Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Lincoln Electric (NASDAQ:LECO) and the best and worst performers in the professional tools and equipment industry.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 10 professional tools and equipment stocks we track reported a slower Q3. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 3% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Lincoln Electric (NASDAQ:LECO)

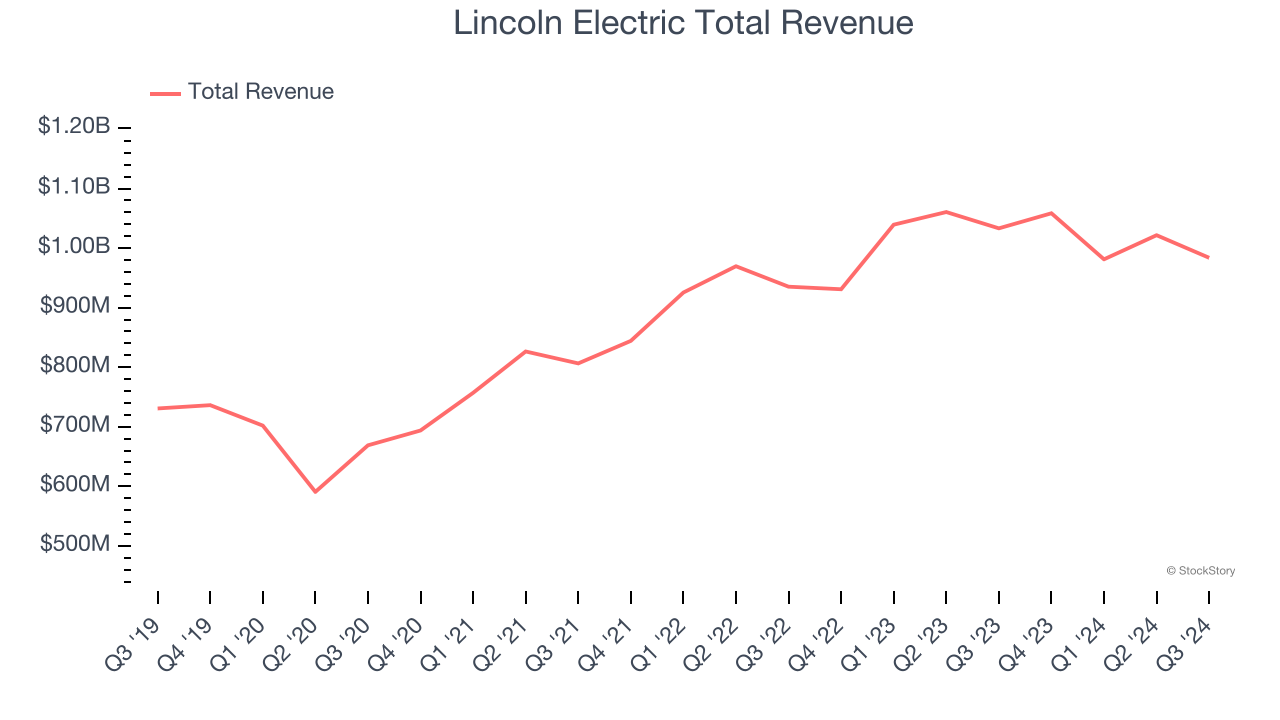

Headquartered in Ohio, Lincoln Electric (NASDAQ:LECO) manufactures and sells welding equipment for various industries.

Lincoln Electric reported revenues of $983.8 million, down 4.8% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with an impressive beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ organic revenue estimates.

“Third quarter results demonstrated the resilience of our business as benefits from our strategic initiatives, diligent cost management, and lower employee-related costs generated solid profitability and cash flow performance,” stated Steven B. Hedlund, President and Chief Executive Officer.

Interestingly, the stock is up 2% since reporting and currently trades at $201.42.

Read our full report on Lincoln Electric here, it’s free.

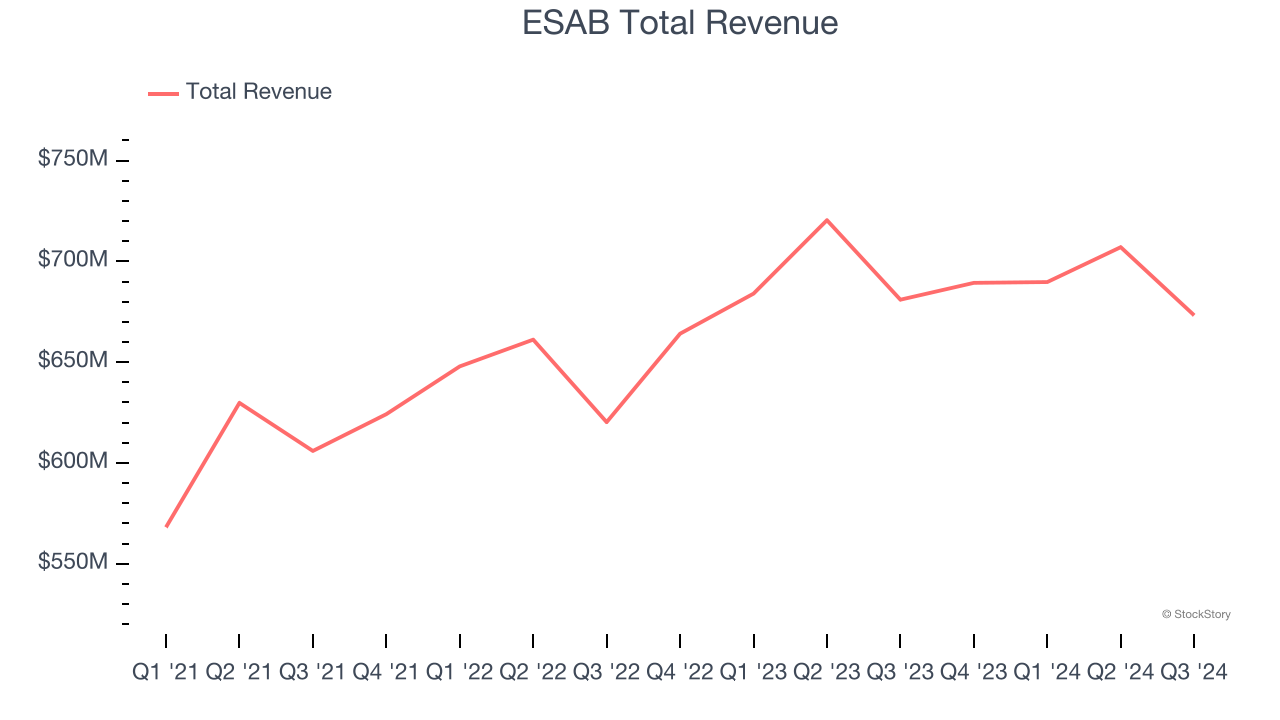

Best Q3: ESAB (NYSE:ESAB)

Having played a significant role in the construction of the iconic Sydney Opera House, ESAB (NYSE:ESAB) manufactures and sells welding and cutting equipment for numerous industries.

ESAB reported revenues of $673.3 million, down 1.1% year on year, outperforming analysts’ expectations by 8.9%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

ESAB achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 15.8% since reporting. It currently trades at $129.01.

Is now the time to buy ESAB? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Hyster-Yale Materials Handling (NYSE:HY)

Playing a significant role in the development of the hydraulic lift truck, Hyster-Yale (NYSE:HY) designs, manufactures, and sells materials handling equipment to various sectors.

Hyster-Yale Materials Handling reported revenues of $1.02 billion, up 1.5% year on year, falling short of analysts’ expectations by 3.8%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 14% since the results and currently trades at $53.91.

Read our full analysis of Hyster-Yale Materials Handling’s results here.

Hillman (NASDAQ:HLMN)

Established when Max Hillman purchased a franchise operation, Hillman (NASDAQ:HLMN) designs, manufactures, and sells industrial equipment and systems for various sectors.

Hillman reported revenues of $393.3 million, down 1.4% year on year. This print topped analysts’ expectations by 1%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ adjusted operating income estimates and full-year EBITDA guidance beating analysts’ expectations.

The stock is up 1.2% since reporting and currently trades at $10.86.

Read our full, actionable report on Hillman here, it’s free.

Fortive (NYSE:FTV)

Taking its name from the Latin root of "strong", Fortive (NYSE:FTV) manufactures products and develops industrial software for numerous industries.

Fortive reported revenues of $1.53 billion, up 2.7% year on year. This number lagged analysts' expectations by 1.2%. Zooming out, it was a mixed quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates but a miss of analysts’ organic revenue estimates.

The stock is up 3% since reporting and currently trades at $76.85.

Read our full, actionable report on Fortive here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.