Since June 2024, Carrier Global has been in a holding pattern, posting a small return of 3.4% while floating around $66.39. This is close to the S&P 500’s 6.1% gain during that period.

Is there a buying opportunity in Carrier Global, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We don't have much confidence in Carrier Global. Here are three reasons why we avoid CARR and a stock we'd rather own.

Why Do We Think Carrier Global Will Underperform?

Founded by the inventor of air conditioning, Carrier Global (NYSE:CARR) manufactures heating, ventilation, air conditioning, and refrigeration products.

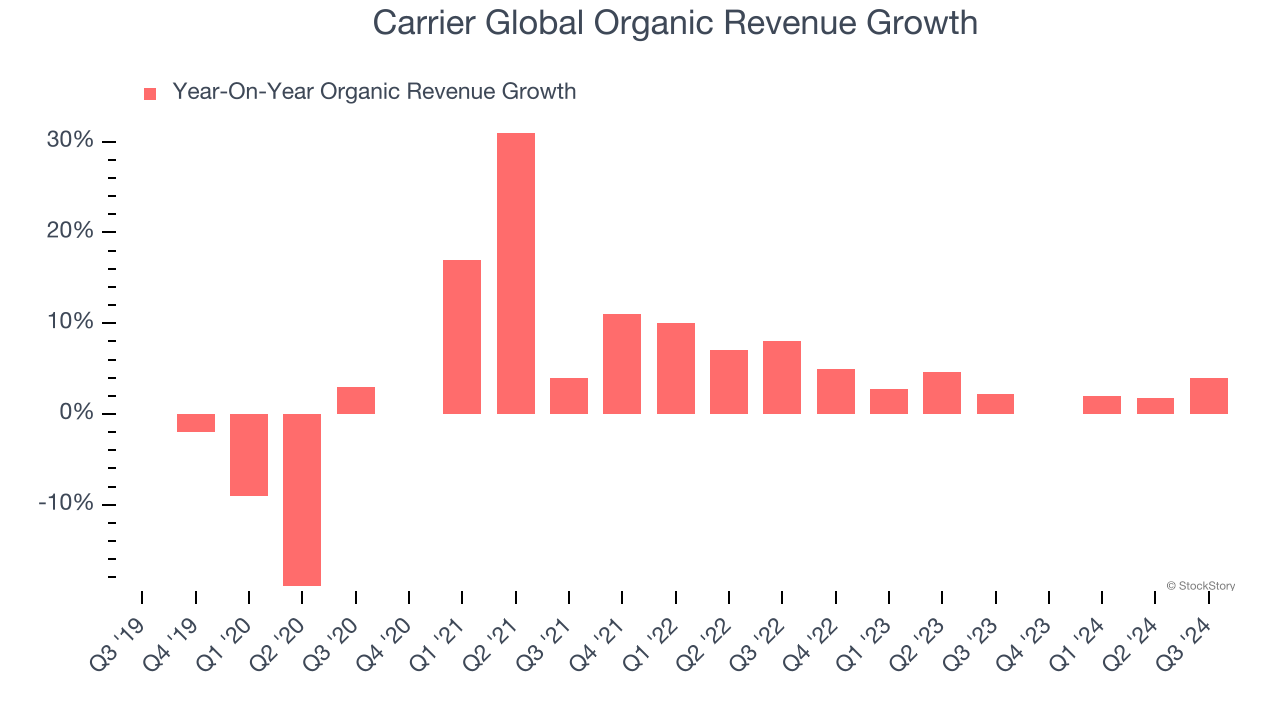

1. Slow Organic Growth Suggests Waning Demand In Core Business

In addition to reported revenue, organic revenue is a useful data point for analyzing HVAC and Water Systems companies. This metric gives visibility into Carrier Global’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Carrier Global’s organic revenue averaged 2.8% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

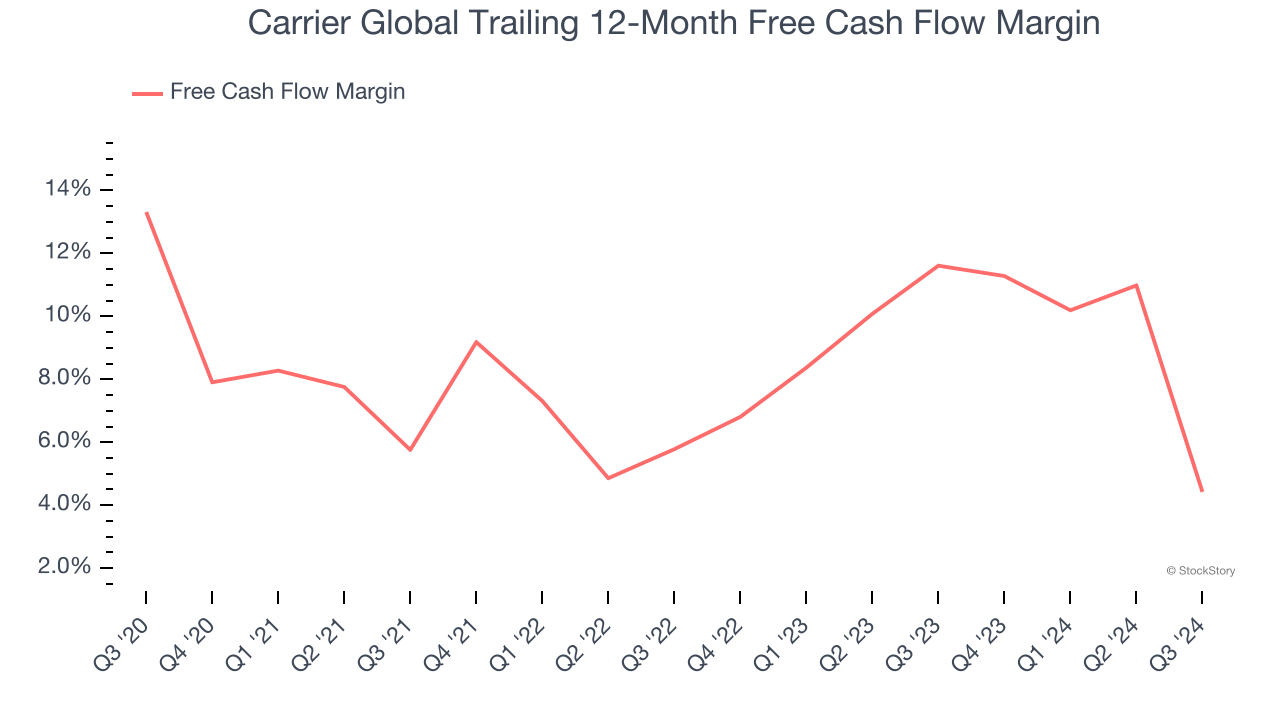

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Carrier Global’s margin dropped by 8.9 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. Carrier Global’s free cash flow margin for the trailing 12 months was 4.4%.

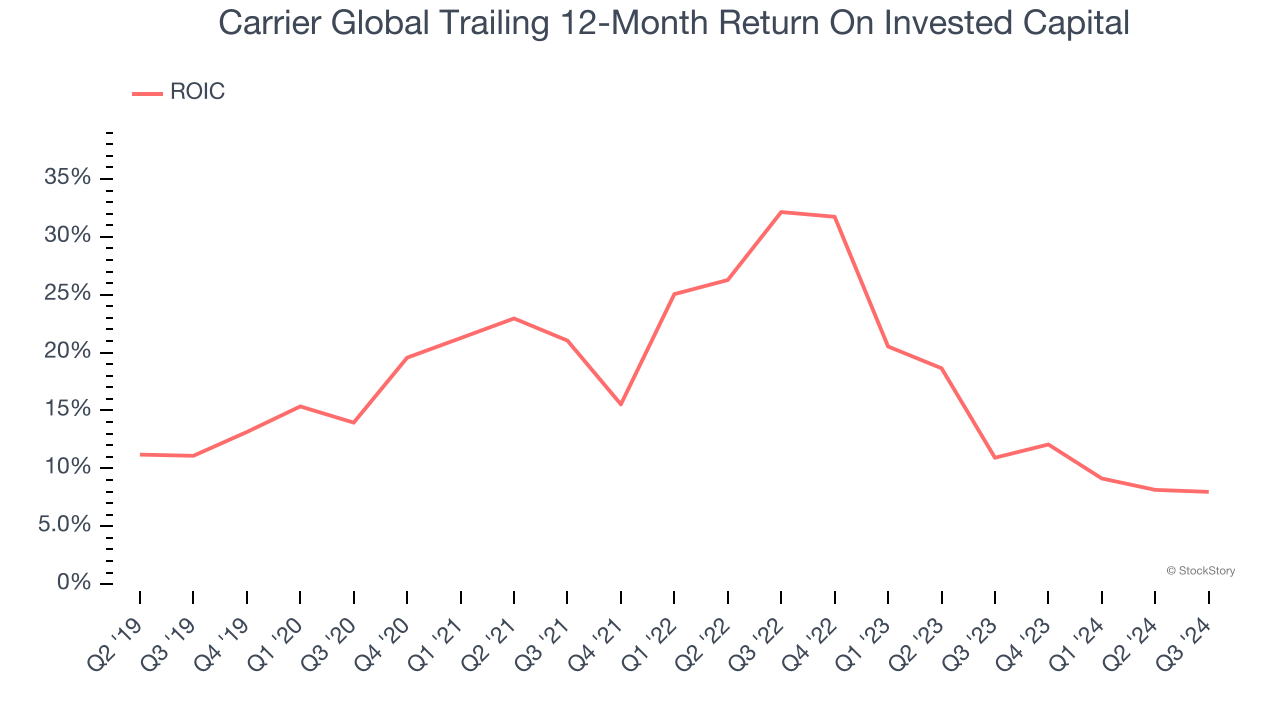

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, Carrier Global’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Carrier Global falls short of our quality standards. That said, the stock currently trades at 21.6× forward price-to-earnings (or $66.39 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d suggest looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Like More Than Carrier Global

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.