The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how UiPath (NYSE:PATH) and the rest of the automation software stocks fared in Q3.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 6 automation software stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.9% on average since the latest earnings results.

UiPath (NYSE:PATH)

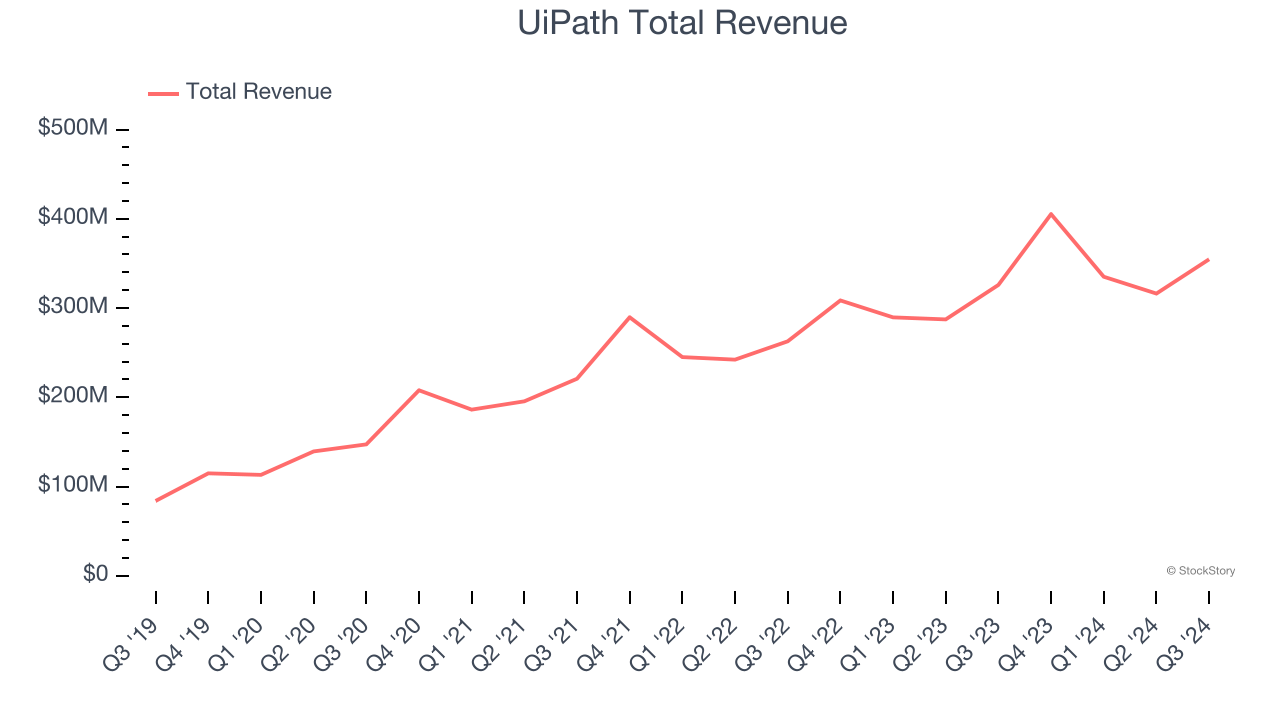

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $354.7 million, up 8.8% year on year. This print exceeded analysts’ expectations by 2%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

“Our customers’ response to the agentic automation vision and roadmap that we announced at FORWARD has been energizing and reinforces our leading position in the AI-powered automation market,” said Daniel Dines, UiPath Founder and Chief Executive Officer.

UiPath scored the biggest analyst estimates beat of the whole group. Still, the market seems discontent with the results. The stock is down 0.2% since reporting and currently trades at $13.05.

Is now the time to buy UiPath? Access our full analysis of the earnings results here, it’s free.

Best Q3: Microsoft (NASDAQ:MSFT)

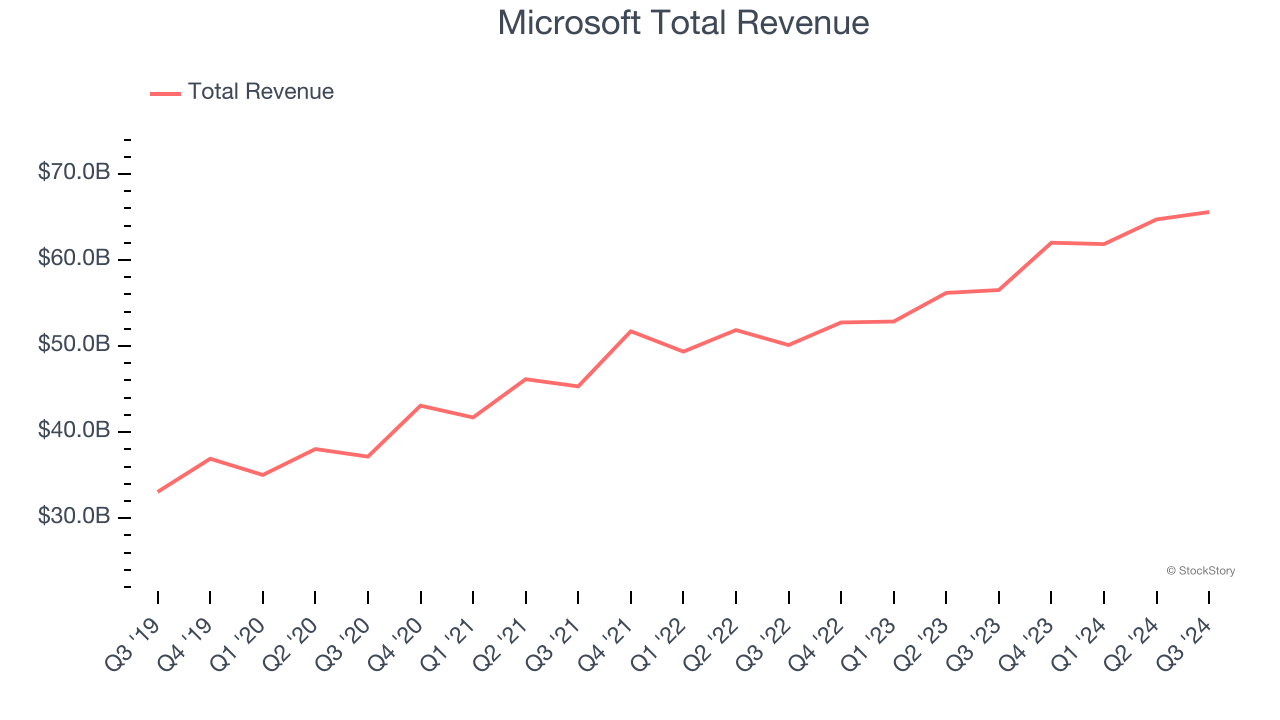

Short for microcomputer software, Microsoft (NASDAQ:MSFT) is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

Microsoft reported revenues of $65.59 billion, up 16% year on year, outperforming analysts’ expectations by 1.6%. The business had a strong quarter with a solid beat of analysts’ operating income estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $434.70.

Is now the time to buy Microsoft? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $325.1 million, down 2.9% year on year, falling short of analysts’ expectations by 0.8%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and billings estimates.

Pegasystems delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 36.2% since the results and currently trades at $94.95.

Read our full analysis of Pegasystems’s results here.

ServiceNow (NYSE:NOW)

Founded by Fred Luddy, who coded the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) is a software provider helping companies automate workflows across IT, HR, and customer service.

ServiceNow reported revenues of $2.80 billion, up 22.2% year on year. This print surpassed analysts’ expectations by 1.9%. More broadly, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ current remaining performance obligation estimates but decelerating growth in large customers.

ServiceNow scored the fastest revenue growth among its peers. The company added 32 enterprise customers paying more than $1 million annually to reach a total of 2,020. The stock is up 19.7% since reporting and currently trades at $1,086.

Read our full, actionable report on ServiceNow here, it’s free.

Appian (NASDAQ:APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Appian reported revenues of $154.1 million, up 12.4% year on year. This result beat analysts’ expectations by 1.3%. Aside from that, it was a satisfactory quarter as it also logged a solid beat of analysts’ EBITDA estimates.

Appian had the weakest full-year guidance update among its peers. The stock is down 15.1% since reporting and currently trades at $34.42.

Read our full, actionable report on Appian here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.