Mister Car Wash has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 10.7% to $7.44 per share while the index has gained 8.8%.

Is now the time to buy Mister Car Wash, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We're swiping left on Mister Car Wash for now. Here are three reasons why you should be careful with MCW and a stock we'd rather own.

Why Do We Think Mister Car Wash Will Underperform?

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE:MCW) offers car washes across the United States through its conveyorized service.

1. Same-Store Sales Falling Behind Peers

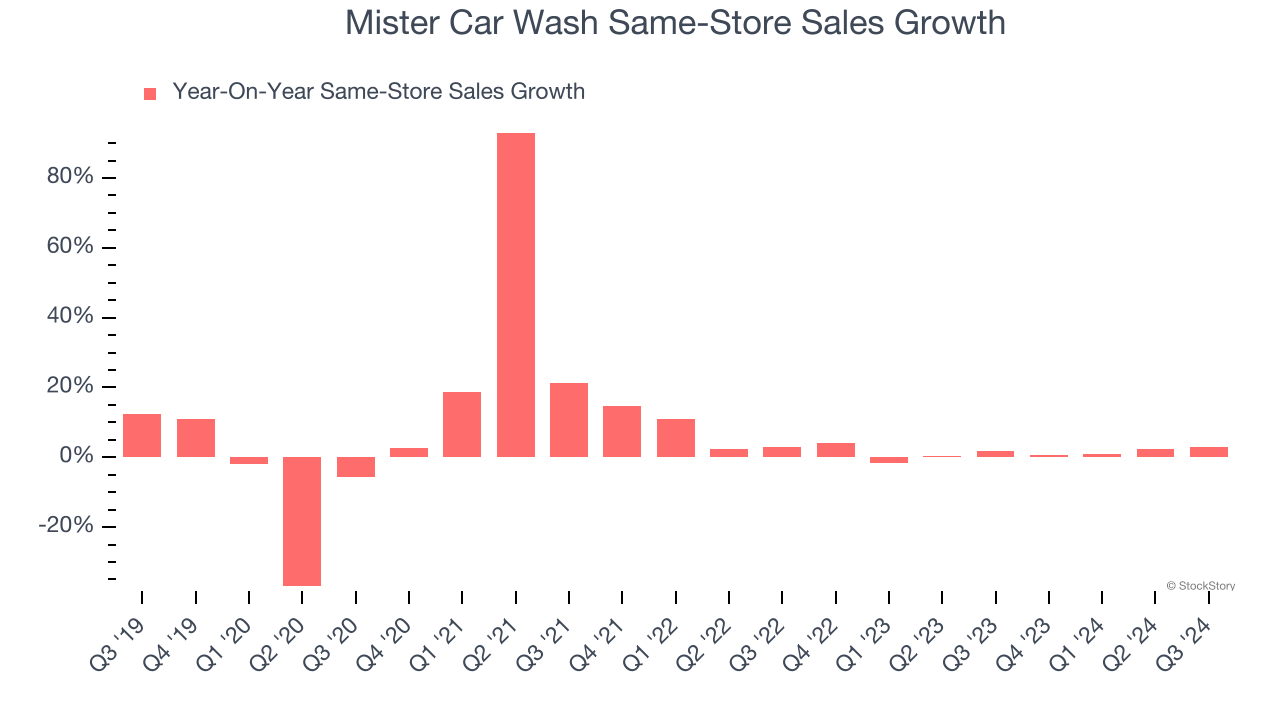

In addition to reported revenue, same-store sales are a useful data point for analyzing Specialized Consumer Services companies. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Mister Car Wash’s underlying demand characteristics.

Over the last two years, Mister Car Wash’s same-store sales averaged 1.4% year-on-year growth. This performance was underwhelming and suggests it might have to change its strategy or pricing, which can disrupt operations.

2. Cash Burn Ignites Concerns

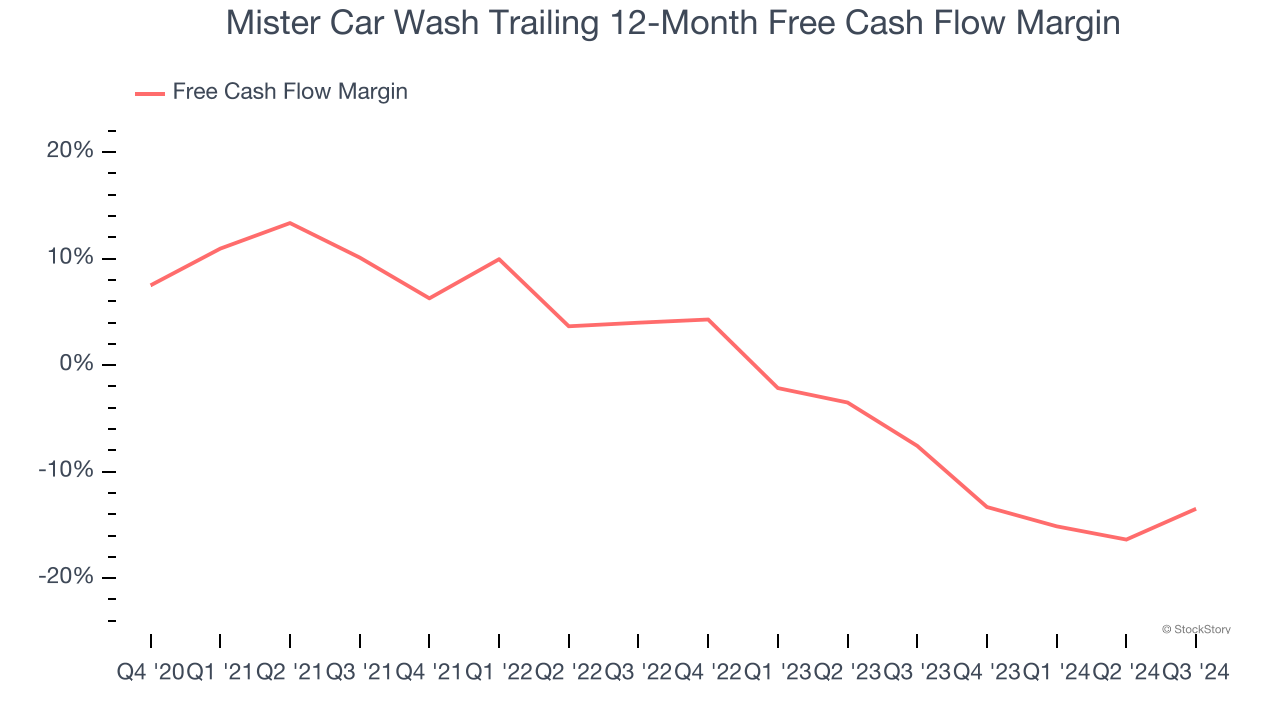

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the last two years, Mister Car Wash’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 10.6%, meaning it lit $10.63 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

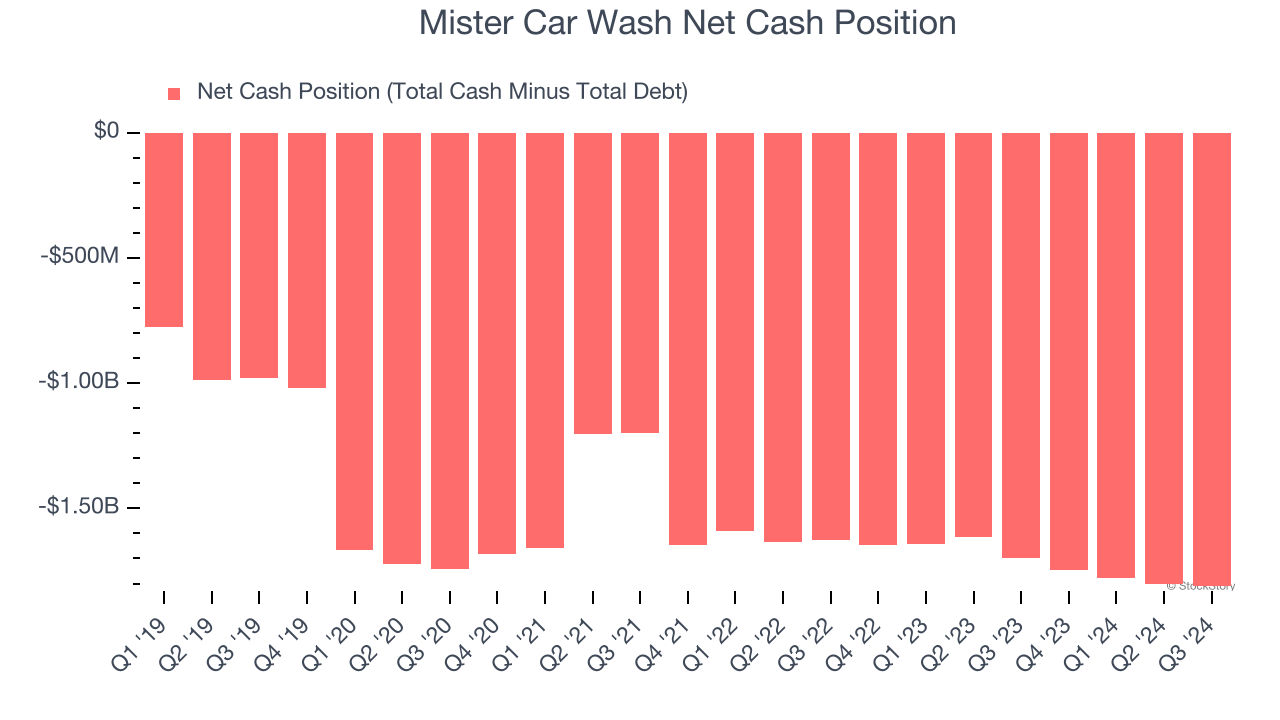

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Mister Car Wash burned through $131.3 million of cash over the last year, and its $1.83 billion of debt exceeds the $16.48 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Mister Car Wash’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Mister Car Wash until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Mister Car Wash, we’ll be cheering from the sidelines. That said, the stock currently trades at 20.1× forward price-to-earnings (or $7.44 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. We’d recommend looking at ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Like More Than Mister Car Wash

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.