Online used car auction platform ACV Auctions (NASDAQ:ACVA) announced better-than-expected revenue in Q3 CY2024, with sales up 44% year on year to $171.3 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $154 million was less impressive, coming in 0.9% below expectations. Its GAAP loss of $0.10 per share was also 12.8% above analysts’ consensus estimates.

Is now the time to buy ACV Auctions? Find out by accessing our full research report, it’s free.

ACV Auctions (ACVA) Q3 CY2024 Highlights:

- Revenue: $171.3 million vs analyst estimates of $160.4 million (6.8% beat)

- EPS: -$0.10 vs analyst estimates of -$0.11 (12.8% beat)

- EBITDA: $11.17 million vs analyst estimates of $7.45 million (49.9% beat)

- Revenue Guidance for Q4 CY2024 is $154 million at the midpoint, below analyst estimates of $155.4 million

- EBITDA guidance for the full year is $26 million at the midpoint, above analyst estimates of $23.81 million

- Gross Margin (GAAP): 27.8%, up from 19.7% in the same quarter last year

- Operating Margin: -10%, up from -18.7% in the same quarter last year

- EBITDA Margin: 6.5%, up from -3.1% in the same quarter last year

- Free Cash Flow was $12.58 million, up from -$4.62 million in the previous quarter

- Marketplace Units: 198,354, up 48,297 year on year

- Market Capitalization: $3.19 billion

“We are very pleased with our strong third quarter results, which delivered revenue and Adjusted EBITDA above the high-end of our guidance range, along with continued margin expansion. ACV's strong market position resulted in additional share gains and accelerated revenue growth in the quarter. Our growing suite of dealer solutions gained further market traction and we executed on initiatives to support our commercial wholesale strategy,” said George Chamoun, CEO of ACV.

Company Overview

Founded in 2014, ACV Auctions (NASDAQ:ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

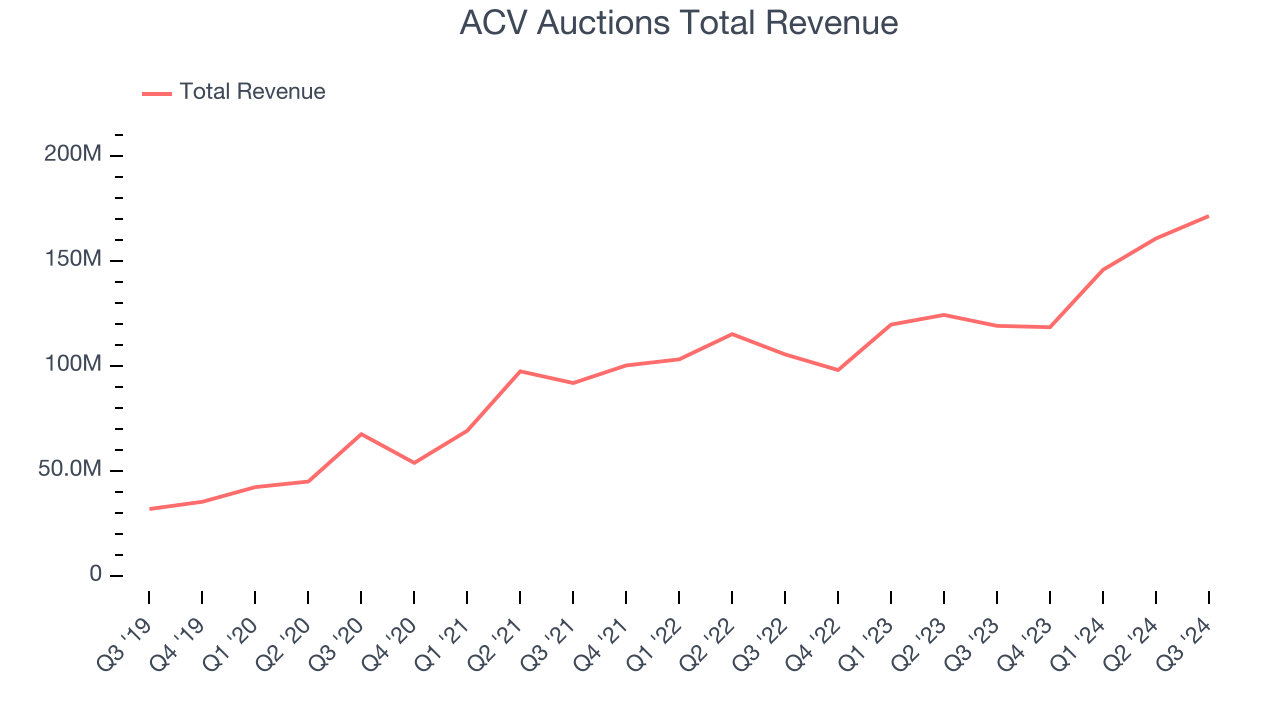

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, ACV Auctions’s 24.1% annualized revenue growth over the last three years was excellent. This is a great starting point for our analysis because it shows ACV Auctions’s offerings resonate with customers.

This quarter, ACV Auctions reported magnificent year-on-year revenue growth of 44%, and its $171.3 million of revenue beat Wall Street’s estimates by 6.8%. Management is currently guiding for a 30.1% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 24.9% over the next 12 months, similar to its three-year rate. This projection is commendable and illustrates the market sees some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

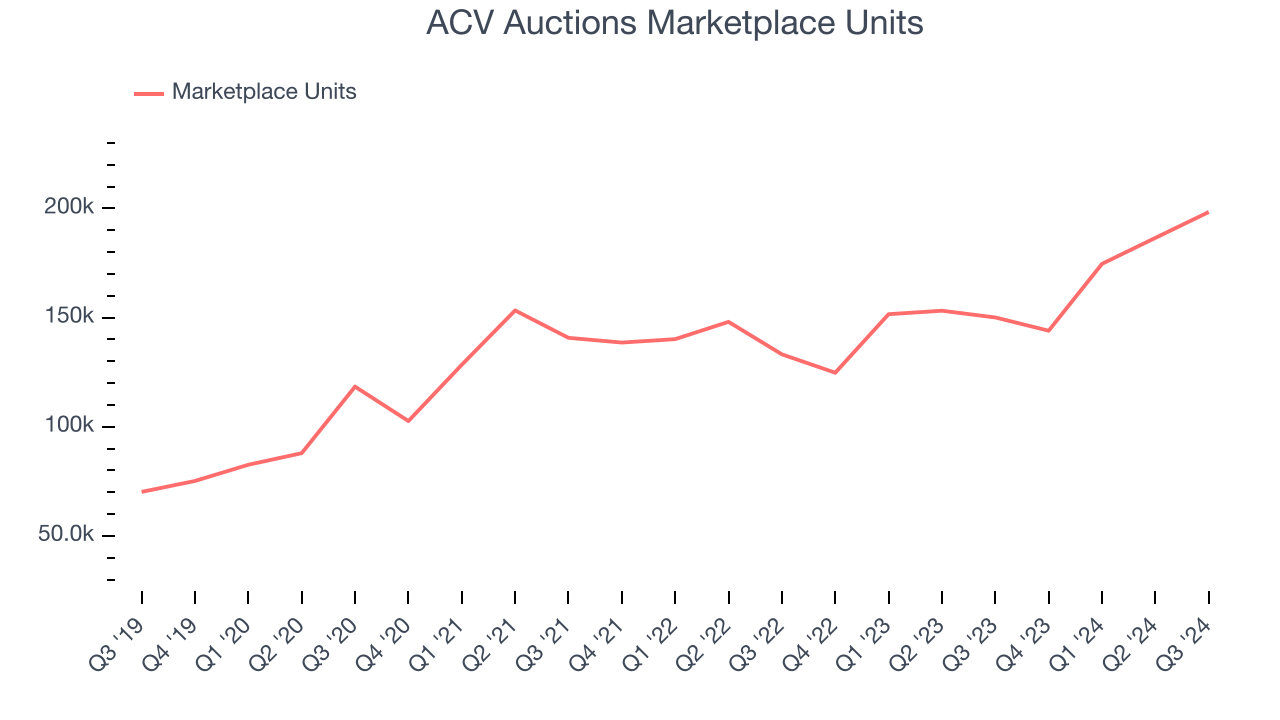

Marketplace Units

Unit Growth

As an online marketplace, ACV Auctions generates revenue growth by increasing both the number of units on its platform and the average order size in dollars.

Over the last two years, ACV Auctions’s marketplace units, a key performance metric for the company, increased by 12.4% annually to 198,354 in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

In Q3, ACV Auctions added 48,297 marketplace units, leading to 32.2% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating unit growth.

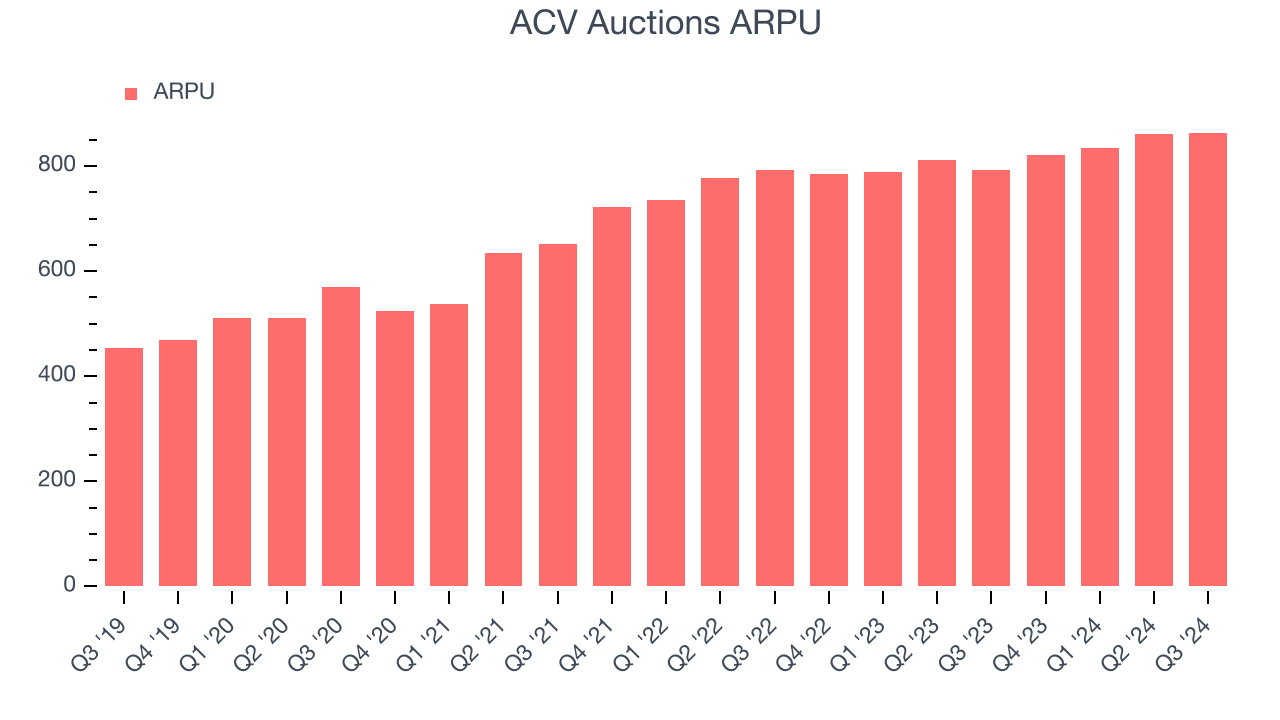

Revenue Per Unit

Average revenue per unit (ARPU) is a critical metric to track for consumer internet businesses like ACV Auctions because it measures how much the company earns in transaction fees from each unit. ARPU also gives us unique insights into a user’s average order size and ACV Auctions’s take rate, or "cut", on each order.

ACV Auctions’s ARPU growth has been decent over the last two years, averaging 5.7%. Its ability to increase monetization while effectively growing its marketplace units demonstrates the value of its platform.

This quarter, ACV Auctions’s ARPU clocked in at $863.75. It grew 8.9% year on year, slower than its unit growth.

Key Takeaways from ACV Auctions’s Q3 Results

We were impressed by how significantly ACV Auctions blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its EBITDA forecast for next quarter missed and its revenue guidance for next quarter missed Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock traded up 6.1% to $20.70 immediately following the results.

ACV Auctions put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.