Fragrance and perfume company Inter Parfums (NASDAQ:IPAR) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 15.4% year on year to $424.6 million. The company expects the full year’s revenue to be around $1.45 billion, close to analysts’ estimates. Its GAAP profit of $1.93 per share was also 4% above analysts’ consensus estimates.

Is now the time to buy Inter Parfums? Find out by accessing our full research report, it’s free.

Inter Parfums (IPAR) Q3 CY2024 Highlights:

- Revenue: $424.6 million vs analyst estimates of $413.4 million (2.7% beat)

- EPS: $1.93 vs analyst estimates of $1.86 (4% beat)

- The company reconfirmed its revenue guidance for the full year of $1.45 billion at the midpoint

- EPS (GAAP) guidance for the full year is $5.15 at the midpoint

- Gross Margin (GAAP): 63.9%, up from 56% in the same quarter last year

- Operating Margin: 25%, up from 23.7% in the same quarter last year

- Market Capitalization: $4.05 billion

Company Overview

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ:IPAR) manufactures and distributes fragrances worldwide.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

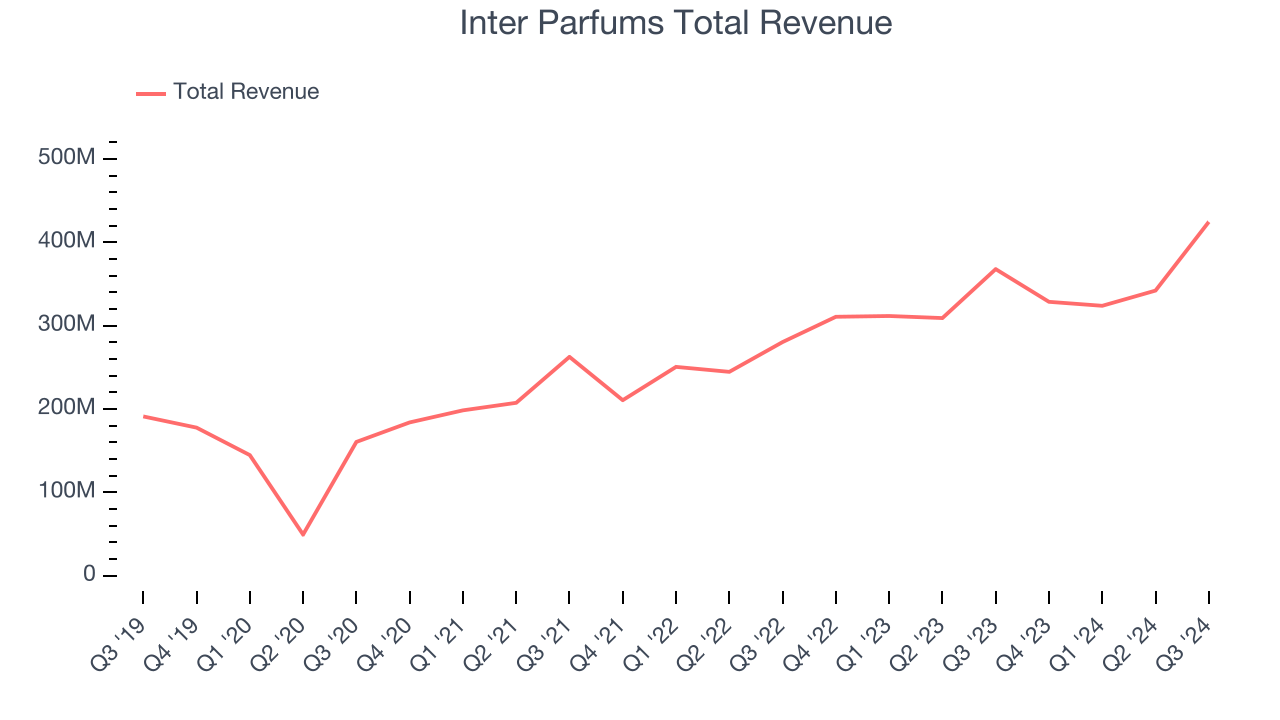

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Inter Parfums is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

As you can see below, Inter Parfums’s 18.5% annualized revenue growth over the last three years was impressive. This is a great starting point for our analysis because it shows Inter Parfums had stronger demand than most consumer staples companies.

This quarter, Inter Parfums reported year-on-year revenue growth of 15.4%, and its $424.6 million of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 8.3% over the next 12 months, a deceleration versus the last three years. Still, this projection is commendable and shows the market is baking in success for its products.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

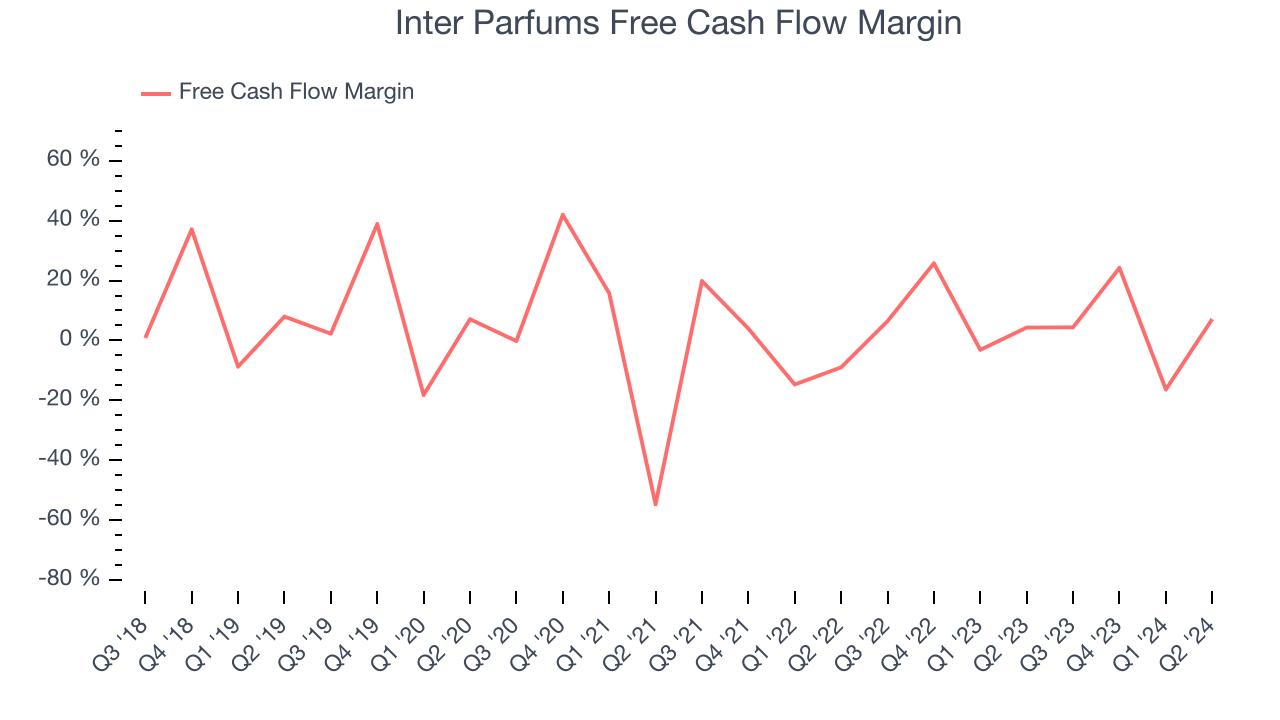

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Inter Parfums has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.6% over the last two years, slightly better than the broader consumer staples sector.

Key Takeaways from Inter Parfums’s Q3 Results

It was good to see Inter Parfums beat analysts’ revenue and EPS expectations this quarter. The company also reaffirmed its previously-given revenue and EPS guidance for the full year. Sometimes when a company beats and doesn't raise full year guidance, the market worries about what that implies for performance for the remainder of the year. This could be why the stock traded down 5.1% to $121.66 immediately following the results.

So do we think Inter Parfums is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.