Commercial lighting and retail display solutions provider LSI (NASDAQ:LYTS) will be reporting earnings tomorrow before market hours. Here’s what to expect.

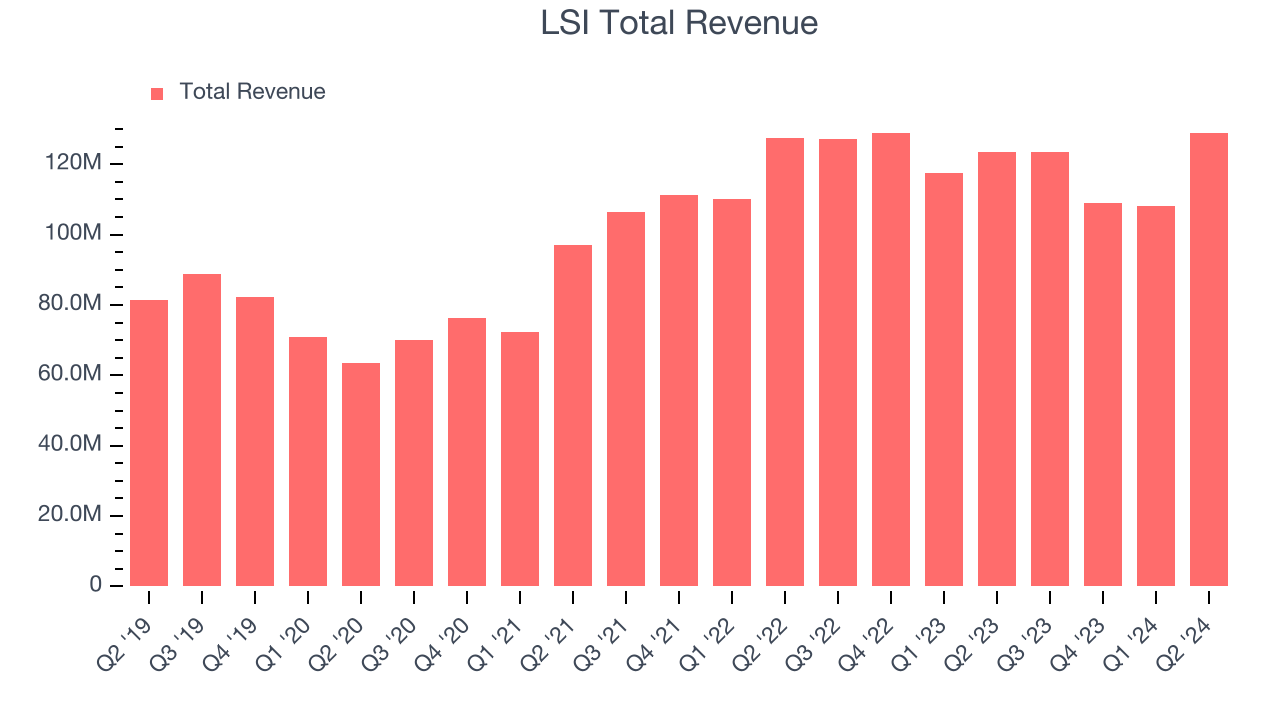

LSI beat analysts’ revenue expectations by 1.6% last quarter, reporting revenues of $129 million, up 4.3% year on year. It was a strong quarter for the company, with an impressive beat of analysts’ EBITDA estimates.

Is LSI a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting LSI’s revenue to grow 6% year on year to $130.9 million, a reversal from the 2.9% decrease it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.23 per share.

The majority of analysts covering the company have reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. LSI has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 4% on average.

Looking at LSI’s peers in the electrical systems segment, some have already reported their Q3 results, giving us a hint as to what we can expect. OSI Systems delivered year-on-year revenue growth of 23.2%, beating analysts’ expectations by 8%, and Vertiv reported revenues up 19%, topping estimates by 4.8%. OSI Systems traded down 5.5% following the results while Vertiv was also down 2.2%.

Read our full analysis of OSI Systems’s results here and Vertiv’s results here.

There has been positive sentiment among investors in the electrical systems segment, with share prices up 2.7% on average over the last month. LSI is up 3.6% during the same time and is heading into earnings with an average analyst price target of $19.67 (compared to the current share price of $16.95).

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.