Membership-only discount retailer Costco (NASDAQ:COST) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 7.5% year on year to $62.15 billion. Its GAAP profit of $4.04 per share was 6.3% above analysts’ consensus estimates.

Is now the time to buy Costco? Find out by accessing our full research report, it’s free.

Costco (COST) Q4 CY2024 Highlights:

- Revenue: $62.15 billion (7.5% year-on-year growth)

- Adjusted EPS: $4.04 vs analyst estimates of $3.80 (6.3% beat)

- Operating Margin: 3.5%, in line with the same quarter last year

- Free Cash Flow Margin: 3.2%, down from 6.2% in the same quarter last year

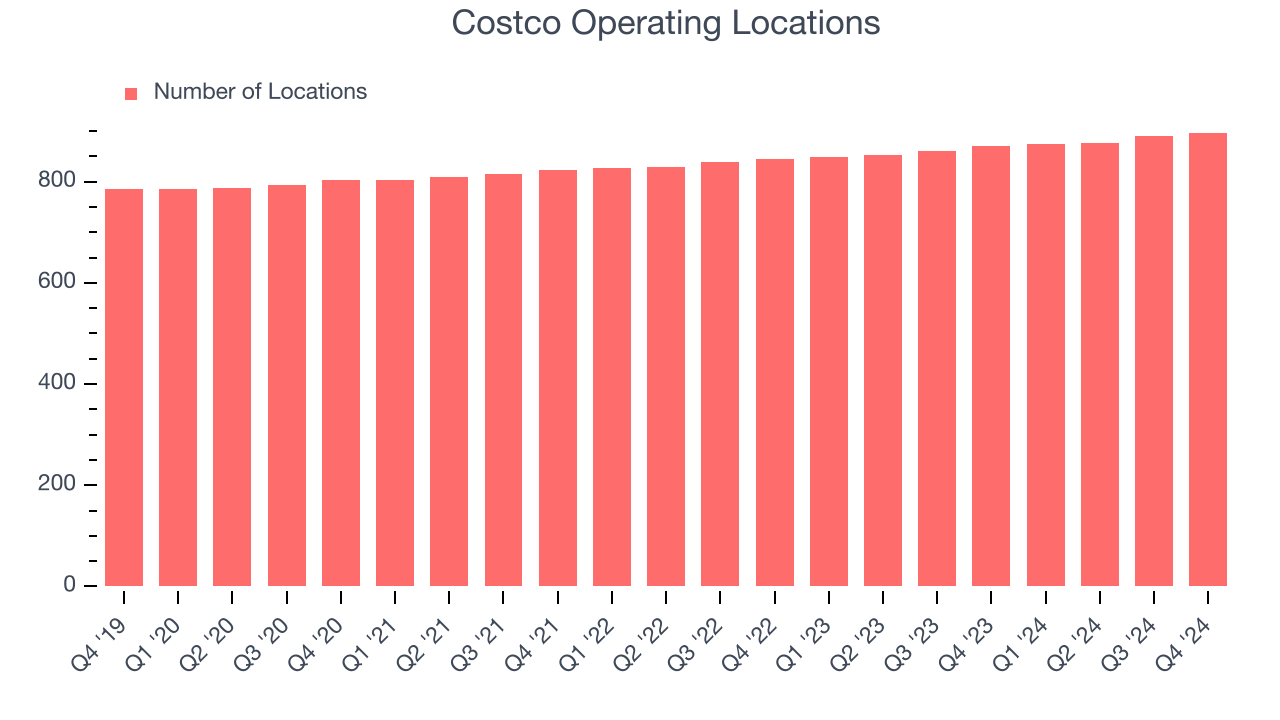

- Locations: 897 at quarter end, up from 870 in the same quarter last year

- Same-Store Sales rose 5.2% year on year (3.8% in the same quarter last year)

- Market Capitalization: $437.7 billion

Company Overview

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ:COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Large-format Grocery & General Merchandise Retailer

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Costco is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

As you can see below, Costco’s sales grew at a decent 10.8% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and increased sales at existing, established locations.

This quarter, Costco’s revenue grew by 7.5% year on year to $62.15 billion.

Looking ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, a deceleration versus the last five years. We still think its growth trajectory is attractive given its scale and suggests the market is baking in success for its products.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Costco sported 897 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 2.9% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

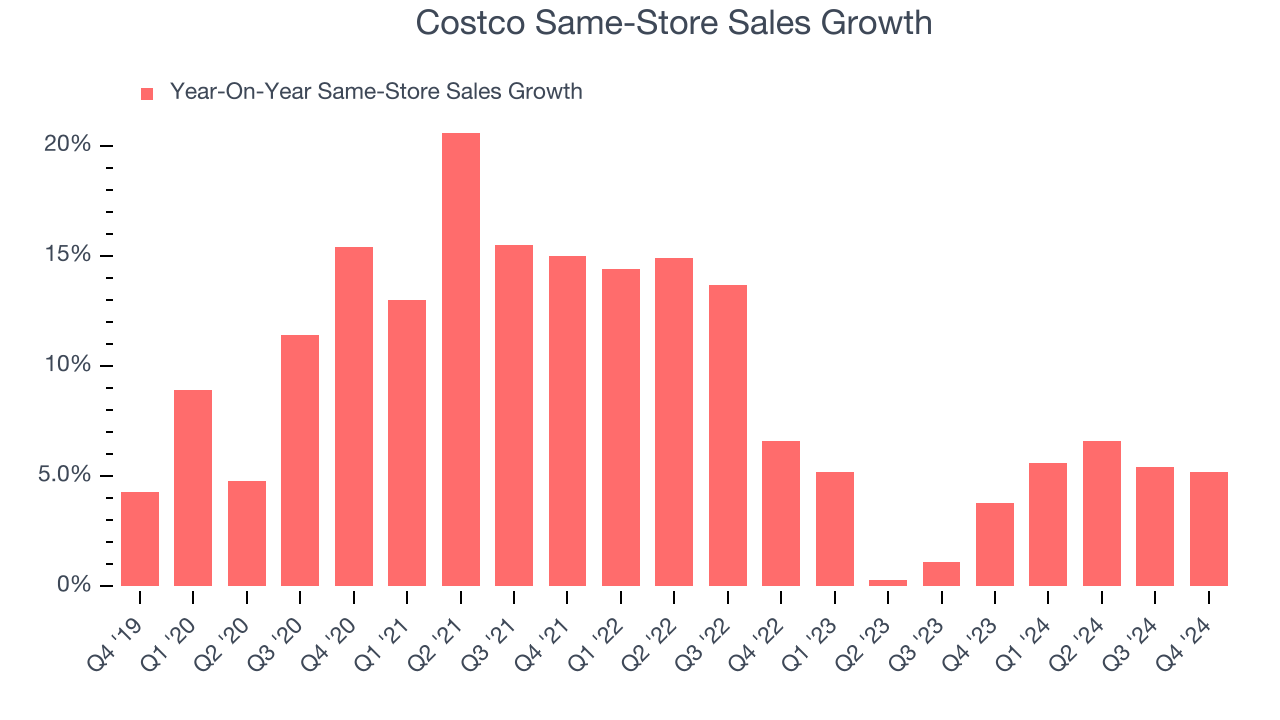

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Costco’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 4.1% per year. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Costco multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Costco’s same-store sales rose 5.2% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Costco’s Q4 Results

It was encouraging to see Costco beat analysts’ EPS expectations this quarter. Overall, this quarter had some key positives. The stock remained flat at $989.49 immediately after reporting.

Sure, Costco had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.