Over the past six months, Allient’s stock price fell to $22.10. Shareholders have lost 12.5% of their capital, which is disappointing considering the S&P 500 has climbed by 9.3%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Allient, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Even though the stock has become cheaper, we're cautious about Allient. Here are three reasons why you should be careful with ALNT and a stock we'd rather own.

Why Is Allient Not Exciting?

Founded in 1962, Allient (NASDAQ:ALNT) develops and manufactures precision and specialty-controlled motion components and systems.

1. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

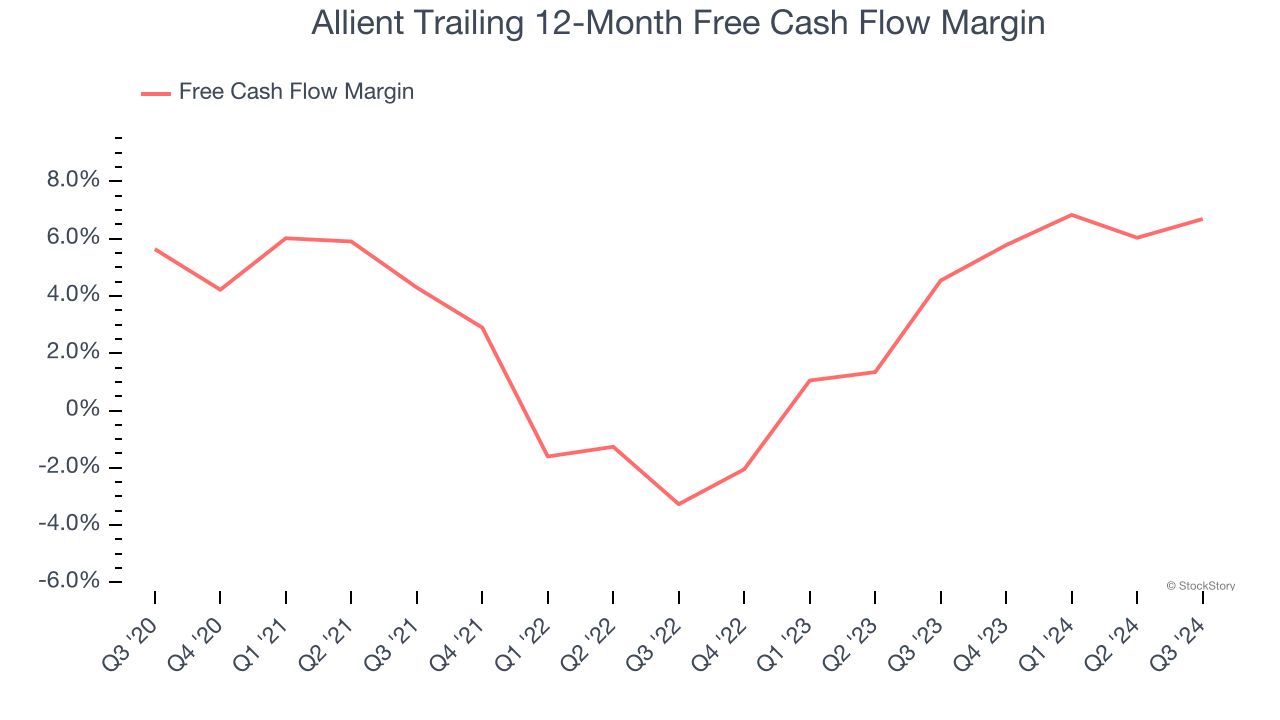

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Allient has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.6%, subpar for an industrials business.

2. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, Allient’s ROIC averaged 2 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

3. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Allient’s revenue to drop by 5.1%, a decrease from its 8.2% annualized growth for the past two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Final Judgment

Allient isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 12.6× forward price-to-earnings (or $22.10 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Would Buy Instead of Allient

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.