As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the building materials industry, including Sherwin-Williams (NYSE:SHW) and its peers.

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

The 9 building materials stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 1% while next quarter’s revenue guidance was 2.8% above.

Thankfully, share prices of the companies have been resilient as they are up 7.9% on average since the latest earnings results.

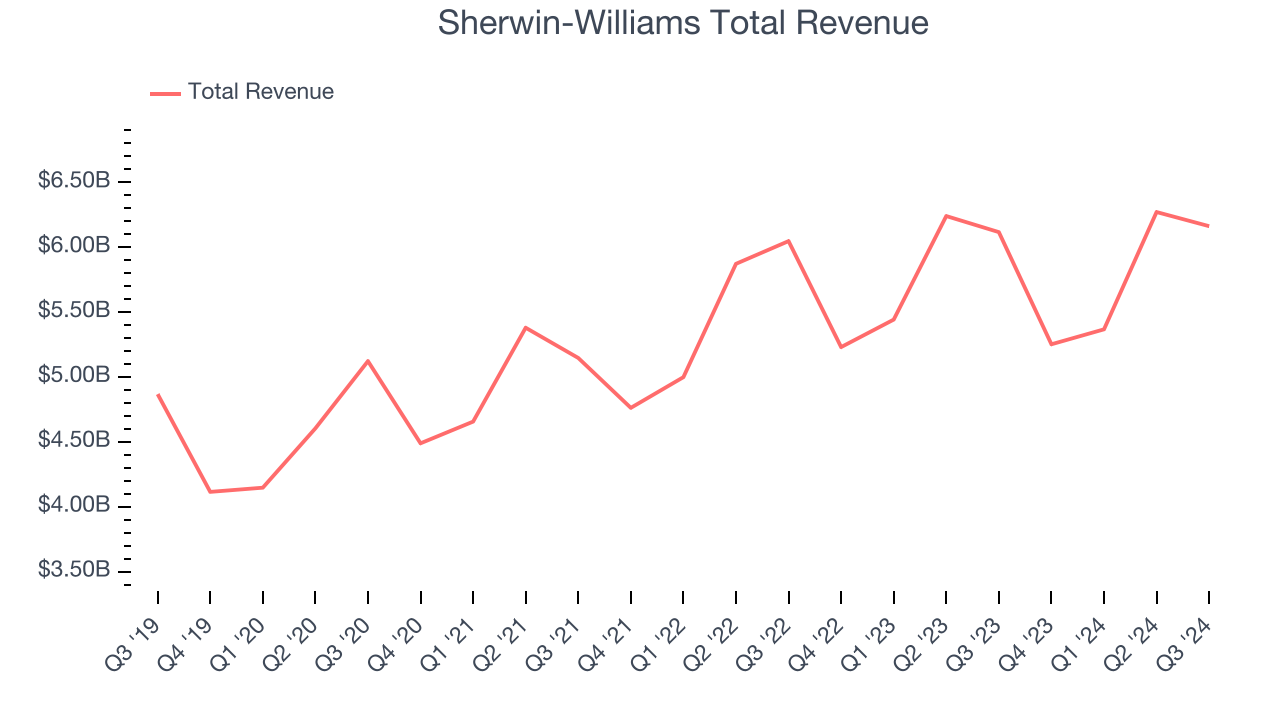

Weakest Q3: Sherwin-Williams (NYSE:SHW)

Widely known for its success in the paint industry, Sherwin-Williams (NYSE:SHW) is a manufacturer of paints, coatings, and related products.

Sherwin-Williams reported revenues of $6.16 billion, flat year on year. This print fell short of analysts’ expectations by 0.6%. Overall, it was a softer quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

"Sherwin-Williams grew sales, expanded gross margin, and increased EBITDA and adjusted diluted net income per share despite continued choppiness in the demand environment," said President and Chief Executive Officer, Heidi G. Petz.

Unsurprisingly, the stock is down 4.6% since reporting and currently trades at $363.86.

Read our full report on Sherwin-Williams here, it’s free.

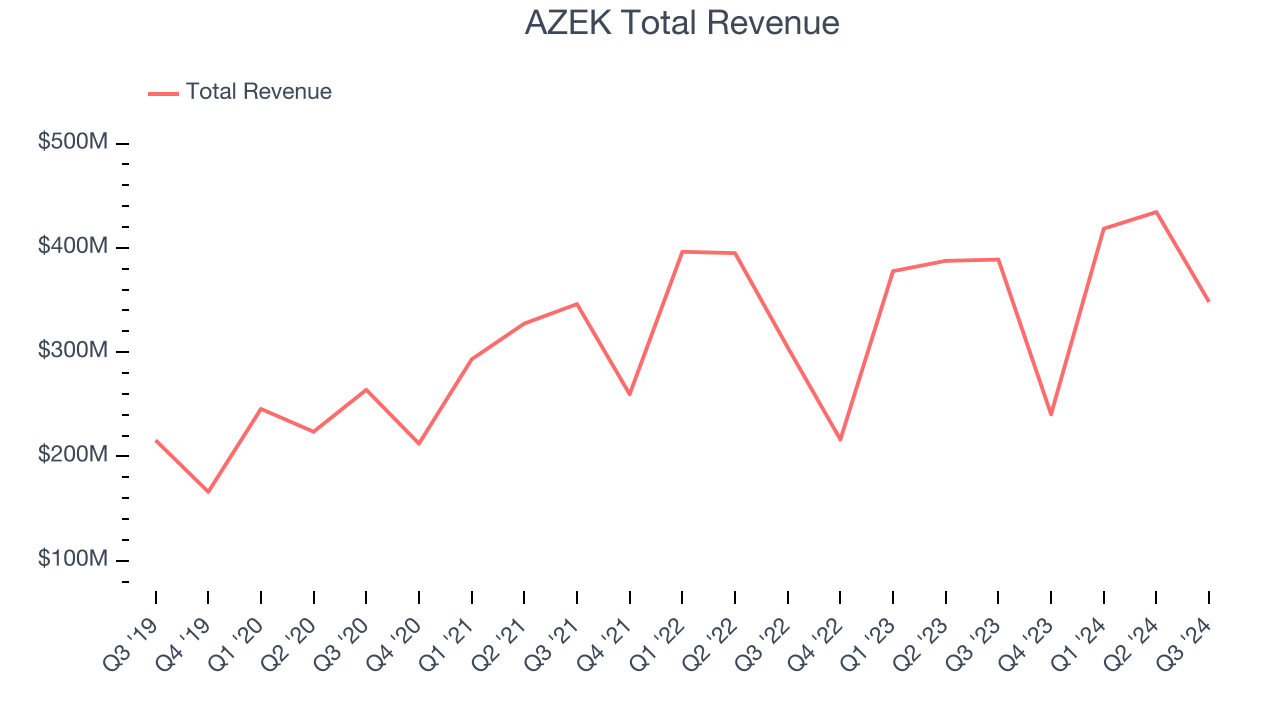

Best Q3: AZEK (NYSE:AZEK)

With a significant portion of its products made from recycled materials, AZEK (NYSE:AZEK) designs and manufactures goods for outdoor living spaces.

AZEK reported revenues of $348.2 million, down 10.4% year on year, outperforming analysts’ expectations by 2.4%. The business had a strong quarter with a solid beat of analysts’ adjusted operating income and organic revenue estimates.

AZEK delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 15% since reporting. It currently trades at $53.44.

Is now the time to buy AZEK? Access our full analysis of the earnings results here, it’s free.

Carlisle (NYSE:CSL)

Originally founded as Carlisle Tire and Rubber Company, Carlisle Companies (NYSE:CSL) is a multi-industry product manufacturer focusing on construction materials and weatherproofing technologies.

Carlisle reported revenues of $1.33 billion, up 5.9% year on year, falling short of analysts’ expectations by 3.3%. It was a softer quarter as it posted a significant miss of analysts’ organic revenue and EBITDA estimates.

As expected, the stock is down 8.3% since the results and currently trades at $420.81.

Read our full analysis of Carlisle’s results here.

Armstrong World (NYSE:AWI)

Started as a two-man shop dating back to the 1860s, Armstrong (NYSE:AWI) provides ceiling and wall products to commercial and residential spaces.

Armstrong World reported revenues of $386.6 million, up 11.3% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a satisfactory quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations.

Armstrong World had the weakest full-year guidance update among its peers. The stock is up 12.9% since reporting and currently trades at $154.98.

Read our full, actionable report on Armstrong World here, it’s free.

Vulcan Materials (NYSE:VMC)

Founded in 1909, Vulcan Materials (NYSE:VMC) is a producer of construction aggregates, primarily crushed stone, sand, and gravel.

Vulcan Materials reported revenues of $2.00 billion, down 8.3% year on year. This print missed analysts’ expectations by 0.8%. Overall, it was a softer quarter as it also recorded a miss of analysts’ EPS estimates and full-year EBITDA guidance missing analysts’ expectations.

The stock is up 7.2% since reporting and currently trades at $278.09.

Read our full, actionable report on Vulcan Materials here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.