Energy and renewable energy projects company Ameresco (NYSE:AMRC) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 49.4% year on year to $500.9 million. The company expects the full year’s revenue to be around $1.75 billion, close to analysts’ estimates. Its non-GAAP profit of $0.32 per share was 39.1% below analysts’ consensus estimates.

Is now the time to buy Ameresco? Find out by accessing our full research report, it’s free.

Ameresco (AMRC) Q3 CY2024 Highlights:

- Revenue: $500.9 million vs analyst estimates of $486.5 million (3% beat)

- Adjusted EPS: $0.32 vs analyst expectations of $0.53 (39.1% miss)

- EBITDA: $20.64 million vs analyst estimates of $66.58 million (69% miss)

- The company reconfirmed its revenue guidance for the full year of $1.75 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $1.25 at the midpoint

- EBITDA guidance for the full year is $220 million at the midpoint, above analyst estimates of $217 million

- Gross Margin (GAAP): 15.4%, down from 19% in the same quarter last year

- Operating Margin: 7%, in line with the same quarter last year

- EBITDA Margin: 4.1%, down from 12.9% in the same quarter last year

- Free Cash Flow was -$314.6 million compared to -$192.5 million in the same quarter last year

- Market Capitalization: $1.68 billion

CEO George Sakellaris commented, “Our team continued to deliver excellent results with year-on-year quarterly revenue growth of 49% and record Adjusted EBITDA of over $62 million, growing 44% in the third quarter, reflecting strong demand for Ameresco’s unique blend of services across our customer base. Each of our four business lines achieved strong year-on-year growth, led by Projects, Energy Assets and O&M, where revenues increased at substantial double-digit rates. At the same time, we brought over 40MWe of Energy Assets into operation, resulting in a year-to-date total of 209 MWe – a record number for Ameresco and already above our full year guidance of 200MWe. New business activity remained robust with our total Project Backlog growing to $4.5 billion at the end of the quarter, an increase of 22% from last year. Importantly, our continued focus on contract conversion helped drive a 56% increase in contracted backlog to a record $1.9 billion. We also had a very strong quarter with our recurring O&M business adding over $180 million in additional backlog versus last year. "

Company Overview

Having played a role in upgrading the energy solutions of Alcatraz Island, Ameresco (NYSE:AMRC) provides energy and renewable energy solutions for various sectors.

Energy Products and Services

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Sales Growth

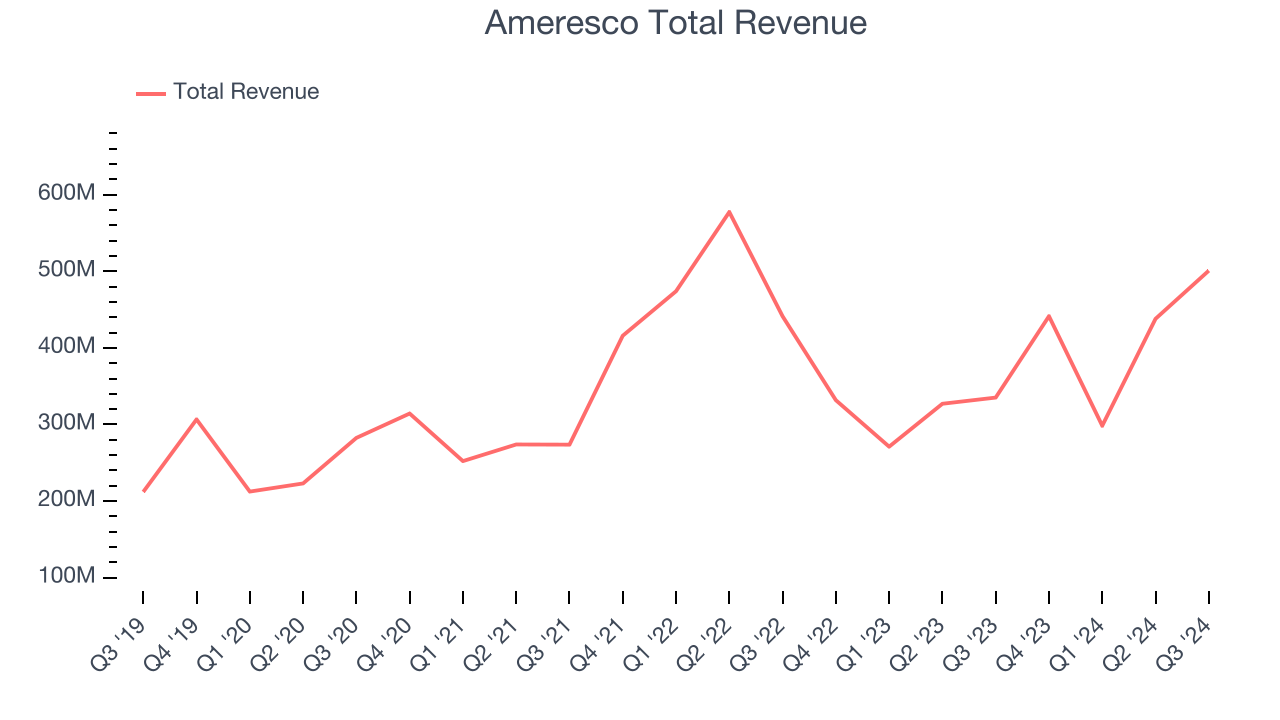

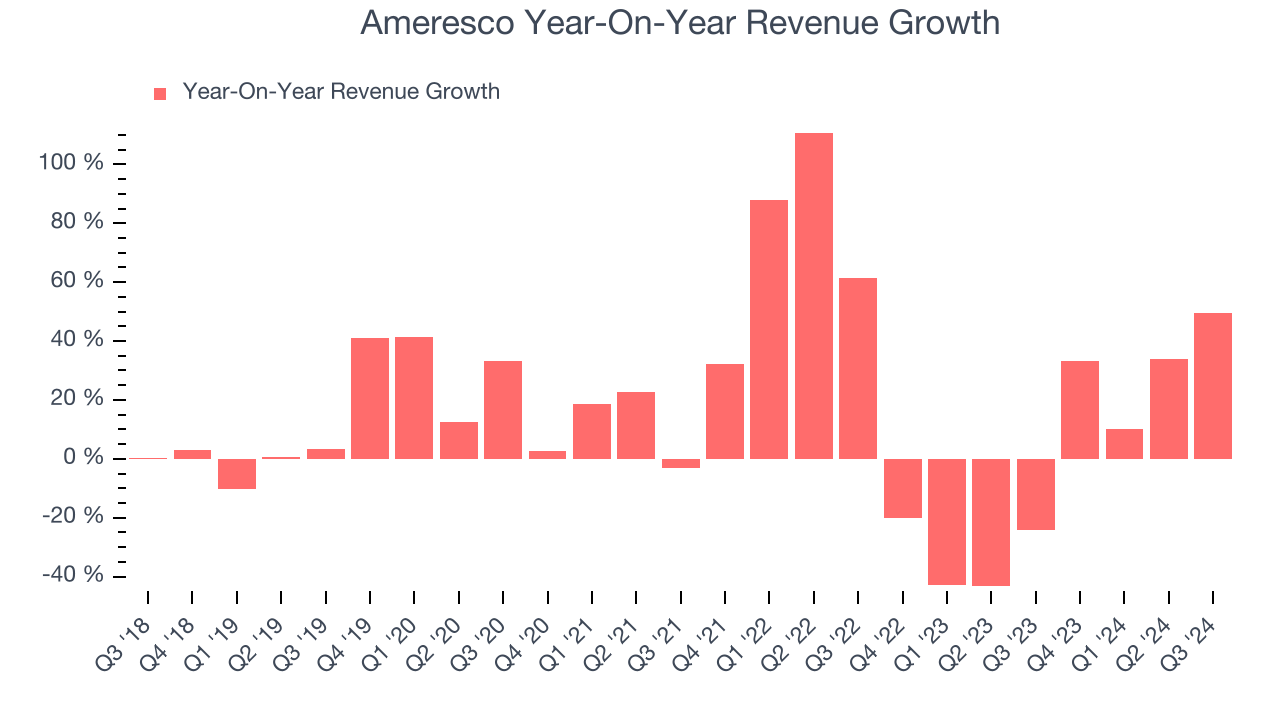

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Ameresco’s 16.6% annualized revenue growth over the last five years was incredible. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Ameresco’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.2% over the last two years.

This quarter, Ameresco reported magnificent year-on-year revenue growth of 49.4%, and its $500.9 million of revenue beat Wall Street’s estimates by 3%.

Looking ahead, sell-side analysts expect revenue to grow 14.9% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates the market thinks its newer products and services will fuel higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

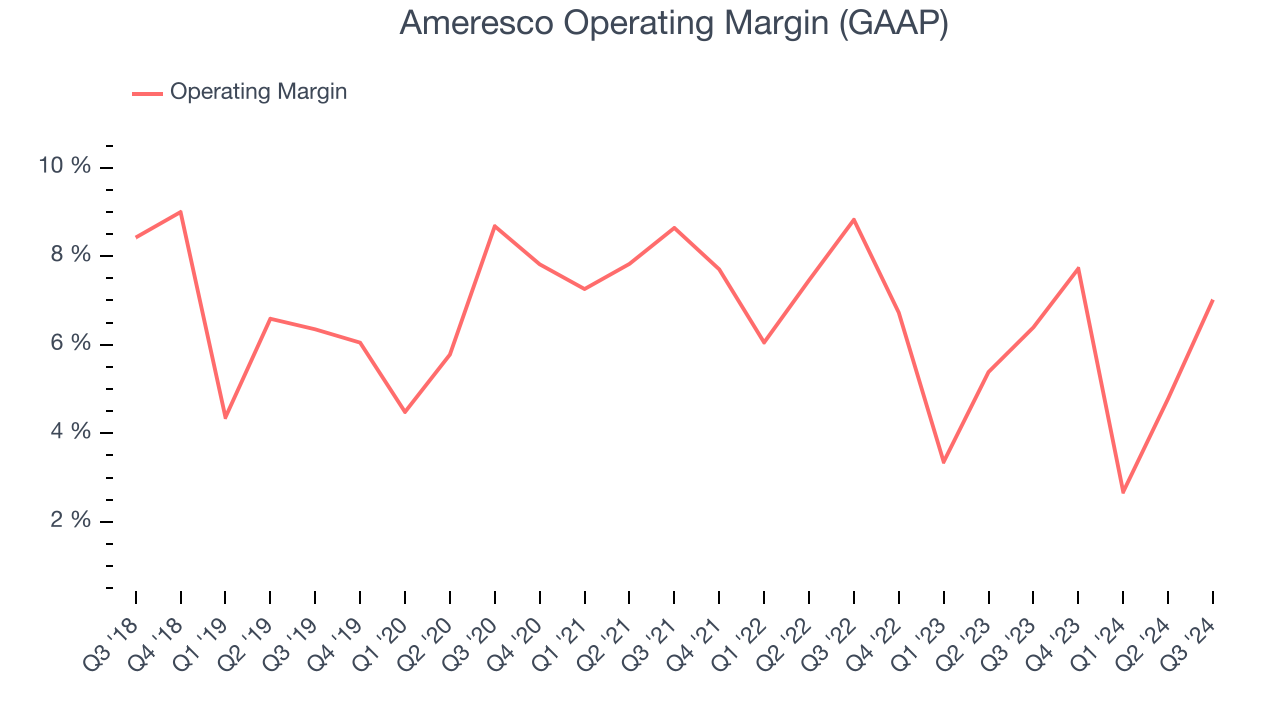

Ameresco was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.6% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Ameresco’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business to change.

In Q3, Ameresco generated an operating profit margin of 7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

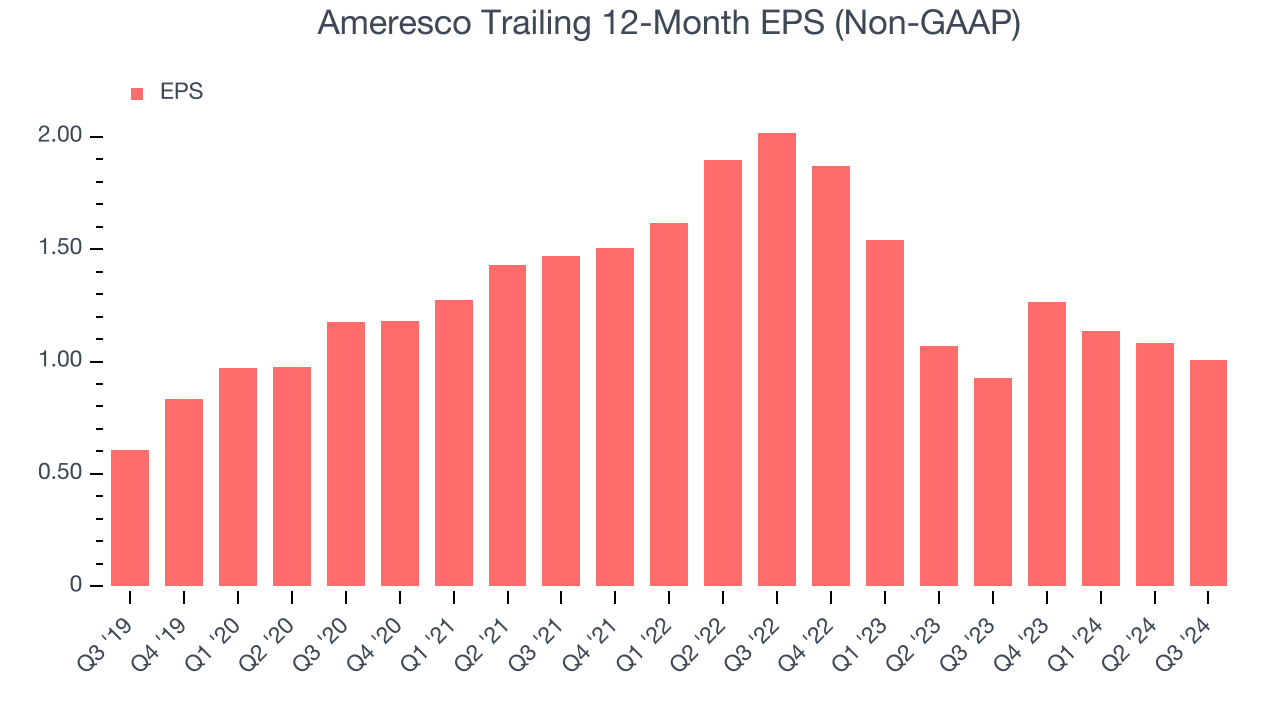

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Ameresco’s EPS grew at a solid 10.7% compounded annual growth rate over the last five years. However, this performance was lower than its 16.6% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

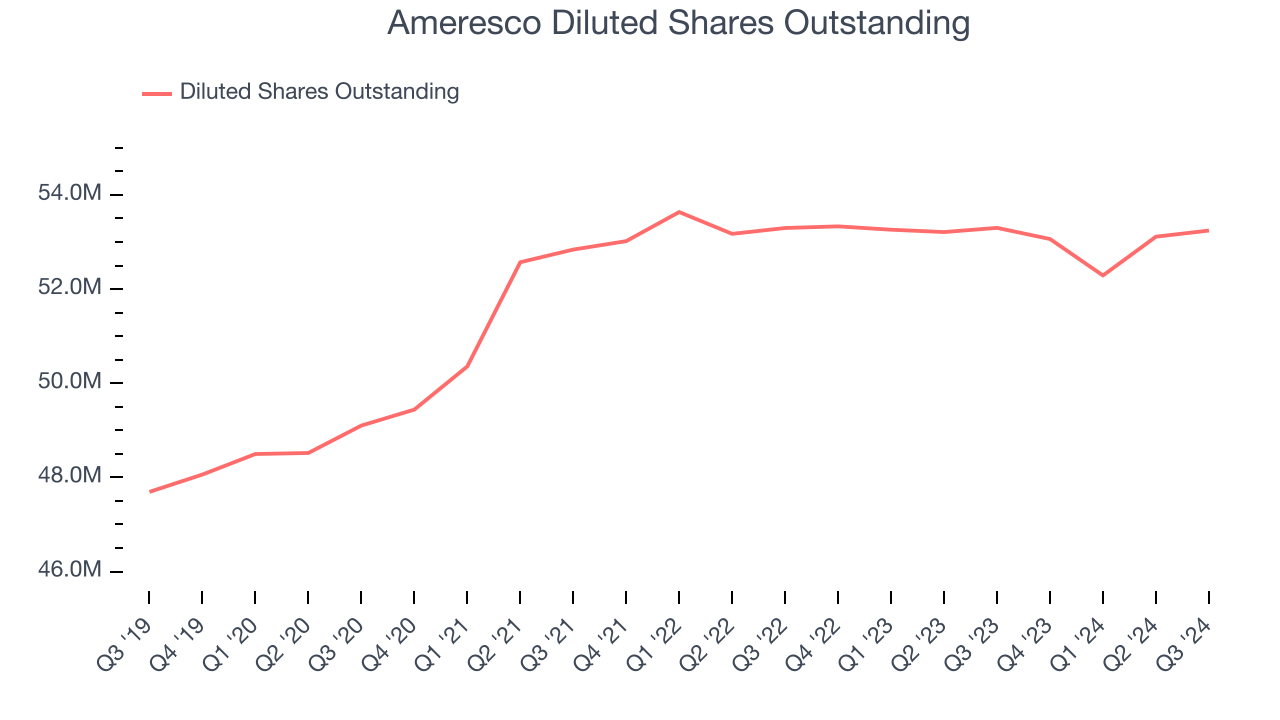

We can take a deeper look into Ameresco’s earnings to better understand the drivers of its performance. A five-year view shows Ameresco has diluted its shareholders, growing its share count by 11.6%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Ameresco, its two-year annual EPS declines of 29.3% mark a reversal from its (seemingly) healthy five-year trend. We hope Ameresco can return to earnings growth in the future.In Q3, Ameresco reported EPS at $0.32, down from $0.40 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Ameresco’s full-year EPS of $1.01 to grow by 86.7%.

Key Takeaways from Ameresco’s Q3 Results

We were impressed by how significantly Ameresco blew past analysts’ revenue expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock traded up 3.2% to $32.66 immediately after reporting.

So should you invest in Ameresco right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.