Social club operator Soho House (NYSE:SHCO) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 10.8% year on year to $333.4 million. On the other hand, the company’s full-year revenue guidance of $1.2 billion at the midpoint came in 2.2% below analysts’ estimates. Its GAAP loss of $0 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy Soho House? Find out by accessing our full research report, it’s free.

Soho House (SHCO) Q3 CY2024 Highlights:

- The company received an offer from a new third-party consortium to acquire the Company for $9.00 per share, representing a premium of 83% to the closing price as of Wednesday, December 18, 2024

- Revenue: $333.4 million vs analyst estimates of $333.9 million (10.8% year-on-year growth, in line)

- Adjusted EPS: $0 vs analyst estimates of -$0.02 ($0.02 beat)

- Adjusted EBITDA: $48.28 million vs analyst estimates of $47.39 million (14.5% margin, 1.9% beat)

- The company dropped its revenue guidance for the full year to $1.2 billion at the midpoint from $1.23 billion, a 2% decrease

- EBITDA guidance for the full year is $140 million at the midpoint, below analyst estimates of $159.1 million

- Operating Margin: 11.4%, up from -6.8% in the same quarter last year

- Market Capitalization: $956.9 million

"Our third quarter results reflect the strength of our membership model. Membership revenues grew 17% year-on-year, while we achieved our highest ever quarterly Total revenues and Adjusted EBITDA. At the end of the period, we opened Soho Mews House in London, our 45th House, with great feedback from members. We have continued to see significant demand for other recent openings, including Sao Paulo, Mexico City and Portland,” said Andrew Carnie, CEO of Soho House & Co.

Company Overview

Boasting fancy locations in hubs such as NYC and Miami, Soho House (NYSE:SHCO) is a global hospitality brand offering exclusive private member clubs, hotels, and restaurants.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

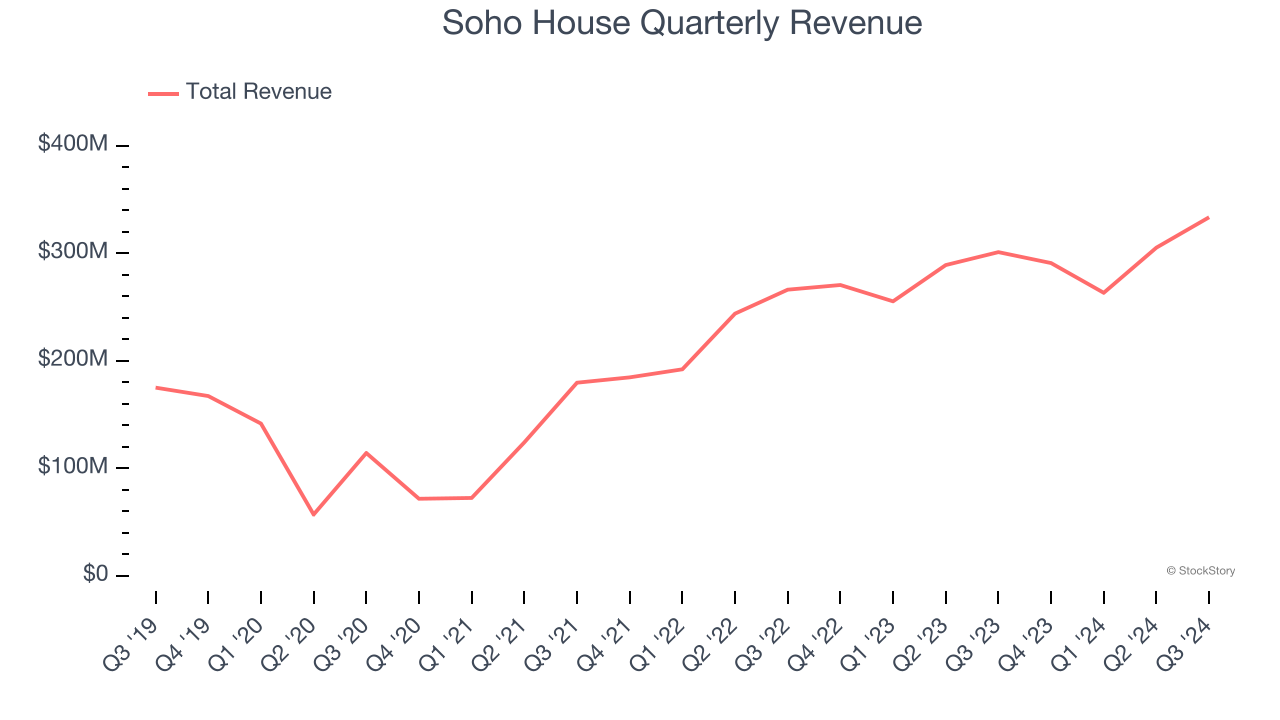

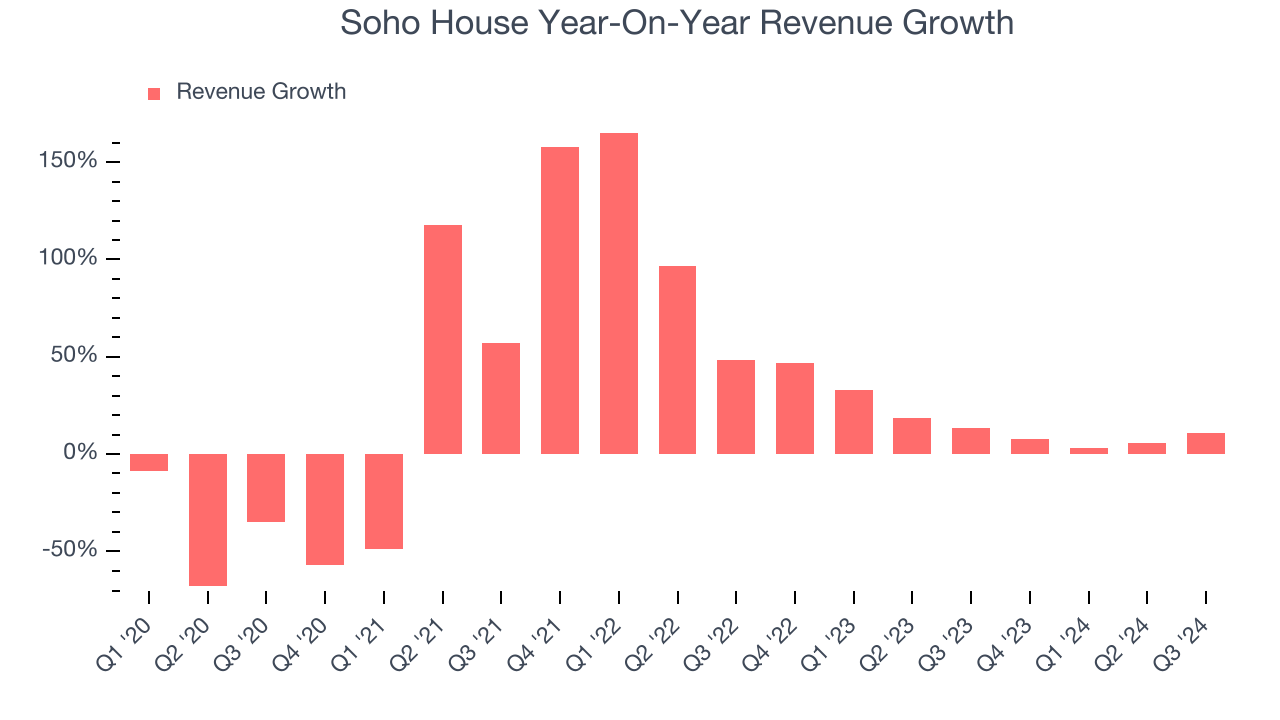

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Soho House grew its sales at a 12.1% annual rate. Although this growth is solid on an absolute basis, it fell short of our benchmark for the consumer discretionary sector.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Soho House’s annualized revenue growth of 16% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Soho House’s year-on-year revenue growth was 10.8%, and its $333.4 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.9% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

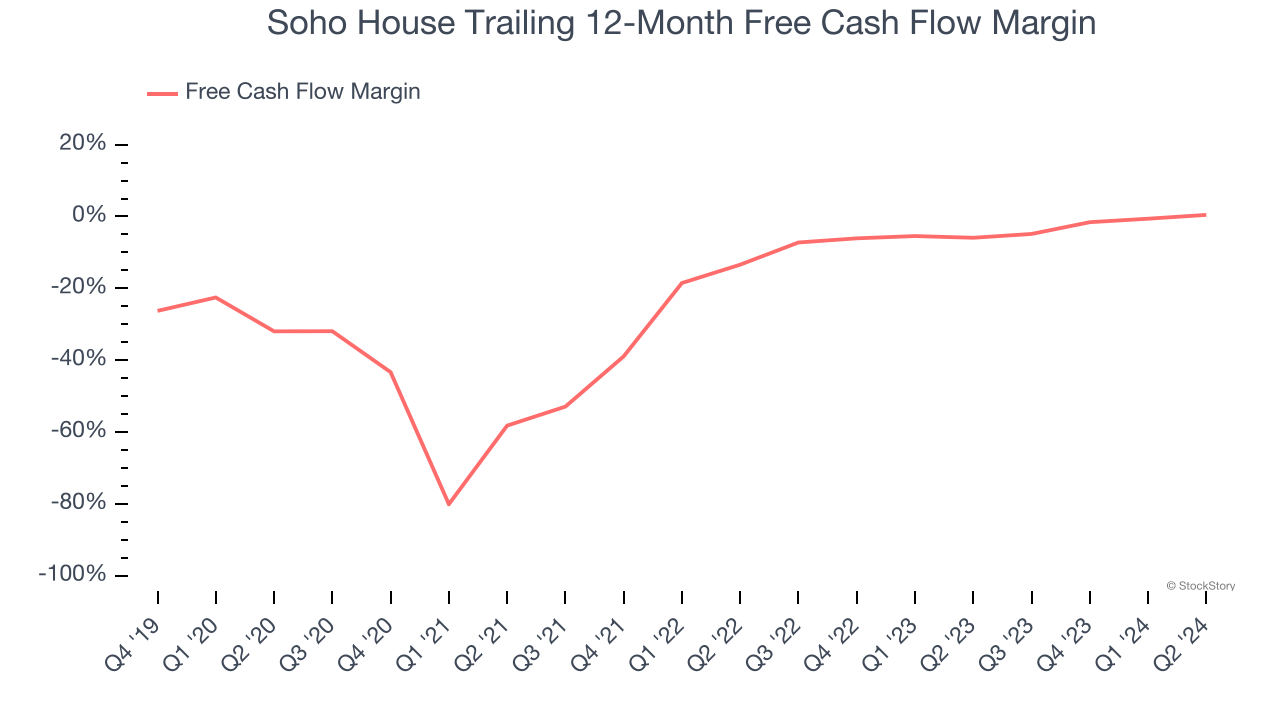

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, Soho House’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 2.7%, meaning it lit $2.73 of cash on fire for every $100 in revenue.

Key Takeaways from Soho House’s Q3 Results

The company received an offer from a new third-party consortium to acquire the Company for $9.00 per share, representing a premium of 83% to the closing price as of Wednesday, December 18, 2024. This is driving the stock action. As for the quarter, we were impressed by how Soho House beat analysts’ EPS expectations this quarter. On the other hand, full year revenue guidance was lowered, which is never a good sign. The stock traded up 64% to $8.07 immediately following the results.

Is Soho House an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.