The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Middleby (NASDAQ:MIDD) and the rest of the professional tools and equipment stocks fared in Q3.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 10 professional tools and equipment stocks we track reported a slower Q3. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 3% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.5% since the latest earnings results.

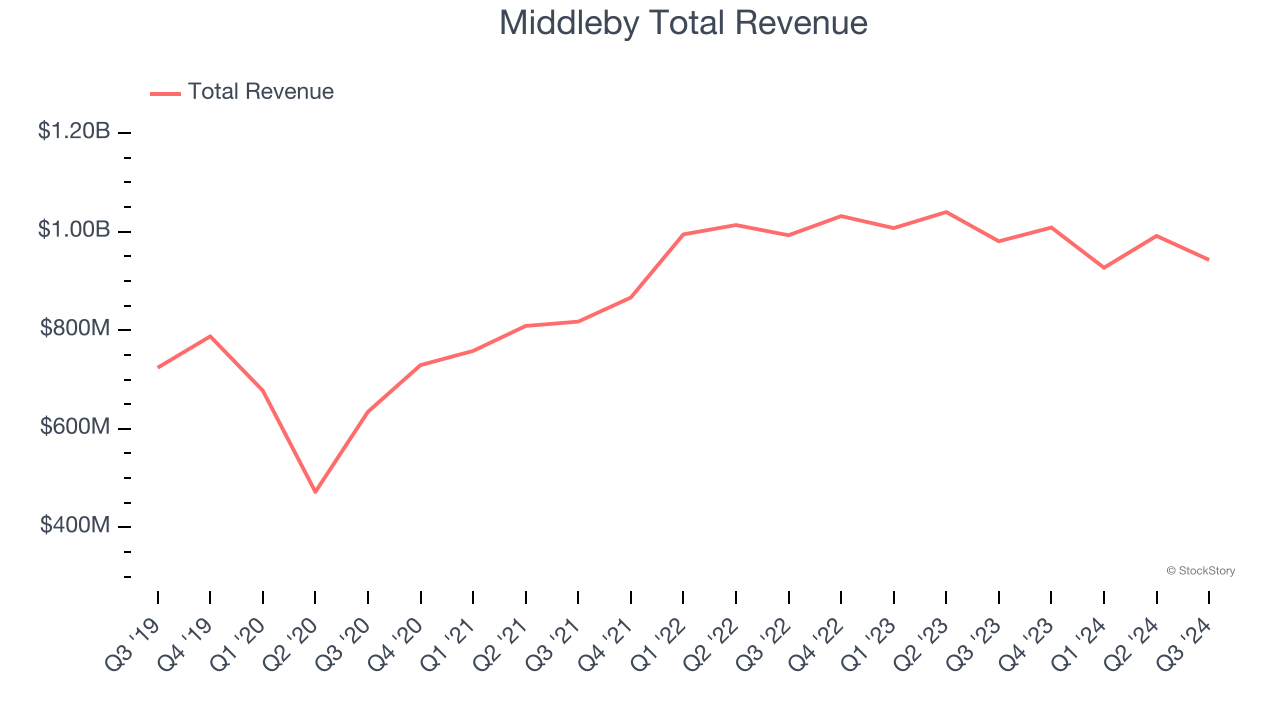

Middleby (NASDAQ:MIDD)

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE:MIDD) is a food service and equipment manufacturer.

Middleby reported revenues of $942.8 million, down 3.9% year on year. This print fell short of analysts’ expectations by 5.4%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

We have continued to resiliently execute on our strategic initiatives focused on the launch of industry leading product innovations and differentiated go-to market capabilities, which have us uniquely positioned and are confident will drive long-term profitable growth. The pipeline of opportunities with customers and new product innovations continues to build, while customer engagement remains at an all-time high. We anticipate the challenging current industry macro-conditions will improve in 2025 and will lead into a multi-year recovery favorably supporting growth at all three of our foodservice segments,” said Tim FitzGerald, CEO of The Middleby Corporation.

Middleby delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 5.5% since reporting and currently trades at $132.61.

Read our full report on Middleby here, it’s free.

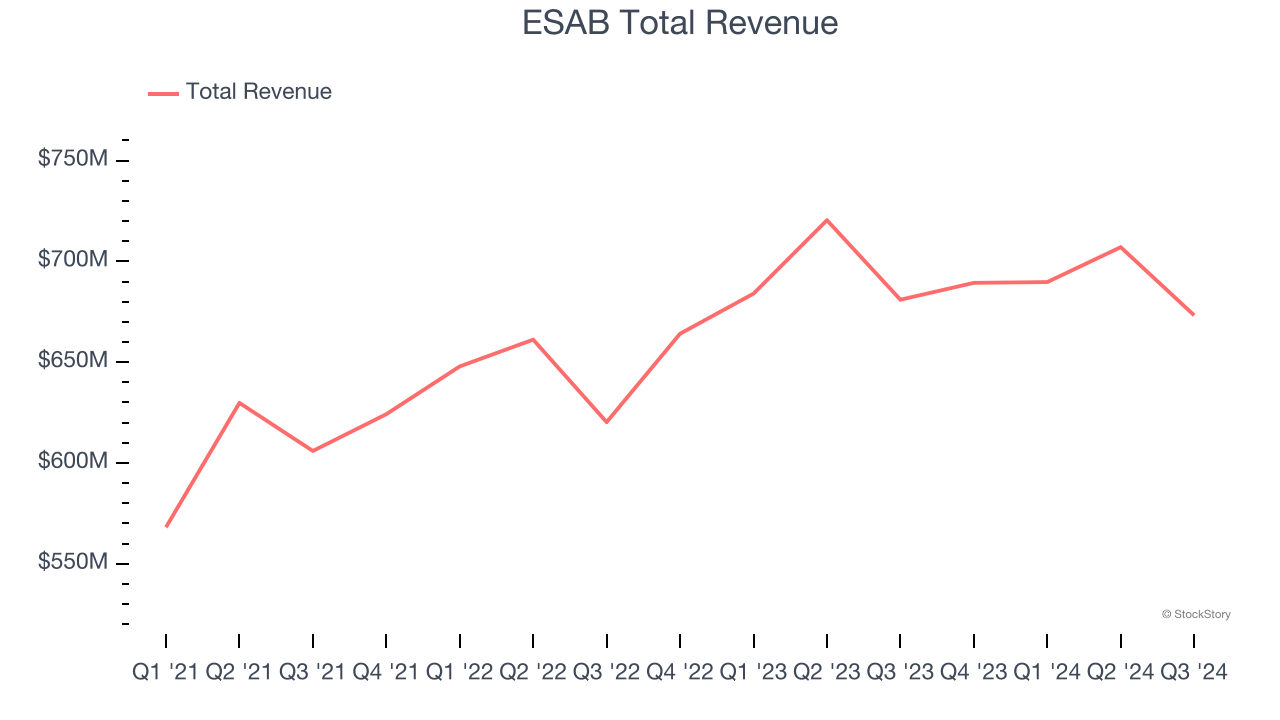

Best Q3: ESAB (NYSE:ESAB)

Having played a significant role in the construction of the iconic Sydney Opera House, ESAB (NYSE:ESAB) manufactures and sells welding and cutting equipment for numerous industries.

ESAB reported revenues of $673.3 million, down 1.1% year on year, outperforming analysts’ expectations by 8.9%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

ESAB delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 6.8% since reporting. It currently trades at $119.01.

Is now the time to buy ESAB? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Hyster-Yale Materials Handling (NYSE:HY)

Playing a significant role in the development of the hydraulic lift truck, Hyster-Yale (NYSE:HY) designs, manufactures, and sells materials handling equipment to various sectors.

Hyster-Yale Materials Handling reported revenues of $1.02 billion, up 1.5% year on year, falling short of analysts’ expectations by 3.8%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 19.2% since the results and currently trades at $50.64.

Read our full analysis of Hyster-Yale Materials Handling’s results here.

Hillman (NASDAQ:HLMN)

Established when Max Hillman purchased a franchise operation, Hillman (NASDAQ:HLMN) designs, manufactures, and sells industrial equipment and systems for various sectors.

Hillman reported revenues of $393.3 million, down 1.4% year on year. This number beat analysts’ expectations by 1%. It was a strong quarter as it also put up an impressive beat of analysts’ adjusted operating income estimates and full-year EBITDA guidance beating analysts’ expectations.

The stock is down 6% since reporting and currently trades at $10.09.

Read our full, actionable report on Hillman here, it’s free.

Fortive (NYSE:FTV)

Taking its name from the Latin root of "strong", Fortive (NYSE:FTV) manufactures products and develops industrial software for numerous industries.

Fortive reported revenues of $1.53 billion, up 2.7% year on year. This result missed analysts’ expectations by 1.2%. Taking a step back, it was a mixed quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but a miss of analysts’ organic revenue estimates.

The stock is flat since reporting and currently trades at $74.52.

Read our full, actionable report on Fortive here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.