Luxury furniture retailer RH (NYSE:RH) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 8.1% year on year to $811.7 million. Its GAAP profit of $1.66 per share increased from -$0.12 in the same quarter last year.

Is now the time to buy RH? Find out by accessing our full research report, it’s free.

RH (RH) Q3 CY2024 Highlights:

- Revenue: $811.7 million vs analyst estimates of $811.8 million (8.1% year-on-year growth, in line)

- Adjusted EBITDA: $168.5 million vs analyst estimates of $170.5 million (20.8% margin, 1.1% miss)

- Raised Full-Year Revenue and EBITDA guidance to 7% year-on-year growth and a 17.3% margin

- Operating Margin: 12.5%, up from 6.8% in the same quarter last year

- Free Cash Flow was -$95.99 million, down from $17.57 million in the same quarter last year

- Market Capitalization: $7.33 billion

Company Overview

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of of high-end furniture and home decor.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

RH is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage.

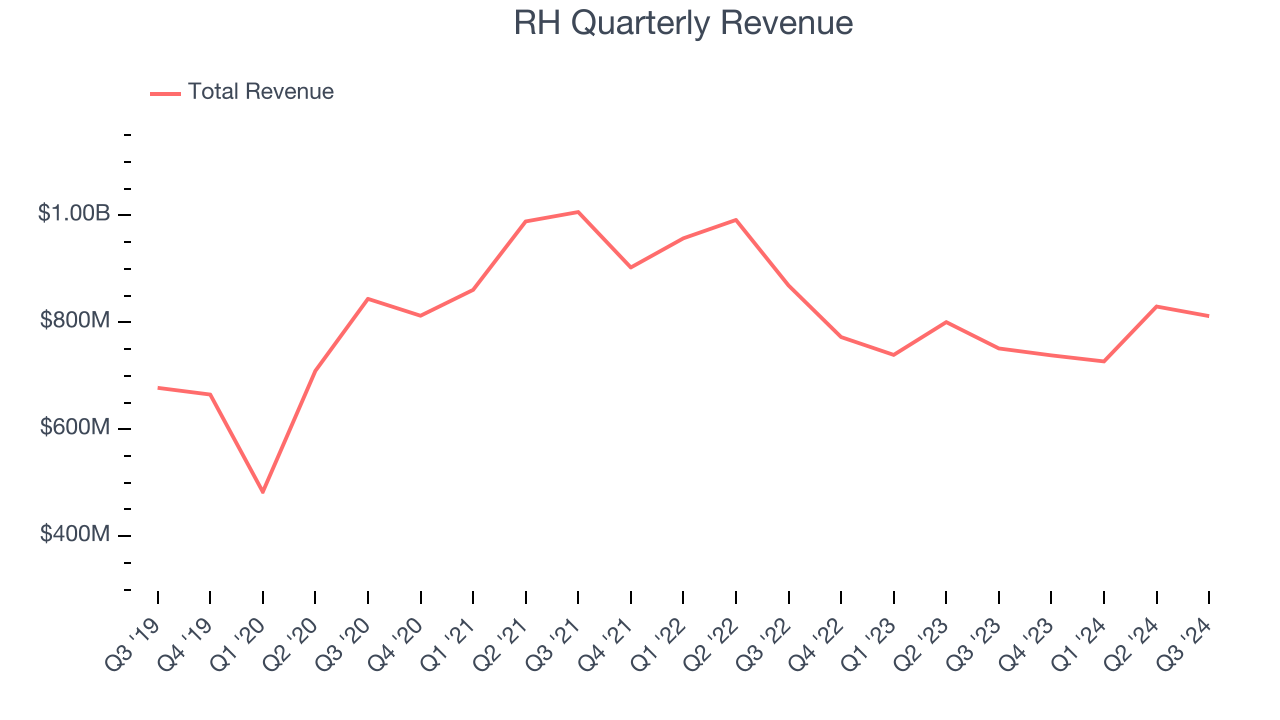

As you can see below, RH’s 3.2% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was sluggish.

This quarter, RH grew its revenue by 8.1% year on year, and its $811.7 million of revenue was in line with Wall Street’s estimates.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

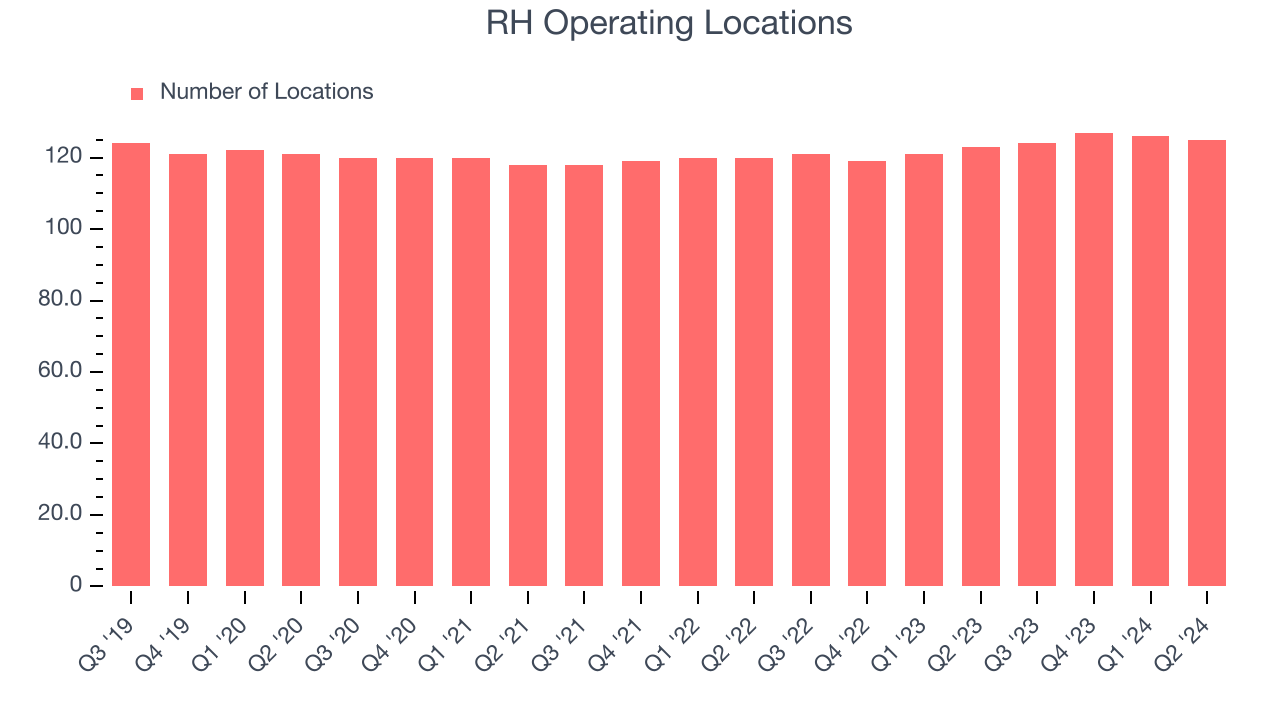

A retailer’s store count often determines how much revenue it can generate.

Over the last two years, RH opened new stores quickly, averaging 2.6% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that RH reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

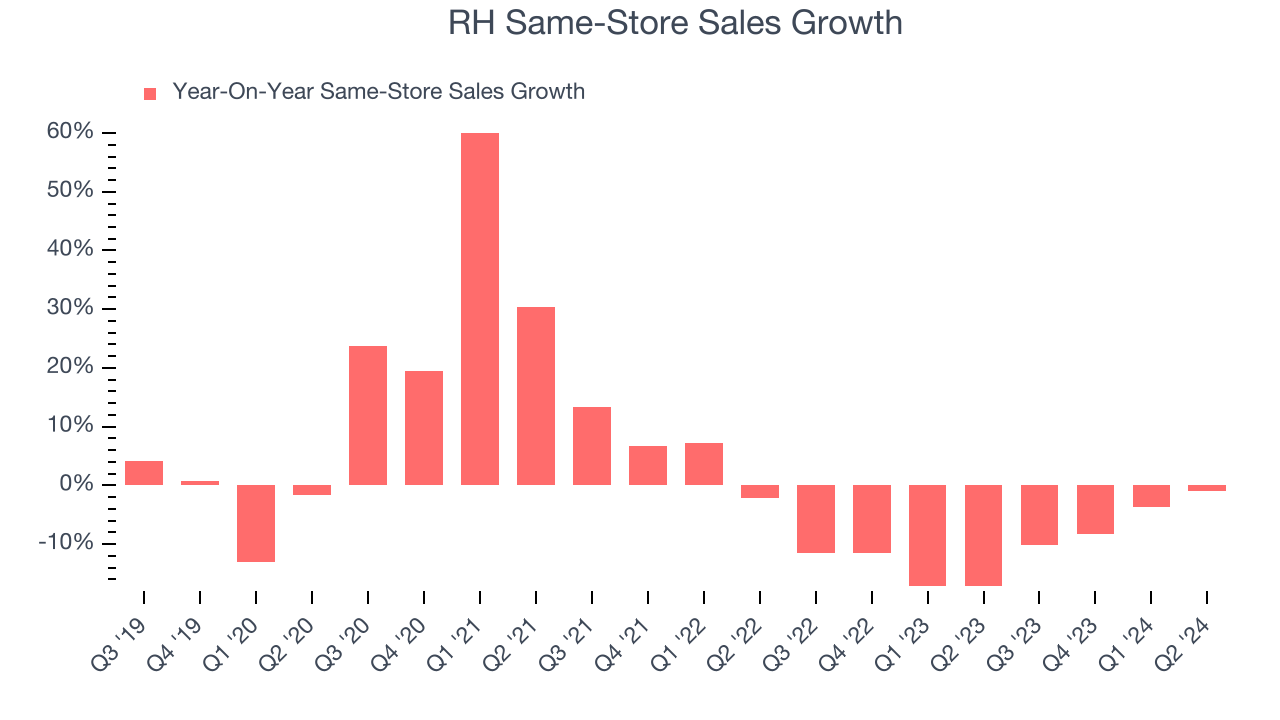

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

RH’s demand has been shrinking over the last two years as its same-store sales have averaged 9.8% annual declines. This performance is concerning - it shows RH artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

Note that RH reports its same-store sales intermittently, so some data points are missing in the chart below.

Key Takeaways from RH’s Q3 Results

It was great to see RH raise its full-year revenue and EBITDA guidance as demand accelerated in November. On the other hand, this quarter's gross margin and EBITDA fell short of Wall Street’s estimates, but the market seemed to weigh the outlook more. The stock traded up 21.2% to $462 immediately following the results.

Is RH an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.