Matson currently trades at $146.22 and has been a dream stock for shareholders. It’s returned 270% since December 2019, tripling the S&P 500’s 89.1% gain. The company has also beaten the index over the past six months as its stock price is up 21.2% thanks to its solid quarterly results.

Is there a buying opportunity in Matson, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the momentum, we don't have much confidence in Matson. Here are three reasons why MATX doesn't excite us and a stock we'd rather own.

Why Is Matson Not Exciting?

Founded by a Swedish orphan, Matson (NYSE:MATX) is a provider of ocean transportation and logistics services.

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Matson’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 16.9% over the last two years. Matson isn’t alone in its struggles as the Marine Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

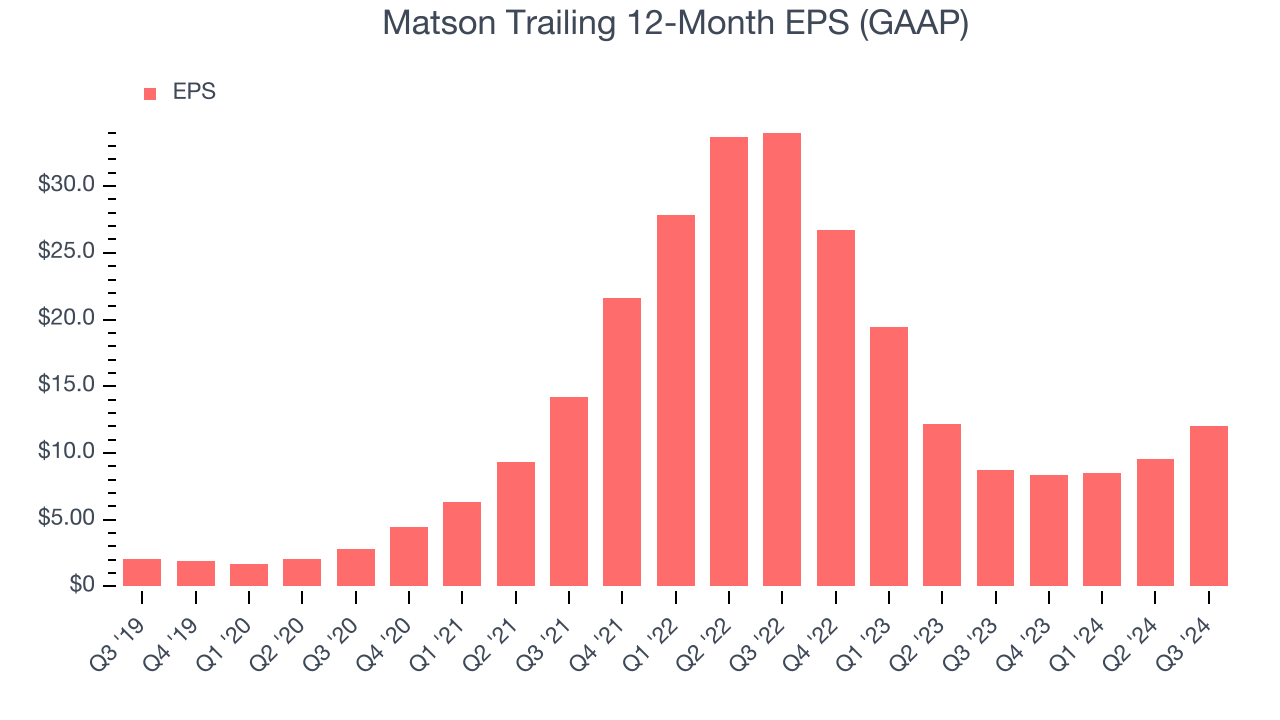

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Matson, its EPS declined by more than its revenue over the last two years, dropping 40.5%. This tells us the company struggled to adjust to shrinking demand.

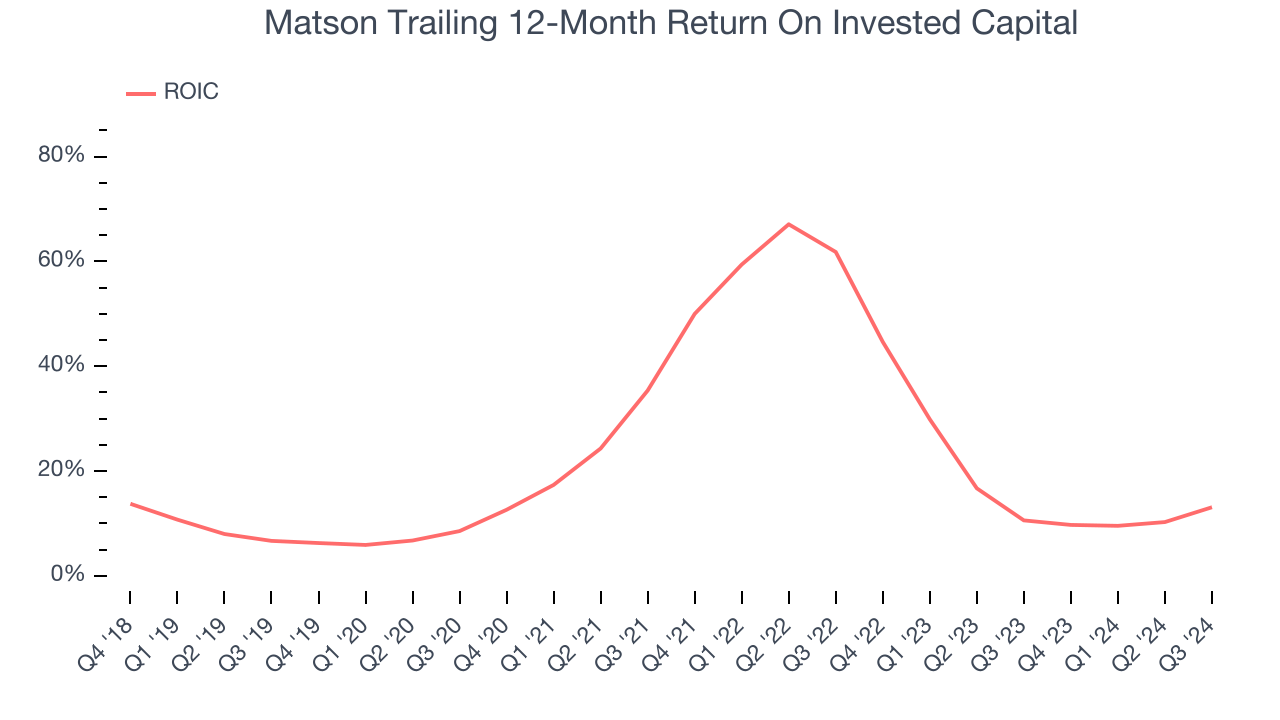

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Matson’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Matson’s business quality ultimately falls short of our standards. With its shares outperforming the market lately, the stock trades at 15.1× forward price-to-earnings (or $146.22 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward Microsoft, the most dominant software business in the world.

Stocks We Like More Than Matson

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.