Taylor Morrison Home has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 11.7% to $60.64 per share while the index has gained 8.8%.

Is there a buying opportunity in Taylor Morrison Home, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We don't have much confidence in Taylor Morrison Home. Here are three reasons why TMHC doesn't excite us and a stock we'd rather own.

Why Is Taylor Morrison Home Not Exciting?

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE:TMHC) builds single family homes and communities across the United States.

1. Backlog Declines as Orders Drop

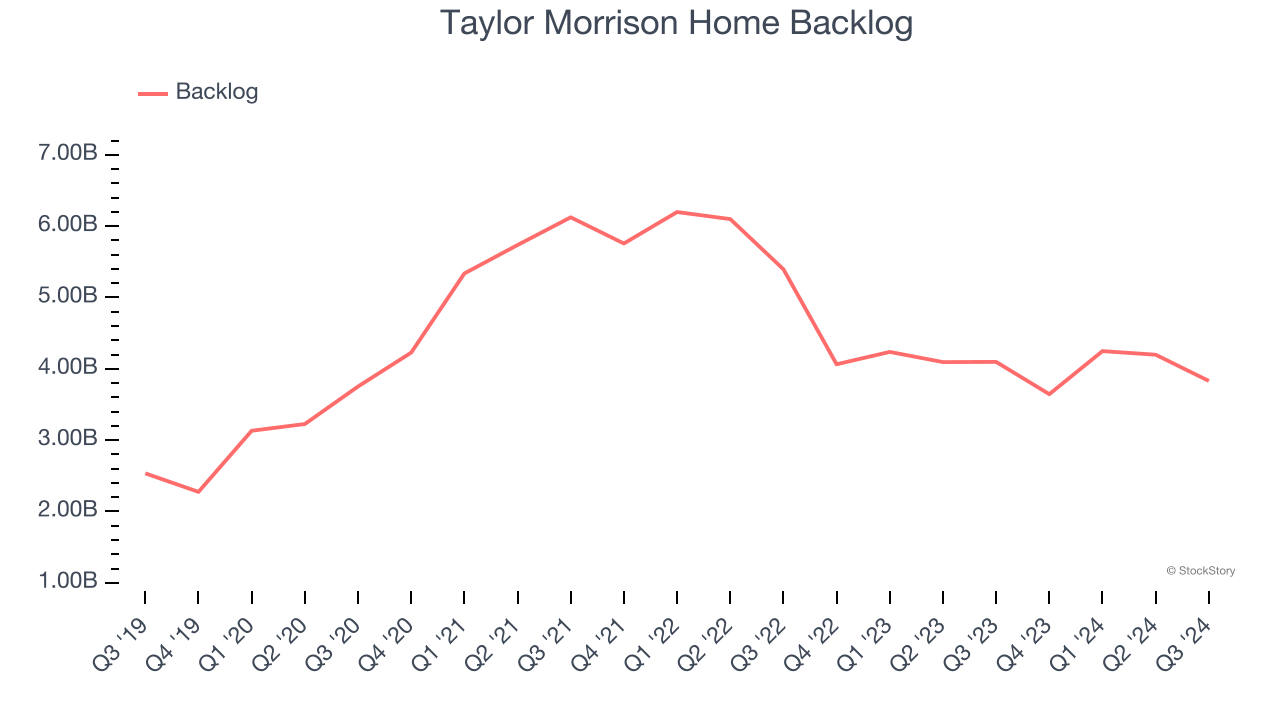

Investors interested in Home Builders companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Taylor Morrison Home’s future revenue streams.

Taylor Morrison Home’s backlog came in at $3.83 billion in the latest quarter, and it averaged 16.5% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

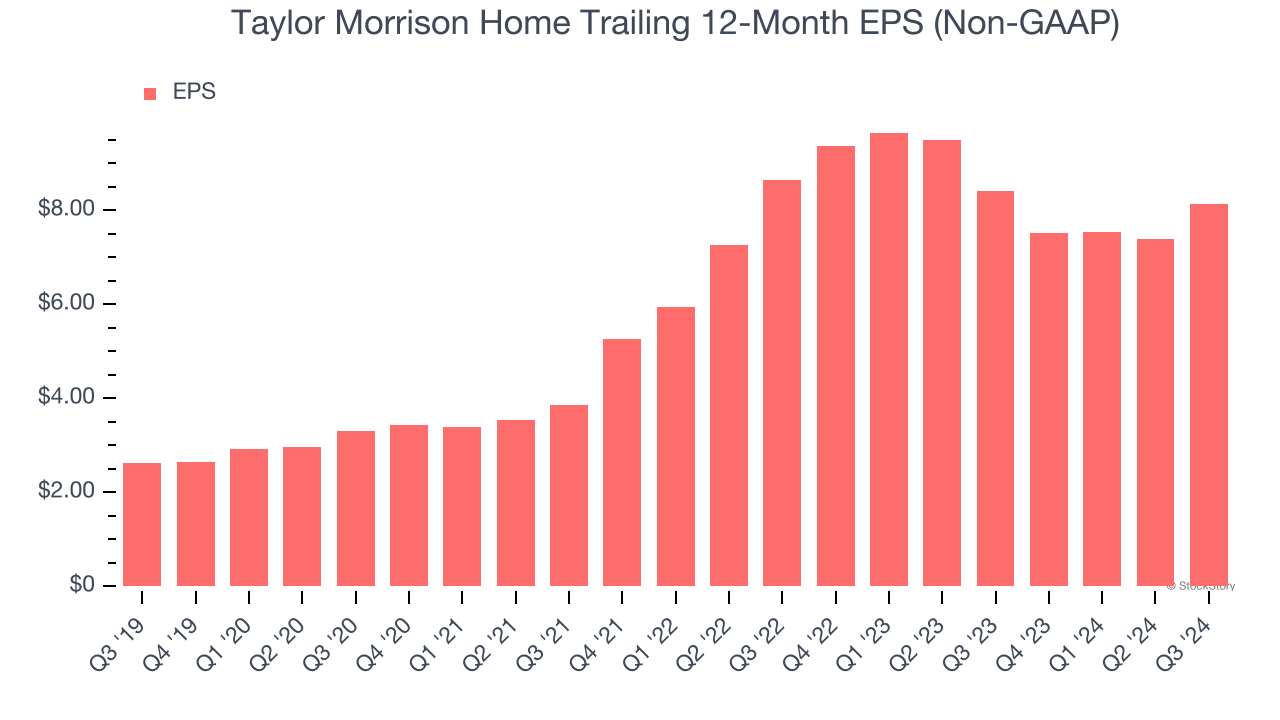

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Taylor Morrison Home, its EPS and revenue declined by 3% and 2.5% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Taylor Morrison Home’s low margin of safety could leave its stock price susceptible to large downswings.

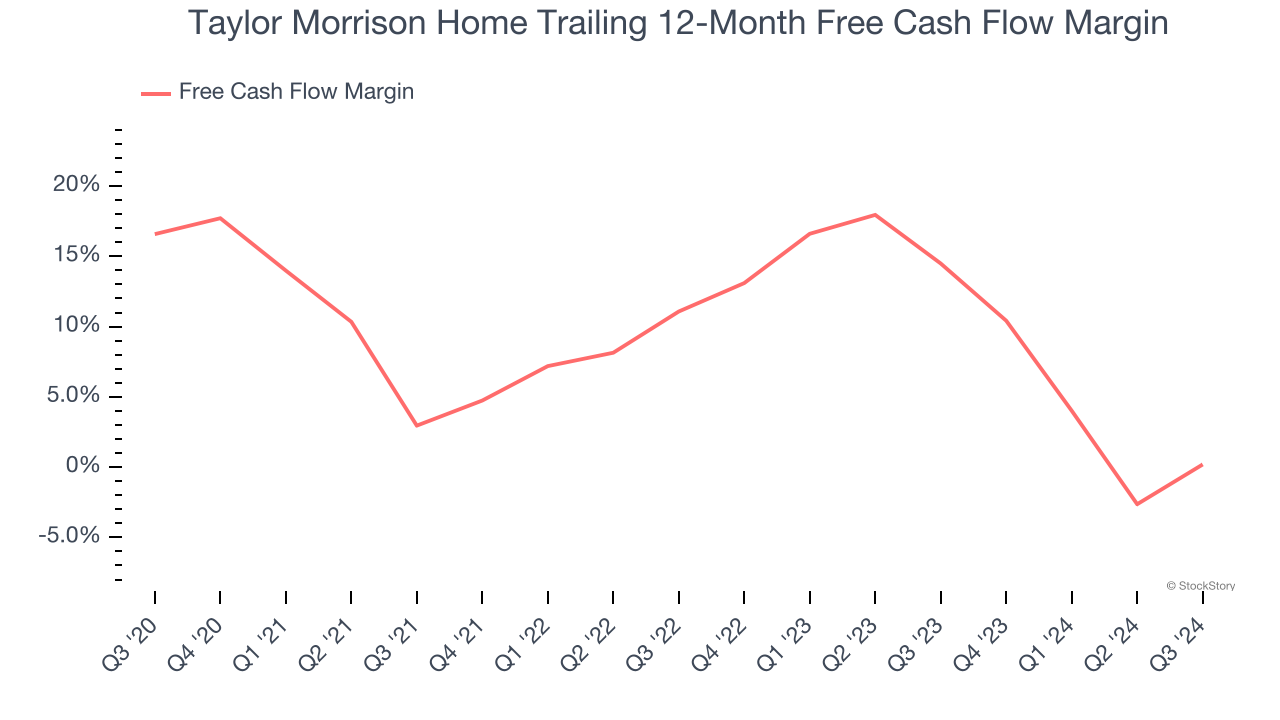

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Taylor Morrison Home’s margin dropped by 16.4 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. Taylor Morrison Home’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

Taylor Morrison Home isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 7.1× forward price-to-earnings (or $60.64 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Like More Than Taylor Morrison Home

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.