Web content delivery and security company Akamai (NASDAQ:AKAM) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 4.1% year on year to $1.00 billion. On the other hand, next quarter’s revenue guidance of $1.01 billion was less impressive, coming in 2.1% below analysts’ estimates. Its non-GAAP profit of $1.59 per share was also in line with analysts’ consensus estimates.

Is now the time to buy Akamai? Find out by accessing our full research report, it’s free.

Akamai (AKAM) Q3 CY2024 Highlights:

- Revenue: $1.00 billion vs analyst estimates of $999.5 million (in line)

- Adjusted EPS: $1.59 vs analyst expectations of $1.59 (in line)

- EBITDA: $426.3 million vs analyst estimates of $421.9 million (1% beat)

- Revenue Guidance for Q4 CY2024 is $1.01 billion at the midpoint, below analyst estimates of $1.03 billion

- Gross Margin (GAAP): 59.3%, down from 60.4% in the same quarter last year

- Operating Margin: 7%, down from 18.2% in the same quarter last year

- EBITDA Margin: 42.4%, in line with the same quarter last year

- Free Cash Flow Margin: 24.8%, down from 27.3% in the previous quarter

- Market Capitalization: $15.87 billion

"Akamai delivered another solid quarter, highlighted by continued momentum in security and cloud computing. Together, these solutions grew 17% on a year-over-year basis and now account for nearly 70% of our total revenue," said Dr. Tom Leighton, Akamai's Chief Executive Officer.

Company Overview

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ:AKAM) provides software for organizations to efficiently deliver web content to their customers.

Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

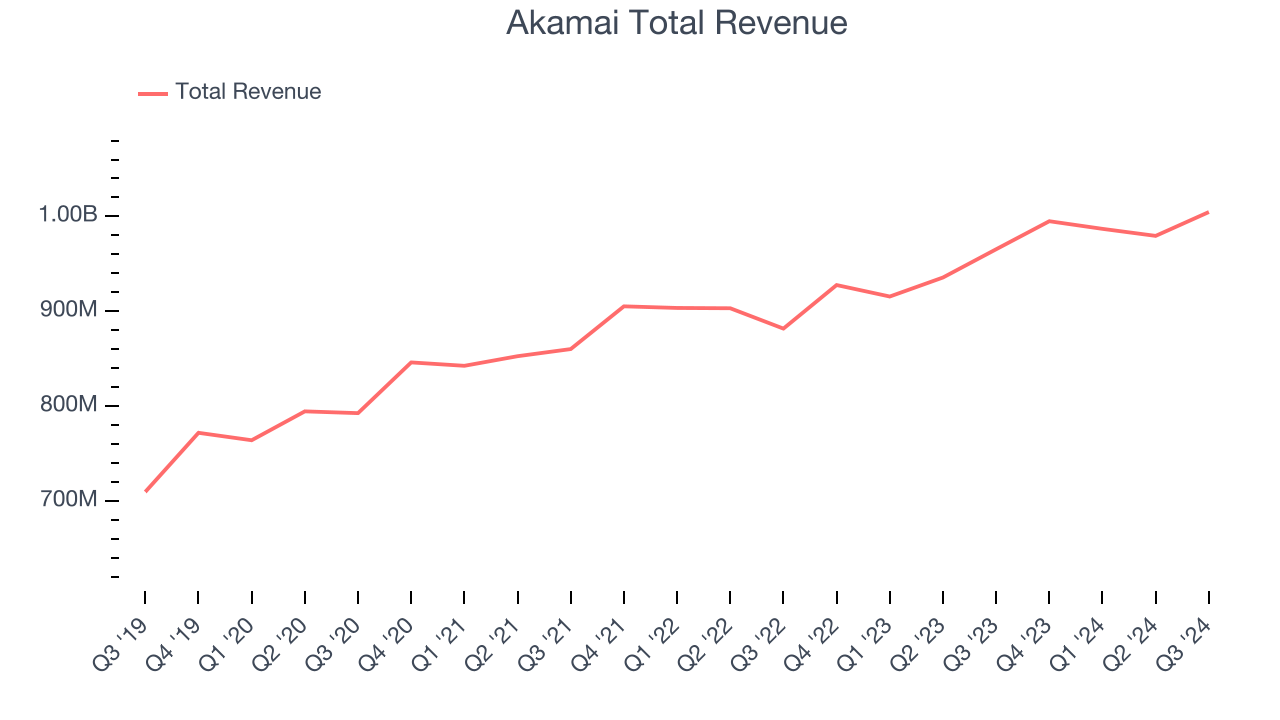

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Akamai’s 5.2% annualized revenue growth over the last three years was weak. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, Akamai grew its revenue by 4.1% year on year, and its $1.00 billion of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 1.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, similar to its three-year rate. This projection is underwhelming and illustrates the market believes its newer products and services will not accelerate its top-line performance yet.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

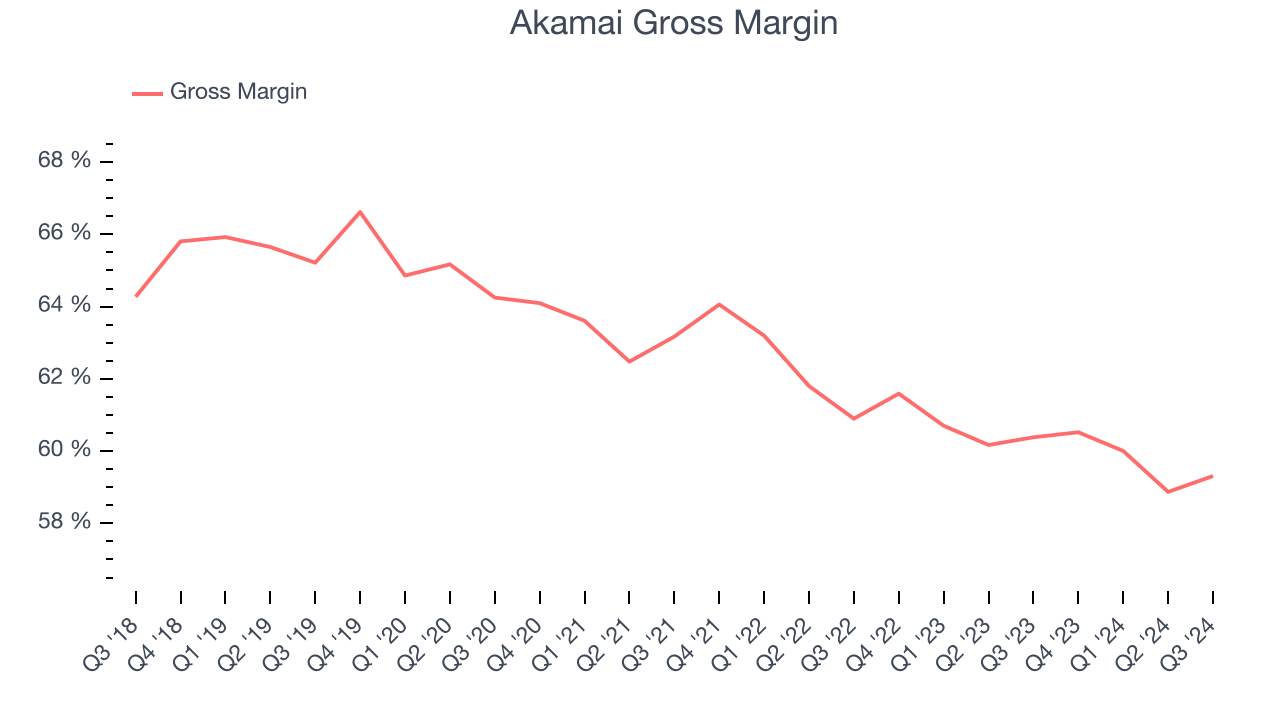

Gross Margin & Pricing Power

For software companies like Akamai, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more competitive than other industries.

Akamai’s gross margin is substantially worse than most other software businesses, signaling it has relatively high infrastructure costs compared to an asset-lite business like ServiceNow. As you can see below, it averaged a paltry 59.7% gross margin over the last year. That means Akamai paid its providers a lot of money ($40.32 for every $100 in revenue) to run its business.

This quarter, Akamai’s gross profit margin was 59.3%, down 1.1 percentage points year on year. Akamai’s full-year margin has also been trending down over the past 12 months, decreasing by 1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

Key Takeaways from Akamai’s Q3 Results

It was good to see Akamai beat analysts’ EBITDA expectations this quarter. On the other hand, its revenue guidance for next quarter missed analysts’ expectations and its full-year revenue guidance slightly missed Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 8.1% to $96 immediately after reporting.

Akamai didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.