Wrapping up Q3 earnings, we look at the numbers and key takeaways for the general industrial machinery stocks, including Kadant (NYSE:KAI) and its peers.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 15 general industrial machinery stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 5.5% below.

In light of this news, share prices of the companies have held steady as they are up 3.7% on average since the latest earnings results.

Kadant (NYSE:KAI)

Headquartered in Massachusetts, Kadant (NYSE:KAI) is a global supplier of high-value, critical components and engineered systems used in process industries worldwide.

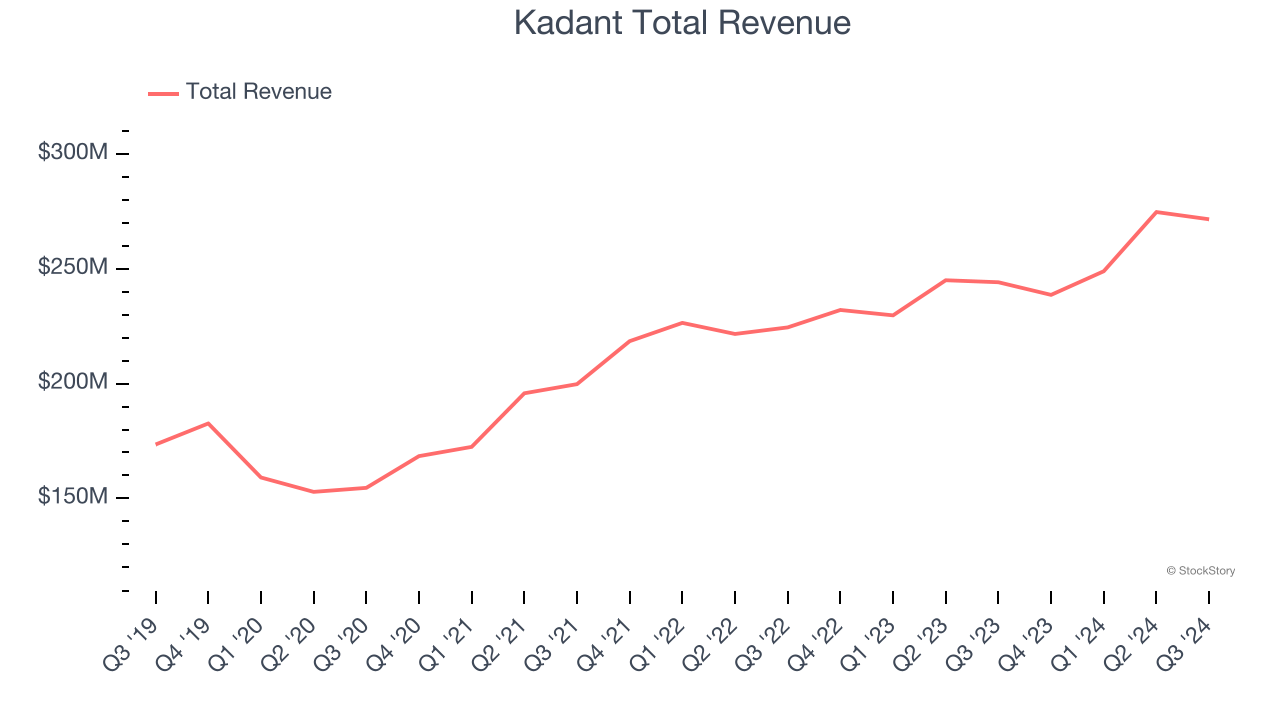

Kadant reported revenues of $271.6 million, up 11.2% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

Management Commentary“We delivered another solid quarter with excellent operational execution leading to outstanding margin performance and record adjusted EPS,” said Jeffrey L. Powell, president and chief executive officer of Kadant Inc.

Interestingly, the stock is up 10.5% since reporting and currently trades at $354.71.

Is now the time to buy Kadant? Access our full analysis of the earnings results here, it’s free.

Best Q3: Luxfer (NYSE:LXFR)

With its magnesium alloys used in the construction of the famous Spirit of St. Louis aircraft, Luxfer (NYSE:LXFR) offers specialized materials, components, and gas containment devices to various industries.

Luxfer reported revenues of $99.4 million, up 2.1% year on year, outperforming analysts’ expectations by 15.9%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Luxfer achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 2.9% since reporting. It currently trades at $13.12.

Is now the time to buy Luxfer? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Icahn Enterprises (NASDAQ:IEP)

Founded in 1987, Icahn Enterprises (NASDAQ: IEP) is a diversified holding company primarily engaged in investment and asset management across various sectors.

Icahn Enterprises reported revenues of $2.22 billion, down 25.7% year on year, falling short of analysts’ expectations by 4.1%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Icahn Enterprises delivered the slowest revenue growth in the group. As expected, the stock is down 23.3% since the results and currently trades at $9.89.

Read our full analysis of Icahn Enterprises’s results here.

Honeywell (NASDAQ:HON)

Originally founded in 1906 as a thermostat company, Honeywell (NASDAQ:HON) is a multinational conglomerate known for its aerospace systems, building technologies, performance materials, and safety and productivity solutions.

Honeywell reported revenues of $9.73 billion, up 5.6% year on year. This result lagged analysts' expectations by 1.8%. More broadly, it was a mixed quarter as it also logged a solid beat of analysts’ EBITDA estimates but a miss of analysts’ organic revenue estimates.

The stock is up 3.4% since reporting and currently trades at $227.79.

Read our full, actionable report on Honeywell here, it’s free.

Hillenbrand (NYSE:HI)

Hillenbrand, Inc. (NYSE: HI) is an industrial company that designs, manufactures, and sells highly engineered processing equipment and solutions for various industries.

Hillenbrand reported revenues of $837.6 million, up 9.8% year on year. This print topped analysts’ expectations by 5.6%. Aside from that, it was a slower quarter as it logged full-year EBITDA guidance missing analysts’ expectations.

Hillenbrand had the weakest full-year guidance update among its peers. The stock is down 1.9% since reporting and currently trades at $29.63.

Read our full, actionable report on Hillenbrand here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.