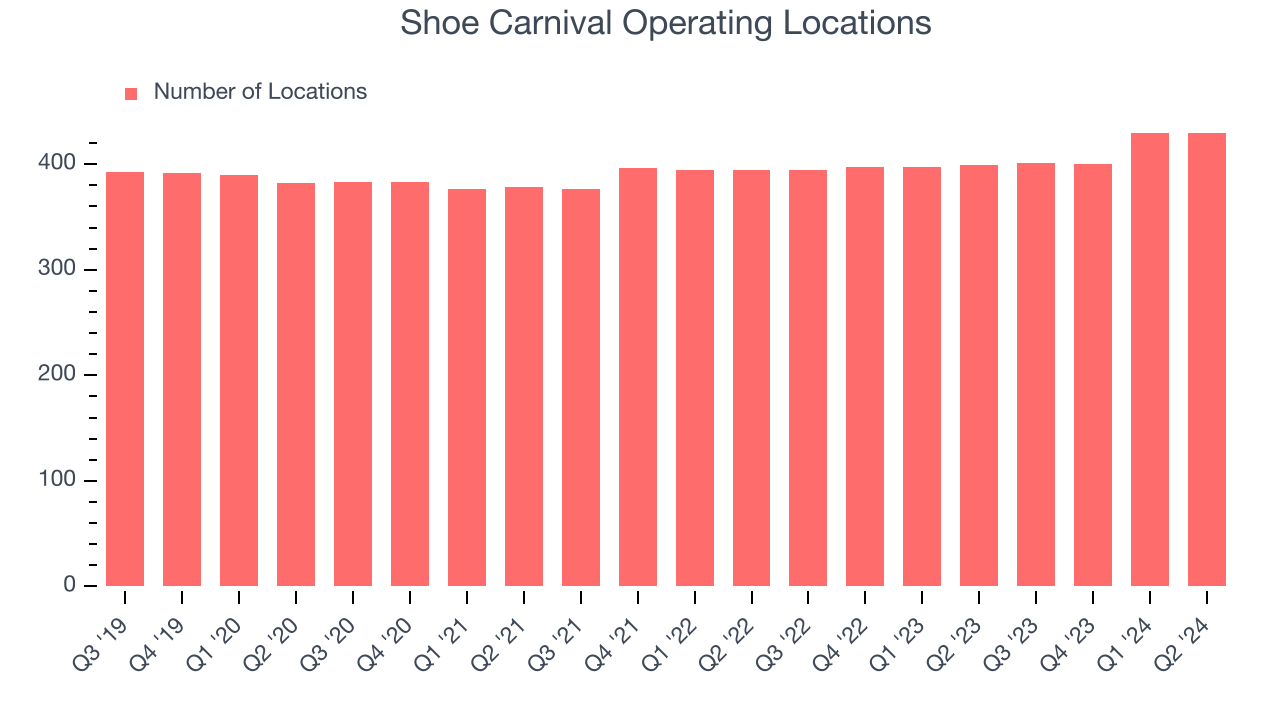

Shoe Carnival opened new stores quickly over the last two years and averaged 2.9% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Shoe Carnival reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at shops open for at least a year.

Shoe Carnival’s demand has been shrinking over the last two years as its same-store sales have averaged 6.9% annual declines. This performance is concerning - it shows Shoe Carnival artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Shoe Carnival’s same-store sales fell by 4.1% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Shoe Carnival’s Q3 Results

We were impressed by how significantly Shoe Carnival blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EPS guidance came in higher than Wall Street’s estimates. On the other hand, its revenue missed and it lowered its full-year revenue guidance. Zooming out, this was a mixed quarter featuring some areas of strength but also some blemishes. The market seemed to focus on the negatives, and the stock traded down 2% to $32.80 immediately after reporting.

Is Shoe Carnival an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.