As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the heavy transportation equipment industry, including Allison Transmission (NYSE:ALSN) and its peers.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 14 heavy transportation equipment stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 1.2%.

While some heavy transportation equipment stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.7% since the latest earnings results.

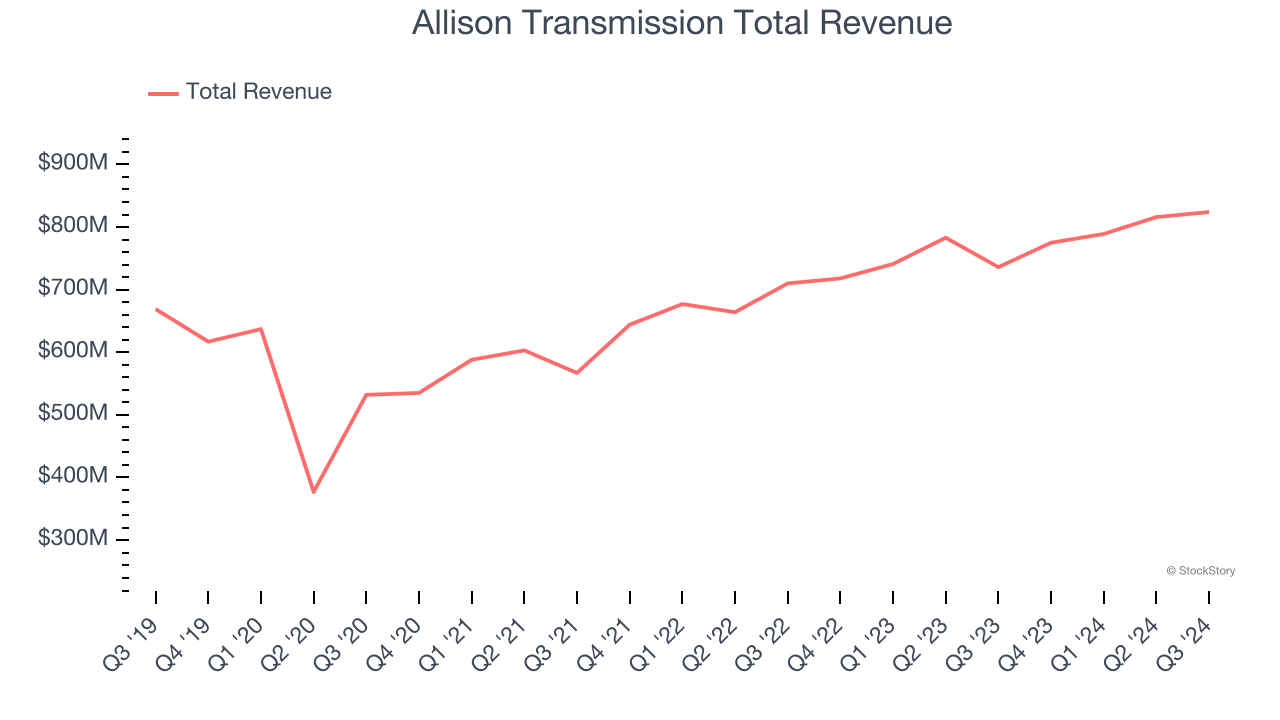

Allison Transmission (NYSE:ALSN)

Helping build race cars at one point, Allison Transmission (NYSE:ALSN) offers transmissions to original equipment manufacturers and fleet operators.

Allison Transmission reported revenues of $824 million, up 12% year on year. This print exceeded analysts’ expectations by 4.3%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates.

David S. Graziosi, Chair and Chief Executive Officer of Allison Transmission commented, "Demonstrated through our third quarter 2024 results, unprecedented demand for Class 8 vocational vehicles in our North America On-Highway end market continues to drive record performance for our business. Third quarter net sales increased 12 percent year over year, surpassed by an even stronger increase in diluted EPS, up 29 percent year over year to a quarterly record of $2.27 per share."

Interestingly, the stock is up 9.8% since reporting and currently trades at $109.83.

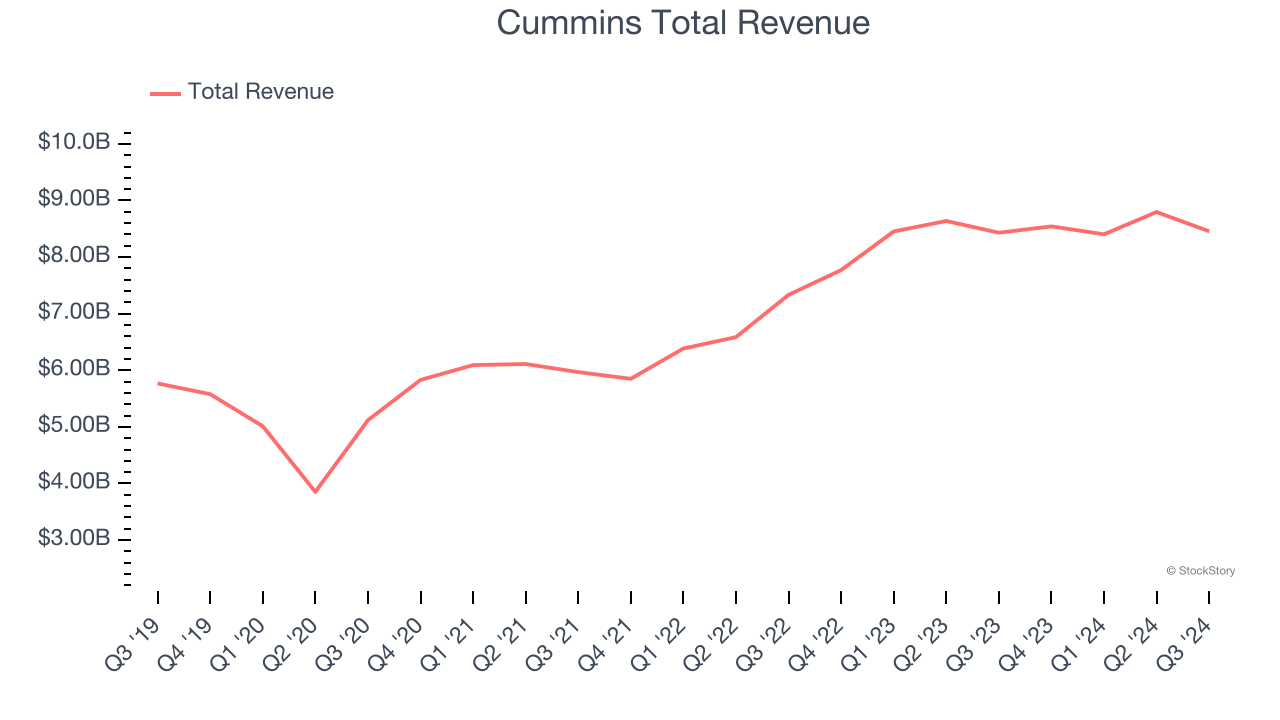

Best Q3: Cummins (NYSE:CMI)

With more than half of the heavy-duty truck market using its engines at one point, Cummins (NYSE:CMI) offers engines and power systems.

Cummins reported revenues of $8.46 billion, flat year on year, outperforming analysts’ expectations by 1.8%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 7.7% since reporting. It currently trades at $351.02.

Is now the time to buy Cummins? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Wabash (NYSE:WNC)

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $464 million, down 26.7% year on year, falling short of analysts’ expectations by 2.8%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 2.2% since the results and currently trades at $16.69.

Read our full analysis of Wabash’s results here.

Wabtec (NYSE:WAB)

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE:WAB) provides equipment, systems, and its related software for the railway industry.

Wabtec reported revenues of $2.66 billion, up 4.4% year on year. This number missed analysts’ expectations by 0.5%. Taking a step back, it was a satisfactory quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ organic revenue estimates.

The stock is up 1.7% since reporting and currently trades at $192.75.

Read our full, actionable report on Wabtec here, it’s free.

Greenbrier (NYSE:GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE:GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $1.05 billion, up 3.5% year on year. This result was in line with analysts’ expectations. Zooming out, it was a satisfactory quarter as it also logged a solid beat of analysts’ EPS estimates but a significant miss of analysts’ sales volume estimates.

The stock is up 20.3% since reporting and currently trades at $61.92.

Read our full, actionable report on Greenbrier here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.